COVID-19 Bulletin: October 14

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices fell slightly on Wednesday, their first loss in five sessions on worries about crude demand growth after China released data showing September crude imports fell 15% from a year earlier.

- Crude futures were higher in late morning trading, with WTI up 0.5% at $80.85/bbl and Brent up 0.6% at $83.64/bbl. U.S. natural gas was 4.5% higher at $5.84/MMBtu.

- Power generation companies are switching to using oil amid soaring natural gas and coal prices, a trend that could add half a million bpd to global demand, the International Energy Agency predicts.

- U.S. power usage is expected to have risen 3% in 2021, the Energy Information Administration said.

- U.S. demand for diesel is surging to the highest level since 2018 as truckers continue working to clear a backlog of deliveries accumulated during the pandemic. Consumption of the fuel, which has already surpassed pre-pandemic levels, is expected to rise another 3% to 4.11 million bpd in 2022.

- Higher energy prices are expected to drive up the cost of heating U.S. homes this winter, with nearly half of U.S. households heated with natural gas predicted to spend 30% more compared to last year.

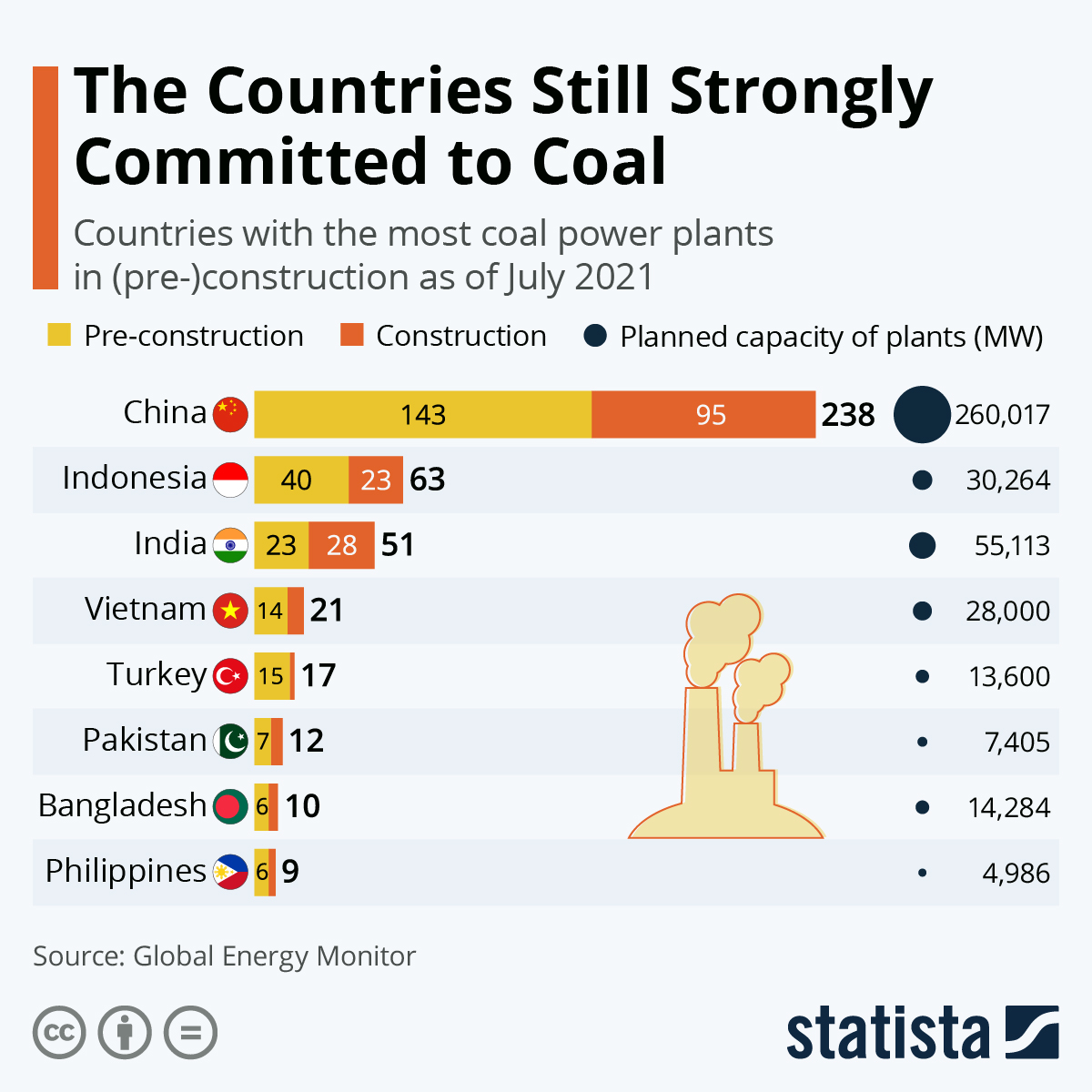

- Coal prices in China are holding near record highs as cold weather hits the country’s northern regions and power plants stock up on the fuel to ease an energy crunch.

- Fuel demand in India rose to 15.9 million tonnes in September, a 5.2% jump compared with the same time last year. A shortage of coal forced a 1.6% drop in power supplies through the first 12 days of October, the worst monthly drop since 2016.

- Mexico’s second-largest refinery remains shut down since late September due to protests by teachers blocking key transport roads used by Pemex.

