COVID-19 Bulletin: November 1

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- U.S. crude prices rose slightly Friday but were down for the week, ending a streak of nine consecutive weekly gains, as top American officials began talks with oil-consuming nations on ways to press OPEC to boost monthly output.

- Oil futures were higher in late morning trading today, with WTI up 0.6% at $84.08/bbl and Brent up 0.8% at $84.42/bbl. U.S. natural gas was 2.2% lower at $5.31/MMBtu.

- Third-quarter net income for Saudi Aramco, the world’s largest oil producer, more than doubled from a year ago.

- Exxon Mobil will resume share buybacks next year after third-quarter profit surged on higher prices, larger refining margins and stronger demand for chemicals. The company also raised its dividend, maintaining its status as a dividend aristocrat with over 25 years of annual dividend increases. The major is just one of many big oil companies generating their biggest cash flows in years and using proceeds to fortify shareholder returns instead of expanding drilling, a trend prominently rejected by Saudi Aramco.

- Almost all planned coal production in the U.S. is sold out through the end of next year and into 2023.

- The Supreme Court agreed on Friday to consider the scope of the Environmental Protection Agency’s authority to restrict power-plant emissions, potentially paving the way to future regulation of the industry.

- One person died and 15 were injured when a Pemex pipeline exploded in Mexico’s central state of Puebla over the weekend.

- Since Sunday, Haiti’s largest gang has blocked access to the country’s biggest fuel terminal that supplies 70% of the country’s needs, causing severe shortages in the capital and several other cities.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- The U.S. and EU have reached a trade truce on steel and aluminum that will allow the allies to remove tariffs on more than $10 billion of trade annually.

- China’s Golden Week holiday at the beginning of October, normally marking the end of the peak ocean shipping season, delivered little respite to shipping congestion this year.

- Transatlantic shipping rates between the U.S. and Asia fell 6% last week as retailers appear to be giving up on getting more goods delivered by Christmas.

- U.S. importers expect to pass on costs from new fees on containers that sit too long at Southern California terminals, a contentious measure they say is mostly out of their control due to a shortage of truckers and congested ocean shipping lanes.

- The latest complication aggravating port congestion: a shortage of container chassis, trucking trailers used to transport containers from dockside terminals.

- More than 200 ports around the world are now offering vaccinations to stranded seafarers, a largely neglected group of essential workers who have been stuck at sea, to forestall further supply chain disruption.

- Nutella spread, Prego pasta sauce and Pringles chips are among many items recently missing from grocery store shelves, as supermarket chains are forced to revamp operations to deal with growing supply chain uncertainty.

- American Airlines canceled close to 1,400 flights over the weekend, accounting for 15% of its operations, due to a lack of available crew members.

- PepsiCo is hiring hundreds of software engineers, data scientists and analysts for two new corporate hubs charged with tailoring digital tools to tackle supply chain issues.

- Stanley Black & Decker has more than $800 million of goods trapped in transit due to supply chain bottlenecks, the toolmaker says.

- Toymaker Hasbro had a backlog of $100 million worth of unfilled orders in the third quarter due to supply chain disruptions.

- Amazon’s global shipping costs hit $18.1 billion in the third quarter, 19.5% higher than the same quarter last year and 2% higher than the second quarter.

- Schneider National saw third-quarter earnings surge 147% from last year, prompting the freight operator to raise its full-year outlook.

- Trucking and logistics firm Werner Enterprises reported that third-quarter profit rose 38% on a 19% increase in revenue from the previous year.

- Samsung saw a 31% rise in third-quarter profit alongside a record $63 billion in revenue on soaring demand for semiconductor chips.

- Skoda, Volkswagen’s prominent brand in the Czech Republic, resumed production Sunday after a two-week outage caused by a shortage of semiconductor chips.

