COVID-19 Bulletin: May 20

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- A larger-than-expected crude oil inventory build of 1.3 million barrels for the week to May 14 pushed oil prices down Wednesday, with Brent falling 3.0% and WTI down 3.3% over fears that a rising wave of COVID-19 in Asia could weaken demand.

- Oil prices were lower in mid-day trading Thursday, with the WTI down 0.7% at $62.89/bbl and Brent down 0.8% at $66.11/bbl. Natural gas was down 1.0% at $2.94/MMBtu.

- EU lawmakers are urging leaders from France, Germany and Italy not to support a $21 billion Russian-led liquefied natural gas project over climate change concerns.

- Norwegian carbon tech company Horisont Energi is partnering with oil and gas company Equinor to develop a 100-million-tonne carbon capture and storage project in Norway. Equinor also announced a new partnership with Algeria’s state-owned oil company Sonatrach to explore hydrocarbon recovery and other high-performance oil operations.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Ford will halt or cut production at eight North American plants through June due to the global semiconductor shortage, affecting a wide range of vehicle models including the Mustang, Escape, F-150 and new Bronco.

- Volkswagen also announced it will suspend vehicle production for two weeks in June at its plant in Chattanooga, Tennessee, due to the chip shortage.

- Japan will begin providing extra support to produce advanced semiconductors and batteries, an effort to combat the global shortage.

- Lake Charles, Louisiana, has received over 18 inches of rain over the past few days from storms along the Gulf Coast, with more precipitation forecast for the region through Friday.

- Despite reporting that its inventory was up 16% year over year for the first quarter, Walmart is struggling with supply chain issues, citing port delays that have extended lead times for orders.

- U.S. output of goods and services is near pre-pandemic levels despite 8.2 million fewer people in the workforce as companies boost productivity through increased automation.

- The increased focus on automation led to a 20% year over year increase in robotics orders in the first quarter.

- Fears of inflation are causing energy and commodity futures to drop, temporarily stalling recent surges.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports primarily due to increased volume of ships and containers. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

