COVID-19 Bulletin: November 10

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices hit a two-week high Tuesday after the American Petroleum Institute reported its first crude inventory draw in six weeks, fueling speculation that the White House will soon tap into emergency crude reserves. Futures were lower in late morning trading, with WTI down 1.9% at $82.52/bbl and Brent down 1.2% at $83.79/bbl. U.S. natural gas was 1.2% lower at $4.92/MMBtu.

- The national average price per gallon of diesel rose slightly last week to $3.73 per gallon, the highest weekly average since December 2014. Rebounding international air travel and higher oil demand in Asia could push crude prices past $120/bbl in the first half of 2022, Bank of America predicts.

- The U.S. ambassador to Mexico outlined “serious” concerns over a proposal from Mexico’s president that would strengthen state control of the nation’s power market at the expense of private companies.

- Six carmakers including Ford, General Motors and Daimler have committed to phasing out the production of gas-powered vehicles globally by 2040. Notably absent from the agreement are major manufacturers including Toyota and Volkswagen.

- The White House and the U.S. Army Corps of Engineers are reportedly looking into replacing Enbridge’s major pipeline that carries crude from Canada to the U.S. through the Great Lakes. The news comes after concerns over initial plans to shut down the pipeline completely.

- Colombia’s state oil producer Ecopetrol saw a near 100% surge in third-quarter earnings from the same time last year due to higher crude prices.

- The U.K. declined to join the Beyond Oil & Gas Alliance, led by Costa Rica and Denmark, that would pledge a fixed date for countries to phase out oil and gas production.

- The U.S. special envoy for climate told international leaders at the COP26 climate summit in Glasgow that the U.S. will likely stop burning coal entirely by the end of the decade.

- Trinseo announced plans to divest its styrenics businesses.

- Paint and coatings makers PPG and Sherwin-Williams said continuing resin supply constraints following 2021 weather events have impacted third-quarter results.

- Spot prices for recycled PET have nearly doubled this year in Europe, while the price for food-grade recycled PET in the U.S. now tops $1 a pound.

- PepsiCo and Unilever cited a need for more chemical recycling of hard-to-recycle plastics to help them achieve their sustainability goals.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- More than 70 container ships remain stuck waiting to dock at Southern California ports, with wait times at the Port of Los Angeles averaging two weeks since the beginning of October.

- The number of imported containers passing through major U.S. ports in October hit 2.19 million TEUs, down 1.2% from last year but 2.3% higher than September.

- Shippers are having an increasingly difficult time finding warehouse and distribution space given the tightest market conditions in years, with vacancy rates hovering near historic lows and expected to thin even more the rest of 2021.

- Air cargo demand in October was 3% higher than in October 2019, while rates are 155% higher.

- CEOs of Walmart, Target, UPS and FedEx spoke with the U.S. President Tuesday about how to relieve supply chain challenges as heavy congestion still plagues the nation’s ports. While no set policies have been released from the talks yet, concerns remain that even urgent efforts will not be fast enough to forestall further disruption.

- The U.S. administration announced plans Tuesday to identify and pay for possible upgrades to U.S. ports within the next 90 days, a bid to ease inflation caused by ships waiting to dock and a shortage of truck drivers.

- Common medical treatments including insulin, supplements, Adderall and oxycodone are running low nationwide due to supply chain disruptions, with the FDA currently listing 112 drug shortages on its website.

- U.S. retail sales of new vehicles are estimated to have fallen 17.4% year over year in October to just 943,500 units due to continued impacts of the global chip shortage.

- Container shortages, factory shutdowns, and increasing labor and transportation costs are hampering apparel production and putting used clothing retailers back on the map, with shares of several of the largest secondhand dealers rising by double digits in recent trading. U.S. apparel imports from China rose 25.2% in September, while imports from Vietnam fell 4.6%.

- Columbia Sportswear is reporting doubled transit times of up to six weeks for its U.S. imports.

- Out-of-stock messages to online customers have risen 32% since June, led by apparel, sporting goods, baby products and electronics.

- Stopgap measures in response to supply and shipping disruptions are being adopted permanently by many large firms, including consumer-goods suppliers trimming product lines and manufacturers resetting assembly lines to accommodate parts shortages.

- Farm equipment dealers are bracing for delayed deliveries from John Deere, the nation’s leading supplier, due to a 10,000-worker strike now stretching into its third week.

