COVID-19 Bulletin: May 12

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Crude futures were higher in mid-day trading today, with WTI up 1.1% at $66.01/bbl and Brent up 1.0% at $69.24/bbl. Natural gas was 0.9% higher at $2.98/MMBtu.

- Gas stations along the East Coast of the U.S. are being overwhelmed by drivers fearing fuel shortages following the recent cyberattack on the Colonial Pipeline.

- The disruption pushed the average price for a gallon of gasoline above $3.00 for the first time since 2014.

- The White House is mulling temporarily waiving the 101-year-old Jones Act, a move that would permit foreign ships to deliver U.S. goods between ports to help ease the supply crunch.

- Even after reopening the pipeline, it could take more than two weeks for gas to move from its Houston refining hub to New York, prolonging shortages.

- The hack of the pipeline underscores the growing threat of hacking-for-ransom plots on the country’s infrastructure.

- After months of production limits, Saudi Arabia will return to exporting full crude volumes to the bulk of Asian refiners next month.

- A Mexican judge issued an injunction nullifying a recent law giving the federal government the power to seize private gas stations and terminals where it asserts a national security threat.

- The White House approved the nation’s first major offshore wind farm off the coast of Massachusetts that will generate up to 800 megawatts of electricity.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Inflation worries are dominating global financial markets, as the U.S. Consumer Price Index jumped a higher-than-expected 4.2% in April compared with April 2020.

- Booming commodities demand is driving shipping prices to multi-year peaks, with the Baltic Dry Index hovering at 11-year highs.

- Iron ore futures on China’s Dalian Exchange jumped 10% in one day to a record high, while tin prices are approaching record highs for the first time in a decade after jumping 47% this year.

- Tyson Foods said average prices across all its products were up 7.5% in the first quarter and warned that cost inflation could dampen profits this year.

- Prices for lumber, the dominant building material for new homes, have quadrupled in the past year.

- The average price for a single-family home in the U.S. jumped to a record high of over $319,000 in the first quarter, up 16.2% compared with a year earlier, with prices increasing the most in historically stagnant neighborhoods.

- Anti-pollution rules could add 3% to the cost of warehouse operations in Southern California.

- Roughly $370 billion in U.S. tariffs on nearly two-thirds of China-made goods have led to a sharp decline in imports for many products, new data show.

- The United States Postal Service posted a net loss of $82 million in the first quarter, a lower-than-expected deficit softened by a 33.6% revenue gain in shipping and packages.

- While still below pre-pandemic levels, orders for new rail cars rose to 6,227 in the first quarter, the highest level in a year.

- Panasonic predicts operating profit to jump by as much as 27.6% this year amid growing demand for automotive batteries used by electric vehicle makers.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- Newly reported U.S. COVID-19 cases fell below 40,000 for the third straight day yesterday, with 33,651 infections and 684 deaths. Over 264.6 million vaccine doses have been administered with 35.8% of the population fully vaccinated.

- With roughly 58% of U.S. adults having received at least one dose of a COVID-19 vaccine, experts expect U.S. infection and death rates to plummet by mid-summer.

- Florida reported 27,028 new COVID-19 cases for the week ending May 9, down 21% from the prior week, with cases falling in 45 of the state’s 67 counties.

- California could eliminate indoor mask-wearing requirements for workers by August, while health officials predict Los Angeles County will achieve herd immunity by mid- to late-July. The state’s governor has proposed sending $600 in direct cash payments to two-thirds of residents to help stimulate the economy.

- With 55% of the adult population having received at least one COVID-19 vaccination, Michigan will allow in-person office work to resume in two weeks.

- New research from the European Academy of Dermatology and Venereology found that bald men are 2 1/2 times more likely to develop severe symptoms of COVID-19.

- Despite overall cases of COVID-19 declining across the country, pediatric researchers are looking into whether the virus is becoming more severe in children, whose hospitalizations aren’t falling as quickly.

- The CDC is in early plans to reserve booster COVID-19 shots from major drugmakers, as many people could need an additional vaccine dose each year to maintain protection. The White House said booster shots will be free if they are needed.

- The White House announced a new partnership with ride-hailing companies Uber and Lyft to provide free rides to and from vaccination clinics through July 4.

- The White House’s top medical adviser says that following the pandemic, mask-wearing may become the new norm during seasons when respiratory illnesses are more prevalent.

- Those seeking a COVID-19 test in the U.S. may now be administered a “quad test,” which not only tests for COVID-19, but also two types of influenza as well as the respiratory syncytial virus.

- Job openings in the U.S. surged to a record 8.1 million in March, up from 7.5 million in February.

- Job cuts and fear of COVID-19 last year drove more Americans to retire early, reversing a trend of people working longer.

- Flexible and remote work opportunities spurred a migration across the U.S., with more than 7 million households moving to a different county.

- Demand for second homes is increasing at a record pace, with rate locks rising 178% over the past year compared to a 78% increase for primary homes.

- Seventy-eight hotels with 13,000 combined rooms will open in New York City this year as the city prepares for an increase in travel and tourism.