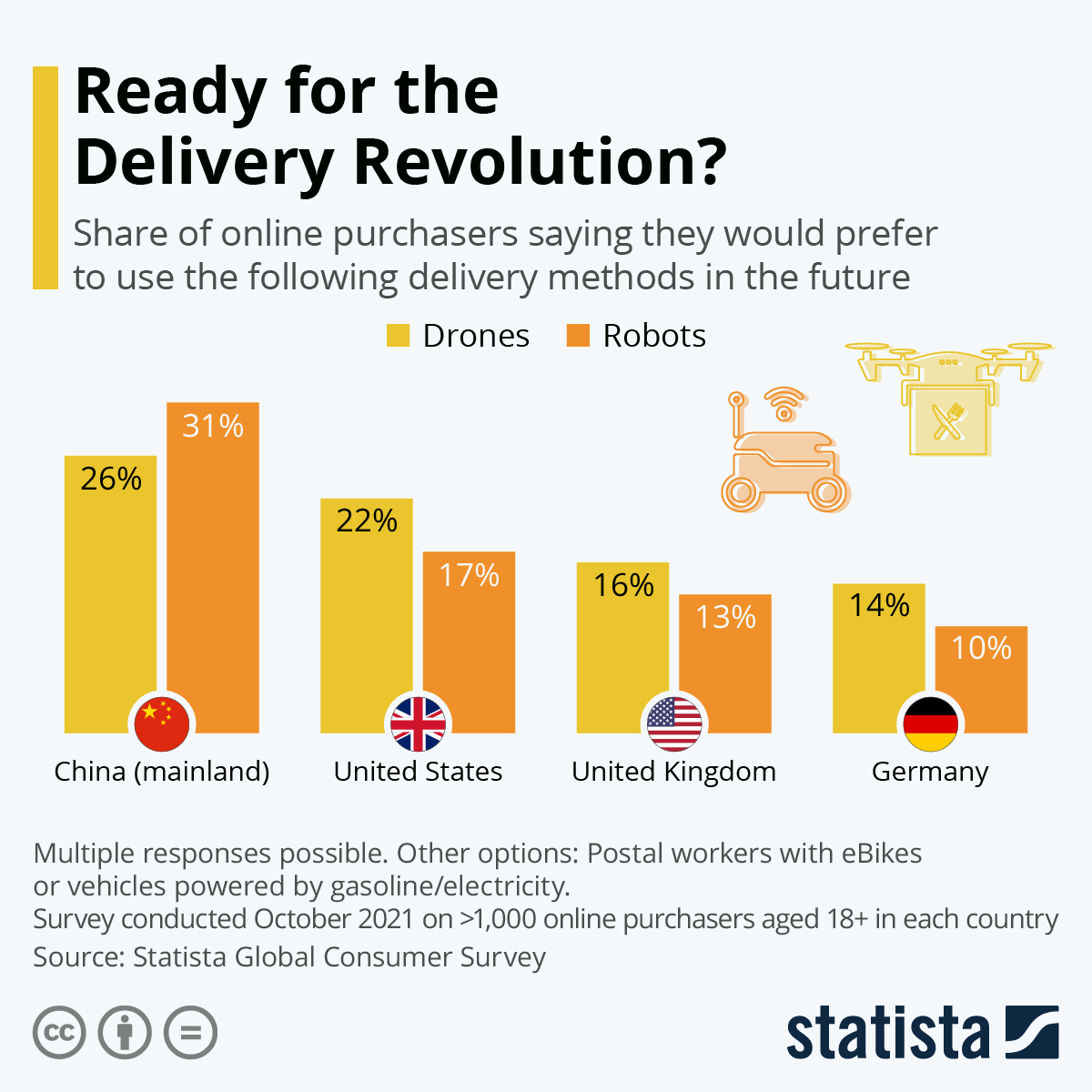

- A subsidiary of Google’s parent company Alphabet will start delivering small consumer products by drone in the Dallas-Fort Worth area, its first densely populated market.

- McDonald’s is partnering with IBM to develop drive-thru robotics.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

- Our Logistics team reports the following:

- Bulk trucking capacity is very limited as demand is exceeding supply.

- Dry van (full, partial and less-than-truckload) capacity is very limited as demand exceeds supply.

- Port congestion continues to be very problematic, delaying deliveries of imported containers.

- Packaging and pulverizing/grinding production challenges persist as demand is exceeding supply.

Domestic Markets

- COVID-19 cases, hospitalizations and deaths are declining in nearly every U.S. state, indicating the most recent wave of the Delta variant is past its peak. The nation reported 17,599 new infections and 164 virus deaths Sunday.

