COVID-19 Bulletin: May 24

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices jumped 2% on Friday after three days of losses. Prices were higher in mid-day trading today, with WTI up 3.6% at $65.88/bbl and Brent up 3.0% at $68.43/bbl. Natural gas was 0.8% lower at $2.89/MMBtu.

- The effects of the Colonial Pipeline shutdown are still being felt in the southeastern U.S., with nearly 30% of gas stations empty in North Carolina, South Carolina and Georgia as of Friday, while Virginia and Tennessee also experienced significant shortages.

- With gas prices rising, American refiners are set to increase production amid the highest refining margins since 2015.

- A new global carbon exchange called Climate Impact X is expected to go live in Singapore by the end of this year, allowing companies that can’t reduce emissions to buy offsetting carbon credits.

- Exxon is seeking support in Washington, D.C. for its ambitious plan to establish a massive carbon capture hub in Houston.

- Tanzania and Uganda have reached an agreement to begin construction on a $3.5 billion pipeline that will carry crude pumped in western Uganda to the coast of Tanzania and international markets.

- A new California regulation will require ride-hailing companies such as Uber and Lyft to ensure 90% of their vehicle miles are fully electric by 2030.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- A worsening coronavirus outbreak in Taiwan threatens to exacerbate the global semiconductor chip shortage. The country reported nearly 600 new infections over the weekend, along with eight deaths.

- The White House is pushing for methods to help chipmakers and buyers share information on the supply chain, a move that could lessen the global supply crisis.

- Mitsubishi, Nissan and Suzuki are adjusting June production schedules at plants in Asia due to the global shortage of computer chips.

- Detroit’s big three automakers have been disproportionately impacted by the computer chip shortage in North America, accounting for the 10 most affected car models.

- Cisco Systems predicts electronics components shortages to last throughout the rest of 2021.

