COVID-19 Bulletin: May 27

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose slightly on Tuesday after the American Petroleum Institute reported a lower-than-expected crude draw of 439,000 barrels for the week ending May 21. Prices were higher in afternoon trading today, with WTI up 1.0% to $66.86/bbl and Brent up 0.8% to $69.40/bbl. Natural gas was 2.2% lower at $2.96/MMBtu.

- If the U.S. and Iran reach a nuclear deal that lifts U.S. sanctions, additional Iranian oil probably won’t hit the market until August at the earliest.

- Canada’s top five pension funds increased their investments in the country’s major oil sands producers by $2.4 billion in the first quarter, a 147% increase from last year.

- Extreme heat this summer could create energy shortfalls across some regions of the U.S., particularly California, which increasingly relies on wind and solar energy.

- Royal Dutch Shell has been ordered by a Dutch court to make quicker and larger cuts to its greenhouse gas emissions, a landmark ruling that could pave the way for legal action against energy companies around the world.

- Exxon shareholders filled at least two seats on the company’s board with nominees of an activist investor pushing the company to diversify beyond oil and fight climate change, while Chevron shareholders voted in favor of a proposal to cut emissions generated by the use of the company’s products.

- The EU is set to unveil 12 climate change policies in July, including an overhaul of renewable energy regulations affecting transport and industry.

- Indonesia is banning new coal-fired power plants in its bid to cut carbon emissions.

- Chile is introducing a new blockchain-based platform that will track renewable energy usage, providing miners with a greater ability to show their green credentials to buyers.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Twenty-five North American car models have lost at least 10,000 units of production so far this year, a result of the continuing global semiconductor shortage.

- Ford announced a spate of new shutdowns at plants in Chicago, Kansas City and two locations in Michigan.

- Kia will shut down its assembly plant in West Point, Georgia, for two days this week due to the chip shortage.

- Without a consensus on how “green” cargo ships will be powered, builders and charterers are not optimistic the global fleet will be able to meet ambitious efficiency and emissions-reductions standards over the next several decades.

- Facing market uncertainties and rising costs, Chinese manufacturers are reticent to expand, posing a further threat to global supply chains.

- Drone delivery service Flytrex is expanding its operations in North Carolina, with plans to deliver orders from Walmart and other local stores within a one-mile radius of retailers.

- California-based startup Kodiak Robotics formed a partnership with SK Inc. to bring its autonomous trucking software to South Korea, hoping to commercialize the technology throughout South Korea and China.

- As more Americans relocate, many are finding their belongings are late to arrive due to capacity constraints and driver shortages among moving companies.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports primarily due to increased volume of ships and containers. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- The U.S. has reported roughly 24,000 COVID-19 infections per day over the past week, down 23% from last week, with 24,052 new COVID-19 cases and 1,009 deaths on Wednesday. Over 289 million vaccine doses have been administered, with 40.2% of the population fully vaccinated.

- The FDA will likely reject new emergency use authorization requests for COVID-19 vaccines for the remainder of the pandemic unless the drugmaker is already holding discussions with the agency.

- An antibody drug made by Vir Biotechnology and GlaxoSmithKline has been approved for use in the U.S., making it the third antibody medicine authorized to treat patients in early stages of COVID-19 who have a high risk of developing severe symptoms.

- Despite a significant decline in active COVID-19 infections in the U.S., the White House’s top medical adviser says that unvaccinated individuals are still at a very high risk for contracting the virus.

- New York state ruled that venues can be at 100% capacity if all patrons are fully vaccinated against COVID-19. In a bid to encourage more teens to get vaccinated, the state’s governor also announced a new weekly raffle for those aged 12-17 to win full scholarships to SUNY or CUNY schools.

- A woman in southwestern Ohio won the first $1 million prize in the state’s “Vax-a-Million” lottery to encourage COVID-19 vaccinations. The program, which also offers scholarships to young people who get vaccinated, has boosted the state’s vaccination rate by 45% and the rate for 16- and 17-year-olds by 94%.

- Puerto Rico has lifted its COVID-19 curfew and other restrictions on a trial basis and will review extending the relaxed rules on June 6.

- Beginning June 4, workers in New Jersey with proof of a COVID-19 vaccination will be able to disregard social distancing measures and work mask free.

