COVID-19 Bulletin: October 13

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices ended mixed Tuesday, with WTI marking its second straight finish above $80/bbl, the highest close since 2014, while Brent fell slightly to $83.42/bbl. Futures were lower in late morning trading, with WTI down slightly at $80.63/bbl and Brent down 0.2% at $83.29/bbl. Natural gas was 1.7% lower at $5.41/MMBtu.

- Rising wholesale gas prices are prompting European utilities to switch to carbon-heavy coal to generate electricity, countering efforts to wean nations off the heavy-pollutant fuel. The U.S. is on track to burn 23% more coal this year than last, the first increase since 2013.

- Electricity prices in Japan have climbed to nine-month highs, driven by rising global prices for oil, LNG and coal.

- China will allow coal-fired power plants to charge some customers market prices for electricity, a shift overturning decades of policy, with the hope of increasing supply amid a worsening energy crisis. The nation’s coal purchases rose 17% in September to 32.9 million tons, the highest monthly total this year.

- India is asking its power producers to import up to 10% of their coal needs due to shortages throughout the country, while also warning of consequences for states imposing power cuts in a bid to cash in on crisis-level prices.

- Diesel and fuel oil are the main oil-product beneficiaries of the extreme energy crunch in Europe and Asia, with spot prices for Russia’s diesel-rich Sokol grade soaring on expectations of higher demand for substitutes this winter.

- 1 in 10 fuel stations in London and southeast England are still empty amid a severe trucker shortage that has led to panic buying in recent weeks.

- California will become the first state to ban the sale of gas-powered leaf blowers and lawn mowers starting as early as 2024.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- The Alisal Fire broke out in the Los Padres National Forest in California Monday, spreading to more than 6,000 acres and prompting mandatory evacuations.

- Tropical Storm Pamela is expected to reach hurricane strength before making landfall on Mexico’s Pacific coast near the Port of Mazatlan today.

- China’s Yantian port suspended container operations Monday due to landfall of Tropical Storm Kompasu, as the number of ships queued outside the port grew to 67, the most since August. The storm wreaked havoc in the Philippines, causing landslides that killed at least 11 people.

- The Port of Los Angeles announced it will begin operating on a 24/7, around-the-clock schedule, doubling the hours cargo can move in a bid to ease bottlenecks that have led to goods shortages and higher consumer prices.

- Maersk had to divert vessels from the British Port of Felixstowe, the nation’s largest, to other EU ports due to congestion linked to a severe trucker shortage.

- South Carolina ports handled 205,008 TEUs in September across three terminals, a monthly record and a 5% increase from the previous year.

- White House officials are warning U.S. consumers they could face higher prices and empty shelves this holiday season due to supply chain disruptions at ports, highways and railways. U.S. carriers have submitted their recommended deadlines for customers to ship packages, letters and other parcels to arrive before the Christmas holidays, largely in line with last year’s.

