COVID-19 Bulletin: May 11

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Gas stations on the East Coast are running out of fuel after a cyberattack shut down the U.S.’s largest pipeline, which transports about 45% of the fuel consumed on the East Coast.

- The operator, Colonial Pipeline, does not expect to substantially restore services before the weekend, risking greater fuel shortages and shutdowns of Gulf Coast refineries running out of storage capacity.

- Fuel prices across the U.S. are expected to rise as the pipeline remains offline for its third straight day.

- Gas prices in New York rose to their highest level in seven years, while prices also rose in Massachusetts, Pennsylvania, South Carolina and North Carolina.

- Charter rates for transatlantic product tankers surged 117% as oil traders sought tonnage to ship or store gas from the Gulf Coast.

- In the wake of last Friday’s attack, traders booked at least six tankers to begin shipping gasoline from Europe to the U.S. to avoid a supply crunch.

- Crude futures were higher in mid-day trading today, with the WTI up 0.2% at $65.05/bbl and Brent 0.1% higher at $68.38/bbl. Natural gas was 0.1% higher at $2.93/MMBtu.

- OPEC’s crude oil production is estimated to have jumped to a three-month high of 25 million bpd in April.

- Premiums on oil from the North Sea have led to significantly higher European imports of oil from Nigeria, Brazil and the U.S.

- Renewable energy was the only power source that saw growth in 2020, as the industry experienced its biggest capacity increase this century.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Nissan reported a smaller-than-expected fourth-quarter loss but a record loss for 2020 while cutting its forecast to breakeven results for fiscal 2021 due to the global semiconductor shortage.