- The Health Insurance Portability and Accountability Act (HIPAA) permits employers to request a copy of employee vaccination cards, keep them on file and share their status with supervisors.

- About 53% of U.S. school districts are offering in-person instruction five days a week, while only about 1% are still fully remote. Most schools are expected to completely return to in-person learning in the fall.

- Many school districts across the U.S. are offering incentives such as prize giveaways and free prom tickets to help encourage more students to get vaccinated against COVID-19.

- First-time jobless claims fell to a pandemic low of 406,000 last week, better than expected.

- Life insurance plans sold in the first quarter of 2021 jumped by 11% from a year earlier, driven by gains from lower-income households, reflecting increased awareness of the need for policies brought about by COVID-19.

- Tourists from Latin America, where just 3% of the population has been vaccinated, are flocking to the U.S. to receive vaccinations.

- Disneyland will begin allowing visitors from outside California starting June 15.

- The days of bargain airfares have ended due to a rise in leisure travel coupled with pandemic-reduced flight schedules, with the median price for a round-trip fare up 12% from the first quarter.

- Amidst the unprecedented economic disruption of the pandemic, travel sectors took the biggest hit in 2020.

- Ford announced plans to increase electrification of its vehicles, aiming to have 40% of its global volume all electric by 2030.

- Hyundai aims to sell about 1 million electric vehicles per year by 2025 to achieve a 10% share of the global electric vehicle market.

- It could take 3-4 years to build the factories to manufacture the roughly 2,000 wind turbines needed to meet offshore wind targets, threatening the White House’s goal for boosting jobs in the industry.

- The U.S. Department of Energy announced plans to invest up to $14.5 million in research and development to help reduce plastic waste and lower the amount of energy used to produce single-use plastics.