- While the European Commission has said energy supply is not at immediate risk despite low gas storage levels ahead of winter, a European fertilizer industry group is warning that new regulations to help mitigate exceptionally high gas prices are insufficient and could lead to permanent shutdowns of facilities.

- The future of Norway’s oil industry, the largest in Europe, was debated during recent elections, but the country will continue exploring for oil and gas over the next four years, according to its incoming government.

- The EU is looking to ban new oil, coal and gas exploration in the Arctic in a bid to protect the region from climate change.

- Phillips 66 is partnering with clean energy provider Plug Power to develop low-carbon hydrogen businesses.

- The White House announced long-term plans to develop large-scale wind farms along the entire U.S. coastline, with plans to begin leasing land to developers by 2025.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- California’s Alisal Fire continued to expand Wednesday, burning more than 13,400 acres with just 5% containment. The state experienced its driest summer since 1895.

- Hurricane Pamela made landfall in Mexico Wednesday as a Category 1 storm, with remnants forecast to bring heavy rain and flooding to Texas and Oklahoma later today.

- The Rocky Mountains were hit with the first snowstorm of the season, with more than a foot of snowfall disrupting traffic throughout the region.

- The U.S. warehouse and transportation industry had a record 490,000 job openings in July, a gap expected to widen in coming months.

- A backlog of containers at the U.K.’s Port of Felixstowe could leave up to $2 billion worth of imported goods stranded ahead of the holiday season.

- UPS and Walmart are among major companies that have agreed to use off hours at the ports of Los Angeles and Long Beach over the next 90 days to help ease congestion.

- A new survey shows that 3 out of 4 U.S. retailers said shoppers expect more from stores than they can deliver this holiday season due to a labor shortage and supply chain disruptions.