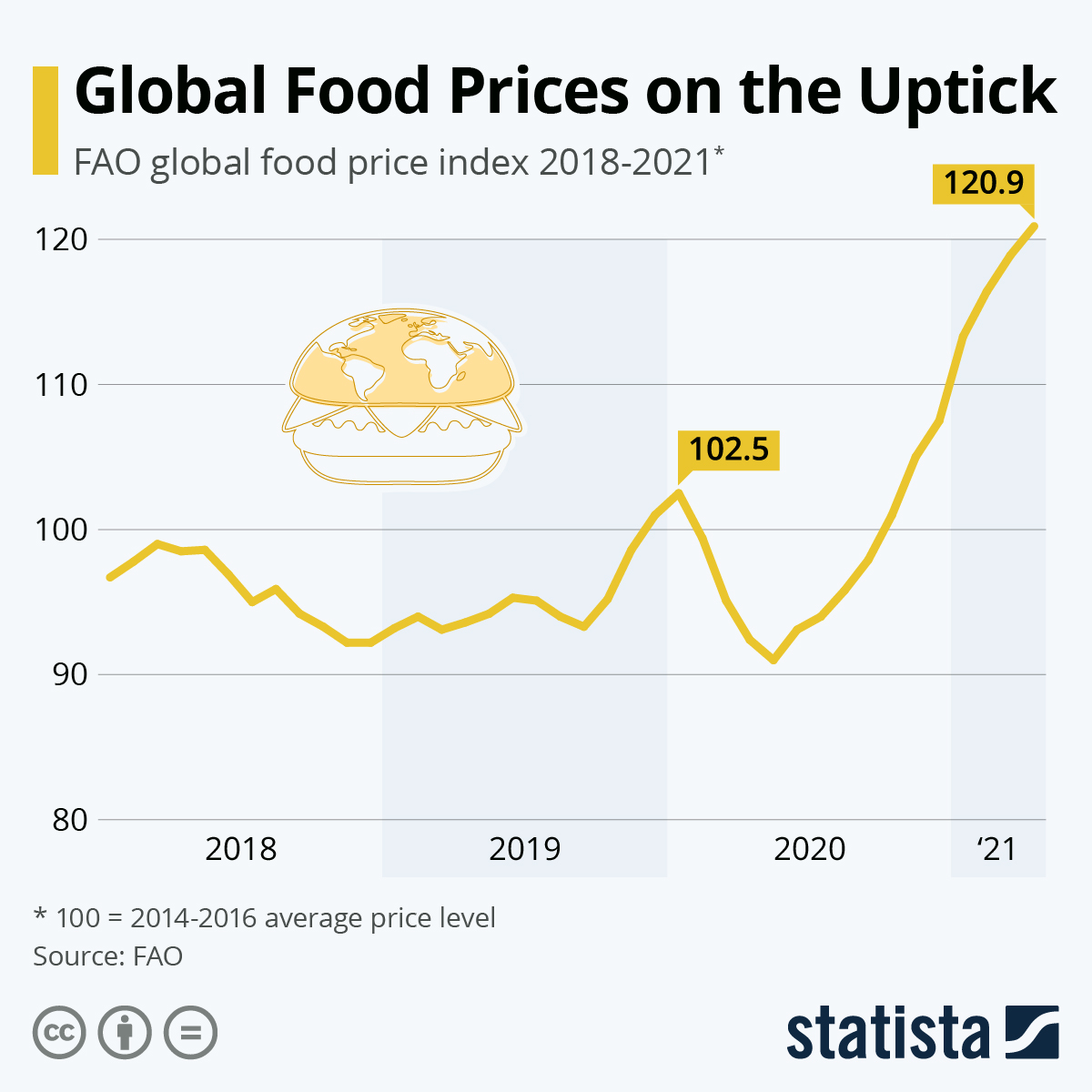

- The average price of corn has risen by 50% so far this year, prompting companies to raise prices on key grocery items as well as motor fuel, sparking inflation fears that could slow a post-pandemic recovery.

- China’s factory-gate prices jumped by 6.8% in April, the most in 3 1/2 years, driven by surging commodities prices.

- China’s futures exchange is working to dampen coal prices, which are up 34% this year on record demand to fuel the nation’s economic rebound.

- Airfreight rates between China and the U.S. have risen 75% since mid-March, driven mostly by sea-to-air conversions stemming from the blockage of the Suez Canal earlier this year.

- Container volumes set a new monthly record in March, with 15.5 million 20-foot equivalent units (TEUs) shipped globally, according to Container Trade Statistics.

- Rail car manufacturer National Steel Car has been forced to temporarily close its facility in Ontario, Canada, over a new COVID-19 outbreak.

- Tropical Storm Andres off the west coast of Mexico, the first named storm of the year, gave an early start to the hurricane season, though it poses little risk of making landfall.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- Despite a slowdown in U.S. vaccinations, the average rate of daily new COVID-19 cases in the U.S. dropped to under 41,000 over the weekend, a 30% drop from two weeks ago and the lowest level since September 2020.

- There were 36,231 new COVID-19 cases and 399 deaths in the U.S. yesterday. Over 261.5 million vaccine doses have been administered, with 32.5% of the population fully vaccinated.

- The number of Americans receiving COVID-19 vaccines fell sharply over the last month to about 2.1 million shots per day, down from 3.4 million shots at the start of April.

- The FDA has authorized the Pfizer/BioNTech COVID-19 vaccine in children aged 12-15.

- Maryland biotech company Novavax says it is unlikely to seek emergency use authorization for its COVID-19 vaccine until July at the earliest.

- In an effort to vaccinate more of its population, New York is offering free subway and train rides to those who get vaccinated at city mass-transit terminals, while also offering free tickets to minor league baseball games, botanical gardens and events at the Lincoln Center as incentives for getting the shots.

- Illinois and the city of Chicago are partnering with building owners to make vaccination clinics available to workers in major commercial buildings throughout the state.

- Washington, D.C., plans to lift the bulk of its COVID-19 capacity restrictions for individuals on May 21, with plans to lift the remaining restrictions at bars, nightclubs, large entertainment venues and sports arenas on June 11.

- More affordable housing, less congestion and a multitude of job industries are helping mid-size cities across the U.S. fuel the nation’s economic recovery.

- Despite posting a net loss in the first-quarter, hotel chain Marriott said it is seeing demand in leisure travel gaining steam in the U.S. and Canada amid an increase in COVID-19 vaccines across the region.

- Despite a disappointing jobs gain in April, job postings at the end of the month were 24% higher than February 2020’s pre-pandemic level, pointing to a widening labor shortage.

- The U.S. Treasury Department said that state and local governments will have flexibility when it comes to spending the $350 billion in COVID-19 relief funds offered by the White House, with a stipulation the funds not be used to offset tax cuts or make deposits into pension funds.

- Consumers paid down credit card balances at the fastest pace since 2000 in the first quarter, confronting large card issuers with declining interest income.

- Slow electric vehicle adoption in the U.S. has ride-hailing companies strategizing how they can meet a 2030 deadline to transition entirely to electric vehicles across North America and Europe.

- Researchers at Cornell University are developing new technology that would allow drivers to charge their electric vehicles while driving on highways.

- Harley-Davidson introduced its brand new all-electric stand-alone motorcycle brand LiveWire on Monday with hopes of making a splash in the emerging electric vehicle market.

- New research predicts that electric vehicles will be cheaper to produce than fossil fuel-powered vehicles by 2027.

- A push for waste-free packaging for consumer products is prompting U.S. policymakers to look at other countries for regulatory guidance.

