COVID-19 Bulletin: October 7

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices fell nearly 2% Wednesday, retreating from seven-year highs following news of an unexpected build in U.S. crude stocks, Russia’s offer to pump more supply into Europe and the likelihood of a further release from the U.S. Strategic Petroleum Reserve.

- Crude futures rose in morning trading, with WTI up 0.9% at $78.12/bbl and Brent down 0.9% at $81.81/bbl. Natural gas was 0.2% lower at $5.66/MMBtu.

- Despite surging oil prices, U.S. shale production is expected to expand only modestly the next 18 months as drillers use improved cash flow to pay down debt rather than expand.

- LNG spot prices in Asia skyrocketed 40% Wednesday to a record $56/MMBtu amid a worsening supply crunch ahead of the winter heating season.

- U.K. wholesale gas futures surged 14.7% Wednesday to 3 pounds/therm, a record high.

- A group of California lawmakers is pushing a bill that would ban offshore drilling in the state, a response to the recent 3,000-barrel spill off the coast of Orange County. The Coast Guard is investigating whether a container ship anchor might have snagged and bent the pipeline over the course of two days.

- With global production of coal 5% below pre-pandemic levels, global supply shortages are causing prices for the fuel to soar.

- Australia’s Newcastle thermal coal, a global benchmark, is trading at $202 per metric ton, three times higher than at the end of 2019.

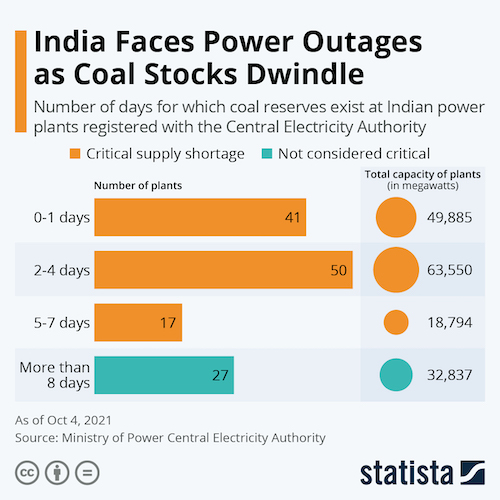

- The coal shortage in India is at crisis levels:

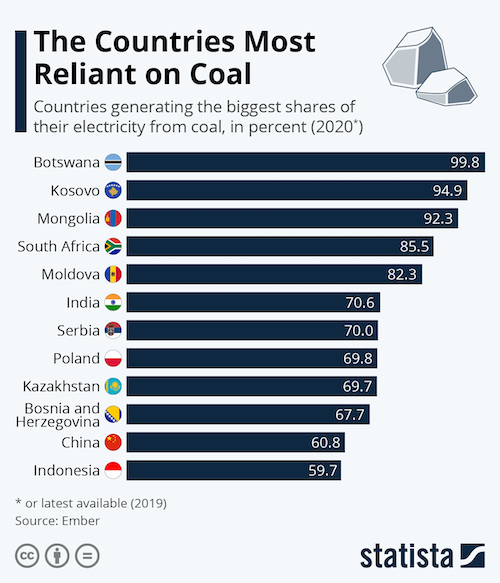

- Coal generates roughly 40% of the world’s electricity:

- Dow forecast a $3 billion increase in core annual earnings by 2030 while announcing plans to build a new net-zero-emissions facility in Canada to produce ethylene and other derivatives.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Semiconductor lead times in the auto industry grew five days to a record 21.7 weeks in September, the ninth consecutive monthly increase.

- Volkswagen extended a production halt for its Jetta model at a plant in Puebla, Mexico, until Oct. 15.

- The ongoing global chip shortage has prompted Jeep to cut production at its Illinois assembly plant for the remainder of October.

- The chip shortage has taken 2,918,000 vehicles out of production in North America and 10,305,000 globally.

- The queue of container ships waiting to dock at the Ports of Los Angeles and Long Beach has grown to 60.

- Shipping giant MSC announced the $146 million purchase of five secondhand container ships in a bid to rapidly expand fleetwide capacity.

- GM and General Electric are partnering to boost supply chains for rare-earth and other metals used in electric vehicles and renewable energy technology.

- The U.S. is urging Singapore to loosen pandemic travel restrictions to maintain bilateral trade and investment activity critical to technology supply chains.

- The U.S. Postal Service is moving forward with plans to extend delivery times for some first-class deliveries despite deepening concerns from lawmakers and other trade groups.

- DHL Express opened an expanded international parcel hub at Paris’ Charles de Gaulle airport, an effort to support cross-border European trade amid a boom in e-commerce.

- Swedish furniture retailer IKEA is moving some production to Turkey in response to growing supply-chain and shipping costs.

- Australia banned entry to its ports for a Singapore bulk carrier accused of underpaying seafarers.

- The International Chamber of Shipping unveiled new plans for measures that would help the industry reach net-zero CO2 emissions by 2050.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

- Our Logistics team reports the following:

- Bulk trucking capacity is very limited as demand is exceeding supply.

- Dry van (full, partial and less-than-truckload) capacity is very limited as demand exceeds supply.

- Port congestion continues to be very problematic, delaying deliveries of imported containers.

- Due to port congestion and other factors, we are seeing inventory buildups at our sites near ports.

Domestic Markets

- The U.S. averaged just over 100,000 new COVID-19 cases per day the past week, down 24% from two weeks ago and 40% from three weeks ago, while virus deaths dropped 12% to roughly 1,800 per day over the past two weeks.

- The nation reported 111,503 COVID-19 infections and 2,556 virus fatalities Wednesday.

