COVID-19 Bulletin: October 4

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil futures rose Friday to settle around $78/bbl, notching their sixth weekly gain in a row ahead of an expected decision today on whether OPEC will maintain its current schedule for resuming pandemic-disrupted production.

- Crude futures were higher in late morning trading, with WTI up 2.7% at $77.95/bbl and Brent up 3.0% at $81.63/bbl. Natural gas was 3.9% higher at $5.84/MMBtu.

- Energy prices continue to rise dramatically across Europe and Asia:

- Natural gas prices in Europe set a new record of $116 a megawatt-hour following China’s order to state-owned energy companies to secure supplies for this winter at all costs, intensifying a battle for LNG and coal cargoes as flows into Germany via a key Russian pipeline (Yamal-Europe) tumble.

- European storage sites are just under 75% full, the lowest level for this time of year in more than a decade. A German coal plant completely ran out of supply late last week, forcing an abrupt halt to operations.

- A North Sea power link between the U.K. and Norway began operations Friday, a bid to lower rising British electricity prices despite Nordic power prices being five times higher in September than a year ago.

- Industrial closures are rising in Europe, as valuations for energy producing companies soar while those of energy intensive firms falter.

- Natural gas revenues accounted for 14% of U.S. oil producers’ total revenues in the first quarter of 2021, the most since 2018.

