COVID-19 Bulletin: November 30

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose several percentage points on Monday as demand concerns over the COVID-19 Omicron variant cooled. Fear returned in late morning trading, with WTI down 4.3% at $66.97/bbl and Brent down 3.7% at $70.75/bbl. U.S. benchmark WTI is headed for its biggest monthly loss since March 2020.

- U.S. natural gas prices were down 6.8% in late morning trading to $4.52/MMBtu.

- The White House will move forward with tapping 50 million barrels of oil from strategic reserves, while also indicating it is open to releasing more.

- U.S. gasoline prices are on pace for their largest yearly rise in at least a decade, up 50% from a year ago.

- JPMorgan said Brent crude could hit $120/bbl next year and $150/bbl in 2023.

- U.S. coal inventories are at their lowest point for this time of year since the 1970s, with prices for Central Appalachian coal more than doubling from last fall to $100 per short ton.

- European energy prices soared Monday on forecasts of colder temperatures over the next two weeks.

- Russia’s Gazprom forecasts European energy prices to remain at or above current elevated levels throughout 2022. The state-owned firm expects to post record financials this year after reporting $7.8 billion in third-quarter profit.

- Norway’s Equinor will end operations in Ireland with the $434 million sale of its stake in a gas field.

- Exxon Mobil is continuing to develop plans for a Vietnamese gas project which, if completed, would become the nation’s largest.

- Italian infrastructure operator Snam plans to invest $26 billion in hydrogen development over the next nine years in an effort to become carbon neutral by 2040.

- BP will build a 60 MW green hydrogen plant in northeast England powered by wind, water and solar energy.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- The backlog of ships anchoring outside the Port of Vancouver rose to 54 over the weekend, including nine container ships, as the Canadian government sent $4.1 million in emergency relief to ease bottlenecks after a series of floods.

- Seattle’s port operator will impose new dwell fees Dec. 1 for containers that spend more than five days at terminals.

- Volume at the Port of Oakland fell 20% in October from a year earlier, as cargo ships bypassed the gateway to head directly back to Asia to make up for lost time after long delays at Southern California ports.

- The Port of Long Beach will increase its annual capacity by 1 million TEUs in December with the opening of a third vessel berth.

- Maersk expects container demand to grow 7% the rest of the year before easing in 2022.

- Port operators across the U.S. West Coast are set to begin negotiations on multiyear labor contracts with unionized dockworkers, a process that led to shipping delays during the last cycle in 2014 and 2015.

- The chief executives of major U.S. firms including Walmart, CVS, Best Buy and Samsung North America affirmed they have ample inventories for the holiday season despite continued supply chain disruptions.

- The FTC is requesting data from large U.S. firms including Amazon, Walmart and Procter & Gamble in a probe of potential anticompetitive activity resulting from supply chain disruptions.

- The U.S. Commerce Secretary is urging Congress to spend $52 billion to boost domestic production of semiconductors.

- U.S. regulators are seeking a response from Norfolk Southern over deteriorating service metrics and rising complaints in recent weeks.

- Mexican regulators approved Canadian Pacific’s $31 billion acquisition of Kansas City Southern, which would link 20,000 miles of rail through Mexico, Canada and the U.S.

- Mexico is set to impose lengthy new record-keeping rules for imported freight starting Wednesday, a controversial measure aimed at reducing smuggling.

- Discount retailer Dollar Tree will increase prices on the bulk of items to $1.25 by the end of the first quarter of 2022, a response to rising logistics costs.

- Gap is forecasting a full-year loss up to $650 million due to port congestion and pandemic-induced factory closures.

- Clothing retailer Urban Outfitters is pulling orders forward and buying more raw fabrics to stay ahead of cost inflation and continuing supply chain constraints.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

Domestic Markets

- The U.S. reported 208,745 new COVID-19 infections and 1,962 virus fatalities Monday.

- Moderna’s chief executive said the world may need new vaccines as current shots won’t provide the same level of protection against the COVID-19 Omicron variant as they do against Delta. The announcement sent U.S. equities and oil prices plunging early Tuesday morning.

- The White House is renewing pressure for eligible Americans to get COVID-19 booster shots amid fears of a new wave caused by the Omicron variant. The administration said it was prepared to fast-track regulatory approval of an Omicron-specific shot while Moderna said it would delay updating its shot pending more research on the variant.

