COVID-19 Bulletin: November 22

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices fell 3% to below $80/bbl Friday as surging COVID-19 cases in Europe threaten to puncture demand. Prices saw their fourth straight week of losses for the first time in more than a year.

- Oil futures were higher in late morning trading, with WTI up 1.2% at $76.84/bbl and Brent up 1.2% at $79.83/bbl. U.S. natural gas was 5.5% lower at $4.79/MMBtu.

- The average U.S. price for a gallon of gas held steady at $3.41 last week, up 50% from the same time last year. The highest price in the nation tops $6/gallon in California’s Mono County.

- OPEC’s compliance with planned output cuts rose slightly to 116% in October, as the group continues producing less oil than agreed upon targets.

- LNG prices in Asia rose for their second consecutive week, spurred by greater competition from European buyers following news that the Russia-to-Germany Nord Stream 2 pipeline will likely be delayed until next year.

- Federal regulators could preemptively suspend a pending rule from the former U.S. administration that would allow railroads to haul LNG, citing safety and environmental concerns.

- Asia is set to receive 3.7 million bpd of sweet crude this month largely from the U.S., up from 3.1 million bpd in October, as high energy costs make processing sour crude more expensive, refiners say.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- A Southern California utility warned Sunday that more than 16,000 people were likely to lose power due to wildfire risks from hot, dry winds sweeping across the region.

- U.S. container imports are expected to approach 26 million TEUs in 2021, up 18% from a year ago.

- New data suggests more than 3 million containers are stranded worldwide due to a shortage of port workers and truck drivers. In the U.S., logistics researchers predict inefficient operations leave some 40% of trucking capacity unused.

- Seventy-one container ships were anchored outside the Ports of Los Angeles and Long Beach on Friday, down from a record 86 three days prior.

- Energy shortages, port-capacity limits and COVID-19-related factory closures in Asia have eased in recent weeks, as global supply chain disruptions show signs of receding.

- The United Nations predicts that rising costs of ocean shipping could increase global inflation 1.5% by 2023.

- Europe-U.S. air cargo rates hit $6.08/kg to the West Coast last week, up 10% since the start of the month and threefold above normal levels.

- High transportation costs and ongoing container shortages are limiting supplies of fruits and vegetables in the U.S., while fertilizer and pesticide shortages threaten yields next season.

- Tanker rates to ship LNG across the Pacific Ocean jumped to $335,000 per day Friday, a record.

- J.B. Hunt opened a 24/7 transloading facility at a Jersey City, New Jersey, site to expand options for moving ocean freight inland, a bid to help ease supply chain congestion on the East Coast.

- Maersk’s APM Terminals will become the operator of a newly planned container terminal and intermodal rail facility in Plaquemines, Louisiana, with the capacity to handle 22,000 TEUs starting in 2024.

- Canadian truck drivers face pressure to get vaccinated by U.S. rules that take effect in early January requiring foreign drivers and other essential workers entering the country to be inoculated for COVID-19.

- Intel put its Chinese expansion plans on hold, scrapping a semiconductor facility acquisition in the western city of Chengdu, a move likely connected to the White House’s inquiry over security concerns a day before.

- Hapag-Lloyd announced plans to reduce the number of shipping hubs it uses, an effort to increase schedule reliability.

- Victoria’s Secret expects to take a $100 million hit in the fourth quarter from continued supply chain disruptions, with more than 45% of the company’s orders currently delayed.

- Arabica coffee bean prices have spiked 80% this year, largely a result of Brazilian harvests damaged by extreme weather.

- Fund managers who invested early in container shipping have seen windfalls amid record-high charter rates and shipper valuations during the pandemic.

- Greek dry bulk carriers saw impressive third-quarter earnings, with Diana Shipping offering its first dividend since 2008 and Star Bulk Carriers more than doubling quarterly revenue to $415.6 million.

- Canadian Pacific issued a $6.7 billion U.S. debt offering ahead of its planned acquisition of the Kansas City Southern rail line.

- Amazon boosted its orders of IVECO compressed natural gas trucks by 800 to more than 1,000 for its European fleet. In another sustainability move, the company will start using insulated packaging made from recycled paper for refrigerated items.

- The world’s first fully electric container ship set sail last Friday in Norway, with the capacity to carry 120 TEUs and reduce intra-Norway truckloads by up to 40,000 per year, its makers say.

- UPS is expanding its partnership with Google’s self-driving unit Waymo, turning from local deliveries using minivans to long-distance freight hauling with autonomous Class 8 trucks.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

- Our Logistics team reports the following:

- Bulk trucking capacity is very limited as demand is exceeding supply.

- Dry van (full, partial and less-than-truckload) capacity is very limited as demand exceeds supply.

- Port congestion continues to be very problematic, delaying deliveries of imported containers.

- Packaging and pulverizing/grinding production challenges persist as demand is exceeding supply.