- Some 12.6 million households got new pets last year, leaving veterinarians burned out and animal healthcare facilities overrun.

- The wedding industry is booming as the economy reopens and couples who postponed nuptials rush to the altar.

- U.S. casinos matched their best quarter ever during the first three months of the year, reporting revenue of over $11.1 billion, an 18% increase from the same time last year.

- Mattel launched a new recycling program that aims to recover and reuse materials from old toys to make new ones.

International

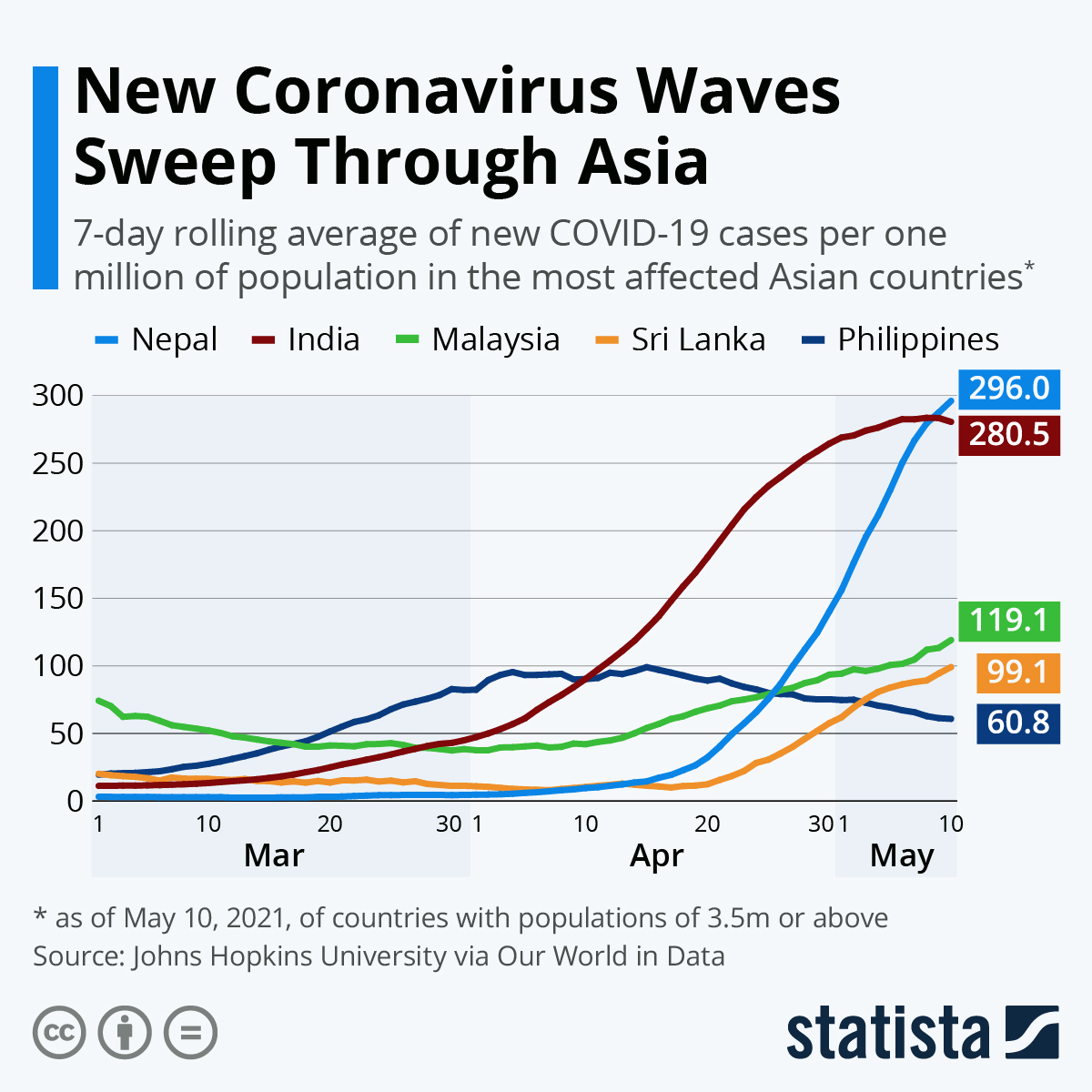

- The pandemic is exploding in Asia, which recorded more than half of global infections over the past two weeks.

- India’s one-day COVID-19 death toll hit 4,205 Wednesday, a record, bringing total deaths to over 250,000, while 348,421 new infections were recorded.

- The nation accounted for more than half of new COVID-19 cases across the globe last week.

- The moving seven-day average of new cases is at a record high of 390,995.

- The highly contagious variant of COVID-19 that emerged in India in October has been found in 44 countries.

- U.S. volunteers from a multitude of faiths are collecting hundreds of oxygen concentrators and electrical transformers to ship to overwhelmed Indian hospitals.

- Vietnam’s capital Hanoi banned public gatherings of more than 10 people amid a surge in new COVID-19 infections.

- Taiwan instated a ban on indoor gatherings of more than 100 people and outdoor gatherings of more than 500 following a new COVID-19 outbreak.

