COVID-19 Bulletin: November 15

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

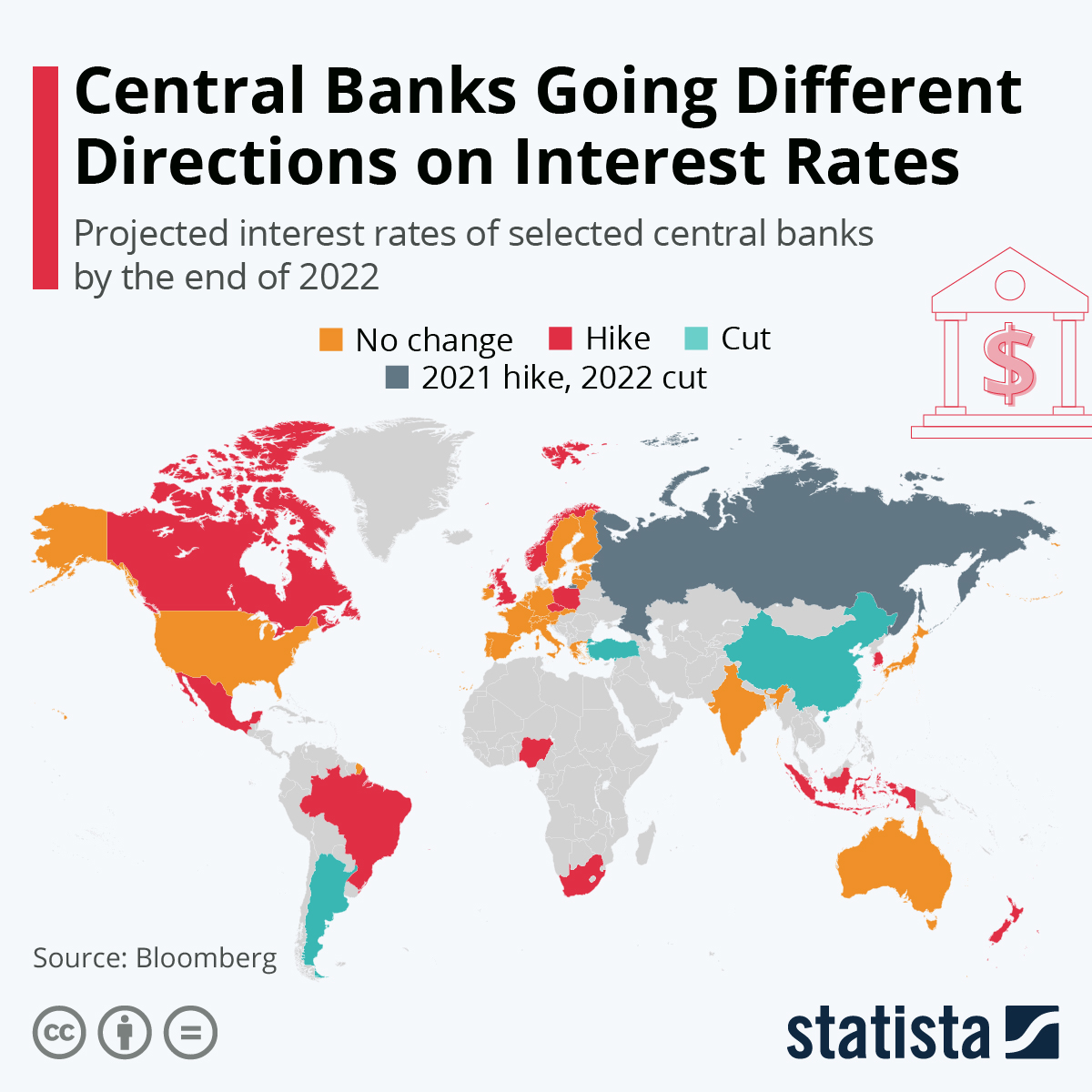

- Oil prices fell Friday on worries of a potential rate hike from the U.S. Federal Reserve as early as the first half of 2022, with prices ending the week lower for the third week in a row.

- Crude futures were lower in late morning trading, with WTI down 1.2% at $79.86/bbl and Brent down 1.2% at $81.16/bbl. U.S. natural gas was 1.3% higher at $4.85/MMBtu.

- Americans will likely pay one-third more to heat their homes this winter due to a shortage of natural gas, the U.S. Department of Energy said. Homes using heating oil primarily in the U.S. Northeast could see costs spike 40% or more.

- Gasoline prices in California reached a new all-time high of $4.68/gallon last Thursday, beating previous records set in 2008 and 2012.

- Despite pledges for cleaner energy and a transition to renewables, major oil and gas producers are looking to African nations as long-term markets, where more than 600 million people still lack electricity and governments are capitalizing on selling oil reserves to help fight poverty.

