COVID-19 Bulletin: May 4

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Crude futures were higher in mid-day trading today, with the WTI up 1.3% at $65.35/bbl and Brent 1.4% higher at $68.49/bbl. Natural gas was 0.3% lower at $2.96/MMBtu.

- The U.S. is forecast to increase its coal consumption by 12% in 2021 after a heavy pandemic-induced drop last year, before resuming its downward trend again in the coming years.

- OPEC’s share of India’s oil imports fell to 4.0 million bpd for the year ending March 2021, down 11.8% from the previous year and the lowest level in two decades.

- Liquefied natural gas deliveries are being diverted away from Indian ports due to the country’s reduced demand amid a surging COVID-19 crisis.

- Saudi Aramco posted a 24% increase in net income in the first quarter.

- Saudi petrochemical company SABIC will take over the bulk of sales and marketing of Saudi Aramco’s chemicals and polymer products.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- The global semiconductor shortage is continuing to wreak havoc on the auto industry, with Ford announcing it will halt production at its two plants in Germany for several weeks.

- The chip shortage has dented vehicle production so much that car rental companies are starting to buy used cars to maintain their fleets.

- Auto manufacturers are beginning to ditch a decades-old, hyper-efficient “just in time” supply chain strategy in favor of stockpiling parts and supplies as a backstop to future disruption.

- Record-long lead times, wide-scale shortages of basic materials, rising commodity prices and transport difficulties led to a slowing of U.S. manufacturing activity in April from record-breaking March.

- The rate for a 40-foot container from Shanghai to Los Angeles hit $4,403 last week, the highest level in data going back to 2011, as increasing consumer demand and company restocks continue to boost shipping rates.

- Lumber futures delivery rose to $1,575.60 per thousand board feet on Monday, a record and more than four times the typical price at this time of year, bringing surging profits to sawmills while homebuyers and do-it-yourselfers foot the bill.

- Grocer chain Kroger will test drone delivery from one of its Ohio stores, enabling up to five pounds of groceries to be delivered within 15 minutes of a customer’s order.

- Autotrader parent Cox Enterprises inked a deal to provide repairs, roadside assistance and battery service to a growing fleet of electric last-mile delivery vans from Electric Last Mile Solutions.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- There were 50,560 new COVID-19 cases and 483 deaths in the U.S. yesterday. Over 246 million vaccines doses have been administered with roughly 30% of the population fully vaccinated.

- The pace of COVID-19 vaccinations in the U.S. has slowed to an average of 2.5 million shots per day, down from 3.2 million per day earlier in April, prompting some states to offer incentives to boost inoculations.

- California posted the nation’s lowest per capita COVID-19 case rate last week, as Los Angeles County reported no new COVID-19-related deaths on Sunday.

- Citing a steady decline in COVID-19 infections and deaths, New York, New Jersey and Connecticut announced plans to end most capacity restrictions by May 19, while New York City will resume 24-hour subway service two days prior.

- New Jersey has initiated a “Shot and a Beer” incentive for the month of May to incentivize people to get vaccinated.

- Florida’s governor suspended all local COVID-19 emergency mandates and plans to issue an executive order to outlaw such mandates in the state beginning July 1. The state is only one of several others broadly rolling back pandemic restrictions.

- The White House threw its support behind Pfizer’s plan to export more U.S.-made COVID-19 vaccines to low- and middle-income countries.

- Pfizer upped projections of COVID-19 vaccine sales this year from $15 billion to $26 billion, as the company reported a 45% increase in first-quarter revenues.

- Shares of BioNTech rose as much as 10% to new highs on Monday, a reflection of the company’s successful COVID-19 vaccine rollout with Pfizer.

- CVS, a major player in rolling out COVID-19 vaccines, reported higher-than-expected quarterly increases in profit and sales.

- Novavax will include 3,000 Americans aged 12-17 in trials of its COVID-19 vaccine, hoping to expand the shots’ use among adolescents.

- Public health experts are backing down on the use of the term “herd immunity,” as widely circulating COVID-19 variants and vaccine hesitancy throw plans to reach the goal into doubt.