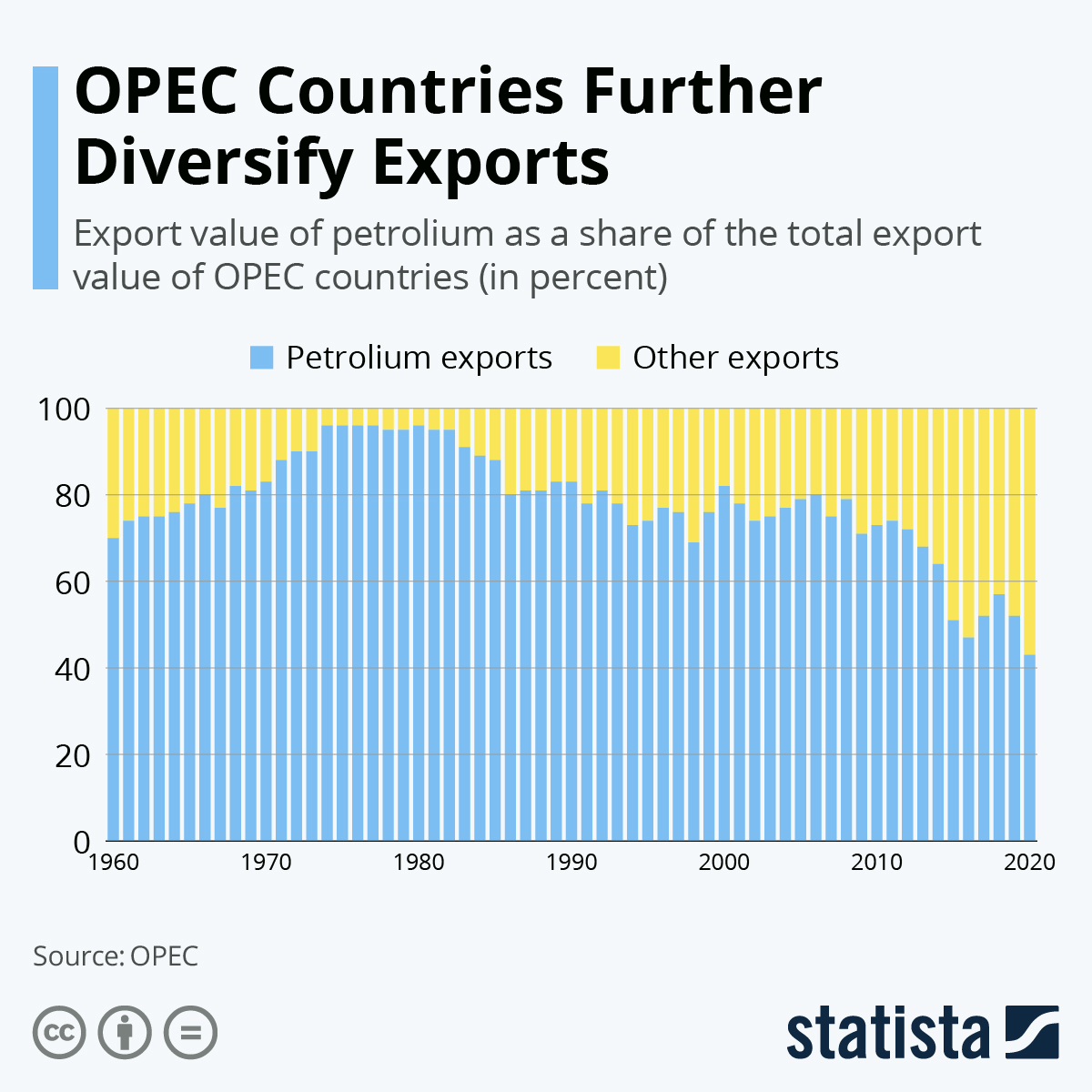

- Petroleum products made up only 43% of OPEC nation exports last year as pressure mounts to diversify their portfolios beyond oil and gas:

- A pipeline leak off the coast of Southern California on Saturday spilled 126,000 gallons of oil into the Pacific Ocean, creating a 13-square-mile “major” oil slick that continued to grow on Sunday.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Hurricane activity is forecast to be calm the next few days as Hurricane Sam and Tropical Storm Victor continue to move through the Atlantic, with neither posing a threat to land.

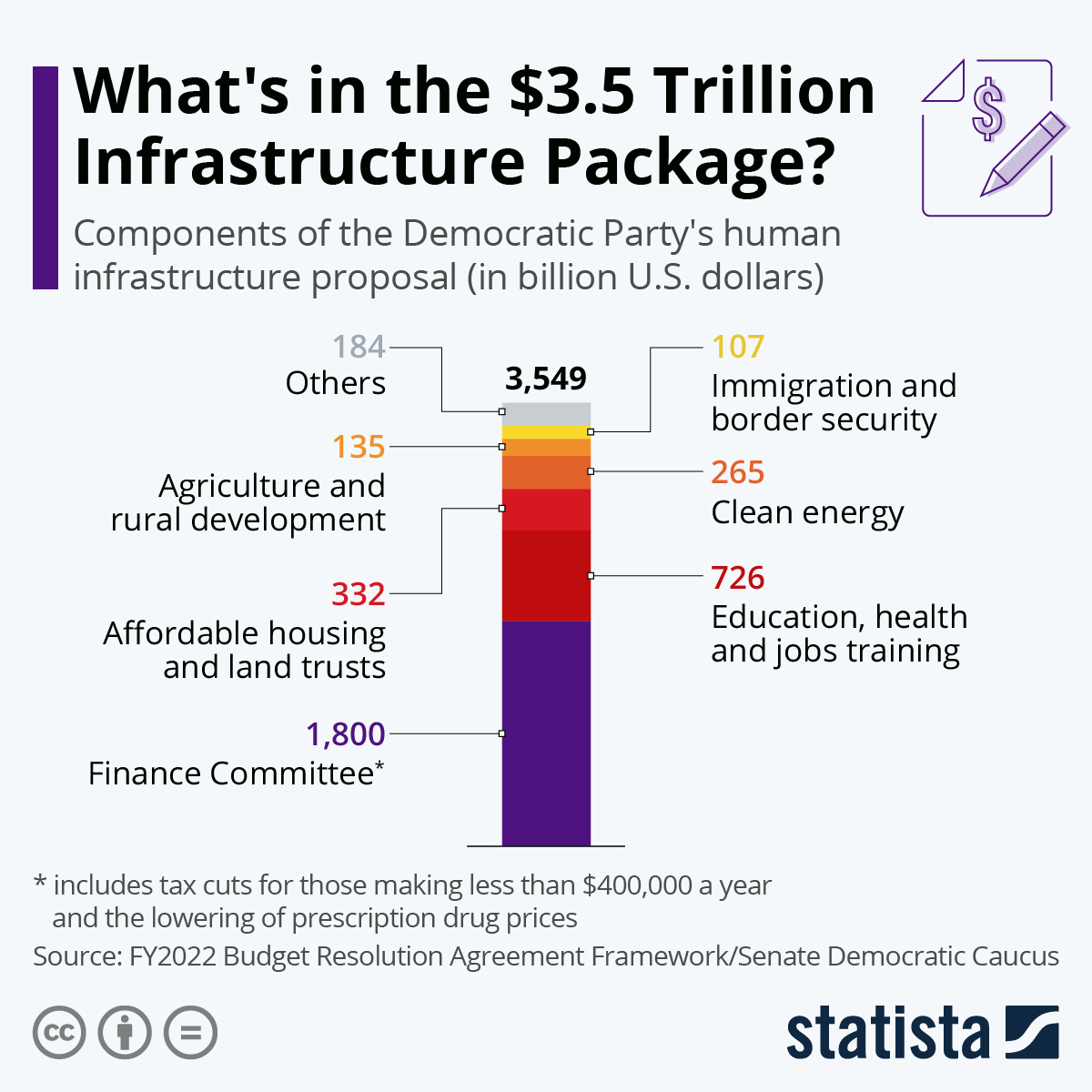

- The U.S. administration is urging lawmakers to reach agreement on lower spending for a $3.5 trillion social-policy and climate bill before bringing a separate, $1 trillion infrastructure bill to the floor for a vote.