- Royal Dutch Shell is abandoning its dual British/Dutch corporate structure and centralizing its headquarters in London.

- Shell plans to pave roads and parking lots at its Beaver County, Pennsylvania, site with asphalt infused with recycled plastic.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- The average price for a 40-foot container from Asia to the U.S. West Coast dropped 26% to $13,924 last week.

- October was the Port of Long Beach’s second busiest month on record, with volumes hitting 789,716 TEUs on a 6.6% increase in exports from the previous month. Meanwhile, the movement of empty containers through the port, long a cause of the worst congestion, dropped 2.4% from October 2020.

- A new queuing system at Southern California ports will require vessels that arrive early to anchor and wait at least 150 miles off the coast, a move expected to reduce the number of backlogged ships within four to six weeks.

- German shipping line Hapag-Lloyd saw a tenfold increase in profits the past nine months amid record high freight rates and rising transport volumes.

- Kroger, the U.S.’s largest retail grocer, has increased its safety stock in more than 70 categories while sourcing additional warehouse space to spread out the ports it uses for imports.

- Walmart has begun diverting ships to less congested ports while hiring 20,000 supply chain workers and further automating warehouse operations.

- By some estimates, shipping rates for furniture have now reached 100% of the price for the furniture itself, a freight CEO said.

- Terminal operators in Los Angeles and Long Beach are looking at doubling current fees for daytime trucking moves to incentivize more nighttime moves and relieve congestion.

- Union Pacific said its intermodal traffic between Southern California and inland terminals is approaching normal levels despite the ongoing backlog of ships, with the rail line crediting expanded hours, incentives to operate on the weekends and boosted storage options in Salt Lake City and Chicago.

- Clorox has boosted the use of third-party manufacturers from historical levels of 20% to roughly 50% of shipments, an effort to temporarily ease pandemic-related material shortages.

- Major apparel companies are beginning to move production out of China and Vietnam over continued production shutdowns caused by strict responses to COVID-19 outbreaks.

- Roughly 6% of factory workers at the world’s largest manufacturer of branded sports footwear in Vietnam have quit their jobs, significantly disrupting production and exports.

- Appliance and vehicle makers are temporarily reversing years’ worth of expanded digital features and wireless technology, an effort to continue supplying products to dealers and consumers amid the global chip shortage.