- Citing weak demand, Iowa turned down 71% of available COVID-19 vaccine deliveries last week, the second week in a row the state asked the federal government to withhold part of its allocation.

- Researchers are warning that missed and delayed doctor’s appointments during the pandemic could have lasting repercussions on Americans’ health.

- Demand for office space in Manhattan was 27% lower in April than a year ago as rental prices continued to fall due to continuing remote work trends.

- U.S. airports screened 1.63 million individuals on Sunday, the highest since the start of the pandemic.

- U.S. construction rebounded less than expected in March, with the Commerce Department reporting a 0.2% monthly gain after a 0.6% decline in February.

International

- India and Brazil accounted for more than half of the world’s total new COVID-19 infections last week, with India posting more than 2.6 million cases and Brazil posting more than 400,000.

- New COVID-19 cases in India dipped slightly to 368,000 on Monday, as one-day virus deaths topped 3,400.

- Despite world-record-breaking infections and death tolls, India’s prime minister refused calls to put the country into lockdown.

- Daily inoculations in the country have fallen from 4.5 million to 2.5 million over the last month.

- Pfizer is requesting expedited approval for its COVID-19 vaccine in the country, a process delayed by Indian regulators’ desire to hold small local trials before administering shots to the public.

- The country postponed exams for trainee doctors and nurses to more quickly deploy them to resource-scare hospitals and clinics.

- More and more countries are adding strict penalties, including jail time, for travelers arriving from India.

- The World Health Organization is looking at other countries to fill a gap in the vaccine-sharing program COVAX left by declining Indian donations.