International

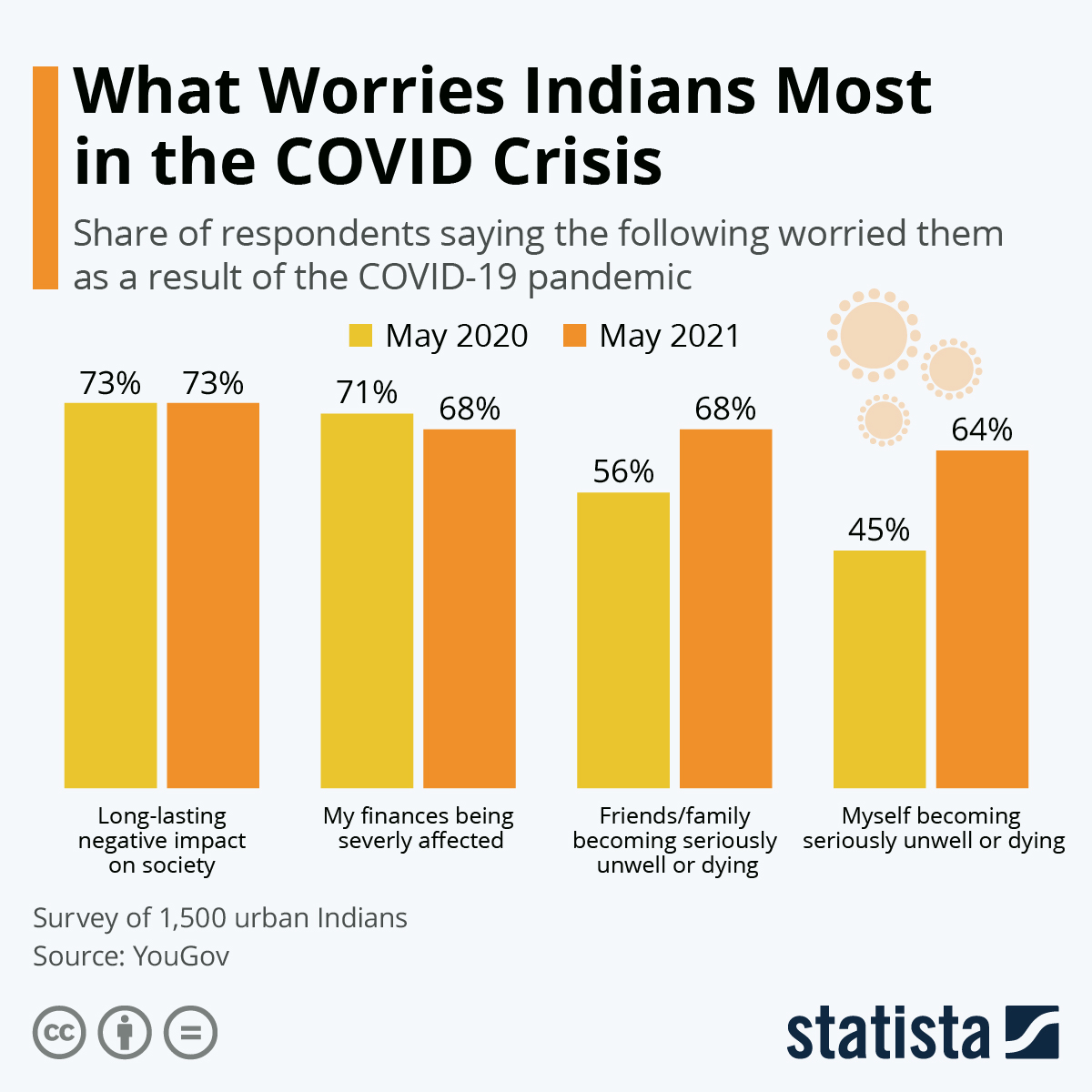

- India reported 211,298 new COVID-19 cases and 3,847 deaths Wednesday.

- The government suggested that reported data may only represent 1 in every 25-30 infections, while the country’s true death toll could be more than 10 times higher than official numbers, the New York Times estimates.

- The government is scrapping local trials for “well-established” foreign coronavirus vaccines, a bid to quicken imports.

- Indian doctors are reporting emotional and physical exhaustion as the nation’s healthcare system continues to be overwhelmed.

- Moderna is planning to launch a single-dose COVID-19 vaccine in India in 2022.

- Global coronavirus deaths could be up to three times more than official records, the World Health Organization said.

- Daily COVID-19 deaths in Mexico have fallen to levels last seen in April 2020, a result of post-infection immunity, modestly increased vaccinations and warmer weather.

- Nineteen countries report facing severe shortages of oxygen due to healthcare systems overwhelmed with COVID-19 patients.

- Nationalism and a shortage of manufacturing capacity has significantly hampered the success of international vaccine-sharing alliance COVAX.

- Japan is likely to extend a state of emergency in Tokyo and other regions beyond its current expiration at the end of the month.

- A backlog at overwhelmed COVID-19 testing facilities is forcing many of Taiwan’s residents to wait up to nine days to receive the results of their COVID-19 tests, adding new challenges to the island’s recent surge in infections.

- Thailand prisons may soon start offering provisional releases to some inmates, hoping to reduce overcrowding and curb COVID-19 infections in its facilities. The country reported 41 new COVID-19 deaths on Tuesday, a record.

- Victoria, Australia’s second-largest state, reported six new COVID-19 cases in the last day, the largest daily rise since last October.

- Belgium is suspending the usage of Johnson & Johnson’s single-shot COVID-19 vaccine for people under the age of 41.

- France will make all incoming travelers from the U.K. undergo quarantine due to the number of highly contagious COVID-19 variants circulating in the country.

- The World Health Organization is asking for more information regarding the safety and manufacturing of China’s Sinovac COVID-19 vaccine before recommending it for global use.

- COVID-19 vaccine manufacturers could make up to $190 billion in sales this year if they reach their production targets, however, researchers say that production constraints and shortfalls will likely bring sales numbers closer to $115 billion.

- Germany has launched a new $3.1 billion fund to help artists and event organizers recover from COVID-19, with the government subsidizing tickets to help support events where the number of attendees is lower due to pandemic restrictions.

- Profit growth of China’s industrial firms slipped in April, causing official concerns about commodity price inflation and prompting government intervention to stop gouging and illegal pricing practices.

- Airbus has ramped up projections for an almost two-fold increase in output of its best-selling jets by the middle of the decade, a bet on the aviation sector’s nascent recovery from the pandemic.

- China’s Lenovo group, the world’s biggest maker of personal computers, posted a 512% gain in fourth-quarter profit fueled by increased demand from people working and studying from home during the pandemic.

- Nissan is in talks with the U.K. to build the company’s largest electric vehicle production hub outside of Japan.

Our Operations

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.