International

- India, current epicenter of the pandemic, reported 366,161 new cases of COVID-19 Monday and 3,754 deaths from the disease.

- The World Health Organization is re-classifying the triple-mutant COVID-19 variant first found in India as a “variant of concern” and calling it a global threat after studies show that the strain may be more contagious than others.

- Thailand reported its first case of the variant, while France has recorded at least 20 cases.

- Health authorities in India are warning about a rare “black fungus” infection being seen in some patients battling COVID-19 that can cause facial disfigurement, blindness and death.

- Malaysia is tightening its pandemic restrictions ahead of the upcoming Eid al-Fitr holiday by closing schools and banning social gatherings.

- Spain’s prime minister expects to achieve “group immunity” with 70% of the nation’s population fully vaccinated by Aug. 18.

- The number of one-day COVID-19 infections in France fell to the lowest level since the start of the year, with the country reporting 3,292 cases on Monday.

- The Czech Republic announced plans to further ease its COVID-19 restrictions, allowing restaurants and bars to reopen to people who have either tested negative, been vaccinated or recovered from the virus.

- Germany plans to make Johnson & Johnson’s single-shot COVID-19 vaccine available to all adults, with millions of doses expected to arrive in the second quarter of this year.

- Nigeria plans to procure 29.6 million doses of Johnson & Johnson’s single-shot COVID-19 vaccine with a goal of vaccinating 70% of its population over the next year.