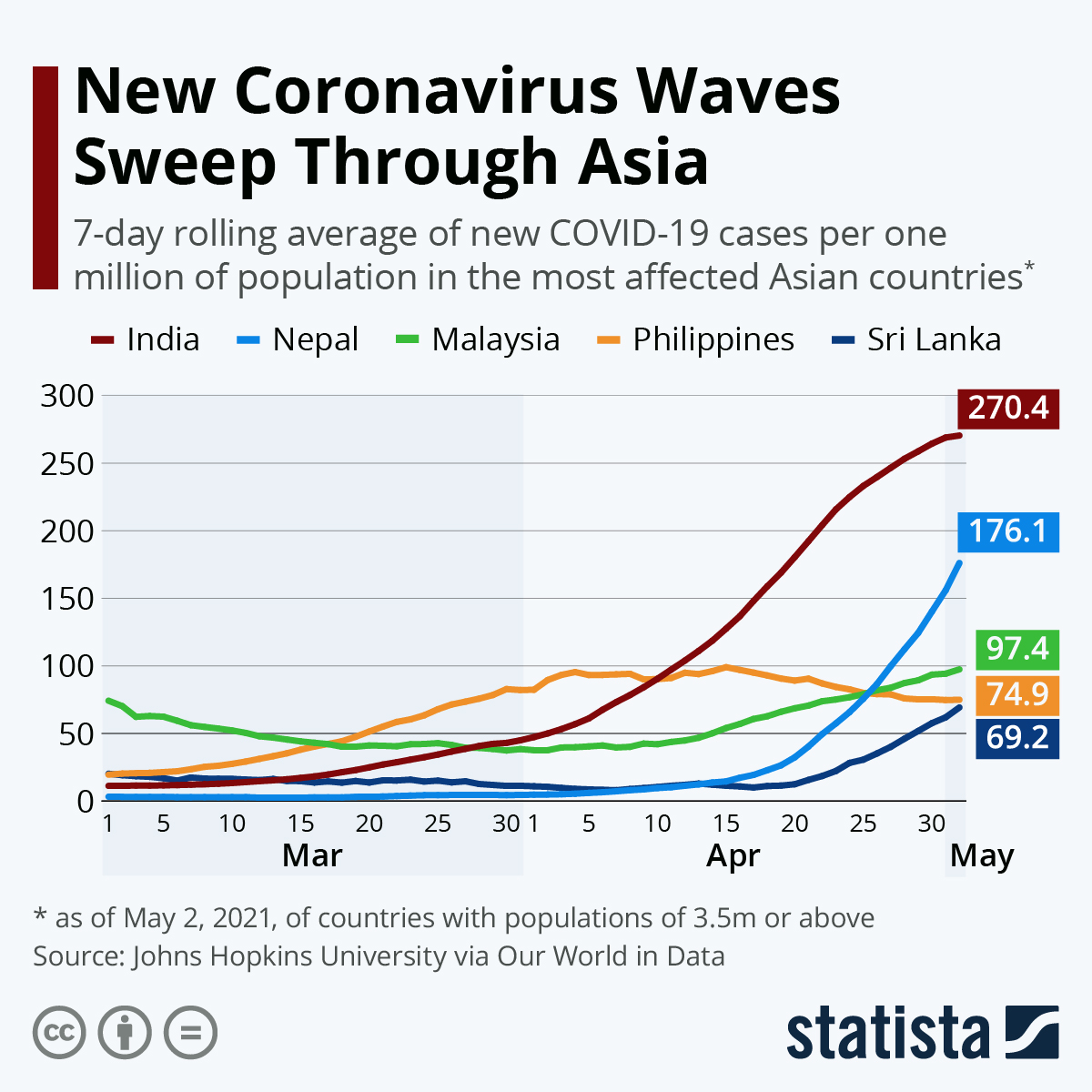

- Laos, Nepal and Thailand are among other nations facing India-like pandemic surges.

- The U.K. is set to end its COVID-19 social distancing rule in June as COVID-19 infections continue to decline.

- EU officials will open up summer travel to the bloc for vaccinated people from countries with low COVID-19 rates by June.

- Germany announced plans to lift some COVID-19 restrictions on people who have been fully vaccinated against the disease.

- Greece reopened restaurants and café terraces following six months of pandemic restrictions.

- Denmark rejected use of Johnson & Johnson’s single-shot COVID-19 vaccine, citing fears of extremely rare blood clots.

- Japan plans to approve Moderna’s COVID-19 vaccine by May 21 and is setting up mass vaccination centers in Tokyo and Osaka. The country reported a record 1,084 patients with severe virus symptoms, its second consecutive daily record.

- Singapore has asked hospitals to postpone non-urgent surgeries and admissions to make room for COVID-19 patients as the country experiences a new flare up. The city-state reported its first COVID-19-related death in nearly two months at a hospital where a recent outbreak occurred.

- Singapore and Malaysia will begin allowing travel between the two countries for critical illness and death-related emergency visits.

- Russia hopes new production deals signed with Chinese biotech companies will help meet surging international demand for its Sputnik V COVID-19 vaccine.

- Venezuela will begin a trial of Cuba’s homegrown COVID-19 vaccine, with plans to vaccinate up to 4 million people if approved.

- Costa Rica is expected to receive fewer than 800,000 foreign tourists this year, down 20% from last year following a recent surge in COVID-19.

- Brazil will sign a contract with Pfizer for an additional 100 million doses of its COVID-19 vaccine, bringing its total expected deliveries to 200 million shots.

- Amid criticism, Brazilian regulators are backing their decision to reject use of Russia’s Sputnik V COVID-19 vaccine, citing serious doubts about the safety and efficacy of the shots.

- Health experts expect a weaker third wave of COVID-19 in South Africa, where up to 40% of the population has already been infected with the virus.

- Morocco reported its first two cases of the “double mutant” COVID-19 strain first discovered in India.

- Growth in Brazil’s manufacturing sector slowed to a 10-month low in April, with a survey of purchasing managers activity falling to 52.3 from 52.8 in March.

- Hong Kong saw a better-than-expected first-quarter rebound, with GDP surging 7.8%, the fastest growth in over a decade.

- India and the EU, its largest trading partner, are set to resume trade talks suspended since 2013, hoping to forge a relationship to take on China’s economic dominance.

- Chinese electric vehicle start-up Nio more than doubled its deliveries in April compared to last year, up 125.1%, as deliveries declined slightly from the previous month.

- Indonesia ride-hailing app Gojek plans to make all vehicles available on its platform fully electric by 2030.

Our Operations

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.