Domestic Markets

- The U.S. reported 28,719 new COVID-19 infections and 105 virus fatalities Sunday. Total virus deaths this year have surpassed those of 2020.

- The FDA and CDC gave blanket permission for adult Americans to get COVID-19 vaccine booster doses.

- COVID-19 hospitalizations in Colorado hit their highest level since December 2020, with a growing number of the state’s healthcare facilities again near full capacity.

- Arizona reported a spike of 5,070 new COVID-19 infections Friday after daily case counts hovered between 1,000 and 3,000 over the past month.

- COVID-19 infections in New England are rising, with active cases in New Hampshire setting a record and daily infections hitting their second-highest of the pandemic in Vermont.

- New COVID-19 cases in Massachusetts rose to 3,196 Thursday, the most since February.

- Average daily COVID-19 infections in Connecticut last week were up 116% from two weeks prior, the biggest increase in the nation.

- Michigan officials issued a public health advisory recommending everyone over age 2 wear a face mask in indoor public spaces, regardless of COVID-19 vaccination status.

- California surpassed 5 million COVID-19 infections since the start of the pandemic, the most in the U.S. State officials have delayed imposing vaccine mandates on private-sector workers while court challenges work their way through the legal system.

- COVID-19 states of emergency in Mississippi and Tennessee expired after 20 months in force.

- A proposed Louisiana law would require all students and daycare children to get vaccinated against COVID-19.

- Nearly 1.9 million Americans have contracted breakthrough infections of COVID-19.

- The U.S. administration indicated it would not impose COVID-19 vaccine requirements for domestic travel ahead of the busy holiday season.

- Twenty-nine states experienced increased resignation rates among workers in September and 34 states had higher quit rates than the 3% national average.

- Offices in 10 major U.S. cities were 39% occupied in the first week of November, a pandemic high, despite growing uncertainty over return-to-work plans amid rising COVID-19 cases.

- The pandemic caused roughly a quarter-million Californians to relocate from the state’s coastal towns to its inland cities in 2020, reshaping the demographics of the state’s Inland Empire region and tying the Phoenix region for the biggest gain in households from migration nationwide.

- Boeing will curtail production of its 787 Dreamliner jet for several weeks to address issues with passenger and cargo doors, another setback for the plane maker that has struggled to fulfill Dreamliner orders for much of the past year.

- GM is rolling out software updates to reduce the charging capacity of Chevy Bolt electric vehicles (EVs) that have not been taken in for replacement batteries, months after the automaker issued a recall on more than 140,000 Bolt EVs due to battery fires.

- Toyota is looking to invest billions in a new battery plant outside Greensboro, North Carolina, to boost U.S. electric vehicle production.

- Stellantis recalled more than 246,000 Ram Heavy Duty and Chassis Cab trucks over faulty fuel pumps that cause engines to stall and prevent vehicles from starting.

- The White House has proposed giving U.S. car buyers the full $12,500 electric-vehicle (EV) tax write-off only if they buy EVs assembled by union workers using American-built batteries, drawing ire from automakers who say the plan would limit demand.

- The U.S. manufactured home industry is on pace to deliver more than 100,000 units in 2021, the most since 2006, as prices for site-built homes remain unusually high.

- Monthly bot attacks on retail sites have increased eightfold over the past two years, as more consumers use “shopping bot” software to secure items from retail websites as soon as they are available.

- Sales of Thanksgiving staple foods were 4% higher two weeks ago than the same time last year, as most Americans plan to hold larger holiday celebrations this year than in 2020.

- Nebraska’s unemployment rate fell to 1.9% in October, the lowest in the nation.

- Emerging pockets of wealth in the U.S. are spurring luxury fashion retailers to expand, with Prada recently opening stores in Dallas, Houston and Austin, Texas.

International Markets

- New COVID-19 infections in the U.K. remain steady above 44,000 per day, as new estimates suggest 1 in every 65 Britons had the virus last week.

- German lawmakers are considering making COVID-19 vaccinations mandatory amid the nation’s worst virus surge of the pandemic, which saw nearly 53,000 new cases Friday. Civil unrest is growing in the nation, as well as across Europe generally, as pandemic restrictions are reimposed.

- Austria became the first country in western Europe to reimpose a full pandemic lockdown regardless of vaccination status. The nation will require its entire population to be vaccinated by Feb. 1, 2022 and fine those who refuse to get vaccinated $4,000.

- Hospitals in the Netherlands have started delaying care for cancer and heart patients to handle a surge of severe COVID-19 cases.

- Denmark is expected to require proof of COVID-19 vaccination to enter private-sector workplaces. Denmark’s consumer index fell to -2 in October, its first negative reading since April, as the nation began reimposing some COVID-19 restrictions amid rising case numbers.

- Positive COVID-19 cases are rising in South Africa ahead of an expected fourth wave, with new infections climbing to 887 Nov. 20, the most since mid-October.

- Canadian regulators approved Pfizer’s COVID-19 vaccine for children aged 5 to 11.