- More than 353,000 COVID–19 deaths have been reported in the U.S. since Jan. 1, surpassing the number of virus fatalities for all of 2020.

- Almost every state in the U.S. has reported at least 1,000 COVID-19 deaths since the start of the pandemic, with Wyoming becoming the most recent state to pass the grim milestone.

- Los Angeles will require proof of COVID-19 vaccination for entry to restaurants, bars, shopping centers and other indoor venues starting Nov. 6, making the U.S.’s largest city the strictest in regard to COVID-19 rules.

- Minnesota’s governor called for COVID-19 vaccine and testing requirements for teachers and long-term care workers.

- New York expanded its statewide COVID-19 vaccine mandate for all hospital and nursing home workers to home care and hospice employees.

- Hawaii’s governor extended an indoor mask mandate and capacity limits on businesses until Nov. 30 due to continued high levels of COVID-19.

- A Colorado healthcare system will begin denying organ transplants to people unvaccinated against COVID-19, citing new data showing recipients face a high risk of dying from the virus if infected.

- Children make up roughly 25% of active COVID-19 cases in Tennessee.

- Nebraska has restored daily updates on COVID-19 statistics following an increase in the state’s virus positivity rate to above 10%.

- COVID-19 cases in Florida continue to drop, with the state’s seven-day average nearing 4,000 compared to summer highs above 30,000.

- The FDA has begun assessing the possibility of mixing COVID-19 vaccines as the nation begins rolling out booster doses to a larger population.

- The White House is investing $1 billion to expand the use of rapid at-home COVID-19 tests, with the goal of quadrupling usage by the end of the year.

- Kaiser Permanente has roughly 2,200 employees on unpaid leave for not complying with the company’s COVID-19 vaccine mandate, down from nearly 5,000 employees who were suspended at the end of September.

- UnitedHealth Group will require most of its U.S. employees to be vaccinated against COVID-19 by Nov. 30.

- COVID-19 patients sick enough to be hospitalized were in danger of developing heart failure and deadly blood clots more than a year after initial infections, new research shows.

- Nearly 130,000 U.S. children lost a primary caregiver during the first 15 months of the pandemic, with the number of orphaned children expected to be much larger than previously estimated.

- The labor market improved last week, with first-time jobless claims decreasing by 38,000 to 326,000, better than expected.

- Senate leaders reached agreement to extend the expiration deadline for the debt ceiling to December. News of a possible deal stoked the biggest positive turnaround in stock markets in more than seven months.

- Several hotel chains are adding all-inclusive resorts to their property portfolios, as travelers increasingly look to stay in one place and limit their exposure to COVID-19 while vacationing.

- Overall crime in New York City has dropped to its lowest levels in three decades during the pandemic, a stark contrast to rising homicide rates in the rest of the nation.

- Bank of America announced plans to boost its starting wage to $25/hr by 2025.

- Boeing will unveil a new air-freight version of its 777X jetliner in the next several weeks, the company’s first new jet in four years.

- GM announced ambitious plans to double revenue by 2030 as it further establishes itself in the electric- and autonomous-vehicle market, with the automaker’s entry-level electric SUV set to sell at $30,000, undercutting the cheapest version of Tesla’s Model 3 sedan.

- Mercedes-Benz plans to add 300 jobs at an Alabama assembly plant by the end of the year as it prepares to build new electric SUVs.

- California’s governor signed new recycling and waste-related bills Tuesday, including measures to limit the export of plastic scrap and to prohibit product packaging from having recyclability claims without state approval.

- Google introduced a suite of new sustainability features Wednesday to a wide array of its core products, including eco-mapping on Google Maps and improved home thermostat settings.

International Markets

- Global COVID-19 cases fell 9% week over week, the fourth consecutive weekly drop, led by a 43% decline in cases in Africa, according to the World Health Organization.

- The U.K. reported 39,851 new COVID-19 infections Wednesday, the most in a month, along with 143 virus deaths.

- New COVID-19 cases in Seoul rose above 2,000 for the second day in a row, worrying officials about a resurgence of the virus, despite South Korea being on pace to fully vaccinate 80% of its population by the end of the month.

- Canada announced sweeping new COVID-19 vaccine mandates for all passengers over age 12 on air, rail and sea transport.

- Russia reported 929 COVID-19 deaths Wednesday, the second record in as many days.

- Singapore reported 3,577 new COVID-19 infections Wednesday, the most since the start of the pandemic.

- COVID-19 cases in Japan have dropped to their lowest levels in nearly a year, with Tokyo reporting just 87 new infections Monday, down from more than 5,000 per day in August.

- Strict pandemic restrictions will be further eased in Sydney, Australia, Monday after the city reached its goal of vaccinating 70% of its population against COVID-19. BHP, the world’s largest mining company, will require vaccinations for all employees and visitors to its sites in Australia.

- New Zealand is looking to vaccinate upwards of 350,000 people per day next week in an accelerated effort to reopen its economy.

- Lithuania is mulling paying people over age 75 to get vaccinated against COVID-19, as over one-third of the vulnerable demographic has yet to receive shots.

- Norway, Spain and Portugal will begin offering COVID-19 booster shots to seniors in the coming weeks.

- AirAsia’s Malaysia group implemented an immediate ban of all passengers not fully vaccinated against COVID-19.

- The International Monetary Fund expects global inflation to peak at 3.6% this fall before returning to pre-pandemic levels around 2% by mid-2022.

- Mazda has introduced new manufacturing technologies aimed at cutting costs and lead times while supporting flexible production for electric vehicles at its Western Japan assembly plant.

- BMW announced new investments in lithium startup Lilac Solutions, a bid to increase efficiencies in the production of the critical electric vehicle battery metal.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.