- Early data shows COVID-19 antibody drugs from Regeneron and Eli Lilly were less effective against the Omicron variant.

- Michigan reported 4,181 current COVID-19 hospitalizations, a record, as statewide ICU bed availability dropped to 16%.

- Hospitals in Maine are delaying elective surgeries, transporting patients to rural facilities and bringing in temporary workers amid a spike in COVID-19 patients.

- COVID-19 hospitalizations in New Jersey have risen a respective 22% and 18% over the past two weeks.

- New York City is once again recommending that all residents wear face masks indoors. Some of the state’s hospitals have halted non-urgent surgeries to prepare for an expected increase in COVID-19 patients.

- Virginia will begin a new strategy of testing sewage in 25 different parts of the state in a bid to predict COVID-19 outbreaks.

- Florida now has the lowest per-capita COVID-19 case rate in the nation at just six infections per 100,000 people.

- The FDA could soon approve COVID-19 booster shots for teenagers as young as age 16.

- Federal agencies will be allowed to delay firing workers who missed the White House’s Nov. 22 COVID-19 vaccine mandate until the new year.

- Roughly 30% of healthcare workers remain unvaccinated against COVID-19 ahead of the White House’s Jan. 4 deadline.

- The U.S. Supreme Court refused to hear a challenge to Massachusetts’ vaccine mandate for healthcare workers.

- “Vaccine” is Merriam-Webster’s 2021 Word of the Year, with searches for the word rising 601% in the company’s website.

- New research out of the U.S. Midwest and Northeast suggests white-tailed deer could be COVID-19 spreaders.