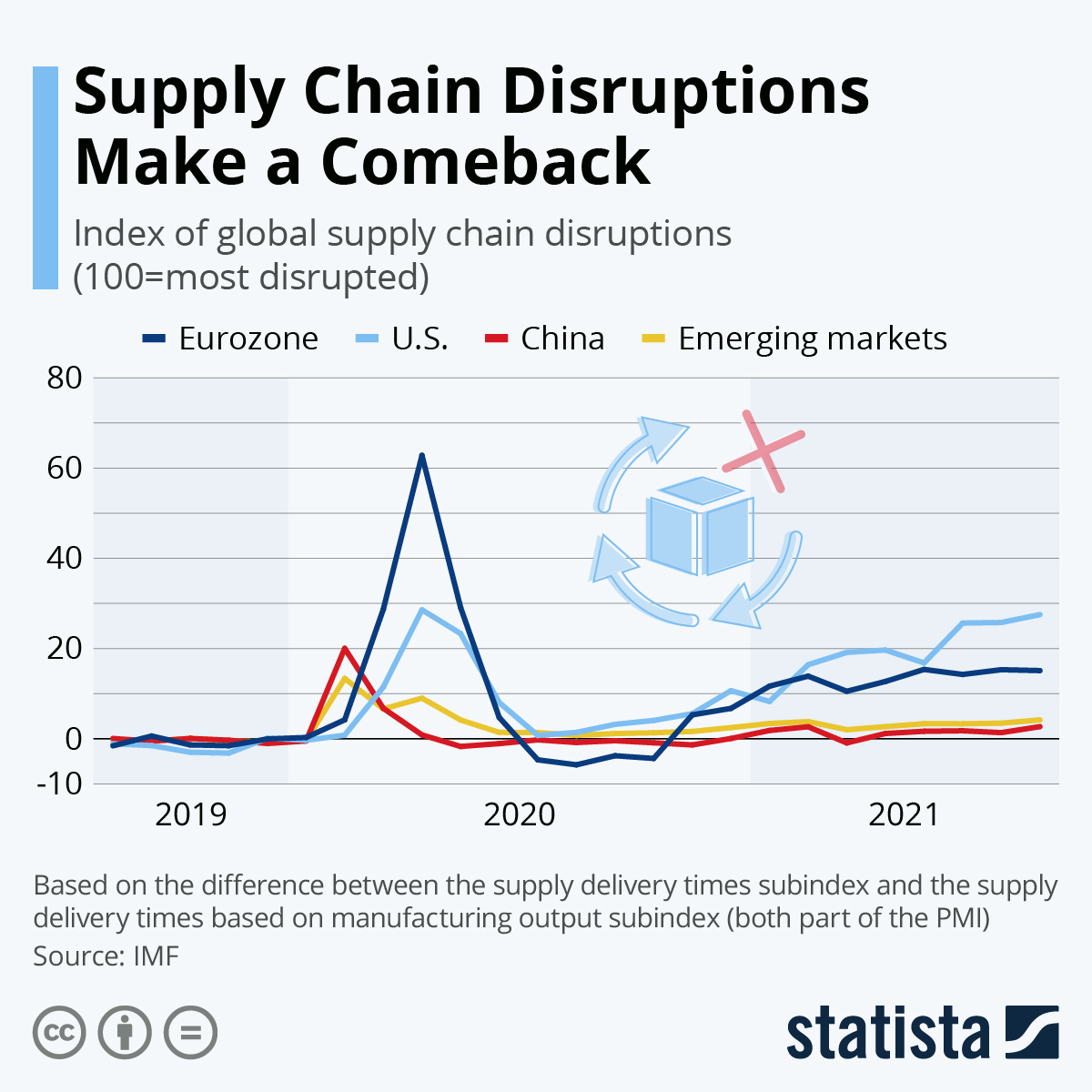

- China’s producer-price index, a gauge of factory-gate prices, rose by 10.7% in September from a year ago, the fastest pace in 25 years, due to surging prices of coal and energy-intensive products. The nation’s widening power crisis has temporarily halted production at numerous factories, including suppliers to big global brands such as Apple.

- The U.K. is working to establish a new bilateral trade agreement with Italy following its exit from the EU, while the EU establishes new measures to ease trade flow to Northern Ireland.

- GM extended a production halt of its Chevrolet Bolt electric vehicle for an additional two weeks due to battery pack shortages related to the vehicles’ recent recall.

- Hyundai Motors is considering manufacturing its own semiconductor chips to lessen its reliance on third-party chipmakers.

- Amazon is bidding for refurbished cargo versions of long-range Boeing and Airbus planes, part of a plan to increase overseas deliveries and better compete with the shipping market’s established players such as UPS and FedEx.

- A component shortage caused by the ongoing supply chain crisis is taking its toll on the farming industry, hampering harvesting and posing a threat to the U.S. food supply.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, clickhere.

- Our Logistics team reports the following:Bulk trucking capacity is very limited as demand is exceeding supply.

- Dry van (full, partial and less-than-truckload) capacity is very limited as demand exceeds supply.

- Port congestion continues to be very problematic, delaying deliveries of imported containers.

- Packaging and pulverizing/grinding production challenges persist as demand is exceeding supply

Domestic Markets

- The U.S. reported 120,321 new COVID-19 infections and 3,054 virus fatalities Wednesday.

- COVID-19 hospitalizations in the U.S. have dropped 10% over the last week, as the country averages roughly 1,300 virus deaths per day.

- COVID-19 was the leading cause of death in the U.S. for people aged 35 to 54 in September and the second-leading cause of death overall.

- COVID-19 vaccination rates in the U.S. rose 20% after mandates were imposed by private businesses and local governments, with roughly 77% of eligible people now having received at least one shot.

- Infection rates are 10 times higher than the North American average in the American Midwest and Alaska.