- The U.S.’s total death toll from COVID-19 has surpassed 700,000, more lives than were claimed by HIV/AIDS in the four decades since its first detection in the nation.

- Nearly 90% of vaccinated Americans are now eligible for a third COVID-19 booster dose.

- COVID-19 vaccines for children aged 5 to 11 are expected to be approved by the CDC this week.

- Colorado officials are preparing to limit services at state hospitals due to an overwhelming influx of COVID-19 patients in recent weeks. Yesterday, the state’s governor authorized hospitals to cease admitting new patients.

- Major employers are using detailed questionnaires to determine whether employees qualify for religious exemptions to COVID-19 vaccine mandates.

- Healthcare workers in New York and Maine can no longer claim religious exemptions from COVID-19 vaccine mandates following a pair of court rulings Friday, including from the U.S. Supreme Court.

- New research shows COVID-19 vaccination provides better immunity protection than previous infection with the virus.

- People with a high risk of allergies overwhelmingly tolerated COVID-19 vaccines in a new study from Harvard Medical School.

- Although the U.S. has 5 million fewer jobs than before the pandemic, the country faces a labor shortage that has been exacerbated by high numbers of baby boomers retiring early.

- U.S. wages rose 1.5% in the third quarter, the biggest quarterly increase in 20 years, as companies in every sector faced labor shortages. Workers in the leisure, hospitality and retail sectors saw the highest compensation boosts.

- U.S. consumer prices rose 4.4% in September from the previous year, the fastest rate of inflation in three decades.

- Economists at Goldman Sachs predict high inflation will prompt the Federal Reserve to hike interest rates next July, a year earlier than expected. Corporate traders will also watch for announcements on tapering monthly asset purchases when the central bank meets this Wednesday.

- The supply of smaller homes is at a 50-year low as first-time homebuyers compete with downsizing baby boomers for houses.