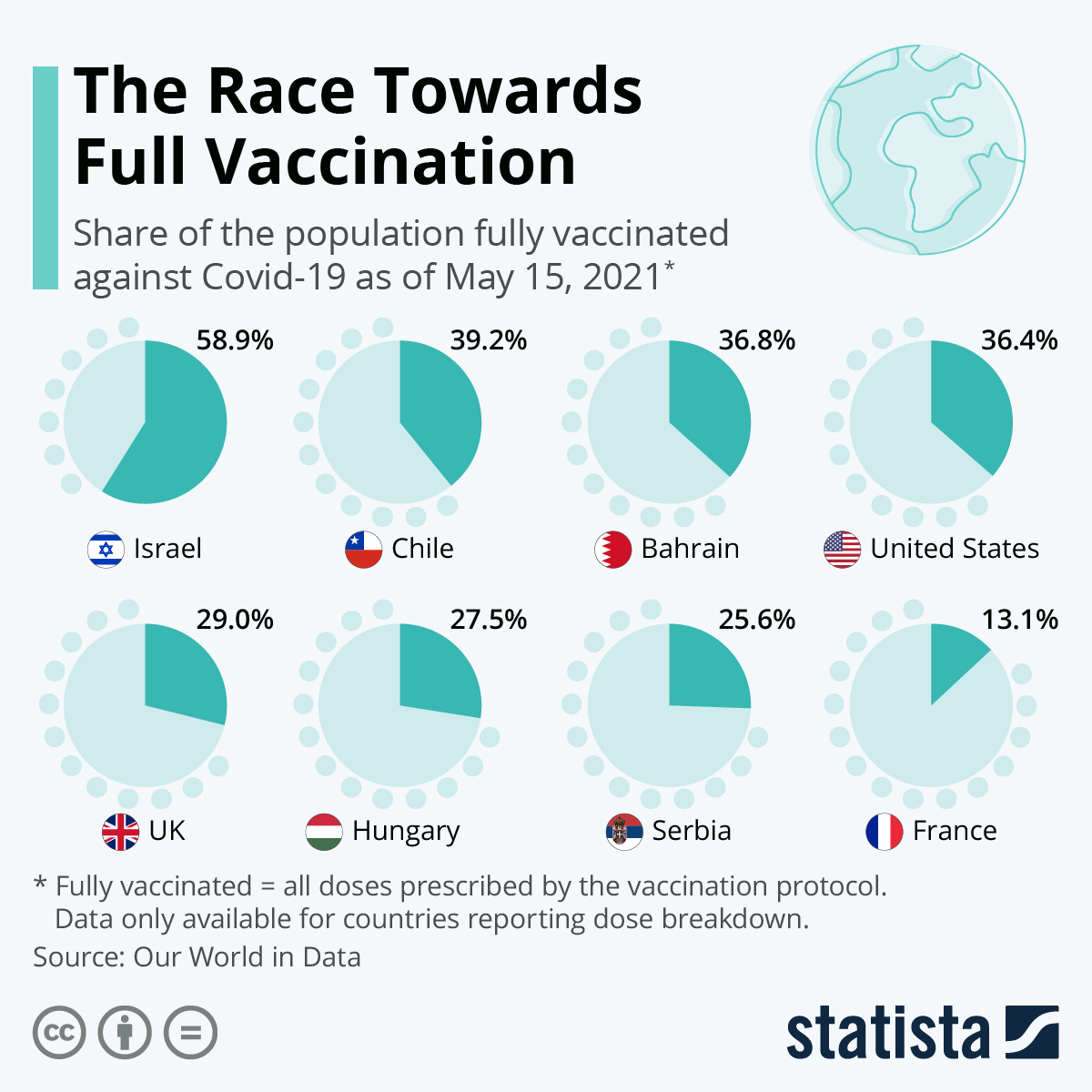

- U.S. COVID-19 cases remained under 30,000 on Wednesday, with the country reporting 29,293 infections and 655 deaths. Over 277.3 million vaccine doses have been administered with 38.2% of the population fully vaccinated. Roughly 160 million Americans have received at least one dose.

- Seven states have reached the White House’s goal of vaccinating 70% of adult residents with at least one shot by July 4. However, experts fear that the uneven vaccination rates across other parts of the country could hinder efforts to end the pandemic.

- COVID-19 cases are trending higher this week in six states: Alabama, Arkansas, Delaware, Hawaii, Mississippi and South Carolina.

- Pfizer is anticipating that recipients of its COVID-19 vaccine will likely need a booster shot between 8-12 months of receiving their second dose.

- Children will likely be able to get COVID-19 vaccinations by year’s end or the first quarter of 2022.

- The recent FDA clearance to give COVID-19 vaccines to children aged 12-15 is causing new challenges to the U.S.’s vaccination campaign, as different state laws have created a multitude of scenarios hindering the administration of doses.

- Birthrates for Millennials, a generation bookended by historic recessions, were down 7% in January from the prior year and are expected to fall further due to uncertainty and isolation throughout the pandemic, continuing a 13-year trend of falling births in the U.S.

- New York dropped its mask mandate for most indoor and outdoor settings alongside lifting capacity limits for most businesses, a pandemic milestone. The state’s seven-day positivity rate for COVID-19 infections fell to 1.47% on Tuesday.

- Washington, D.C. updated its mask guidelines to be consistent with new guidance from the CDC, with plans to lift most capacity restrictions on Friday and the remainder on June 11.

- More than two-thirds of California’s adult population has received at least one dose of a COVID-19 vaccine, while the state contemplates dropping mask and physical distancing rules for employees at work sites if everyone on-site is fully vaccinated.

- Whole Foods and Kroger joined a growing list of companies dropping mask mandates for fully vaccinated customers.

- Amazon will lift its mask mandate for fully vaccinated frontline workers next week, making the company the country’s largest retailer to stop mandatory mask wearing.

- HIPAA healthcare privacy laws do not prevent employers from inquiring whether employees have been vaccinated, though the verdict is out whether they can mandate vaccines.

- U.S. automakers and the United Auto Workers union agreed that industry employees will continue wearing masks at work.

- A children’s hospital in Cleveland, Ohio, is opening the country’s first long-haul clinic to treat the growing number of children dealing with lingering side effects from COVID-19.

- New research shows dogs can detect COVID-19 in human sweat almost as well as PCR tests, possibly paving the way for non-invasive mass screening at airports and train stations.