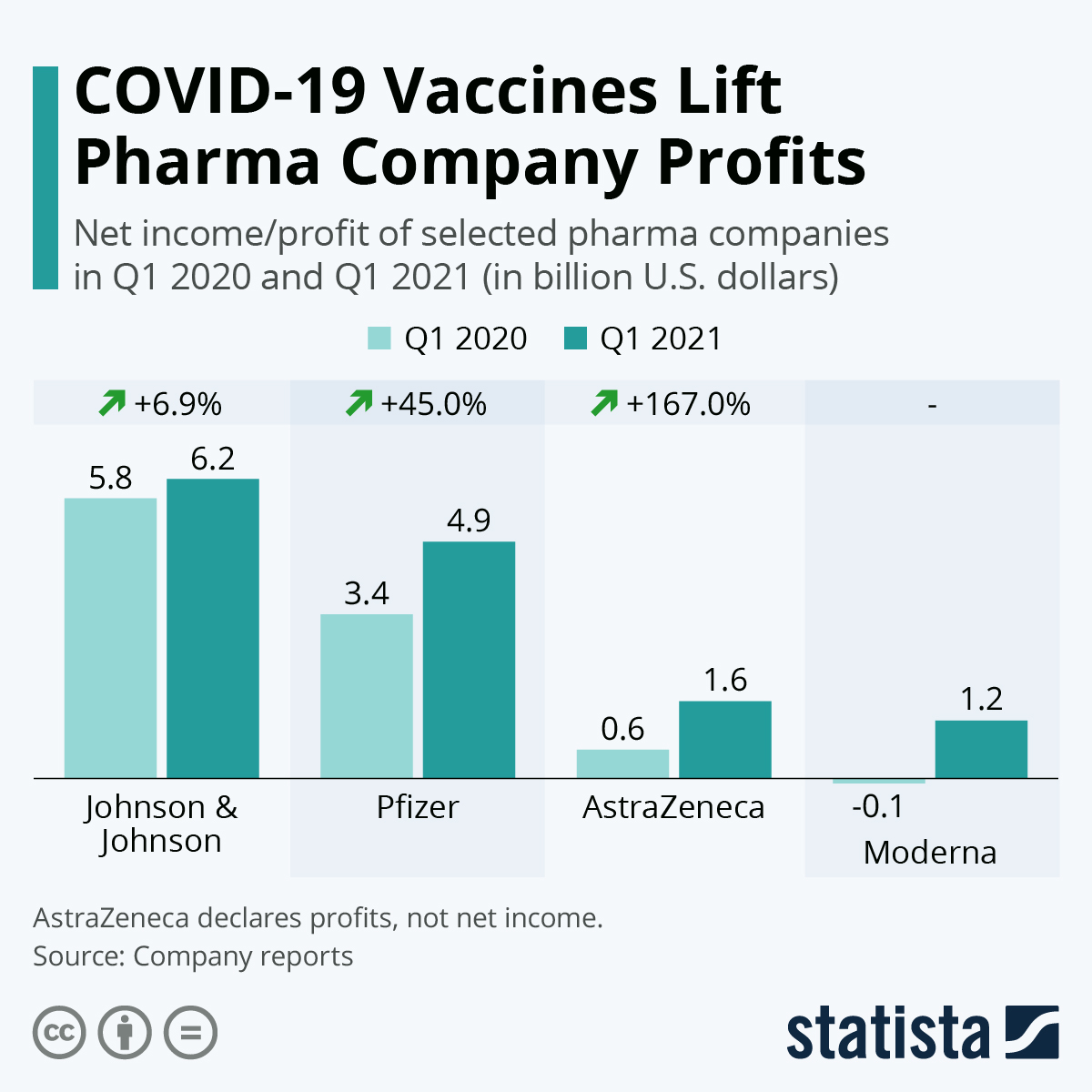

- The success of BioNTech’s partnership with Pfizer to develop its COVID-19 vaccine has sparked huge interest from investors looking to back German biotech companies. The company updated its vaccine sales estimates to more than $15 billion, while announcing plans to build a new manufacturing site in Singapore by 2023 and to partner with Shanghai Fosun Pharma to produce up to 1 billion COVID-19 vaccines for China.

- Investor confidence in Germany hit a more than two-decade high as the nation’s inoculation program accelerates.