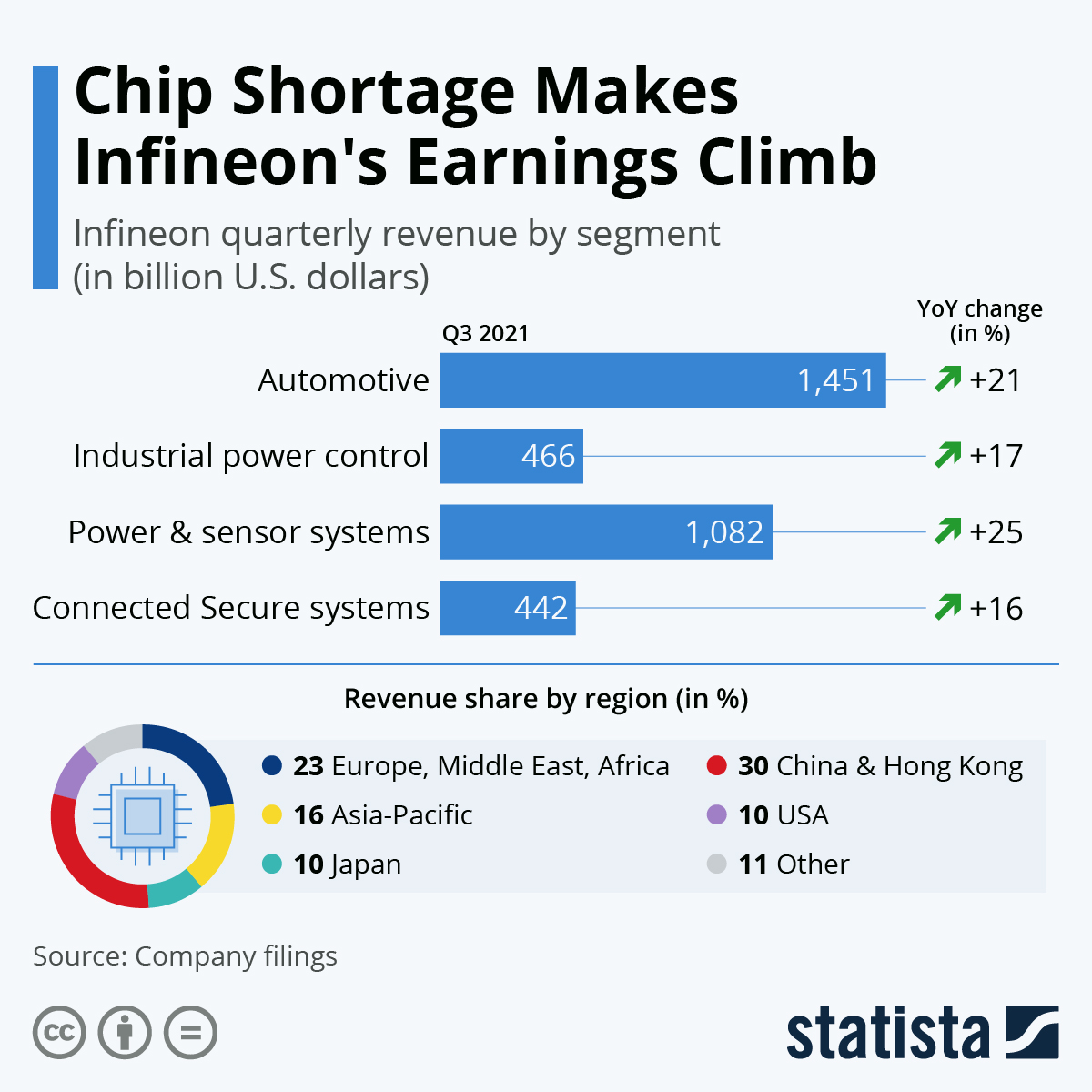

- Apple supplier Infineon, Europe’s largest chipmaker, posted a 10% rise in fourth-quarter revenue as it struggles to meet surging demand for computer chips. The company forecasts the global shortage to remain well into 2022.

- Demand for single-aisle jets is rising faster than Airbus’ ability to ramp up production amid continued parts and component shortages caused by the pandemic.

- Malaysia’s closing of its border to migrant workers at the beginning of the pandemic has created an estimated 500,000-worker shortage, including in the critical export industries of garments, oil and semiconductors.

- Prices for coal-derived urea, a critical ingredient of fertilizer and diesel exhaust systems in India and South Korea, surged tenfold after China restricted coal exports earlier this year.

- A rise in global shipping costs is making 3D printing more attractive, with some customers using the technology to eliminate large inventories and better tailor production based on demand.

- Popular holiday retailers are warning U.S. consumers to order goods as early as possible this year to avoid delayed shipments in the Christmas logistics crunch time.

- “Nuclear verdicts” for crashes in the U.S. trucking industry are soaring, raising insurance rates and leading to calls for increasing drivers’ minimum liability coverage.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

- Our Logistics team reports the following:

- Bulk trucking capacity is very limited as demand is exceeding supply.

- Dry van (full, partial and less-than-truckload) capacity is very limited as demand exceeds supply.

- Port congestion continues to be very problematic, delaying deliveries of imported containers.

- Packaging and pulverizing/grinding production challenges persist as demand is exceeding supply.

Domestic Markets

- The seven-day average for new COVID-19 cases in the U.S. is edging above a recent plateau of around 70,000, led by surges in the Upper Midwest, Northeast and Southwest. The nation reported 23,578 new infections and 120 virus fatalities Sunday.

- Arizona reported 4,447 new COVID-19 cases Friday, just the fourth time since last winter daily cases have topped 4,000.

- Pennsylvania’s seven-day average of new COVID-19 cases is up 20% week over week.

- New COVID-19 cases climbed 29% in Illinois for the week ending Nov. 12.

- Ohio is seeing a surge in COVID-19 infections, reporting 4,689 new cases Saturday and more than 3,600 Sunday, bringing its 21-day case average to 3,935.

- The number of active COVID-19 infections in New Hampshire has climbed above 6,000 for the first time since January, after the state reported 1,000 new virus cases Friday.

- Louisiana currently has the lowest COVID-19 hospitalization rate in the country — just 231.

- Weekly vaccinations against COVID-19 in the U.S. rose to their highest level in six months last week at 9.5 million.

- California became the second state behind Colorado to expand COVID-19 booster shots to all adults over 18.

- With just 58.5% of Americans fully vaccinated against COVID-19, the CDC announced a strategic shift away from herd immunity and will redefine pandemic resilience in terms of reducing infections and deaths.

- Prices for frozen turkeys are up 20% year over year while milk and sugar have hit multi-year highs, the U.S. Department of Agriculture said.

- A record 4.4 million Americans quit their jobs in September, up from 4.3 million people in August as workers continued to take advantage of a surge in job openings across the country. The “big quit” was led primarily by low-wage workers, people of color and women outside management ranks.

- The U.S. labor force participation rate has stagnated roughly 2% below pre-pandemic levels in recent months, with about 1.4 million fewer adults ages 25 to 54 working or looking for a job than in February 2020.