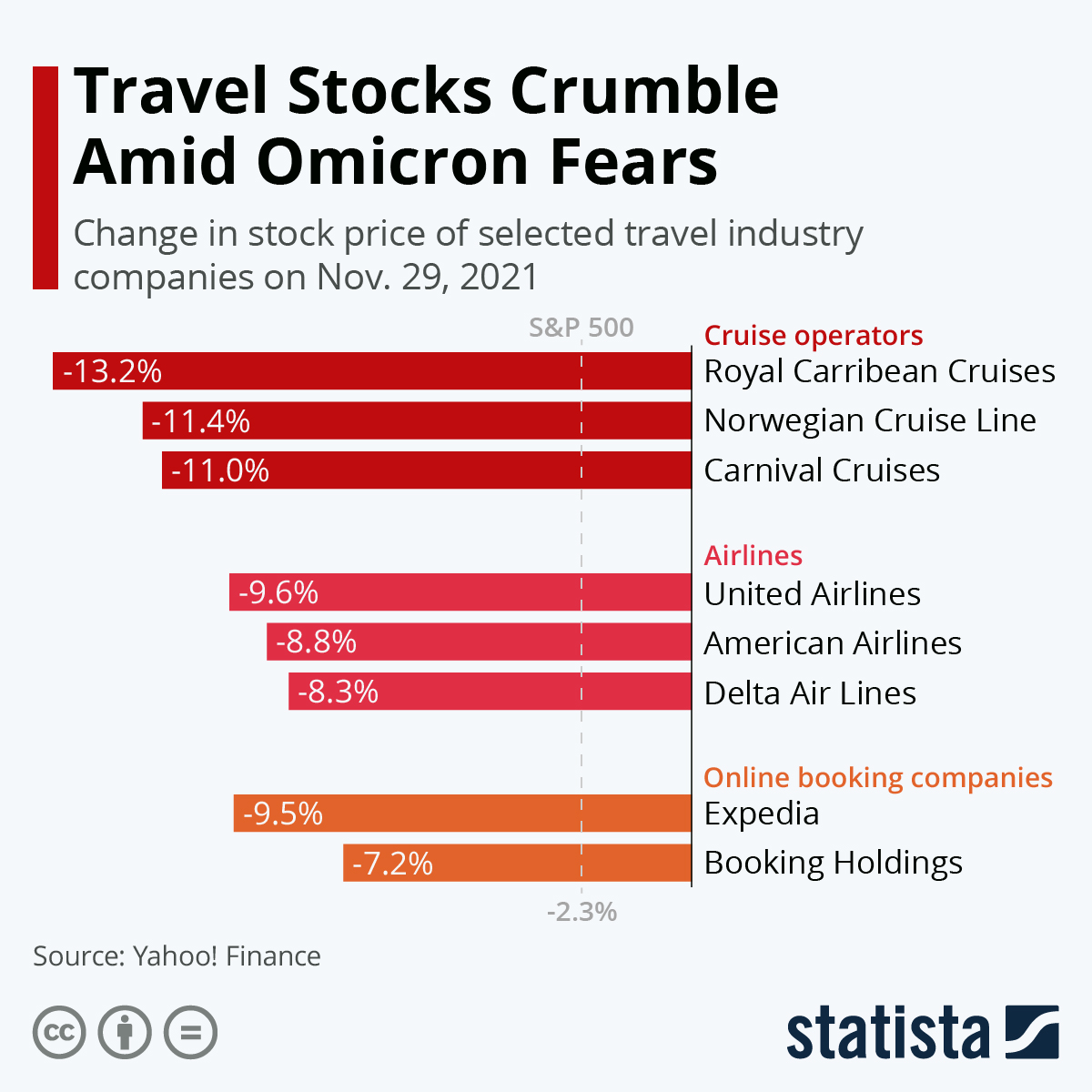

- U.S. airline and other travel stocks remained depressed Monday as more countries announced travel restrictions over fears of the COVID-19 Omicron variant:

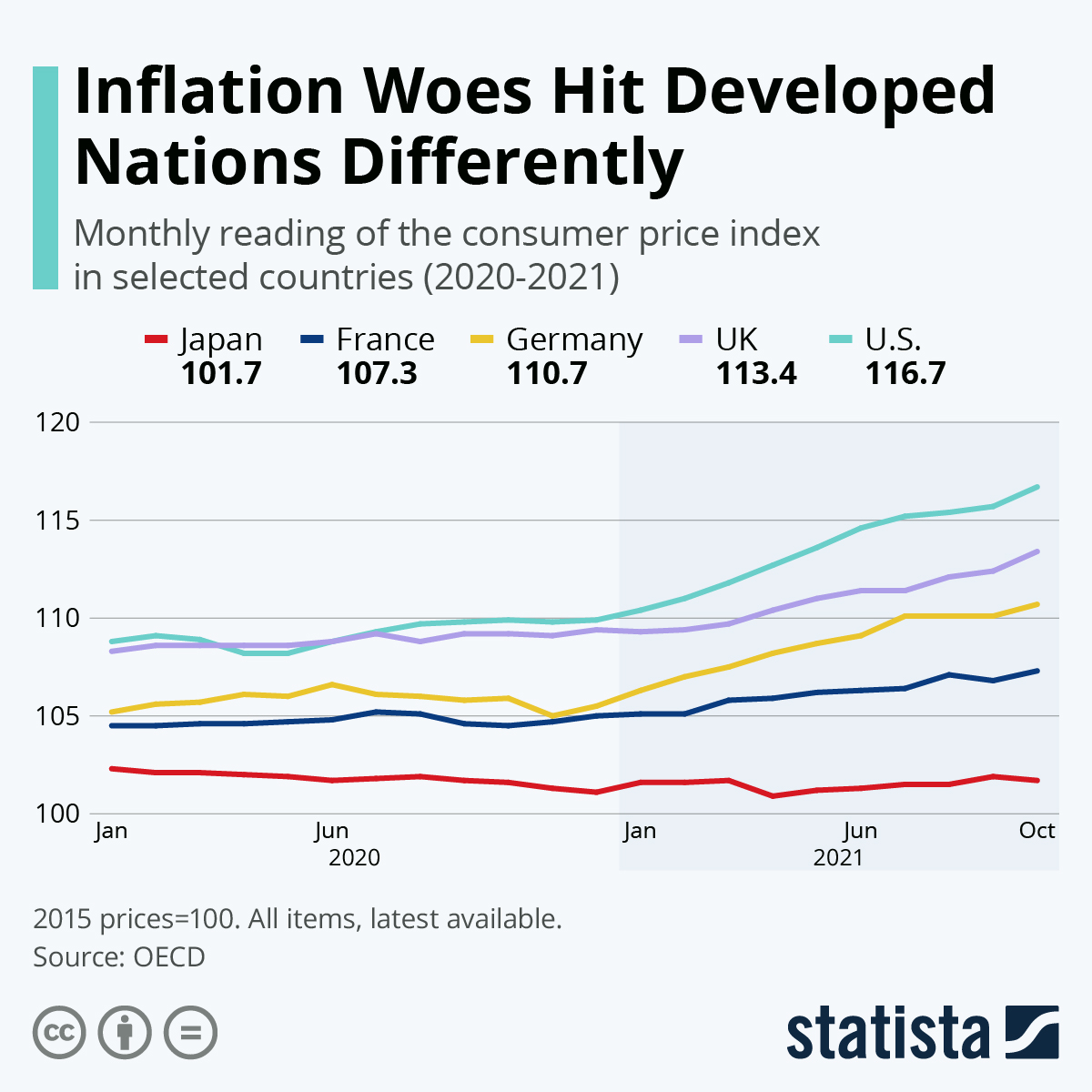

- Consumer prices were up 6.2% in October from the previous year, significantly higher inflation than other major economies:

- At 7.9%, Atlanta’s inflation rate was the highest of any major U.S. metro area.

- The number of self-employed workers in the U.S. is up 500,000 since the start of the pandemic to a near-record 9.44 million, the most since 2008.

- U.S. durable goods orders fell 0.5% from September to October, the second straight month of declines on a 14.5% drop in aircraft orders. Orders for core capital goods rose 0.6%.