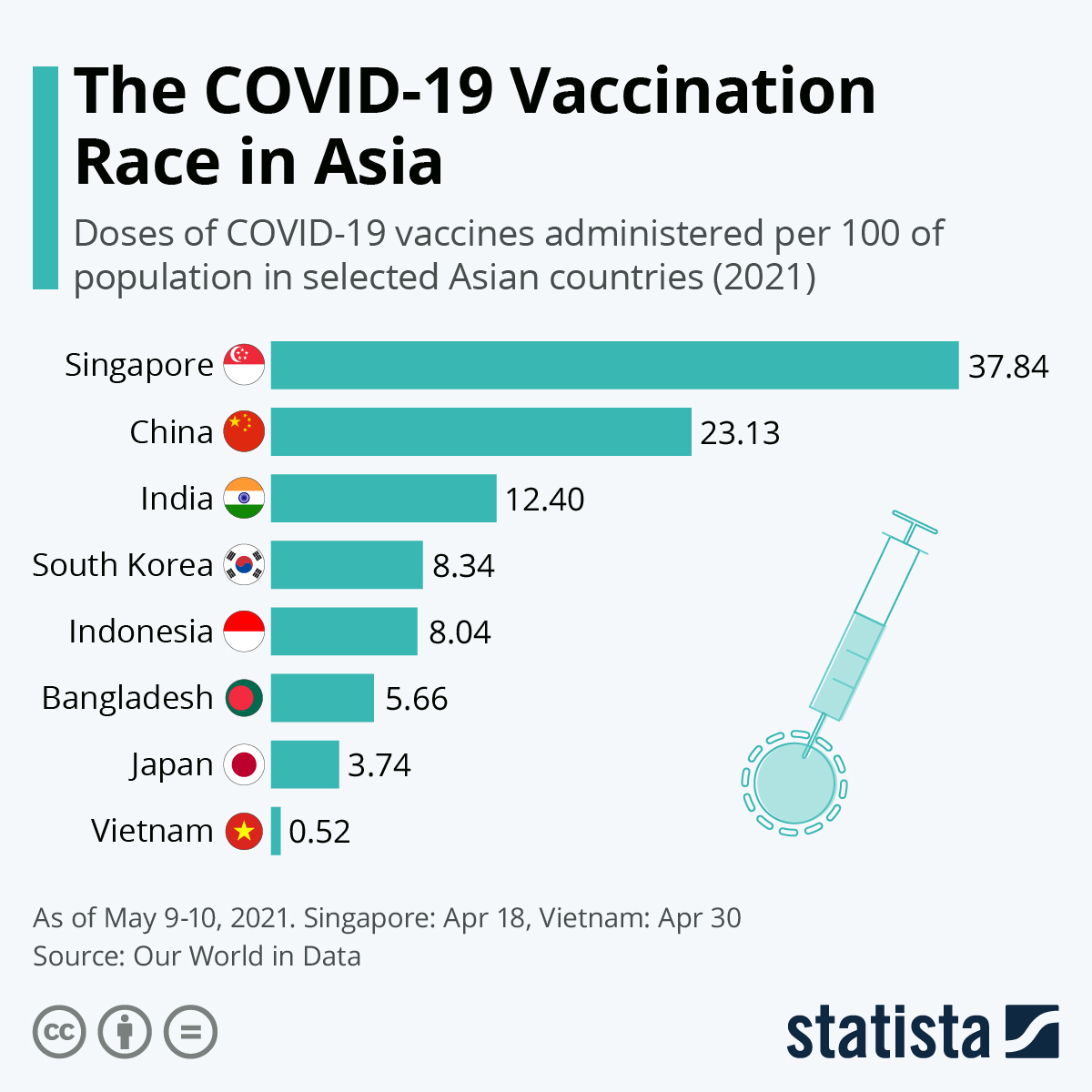

- Japan’s troubled inoculation rollout suffered a setback yesterday when its vaccine booking system crashed. The U.S. Olympic track and field team cancelled plans to train in Japan prior to the games because of rising COVID-19 infection rates.

- Roughly 1.8 million of Singapore’s 5.7 million residents have received their first COVID-19 vaccine dose, as the nation-state’s strict border measures are expected to weaken its construction, marine and process sectors, which are heavily dependent on foreign laborers.

- Vaccinations in the EU are starting to pick up steam, with the bloc administering nearly 3 million doses daily last week.

- As COVID-19 cases continue to drop in Germany, several states announced plans to loosen pandemic restrictions, while investors are increasingly optimistic about the nation’s economic rebound.

- Greece could have all its permanent residents vaccinated against COVID-19 by the end of June.

- England reported no new daily COVID-19 deaths for the first time in 14 months. Scotland is set to ease pandemic restrictions on Monday amid declining COVID-19 cases.

- France’s National Assembly approved creation of a health pass allowing vaccinated and immune citizens to attend public events.

- Costa Rica suffered its highest daily death toll of the pandemic yesterday as a new COVID-19 wave sweeps the island nation, stressing hospitals and threatening its important tourism industry.

Our Operations

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.