- Hong Kong is the latest Asian nation to expand COVID-19 booster eligibility to its entire adult population.

- With 88% of its population fully vaccinated against COVID-19, Cambodia has removed quarantine requirements and reopened its borders to many foreign visitors.

- With raw material shortages and high energy prices expected to persist, European Central Bank officials indicated they will not increase interest rates next year from current record lows, breaking from the U.S. Federal Reserve’s expected strategy for 2022.

- Japanese consumer prices rose just 0.1% in October from a year earlier, a stark contrast to soaring inflation rates in Europe and the U.S.

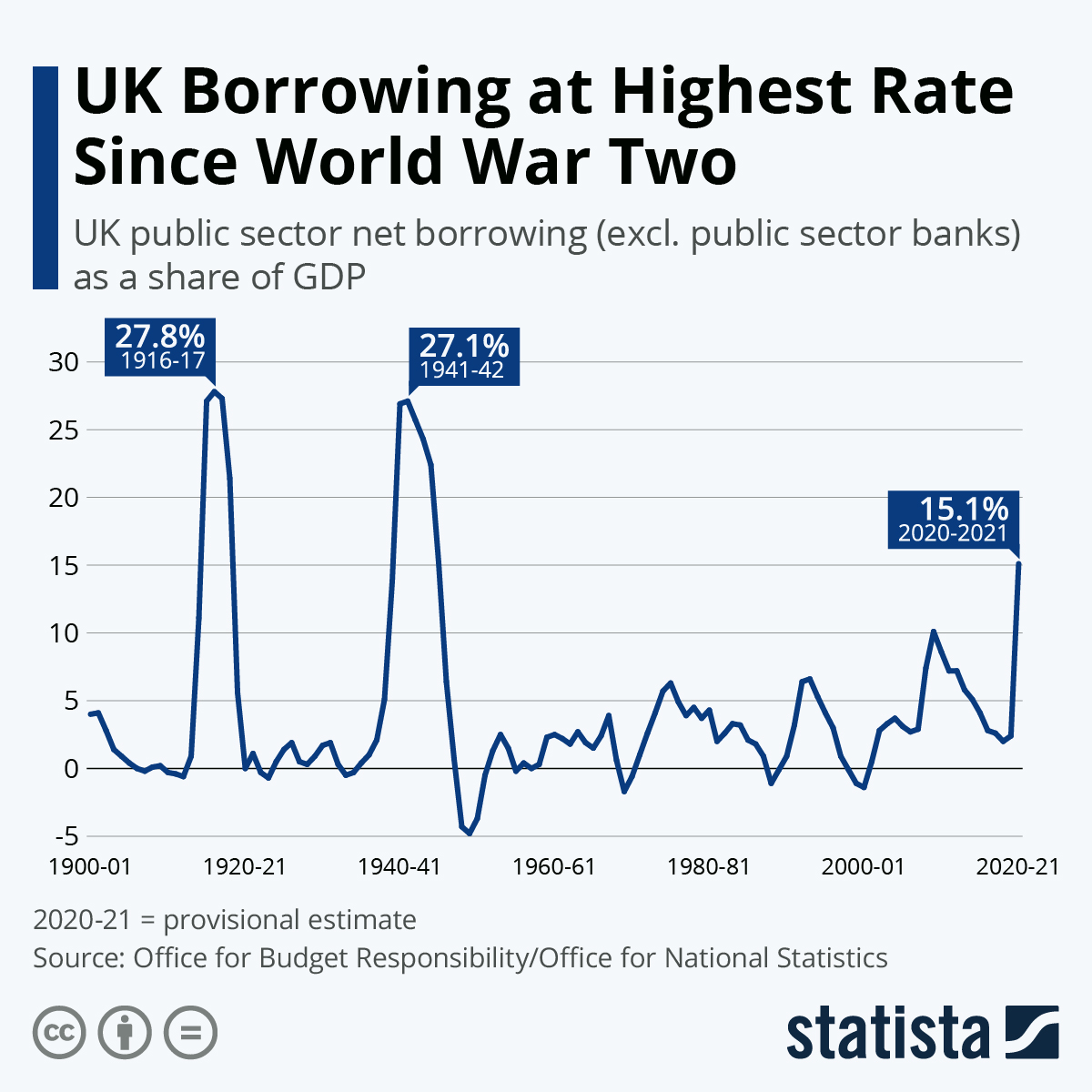

- U.K. public sector borrowing is expected to hit 95.1% of GDP in the current financial year, the highest since WWII.

- The global shift to cleaner energy raises the risk that trillions of dollars of business assets will become worthless, economists say, as accounting rules for climate write-downs rapidly grow in importance. New data shows only 1.2% of all companies globally make substantial disclosures of their climate risks, while 54% make no disclosures at all.

At M. Holland

- M. Holland’s U.S. and Puerto Rico offices will be closed Thursday, Nov. 25 and Friday, Nov. 26 in observance of the Thanksgiving holiday.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.