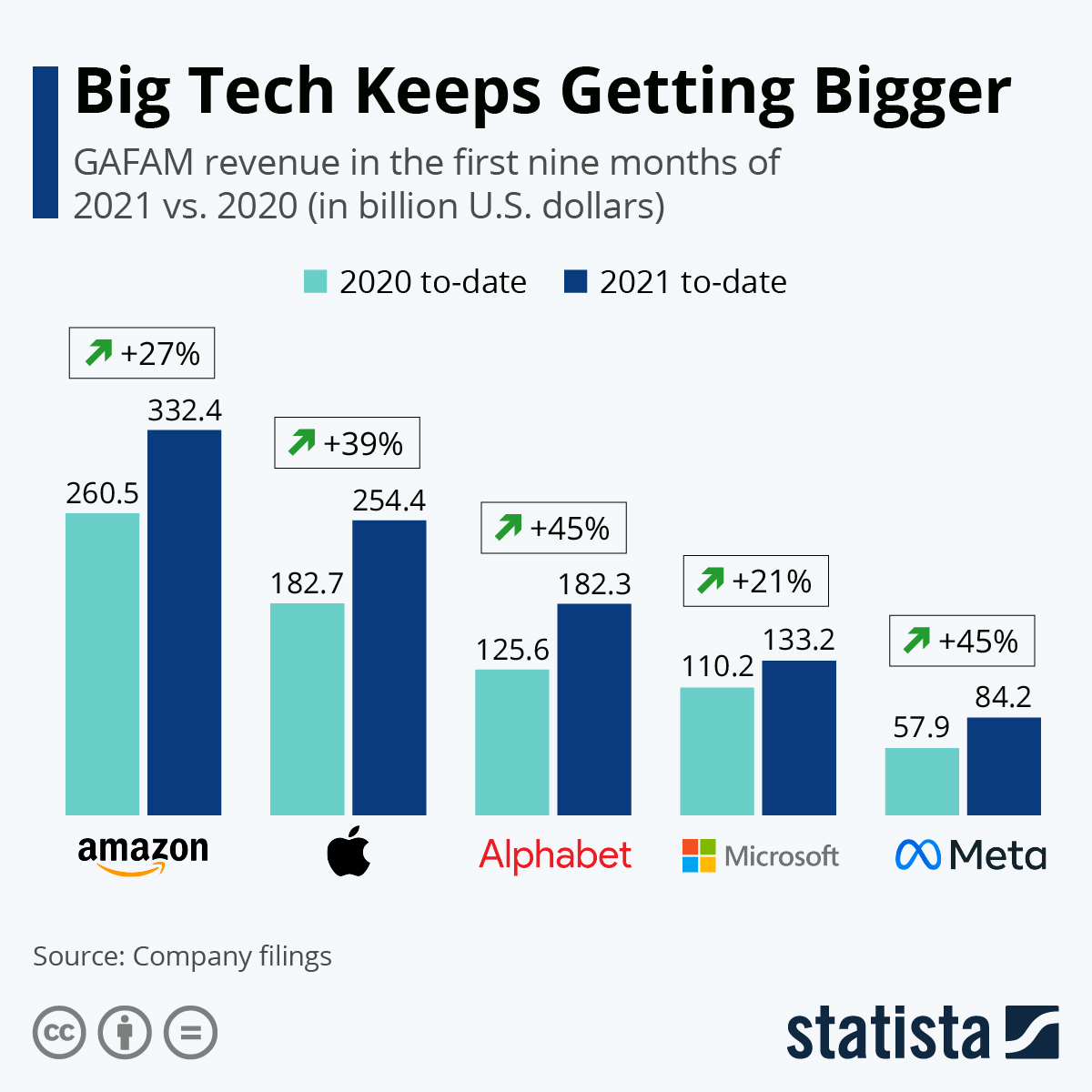

- Earnings at the largest U.S. tech companies all rose more than 20% in the third quarter from the same time last year:

- The Federal Trade Commission is tightening regulations on corporate mergers, most recently with a measure that will give the commission veto power over a company’s future transactions once it attempts an allegedly anti-competitive merger or acquisition.

- GE Appliances will add 1,000 jobs to its main appliance facility in Louisville, Kentucky, as part of a $450 million investment to boost capacity.

- John Deere reached a tentative agreement with striking workers who have been off the job for the past two weeks, the company’s first employee strike in 35 years.

- Electric vehicle (EV) startups Rivian and Lucid have delivered their first EVs.

- Toyota unveiled details regarding its new BZ4X electric SUV, which includes a new steering system, bidirectional charging and a solar roof that can generate up to 1,800 km in driving distance per year.

- The U.S. administration’s plan for a $12,500 tax credit on union-made U.S. electric vehicles is drawing growing opposition from other countries, who say the measure violates international trade agreements.

- The Federal Aviation Administration is preparing to warn pilots and airlines over expected interference caused by a new 5G wireless service set to turn on in December.

International Markets

- The global death toll from COVID-19 crossed 5 million Sunday.

- Russia reported nearly 41,000 new COVID-19 cases Sunday, a record.

- With the financial and tech hub of Singapore reporting more than 3,000 COVID-19 cases per day, the city-state has abandoned its zero-tolerance virus strategy in favor of measures that permit economic activity to continue. South Korea, now consistently reporting more than 2,000 cases per day, adopted a similar strategic shift.

- China has reported close to 380 new COVID-19 infections since Oct. 17, its largest outbreak in months. Shanghai Disneyland was forcibly locked down Sunday when a single COVID-19 infection was detected.

- Melbourne, Australia, emerged from its sixth COVID-19 lockdown Saturday as the city’s full vaccination rate surpassed 80%.

- Cambodia’s prime minister announced that the country is ready to reopen after vaccinating roughly 86% of its population against COVID-19.

- Only five African countries are expected to meet a year-end deadline for vaccinating 40% of their populations, the World Health Organization said.

- Indonesia became the first country to give emergency use authorization to Novavax’s COVID-19 vaccine.

- New research from Israel showed third COVID-19 vaccines reduced the chance of hospitalization and death by a respective 93% and 81%, effectively restoring full levels of protection.

- Factory activity in China contracted for a second straight month in October, with the nation’s manufacturing purchasing managers’ index dropping to 49.2 from 49.6 in September. A non-manufacturing gauge, which measures activity in the construction and services sectors, dropped below expectations to 52.4.

- Mexico’s economy contracted 0.2% in the third quarter from the prior quarter, below analyst expectations and the first quarterly decline of the pandemic recovery.