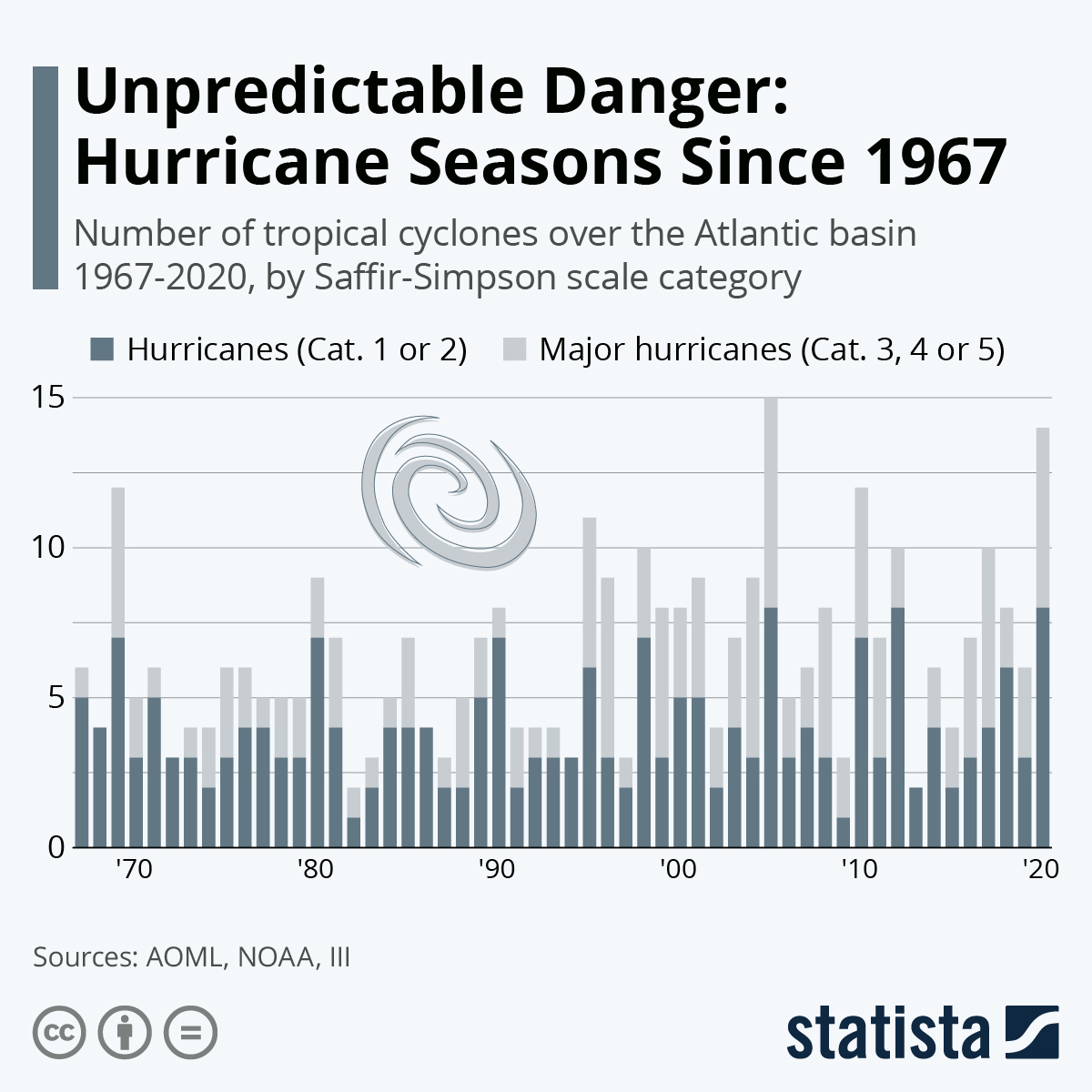

- Ana became the first named Atlantic storm of the year a week before the official hurricane season begins on June 1.

- Prices for used Class 8 tractors have soared more than 70% since last year, a result of manufacturers’ production constraints.

- Canadian National Railway has won out in a battle to merge with U.S. railroad Kansas City Southern, inking a $30 billion deal that will create the first railroad linking Canada, the U.S. and Mexico.

- The quadrupling in cost of a key raw material has increased solar module prices 18% since the start of the year, a sharp reversal of the 90% price decline over the previous decade.

- Booming U.S. restaurants are now facing a “bullwhip” effect in their supply chains, where venues that pulled back operations during the pandemic rapidly scale up to meet increasing demand, leaving suppliers scrambling to keep up.

- The on-time delivery performance of container ships globally fell to 40% in March.

- A move to automate a fourth container terminal at California’s Port of Long Beach is drawing ire from the West Coast dockworkers’ union.

- The recent Colonial Pipeline shutdown has drawn scrutiny to the inefficiencies and economic costs of the 101-year-old Jones Act, which places restrictions on which vessels can serve U.S. ports.

- Electronics supplier Cisco Systems was ranked at the top of Gartner’s annual ranking of the top 25 global supply chains for the second year in a row.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports primarily due to increased volume of ships and containers. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- On Sunday, the U.S. reported just 12,853 new infections and 190 deaths. Over 285.72 million COVID-19 vaccine doses have been administered, with 39.61% of the population fully vaccinated. Fewer than 20,000 new COVID-19 cases were reported Saturday, down from more than 28,000 on Friday.

- With the U.S. ending its first week since last June with no days of infections exceeding 30,000, Americans are starting to return to many pre-pandemic routines.

- Eight states — Connecticut, Hawaii, Maine, Massachusetts, New Hampshire, New Jersey, Rhode Island and Vermont — have now administered at least one COVID-19 vaccine shot in over 70% of their populations, while half of states have vaccinated at least half of their residents.

- The average pace of daily COVID-19 vaccines is down almost 50% from its April peak, the CDC says.

- Under-vaccinated areas in the U.S. could become hot spots for the COVID-19 mutation first identified in India, officials say, while the CDC steps up its surveillance of the strain.

- A new study shows the AstraZeneca and Pfizer/BioNTech COVID-19 vaccines offer significant protection against the strain, which is believed to be more infectious than others.

- South Carolina reported its first four cases of the Indian variant.

- With vaccine supply outweighing demand, the CDC is telling clinics that vaccinating people should take precedence over ensuring every dose in an open vial is used, possibly leading to extra shots being thrown out.

- Amazon will stop requiring face masks for fully vaccinated workers inside warehouses, except where required by law.

- Performance venues including concert halls and theaters will begin receiving roughly $16 billion in federal grants this week, part of the latest pandemic aid bill that seeks to restore local arts and entertainment.

- The White House is mulling the extension of a deadline for hospitals to spend remaining emergency COVID-19 funding after some lawmakers and healthcare workers said they need more time to allocate the funds.

- The percentage of recent college grads who are taking jobs that pay less than $25,000 per year and do not require a college degree fell to its lowest level since 2001, while unemployment for the group dropped to 6.4% in March.

- Limited inventory and record high prices are causing the U.S. housing market to cool for the first time since last year, with existing home sales falling 2.7% in March on a 19% increase in home costs from last April. Meanwhile, home resales surged 33.9%.

- Strong domestic demand boosted U.S. manufacturing in early May, with a purchasing managers index rising to 61.5, indicating growth, while backlogs of uncompleted work pile up as manufacturers struggle to find raw materials and labor.