- IHS Markit’s global manufacturing index fell to 58.6 in September, down from August’s 61.4 reading, as costs and supply chain bottlenecks continue to increase.

- GM’s third-quarter sales fell nearly 33% to 446,997 vehicles, its worst sales quarter in more than a decade, as the automaker grapples with continued production halts stemming from the global chip shortage.

- Long-term contracted ocean container rates were up 91.5% in September from the same time last year, following a 3.2% increase from August. The median cost of shipping a single container from China to the U.S. West Coast last week hit a record $20,586, almost twice the rate in July.

- The Chinese government is encouraging exporters to sign long-term shipping contracts as a hedge against skyrocketing container freight rates.

- A pilot program offering 24-hour container operations at the Port of Long Beach hasn’t attracted any truckers more than two weeks after the extended hours began, an unpromising start to a measure that was hoped to reduce port congestion.

- A record 87 vessels passed through the Suez Canal in a single day last week, topping the previous record of 75 in February 2019.

- The Jacksonville Port Authority announced plans for a $48 million investment to expand container handling capacity.

- The U.S. Postal Service began slowing down some deliveries Friday as part of efforts to cut costs as lawmakers continue to debate a financial relief package for the cash-strapped service. Roughly 4 in 10 pieces of first-class mail are expected to take longer to arrive.

- DHL will raise rates for U.S. shipments by an average of 5.9% starting Jan. 1, matching similar price increases recently imposed by FedEx.

- U.S. grocery store prices rose another 0.4% in August, leaving them 3% higher than a year ago and 7.6% higher than in 2019. Prices for staples such as beef, pork, fish and eggs have notched double-digit increases in just the last 12 months.

- Strict lockdowns to contain COVID-19 in largely unvaccinated Vietnam have prompted many companies, including Nike and Lululemon Athletica, to shift production to other countries.

- Supply chain disruptions were behind a sharp decline in Bed Bath & Beyond’s quarterly sales, with the company losing more than a quarter of its market valuation following the news Friday. Apparel retailer H&M suffered third-quarter sales declines for similar reasons, despite posting profits 22% higher than before the pandemic.

- Valued at $5.06 billion in 2020, the market for supply chain analytics is projected to nearly triple by 2028.

- Home Depot will offer its flatbed capacity to other shippers under a new partnership with Loadsmart, a third-party platform used to book and track freight shipments.

- Our Logistics team reports the following:

- Bulk trucking capacity is very limited as demand is exceeding supply.

- Dry van (full, partial and less-than-truckload) capacity is very limited as demand exceeds supply.

- Port congestion continues to be very problematic, delaying deliveries of imported containers.

- Due to port congestion and other factors, we are seeing inventory build-ups at our sites near ports.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

Domestic Markets

- New COVID-19 cases in the U.S. are on track to slip below 100,000 per day after plateauing around 150,000 per day in the first half of September. The nation reported 25,215 new infections and 237 virus fatalities Sunday.

- The U.S. surpassed 700,000 officially recorded deaths from COVID-19 Friday, the most in the world. More than 80,000 were added in just the past two months, with Florida accounting for roughly 20% of those.

- Daily COVID-19 vaccinations in the U.S. topped 1 million Saturday for the first time in several weeks, as nearly 200,000 more people got booster doses.

- FDA advisers will meet this month to discuss COVID-19 booster doses for recipients of the Moderna and Johnson & Johnson shots and approving Pfizer’s vaccine for children aged 5 to 11.

- California will be the first state to require all elementary through high school students to receive COVID-19 vaccines once the shots gain regulatory approval for lower age groups.

- Alaska activated emergency crisis protocols for more than 20 medical facilities Saturday that will allow them to ration care if needed, as the state in recent days has recorded the nation’s worst COVID-19 infection rates.