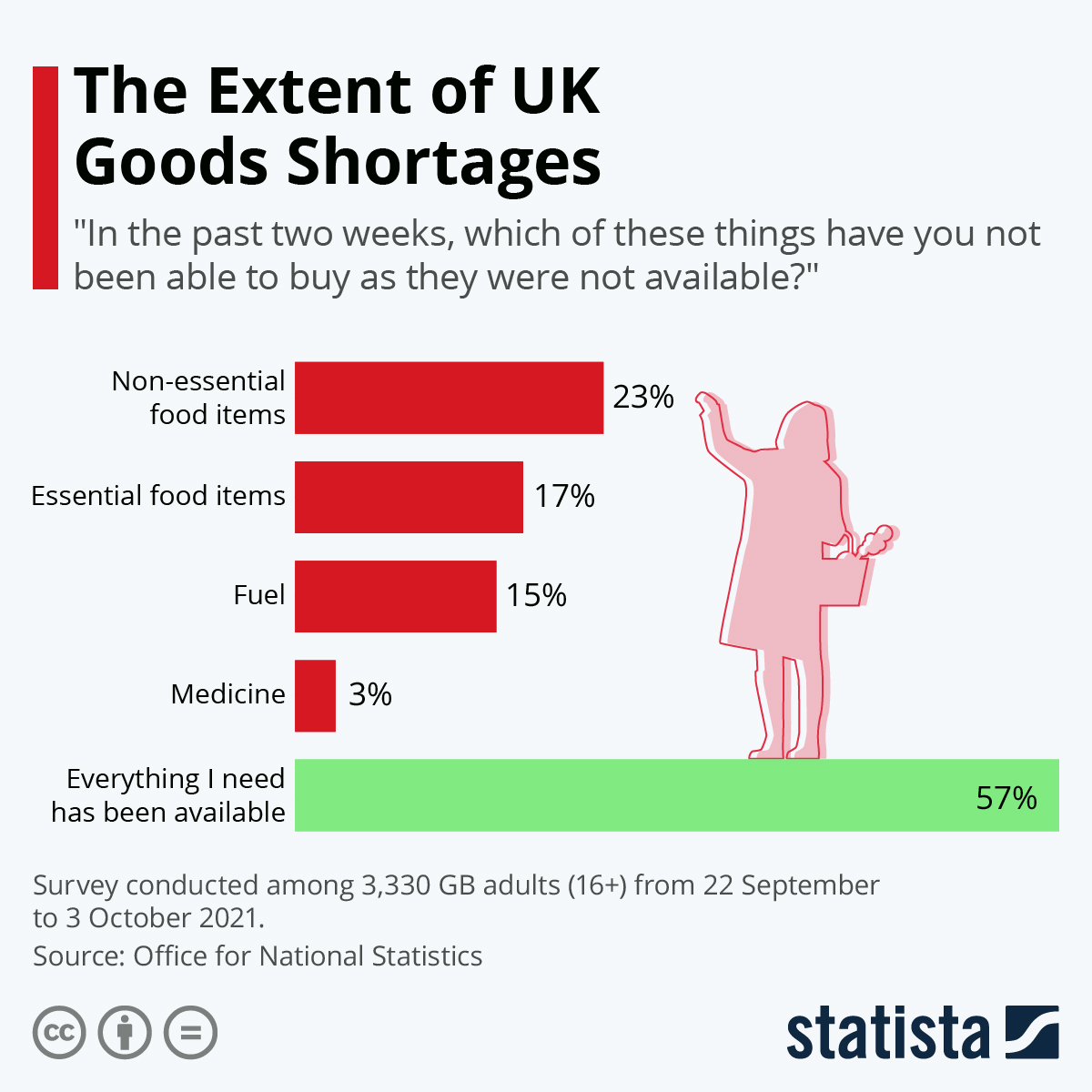

- Consumer goods shortages are rising in the U.K.:

- Apple is expected to cut its 2021 production forecast for iPhones by 10 million units to 80 million due to the global computer chip shortage.

- Component shortages forced Toyota to cut production targets by 300,000 vehicles for the rest of the fiscal year, while the company works with suppliers to limit impacts of the global chip shortage.

- LG will reimburse GM nearly $2 billion in recall costs for Chevrolet Bolt electric vehicles due to the risk of battery fires.

- Kraft Heinz is warning consumers of broadly higher prices for its products as increased demand and rising inflation push global food prices to 10-year highs.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

- Our Logistics team reports the following:

- Bulk trucking capacity is very limited as demand is exceeding supply.

- Dry van (full, partial and less-than-truckload) capacity is very limited as demand exceeds supply.

- Port congestion continues to be very problematic, delaying deliveries of imported containers.

- Packaging and pulverizing/grinding production challenges persist as demand is exceeding supply

Domestic Markets

- The U.S. reported 106,308 new COVID-19 cases and 2,416 virus fatalities Tuesday. Weekly infections have dropped 44% since the Delta-driven peak in mid-September, led by declines in Southern states.

- A federal judge issued a ruling upholding New York City’s COVID-19 vaccine requirement to enter restaurants, gyms and clubs. Separately, a judge ruled New York state could not impose vaccine mandates on healthcare workers without allowing for religious exemptions.

- IBM, Southwest Airlines and American Airlines announced they would comply with the U.S. administration’s pending COVID-19 vaccine mandate, setting up a legal clash with the state of Texas over the governor’s recent order prohibiting the requirement.

- Boeing will mandate COVID-19 vaccines for its 125,000 U.S. employees by Dec. 8, complying with the U.S. administration’s recently announced deadline.

- Major hospital systems in Ohio will require COVID-19 vaccinations for patients receiving organ transplants.

- Minnesota’s COVID-19 positivity rate rose to 8.3% Tuesday, its highest since the end of last year.

- Many firefighters in the U.S. have yet to be vaccinated against COVID-19 as nearly 900 in Los Angeles prepare to sue the city over its mandate.

- California passed a new law prohibiting protesters from physically interfering with the state’s vaccination efforts.

- An FDA staff review did not take a firm stance on Moderna’s COVID-19 booster dose, indicating there may not be sufficient data to support the third shot. Pfizer’s dose received the same treatment and was later approved.

- New data suggests greater COVID-19 vaccination levels could have prevented more than 90,000 COVID-19 hospitalizations and 20,000 virus deaths in Texas and Florida since August. Meanwhile, Florida’s governor proposed a new law Tuesday aimed at preventing workers from being fired for not getting vaccinated against COVID-19.

- Over 24,000 nurses and other healthcare workers at Kaiser Permanente have authorized a strike over pay and strained working conditions, as COVID-19 continues to wreak havoc among hospitals and clinics.

- A study of 9 million New Yorkers suggests waning COVID-19 vaccine efficacy was caused largely by relaxed human behavior in avoiding the virus rather than declines in the efficacy of shots themselves.

- Scientists and doctors recommend people who have recovered from COVID-19 still get vaccinated against the virus.