- UPS is responding to job applicants in as little as 30 minutes, down from an average response time of two weeks before the pandemic as labor shortages continue.

- Unemployment in the U.S. transportation sector fell to 5.1% in October, down 3.8 percentage points from the same time last year.

- Evergreen Marine’s container ship order book increased by two to 78 vessels, with a projected capacity addition of 24,000 containers per ship.

- Texas has begun deploying used shipping containers to fill gaps in its border wall with Mexico.

- New York and New Jersey port operators have pledged to halve greenhouse gas emissions at their facilities by the end of the decade.

- Maersk is in the process of developing a fuel cell tugboat capable of running on green methanol, part of broader efforts to lower carbon emissions from ships.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

Domestic Markets

- The U.S. reported 79,829 new COVID-19 infections and 1,662 virus deaths Tuesday.

- New research from Texas shows unvaccinated people are 20 times more likely to die from COVID-19 than those vaccinated.

- Colorado has opened COVID-19 booster shots to its entire adult population amid a surge in infections that has pushed state hospitals to ration care.

- California’s COVID-19 case rate is now above that of Texas and nearly double Florida’s, a result health experts attribute to vaccinations being administered earlier in California and therefore waning earlier. Hospitalizations in some regions of the state are up more than 20% the past several weeks.

- COVID-19 cases in New Hampshire and Minnesota have risen to levels not seen since January.

- Michigan State University has begun firing staff and suspending students for failing to get vaccinated.

- More than 360,000 children under age 12 have been vaccinated against COVID-19 since federal regulators authorized Pfizer’s shot for the age group last week.

- San Francisco will require children between ages 5 and 11 to show proof of COVID-19 vaccine for some indoor activities.

- COVID-19 cases among school children have become Michigan’s largest source of recent outbreaks, officials say.

- The Federal Reserve declared that a broad deterioration in the health of Americans spurred by the pandemic is among the largest near-term risks to the financial system. Central bank officials also are warning that high inflation could last longer than expected, potentially justifying an interest rate increase as early as the end of 2022.

- The House of Representatives could vote as soon as next week on a roughly $2 trillion social-spending and climate bill.

- The Consumer Price Index rose 0.9% in October from the prior month, raising the annual inflation rate to 6.2%, the highest in 31 years.

- Tyson Foods, Conagra and Kraft Heinz informed retailers they will raise prices on frozen and refrigerated meats in January.

- Older U.S. apartment buildings with low-income tenants have seen larger rent spikes than higher-end properties since March, a reversal from trends earlier in the pandemic as people begin returning to cities and more densely populated areas.

- A quarter of U.S. workers are considering a job change or retirement in the next 18 months, new research shows, pointing to prolonged uncertainty in an already tight labor market.

- General Electric’s announcement that it would split into three public companies is reigniting years-long calls for large industrial conglomerates to break up for simplified operations and clearer value propositions.

- Airlines are adding flights following the lifting of restrictions on nonessential travel.

- American Airlines is offering to pay employees three times their normal salaries as well as $1,000 bonuses to work during the holiday season, a bid to avoid the critical staffing shortages that led to thousands of recent flight cancellations.

- Amazon-backed electric vehicle maker Rivian went public yesterday at a valuation of more than $10.5 billion, topping $78 per share as preorders rise above 55,000 vehicles in the U.S. and Canada.

- Ford sold 14,062 electric vehicles in October, three times the number of electric vehicles sold from a year earlier.

International Markets

- Germany suffered a record number of new COVID-19 infections yesterday.

- French seniors will now be required to include proof of a COVID-19 booster shot on the national health pass that gives access to restaurants, trains and planes.

- Russia now has the highest weekly COVID-19 death rate in the world.

- Yesterday, more than 330 people died from COVID-19 in Bulgaria, a nation with a population of just over 7 million that has among the lowest vaccination rates in Europe.

- New COVID-19 cases in South Korea rose above 2,400 for the first time after the nation began its “living with COVID” strategy last week.

- Canada is the latest nation to approve COVID-19 vaccine booster shots for its adult population.

- Confidence among Japanese manufacturers fell to a seven-month low in November, the third straight month of declines due to ongoing supply shortages. New data shows the nation’s economic output fell 2.1% in September.

- In October, China’s producer price index rose a record 13.5% due to higher energy costs, the second consecutive month of double-digit inflation.