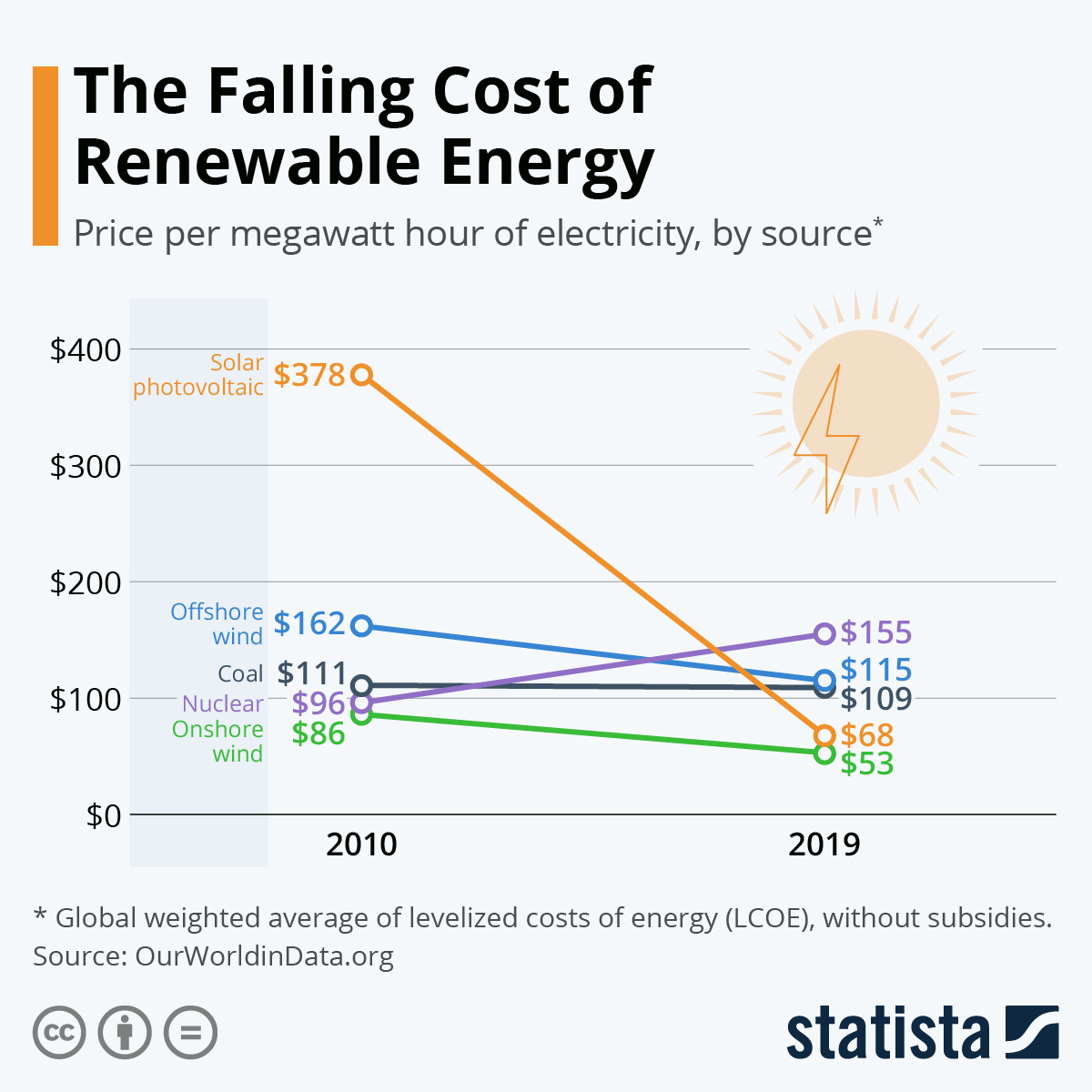

- Leaders of the G20 nations meeting in Rome on Sunday held firm to Paris-agreement climate goals set in 2015 but failed to reach consensus on new measures such as halting financing for foreign coal projects or speeding up the transition to renewable energy.

- G20 leaders have reached a preliminary agreement on a global corporate tax rate of 15% on large businesses, with a provision directing tax revenues to countries where a company’s goods and services are consumed rather than its legal headquarters.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.