- The U.S. is ending temporary policies that allowed more companies to produce hand sanitizer at the height of the pandemic, saying there’s no longer a shortage.

- U.S. consumer prices rose a higher-than-expected 0.4% in September and were up 5.4% from a year ago, the highest annual increase since 2008. Excluding food and energy, core inflation was up 0.2% in September.

- House lawmakers voted to temporarily raise the U.S. debt limit, a partial solution that will allow the Treasury to pay its bills until the matter is taken up again in December.

- U.S. revenues jumped 18% last fiscal year despite the pandemic, the largest yearly increase since 1977.

- More than 4.3 million workers quit their jobs in August, a record, led by an exodus of employees in the food and retail sectors. U.S. job openings, meanwhile, fell by 659,000 to 10.4 million, below the 11 million expected.

- The pandemic led roughly 35% of Americans to change the age at which they expect to retire, a new survey shows.

- Delta Air Lines posted its first quarterly profit of the pandemic, but earnings were 19% below the comparable period in 2019. The airline, which took no government pandemic aid, warned that high fuel costs could hurt future results.

- American Airlines forecast a smaller-than-expected third-quarter loss amid an increase in travel bookings and an expected surge in holiday travel demand.

- Boeing delivered 35 airplanes in September, up from 22 in August, as domestic travel continues to rebound from the pandemic.

- After cancelling over 2,000 flights between Friday and Monday, Southwest Airlines’ network is beginning to stabilize, with the airline regaining control of systems disrupted by rough weather in Florida and air traffic control problems. Pilots are warning of increasing fatigue and frustration that could pose further disruption down the line.

International Markets

- The U.S. will open its land borders with Canada and Mexico next month to non-essential travel for those fully vaccinated.

- The U.K. reported 38,520 new COVID-19 cases and 191 virus deaths Tuesday.

- Russia set another record yesterday for daily COVID-19 fatalities: 984.

- Civil unrest is rising in Italy over the nation’s proof-of-vaccine and testing requirements for COVID-19, among the strictest in the world.

- Australia’s capital of Canberra is on track to have 99% of its eligible population fully vaccinated against COVID-19 by the end of November, making it the most vaccinated city in the world.

- Japan will begin administering third doses of COVID-19 vaccines in December.

- A growing number of countries have already begun purchasing Merck’s as-yet unapproved COVID-19 antiviral pill, sparking fears that lower-income nations could be left behind. An Indian company has started making a generic version of the drug.

- German drugmaker CureVac has withdrawn its COVID-19 vaccine from the approval process in Europe, instead shifting focus to making booster doses and new vaccines to help tackle virus variants.

- Moderna will sell 176.5 million COVID-19 vaccine doses to the Gavi vaccine alliance, hoping to deliver the shots to low-income nations in the first half of next year.

- Home sales in China are slowing at a normally busy time of year, reflecting growing concern over the nation’s staggering property debt, which currently accounts for roughly half of the world’s $139 billion in distressed debt.

- The prospect of a housing bubble is rising in many international cities including Tokyo, Sydney, Frankfurt and Toronto, but unlike 2008, U.S. cities are mostly out of the danger zone, data shows.

- The U.K.’s unemployment rate fell to 4.5% in the June-through-August period, and employers added 207,000 jobs in September, a monthly record high.

- Grocery prices in the U.K. rose 1.7% year over year in September.

- India’s retail inflation dropped to a five-month low in September as soaring global energy prices weighed on the nation’s economic activity.

- Business sentiment in South Africa fell to a one-year low in September amid pandemic restrictions and related civil unrest.

- Tesla sold more than 56,000 China-made vehicles in September, the most since it began production in the country roughly two years ago.

- Electric vehicle battery maker CATL announced plans to invest nearly $5 billion in a battery-material recycling facility in China’s Hubei province.

- Mercedes-Benz is doubling down on efforts in China, preparing to unveil a new tech center in Beijing in a bid to stay ahead of regulations and consumer trends in the world’s largest car market.

- India-based automaker Tata Motors has raised roughly $1 billion to invest in electric vehicle platforms, charging infrastructure and battery technologies.

- Low-cost Swiss-based airline easyJet is planning to fly 70% of its pre-pandemic capacity between now and December amid increased travel demand for the holiday season and loosened travel restrictions throughout Europe.

- Brazilian aircraft maker Embraer inked a $1.2 billion deal to sell 100 aircraft to U.S.-based NetJets, with plans to begin delivery from the second quarter of 2023.

- A new survey shows that roughly 75% of Australians are concerned about climate change, up from 34% four years ago, as the nation’s prime minister considers stricter emissions targets.

- The U.K. will need over $132 billion in private investments to meet its 2050 climate-related targets, including net-zero carbon emissions, a new report shows. Separately, the country will be one of the first in the world to implement corporate sustainability disclosure standards.

- At least 85% of the global population has experienced weather events made worse by climate change. New data suggests rising temperatures will exceed the limit global leaders committed to in the Paris Agreement, even if ambitious climate goals laid out in recent months are kept.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.