- Several hundred hospital workers in Virginia were suspended or fired for refusing to get vaccinated against COVID-19, as required by most major healthcare systems. A major provider put more than 800 healthcare workers in Oregon and Washington state on leave for the same reason. The disruption comes as 16% of American hospitals face critical staffing shortages.

- Facing a COVID-19 vaccine deadline that took effect last week, hospital staff in New York received shots at more than twice the rate of the general population over the past month.

- One in four companies are now mandating COVID-19 vaccines for U.S. workers, while many more have plans to put the mandate in place.

- The White House is calling for all major U.S. airlines to instate COVID-19 vaccine mandates for employees by Dec. 8. American Airlines, Alaska Airlines and JetBlue followed United in imposing mandates against COVID-19, while Delta continues to consider complying.

- The U.S. Supreme Court upheld New York City’s COVID-19 vaccine mandate for public school employees.

- Roughly 25% of U.S. parents reported that a child of theirs had to quarantine at home because of possible exposure to COVID-19 since the beginning of the school year.

- PwC, the second-largest professional services network in the world, will allow its 40,000 U.S. employees to permanently work remotely from anywhere in the continental U.S.

- U.S. personal spending growth accelerated more than forecast in August, reflecting an increase in outlays for nondurable goods as people spend less time dining out and traveling due to heightened COVID concerns.

- The decline in dining out is hurting restaurant sales, with 51% of small restaurants unable to pay their rent in September, according to a recent survey.

- The Federal Reserve’s preferred inflation gauge rose the most year over year in three decades in August, fueling concerns that price increases will last longer than expected and eventually hit consumer spending.

- Thanksgiving week property bookings are 35.5% higher than at the same point in 2019 as a rush of people traveling for the holidays drive up related prices.

- The median monthly rent in Manhattan is up to $3,118 after bottoming out last November at $2,743, as steep pandemic-induced rental discounts begin to fade nationwide.

- Soaring housing prices have pushed up the average income needed to cover mortgage payments to levels not seen since just before the 2008 financial crisis.

- Apple supplier Foxconn, which recently agreed to buy a Lordstown electric-truck assembly plant in northeast Ohio, is reportedly in advanced talks with the U.S. Department of Energy for a substantial factory retooling loan.

- Tesla delivered a record 241,300 new vehicles in the three months ending in September, defying severe supply chain disruptions in the global auto market and a broader trend of declining third-quarter sales among fellow American automakers.

- GM’s U.S. factories are expected to run completely on renewable energy five years ahead of schedule by 2025, the automaker announced.

International Markets

- New global COVID-19 cases and deaths dropped a respective 10% and 9% last week, figures show.

- Russia reported 890 COVID-19 deaths Sunday, its fifth record in the past week.

- Almost 3,000 COVID-19 infections were reported Friday in Singapore, a record.

- Japan fully lifted its COVID-19 state of emergency for the first time in more than six months, easing some virus measures as new daily infections drop to just a fraction of August’s peak.

- Australian officials authorized fines up to $5,000 for New South Wales businesses that fail to stop unvaccinated people from entering their doors. Meanwhile, the nation’s Victoria state mandated COVID-19 vaccines for professional athletes.

- New Zealand extended a lockdown in Auckland, its largest city, for another week as additional COVID-19 cases continue to be reported in the region, while the nation’s prime minister outlined plans to gradually reopen the city in phases. The country also announced that it would pivot from its virus elimination strategy to a “living with Covid” approach as it continues to vaccinate its residents.

- India will require all arriving passengers from the U.K. to quarantine on arrival, even if they are vaccinated against COVID-19.

- Portugal ended most remaining COVID-19 restrictions as roughly 86% of the nation’s population is fully vaccinated.

- Switzerland is offering free meals and movies to those who can persuade an unvaccinated person to receive COVID-19 shots.

- Israel will require people to get a COVID-19 booster shot to be considered “fully vaccinated.”

- The global COVID-19 vaccine-sharing program COVAX will begin prioritizing deliveries to nations with the lowest overall vaccine coverage, a marked strategic shift as just 2.3% of people in low-income countries have received their first COVID-19 shot.

- The World Health Organization will send millions of China-made COVID-19 vaccines to Latin America and the Caribbean.

- The U.K. has begun winding down an array of financial measures that helped stave off business insolvencies during the pandemic.

- It is safe to receive both a COVID-19 vaccine and a flu shot at the same time, with neither impacting the effectiveness of the other, a new British study shows.

- Electric vehicles accounted for nearly 80% of total car sales in Norway last month, as the nation becomes the first to fully end the sale of gas-powered cars by 2025.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.