- Activity in the U.S. services sector saw its sharpest increase in over a decade in early May, with preliminary data showing a purchasing managers index rising to 70.1 from 64.7 in April.

- Early data from April show that vaccinated consumers were less likely to go out to restaurants, salons and entertainment venues than those who do not plan to get a vaccine.

- After taking 20,000 reservations for its 2022 F-150 Lightning electric pickup truck, Ford announced it will limit production of the vehicle for its first year on sale.

- Ford will partner with South Korean firm SK Innovation in a joint venture to produce electric-car batteries in the U.S., which will likely include the construction of two new plants in North America.

- Petco soundly beat earnings estimates and raised its forecast for the year after same-store revenue in the first quarter rose 28% following a surge in pet adoptions and shift to e-commerce shopping during the pandemic.

International

- With 222,315 new infections Monday, India posted its eighth straight day of coronavirus cases below 300,000. The country’s single-day death toll, however, remained at a near-record 4,454.

- Total COVID-19 deaths in India topped 300,000 today.

- Singapore faces increased restrictions amid 32 active virus clusters. A breath test that gives almost immediate results of COVID-19 infection has been approved for use in the country.

- South Korea, which has only 3% of its population vaccinated against COVID-19, is expected to make a “swap” deal with the U.S. where shots will be shared now in return for South Korea’s sharing of shots in the future.

- Taiwan may extend current COVID-19 restrictions that were scheduled to expire this week in the face of rising COVID-19 infections.

- Thailand has put up barbed wire and checkpoints in several villages along Malaysia’s border after finding a new cluster of COVID-19 cases with a fast-spreading variant. To curb a recent surge of COVID-19 infections, the country has deployed sweat-sniffing dogs trained to detect the virus in humans after trials showed them to have a 95% success rate.

- The healthcare system in Osaka, Japan’s second-largest city, is “crumpling” under the latest COVID-19 wave as it accounts for one-third of the nation’s virus cases as doctors urge cancellation of the summer Olympics. Japan will not administer doses of AstraZeneca’s COVID-19 vaccine over fears of extremely rare blood clots.

- Israel is ending many COVID-19 restrictions and initiating a “Green Pass” program after a successful vaccination campaign that has nearly stamped out new infections.

- The EU has issued a warning regarding second doses of AstraZeneca’s COVID-19 vaccine, saying that anyone who developed a blood clot with low platelets after receiving their first shot should not receive a follow-up jab.

- Germany’s health minister announced that the country had broken through its third wave of COVID-19 infections but cautioned the public to remain vigilant against the virus, warning that the available vaccines may be less effective against the variant found in India.

- Despite a rise in U.K. COVID-19 cases stemming from the Indian variant, the country’s prime minister is sticking to plans to end lockdowns on June 21.

- Ireland is closely watching the COVID-19 variant first found in India after the country reported 524 new overall infections on Friday.

- Scotland is keeping Glasgow under tighter restrictions than the rest of the country for at least an additional week due to a rising number of COVID-19 cases.

- Norway announced plans to ease its COVID-19 restrictions next week, allowing larger groups of people to congregate and to let most bars and restaurants serve alcohol until midnight.

- On Saturday, total COVID-19 deaths in Latin America surpassed 1 million, about 30% of the global total.

- Mexico reported its lowest daily COVID-19 death count in a year over the weekend — 60.

- Canada surpassed the U.S. for the percentage of its citizens having received their first dose of a vaccine, although most regions in the country remain under strict lockdowns.

- China said it would provide an additional $3 billion in aid over the next three years to help developing countries recover from the pandemic.

- The International Monetary Fund unveiled a $50 billion plan it says could vaccinate at least 40% of the global population by the end of the year and at least 60% by the first half of 2022.

- Pfizer/BioNTech will deliver 2 billion vaccine doses to developing nations over the next 18 months.

- Leaders of the G-20 are set to sign a new set of guiding principles that pledge cooperation to prevent future outbreaks like COVID-19.

- A maze of jurisdictional rules threatens to weaken international travel at a time when many countries, especially in Europe, are reopening borders and promoting tourism.

- Food prices have jumped by nearly one-third over the past year to their highest levels since 2014, with corn prices up 67%, sugar up 60% and cooking oil up 50%.

- Indonesia’s exports rose at the fastest pace in 11 years on rising commodity prices.

- The economic fallout of the pandemic on Germany will likely extend to more than $366 billion and take years for losses and structural distortions to be balanced out.

- Despite growing interest in circular economies, separation and recycling have been made less viable by low oil prices, bans on imported recyclables in countries like China, and new trends in packaging and design.

- Chile has passed a new regulation that aims to reduce single-use plastic pollution by banning hard-to-recycle items from restaurants and delivery services.

Our Operations

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.