- An index of U.S. consumer sentiment unexpectedly dropped to a 10-year low of 66.8 in the first two weeks of November on rising concerns about the effects of inflation.

- Federal regulator concerns over the effects of 5G technology on airplane cockpits have stalled rollouts of the technology among the largest U.S. telecom firms, many of which have poured significant investments into developing networks.

- Home sale volumes in major U.S. metro areas such as New York and Los Angeles hit record highs in the second and third quarters.

- With bus ridership still 50% below pre-pandemic levels, Atlanta’s municipal transportation service is slashing service.

- U.S. holiday travel is rebounding, with about 53 million people expected to travel for Thanksgiving, up 13% from last year and nearly matching pre-pandemic levels.

International Markets

- More than 2 million COVID-19 infections were reported in Europe last week, the most during a single week of the pandemic.

- Germany reported a near-record 48,640 new COVID-19 cases Friday, as health experts predict infections will continue rising in the near-term. Neighboring Austria began a strict lockdown that only applies to unvaccinated people.

- Russia reported 1,241 COVID-19 deaths Saturday, a pandemic record.

- The Netherlands imposed a 7 p.m. curfew on bars, restaurants and shops after 16,364 COVID-19 infections were reported Thursday, a record.

- Norway expanded COVID-19 booster doses for anyone over 18 and will resume the required use of a health certificate for entry to large events and venues.

- China’s latest COVID-19 outbreak is the nation’s largest since June of last year, with more than 1,000 cases reported across 21 provinces, including 45 in the capital Beijing.

- Thailand will keep bars and nightclubs shut until at least mid-January, as the nation steadily reports more than 7,000 new daily COVID-19 cases alongside dozens of fatalities.

- Japan is increasing hospital beds and boosting medical resources ahead of an expected COVID-19 surge this winter.

- India reopened its borders Monday for the first time since March 2020, allowing quarantine-free travel for vaccinated individuals from 99 of the world’s countries.

- Daily COVID-19 cases have risen for the past 12 days in Ontario, Canada, as the province appears set to enter another virus wave.

- Peru, grappling with the highest COVID-19 mortality rate in the world, will require adults to show proof of vaccination to enter indoor spaces.

- International research suggests roughly 40% of people who have died from COVID-19 had diabetes.

- AstraZeneca will begin selling its COVID-19 vaccines for profit in 2022, a shift away from the nonprofit model developed with the University of Oxford early in the pandemic.

- The Philippines will require all on-site private and public workers to be vaccinated against COVID-19.

- Canada could become the next large country to authorize COVID-19 vaccines for children as young as 5 this week.

- The Bank of Mexico raised the overnight interest rate by a quarter percentage point to 5% late last week, the fourth hike in as many meetings to counter rising inflation. The central bank raised its annualized inflation forecast for the fourth quarter to 6.8%.

- A weekend summit among the 21 nations at the Asia-Pacific Economic Cooperation forum led to more pledges to work together on managing supply chain and labor issues, tackling climate change and responding to the pandemic.

- Scotland will ban the sale of plastic straws, cutlery, polystyrene cups and food boxes starting in June 2022.

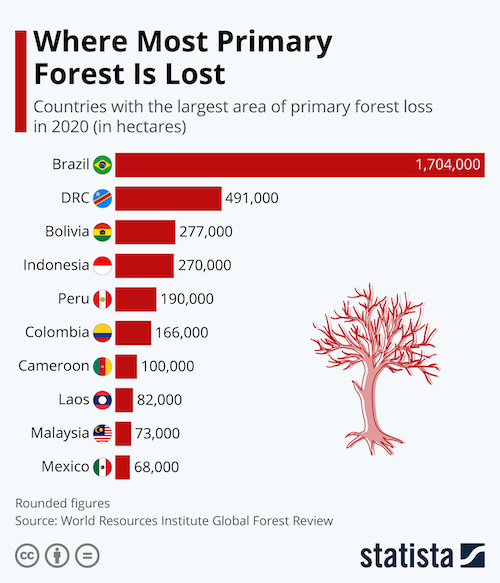

- Despite government pledges to curb the practice, deforestation in Brazil’s Amazon rainforest rose 5% in October compared to a year ago at 339 square miles.

- GM plans to launch 10 new electric vehicles in South Korea by 2025.

- Japan’s Isuzu Motors will begin mass producing electric commercial trucks next year, aiming for an initial batch of 10,000 vehicles amid growing demand for electric vehicles in the logistics industry.

- An agreement among more than 190 nations at Scotland’s COP26 climate summit promises to boost emissions-reduction efforts over the next several decades, but supporters are concerned about the lack of hard targets and enforcement mechanisms that would bind governments to their pledges.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.