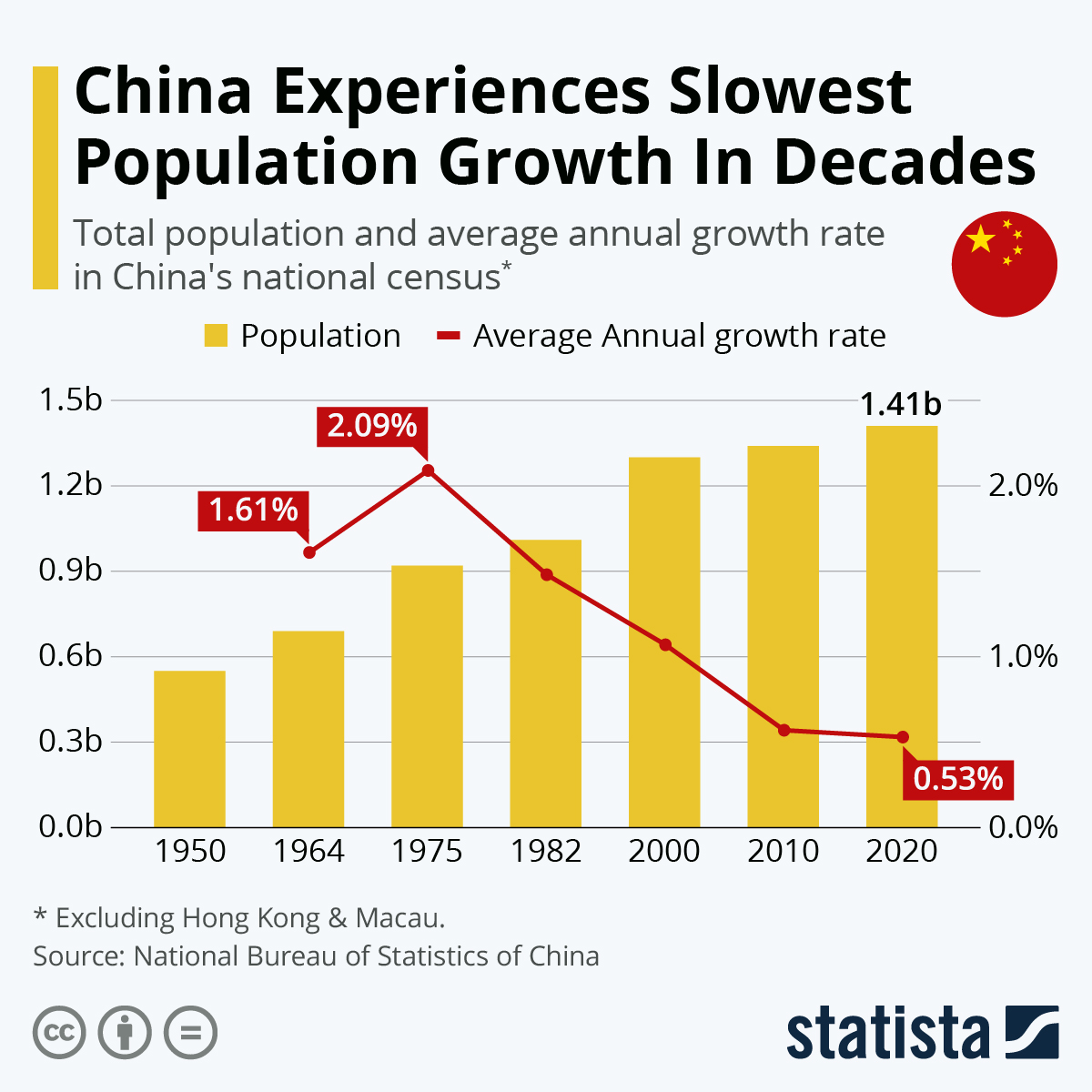

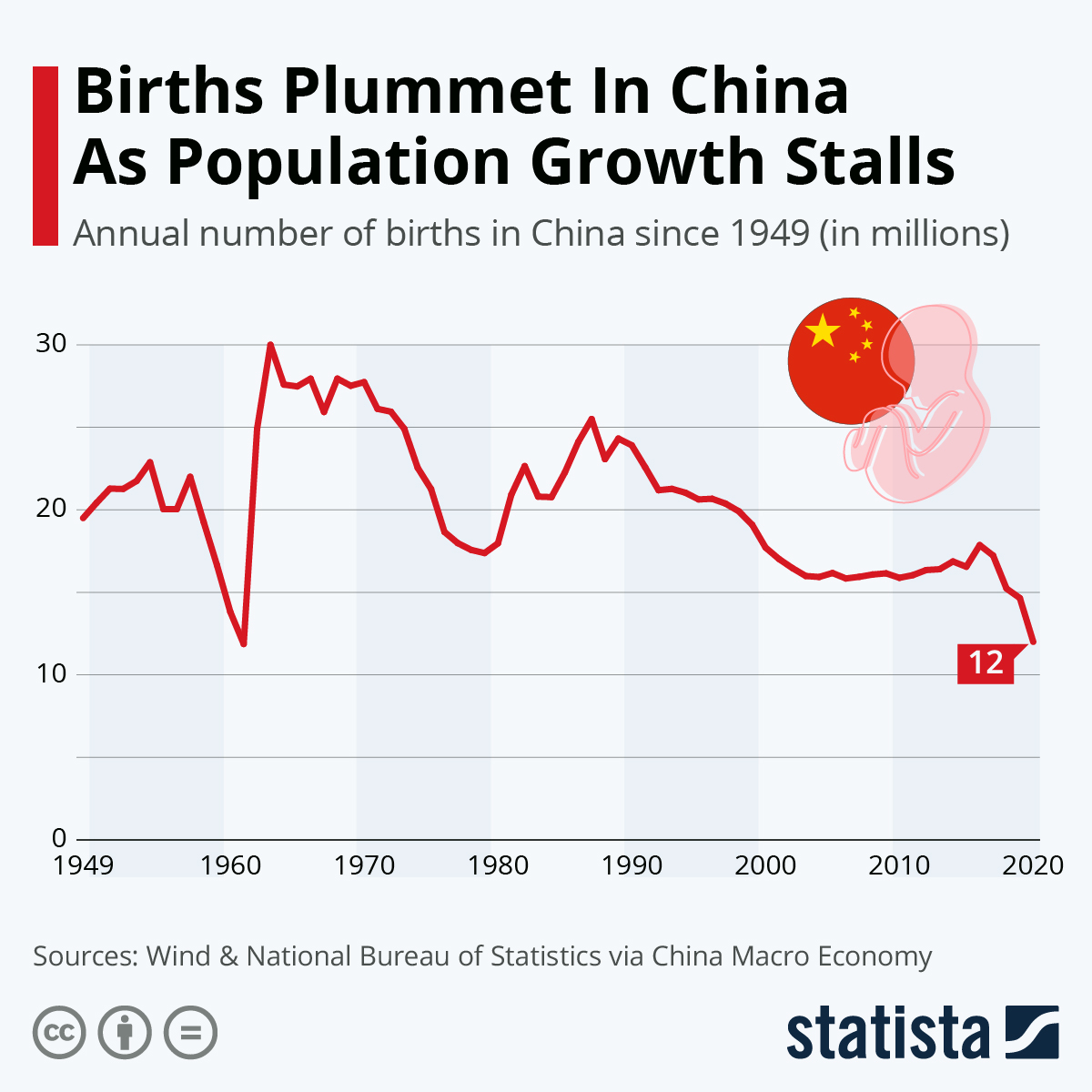

- China reported that its population rose fractionally to 1.4 billion in 2020 after the fourth straight year of declining birth rates last year.

- Continued COVID-19 outbreaks are hampering the economic growth of many Southeast Asian economies, including the Philippines, Indonesia, Thailand and Malaysia.

- New research from Australia shows that every 100 grams of rice consumed globally also includes 3 to 4 milligrams of plastic.

Our Operations

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.