- First-time jobless claims in the U.S. decreased to a pandemic low of 444,000 last week.

- Texas, Indiana and Oklahoma have joined the list of states ending an extra $300 in federal benefits for unemployed workers as well as benefits for freelancers, part-timers and those who have been unemployed for over six months.

- The U.S. inoculation drive is helping airlines recover from the pandemic, with overall capacity jumping by more than 7% over the last month to a level just 25% down from the same time in 2019.

- U.S. airline passengers anxious to resume traveling are encountering long waits on hold after airlines lost 20% of their call center employees last year.

- Consumers reemerging from relative isolation are shifting their buying habits from staples to stylish clothing, luggage, cosmetics and sunscreen.

- Ford announced that its F-150 Lightning electric pickup truck will be priced below $40,000, about 20% less than the average price of the internal combustion version of the company’s best-selling vehicle.

- Third-party food deliverer DoorDash is struggling to maintain its driver network due to high consumer demand, extreme weather events and the impact of stimulus checks, resulting in longer wait times for deliveries and unreliable service.

International

- India reported 276,110 new COVID-19 cases and 3,874 deaths on Thursday, a drop from the previous day’s record fatality count of over 4,500.

- Nearly two-thirds of Indians tested for COVID-19 have had exposure to the virus.

- The country’s Serum Institute, which initially planned to supply 2 billion doses of vaccines to low-income countries, said it would not be able to export any vaccines before the end of the year.

- Several states throughout the country are experiencing a shortage of a drug used to treat an extremely rare “black fungus” infection in COVID-19 patients, which can cause facial disfigurement, blindness and death.

- Several Asian countries are struggling with new COVID-19 outbreaks, fueled by more contagious variants that are spreading quickly throughout cities and rural areas.

- Malaysia reported its highest single-day increase in COVID-19 cases since the pandemic began with 6,075 new infections.

- Taiwan, where over 600,000 people are in quarantine, expanded its COVID-19 restrictions beyond Taipei to the entire island.

- Thailand has yet to start an immunization campaign amid its deadliest virus outbreak so far. Japan will bar entry of foreign nationals who recently traveled to Thailand and six other countries.

- The International Olympic Committee reaffirmed that this year’s Tokyo Olympics will go on despite a recent surge in infections across Japan.

- The EU opened its borders to tourists yesterday, allowing vaccinated visitors from pre-determined “safe countries” to skip quarantine and testing requirements.

- France eased its pandemic restrictions yesterday, allowing museums, cafes and cinemas to reopen to the public following a six-month lockdown.

- Brazil’s dominant COVID-19 variant could account for the disproportionately large number of young children who die from the virus there. The country could soon receive additional COVID-19 vaccines from Moderna and China’s CanSino.

- Vaccine hesitancy in Australia, where roughly 30% of citizens say they won’t get shots, could cause up to a quarter of doses to go unused.

- Finland said it will not administer Johnson & Johnson’s single-shot COVID-19 vaccine as part of its inoculation program, citing the shot’s extremely rare blood clot risks.

- Over 130 cases of COVID-19 have been contracted by people in Switzerland who received both doses of a vaccine, with 12 cases proving to be fatal.

- More than 70% of adults in Britain have received at least one dose of a COVID-19 vaccine, while 40% are fully vaccinated.

- The United Arab Emirates and Bahrain are administering COVID-19 booster shots within six months after a person’s second dose.

- Colombia reopened its borders to its immediate neighbors except Venezuela yesterday, hoping to revive the economy in its border regions.

- A new poll shows that most Canadians are willing to use a vaccine passport so that they can travel again but are less open to use them for restaurants and other non-travel purposes.

- The U.K. is pledging to mandate climate disclosures by large companies and financial institutions within the country by 2025 while working toward an agreement with other G-7 economies to end government subsidies for fossil fuels.

- Madrid recently opened a new museum made entirely of plastic that aims to educate visitors about the essential functions of the material, displaying objects used in healthcare, communication, construction, food and sustainable mobility.

- The world’s largest iceberg has broken off the coast of Antarctica as the continent’s ice sheet continues to warm faster than the rest of the planet.

Our Operations

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.