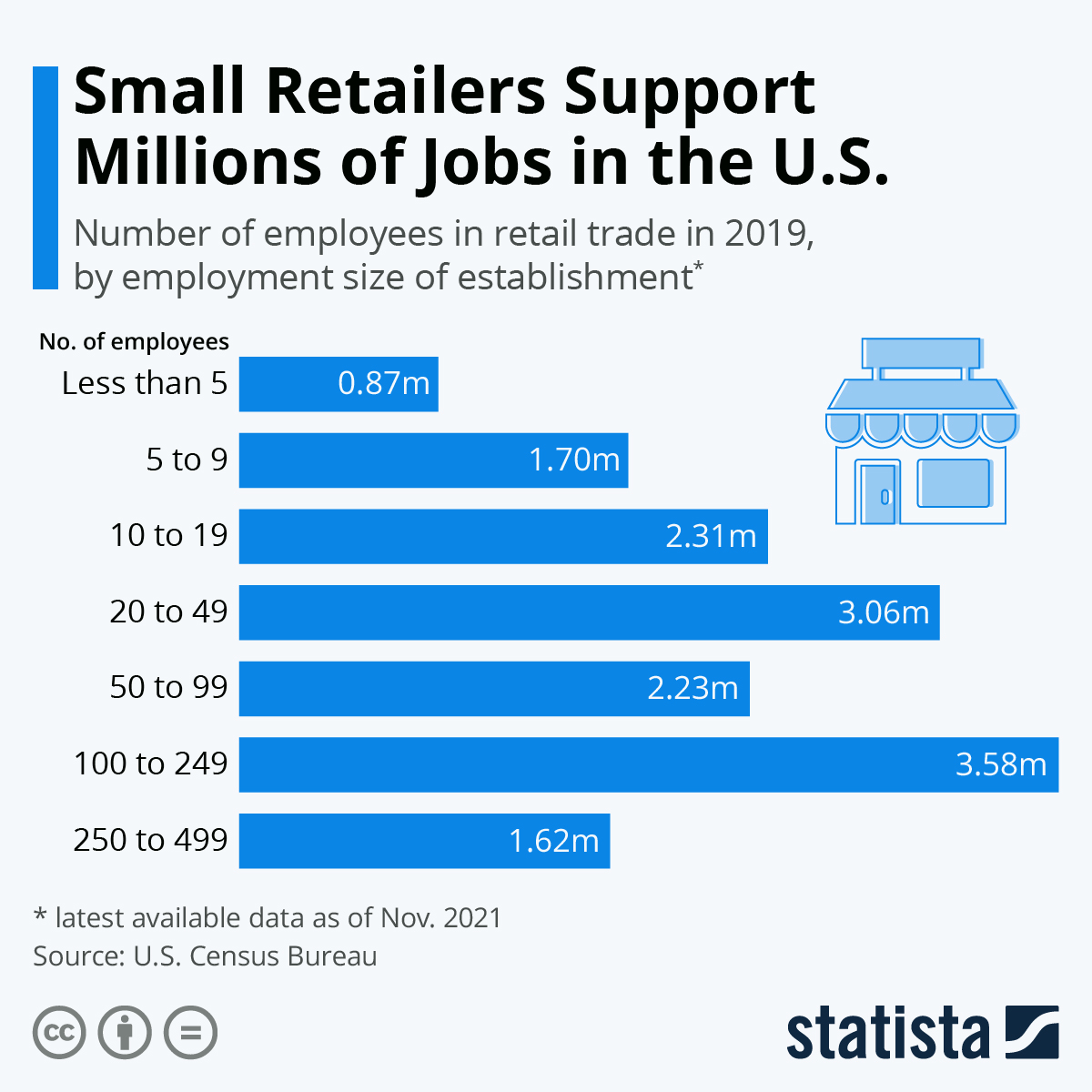

- U.S. retailers are expected to open more stores than they close this year for the first time since 2017.

- Online spending on Black Friday hit $8.9 billion this year, slightly less than in 2020, as in-store shopping rose nearly 50%. It was the first decline in overall Black Friday sales on record, with 45% of shoppers using “buy now, pay later” financing.

- Early data suggests this year’s Cyber Monday sales were mostly flat with last year’s $10.8 billion, as retailers offered fewer discounts due to global supply chain disruptions.

- U.S. localities are reporting improved sales on Small Business Saturday, as data continues to be gathered on how this year’s performance stacks up to last year’s $19.8 billion in sales for the day.

- Pending U.S. home sales rose a faster-than-expected 7.5% from September to October, largely concentrated in the Midwest and South.

- The U.S. administration has begun redirecting unused rental assistance money from largely rural states to areas with greater demand, including New York and Texas.

- Undergraduate college enrollment has fallen 8% since 2019, including a 3.5% drop this year, increasing financial stress on colleges and universities.

- Farm equipment-maker Deere reported better-than-expected quarterly financials, with revenue rising 16% to $11.3 billion despite a month-long strike of more than 10,000 workers.

- In a bid to attract and keep talent and reduce burnout, Goldman Sachs is boosting employee benefits, including raising its 401(k) match and providing sabbaticals.

- Williams-Sonoma continues to benefit from stay-at-home trends and this year’s return to holiday gatherings.

International Markets

- A global surge of the COVID-19 Omicron variant is highly likely, the World Health Organization said. Symptoms of the variant appear to differ from other COVID-19 variants and include fatigue, head and body aches, sore throats, and coughs.

- Children under age 2 account for 10% of hospital admissions from the COVID-19 Omicron variant in Tshwane, South Africa. Health experts say the nation’s daily infection count could triple by the end of the week due to the variant, as lawmakers consider upping pandemic restrictions.

- The U.K. reported 42,583 new COVID-19 cases and 35 virus fatalities Monday. The nation has expanded eligibility and cut the minimum amount of time for a COVID-19 booster jab to three months in a bid to accelerate vaccinations.

- COVID-19 hospitalizations in France surged by 470 the past 24 hours, the most since March.

- Japan, Scotland, Portugal and Spain have reported their first cases of the COVID-19 Omicron variant.

- Israel, Japan and Morocco will bar entry to foreign travelers over fears of importing the COVID-19 Omicron variant. Australia, Poland, Ukraine and India have also stepped up travel restrictions.

- The Philippines is deploying security forces to help vaccinate 9 million people over the next three days in a bid to stay ahead of the COVID-19 Omicron variant.

- Computerized models predict China would see more than 630,000 COVID-19 cases per day if it dropped its “Covid Zero” containment strategy.

- South African drugmaker Afrigen Biologics and Vaccines is working to replicate Moderna’s COVID-19 shot for use in a boosted domestic vaccine drive.

- An index of Chinese factory activity rose to 50.1 in November, the first time in three months it exceeded the 50-mark signaling expansion.

- Porsche is developing a new electric vehicle battery it claims will hold a charge 25% longer than current models.

- Tesla will invest $188 million on upgrades at a Shanghai plant as the facility nears exhausting its current production capacity.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.