- The possibility that developer Evergrande will not be able to meet interest payments today has added to fears of a liquidity crisis in the Chinese property sector.

- LATAM, Latin America’s largest airline, reported nearly $700 million in third-quarter losses as revenue remained less than half pre-pandemic levels.

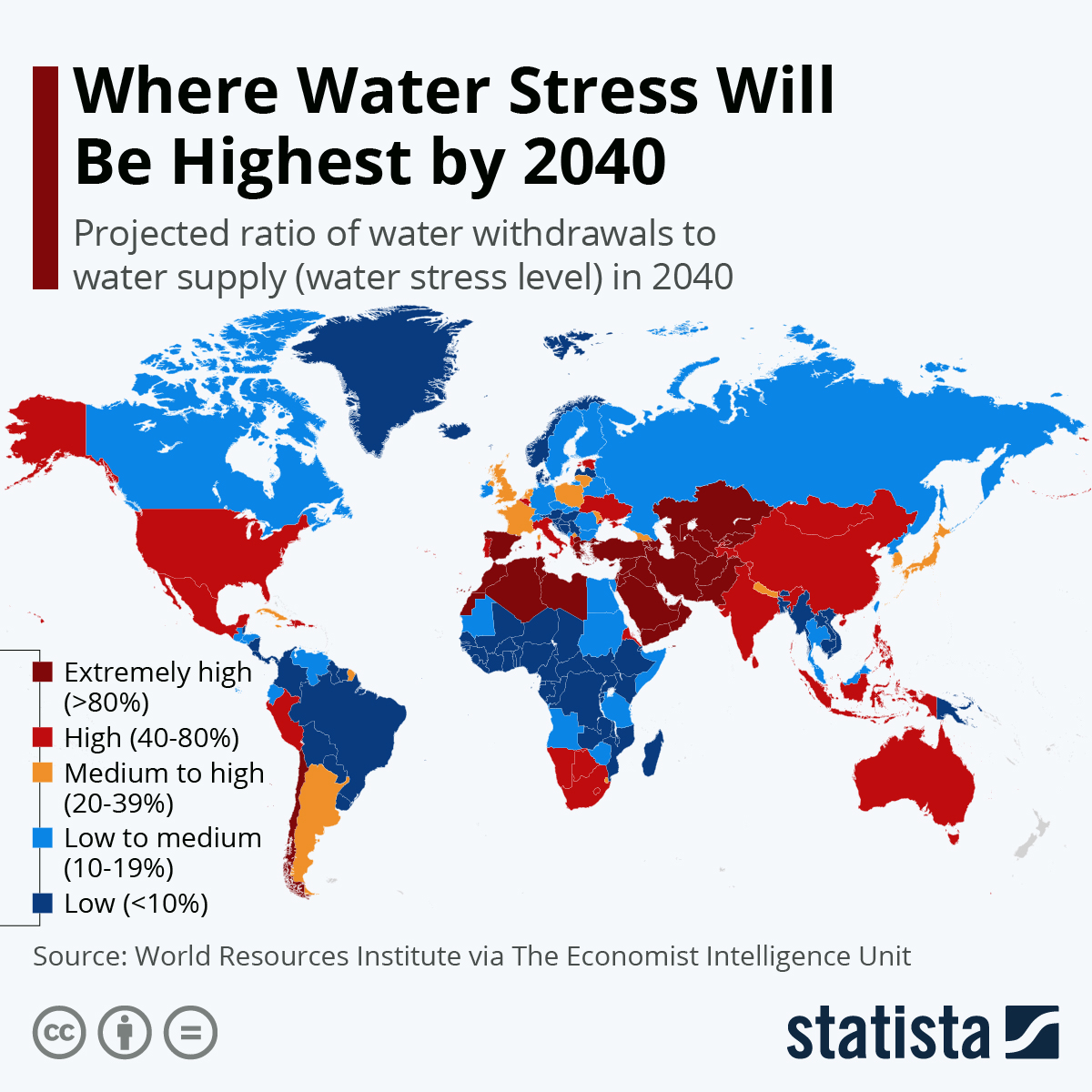

- Over 1 billion people will be at risk of extreme heat and humidity stress if global temperatures rise by an average of 2°C, researchers at the COP26 climate summit in Glasgow say. Global water shortages are set to exacerbate the problem:

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.