- Minnesota’s daily COVID-19 cases have surged 29% over the last two weeks, while virus hospitalizations have risen 17%, pushing the state’s ICUs to near-capacity.

- Anchorage, Alaska, will mandate masks in indoor public places as the city’s hospitals continue to operate at crisis levels due to surging COVID-19 patients.

- Montana reported 2,227 new COVID-19 cases Tuesday, with the state ranking fourth for most new virus infections per week behind Alaska, Wyoming and North Dakota. Virus hospitalizations in Montana have more than doubled the past two months, forcing some facilities to ration care.

- Florida reported nearly 900 COVID-19 deaths Tuesday, as the state issued a $4 million fine to one county for requiring proof of vaccines for access to certain activities.

- Massachusetts has activated its National Guard to help the state test for COVID-19 in public schools and manage a staffing shortage at jails.

- Legal experts argue that federal vaccine mandates would override the Texas governor’s order that bars most COVID-19 vaccine requirements in the state.

- Vaccination rates among Black Americans, initially low due to vaccine suspicions, have caught up with rates among white and Hispanic populations.

- A federal judge has stopped United Airlines from withholding pay from unvaccinated workers who refuse to get COVID-19 shots claiming religious or medical exemptions.

- More than 800 city workers in Boston were placed on unpaid leave for failure to get COVID-19 vaccinations.

- Roughly 40% of TSA workers have yet to receive COVID-19 vaccinations six weeks ahead of a federal deadline.

- All but four players in the National Hockey League are vaccinated against COVID-19, the league reports.

- A booster dose of Johnson & Johnson’s COVID-19 vaccine raised virus-fighting antibodies in people who received a first jab of the shot, though FDA regulators warn the data relies heavily on the drugmaker’s own findings. A new study suggests people who received the shot first would benefit from receiving a booster of the Pfizer or Moderna vaccines.

- First-time jobless claims fell to 293,000 last week, down by 36,000 from the prior week to the lowest level since March 2020.

- The Federal Reserve could begin reducing the pace of its $120 billion monthly asset purchase program by as soon as mid-November, according to minutes from the central bank’s September meeting.

- Rising inflation prompted the Social Security Administration to boost its cost-of-living adjustment for 2022 by 5.9%, the largest increase in nearly 40 years.

- Roughly 20% of U.S. households lost their entire financial savings during the pandemic, new data shows.

- JPMorgan, reporting a 24% rise in third-quarter profits after reversing loan-loss accruals reserved early in the pandemic, expects the economy to remain healthy for the foreseeable future. Bank of America reported a 58% increase in quarterly earnings on higher interest income and a reversal of loan-loss reserves.

- The expiration six weeks ago of the federal eviction moratorium has not led to mass evictions that many feared thanks to the federal rental assistance program.

- Rising housing costs in the San Francisco Bay Area have caused more than half the region’s residents to consider moving from the area permanently.

International Markets

- Weekly global deaths from COVID-19 are at their lowest levels in nearly a year, according to new data released by the World Health Organization.

- The U.K. reported 42,776 new COVID-19 cases and 136 virus fatalities Wednesday.

- The French administration is preparing to ask lawmakers to extend the nation’s COVID-19 state of emergency until July 31, 2022.

- Costa Rica and Wales became the latest countries to mandate proof of COVID-19 vaccination for access to indoor activities and services.

- China has begun administering third COVID-19 shots to high-risk populations in at least 10 regions.

- Russia will begin testing a nasal spray version of its Sputnik V COVID-19 vaccine.

- India has resumed exporting COVID-19 vaccines to other countries now that a large portion of its population has received shots.

- The director of the World Health Organization is urging countries to prioritize supplying COVID-19 vaccines to the COVAX sharing program to meet global inoculation targets.

- Asia’s loosened pandemic travel restrictions have spurred a rebound in the airline industry, with travel agencies reporting a surge in bookings to Malaysia and Vietnam.

- India will begin allowing domestic flights to fly at full capacity starting Oct. 18.

- Gross domestic product in the U.K. grew 0.4% in August after contracting in July for the first time in six months, fueling speculation that the Bank of England will raise interest rates before the end of the year.

- Germany slashed its 2021 economic growth forecast from 3.7% to 2.4%, as global supply chain disruptions continue to hamper the country’s recovery from the pandemic.

- Russia announced a new goal to become carbon neutral by 2060.

- Indonesia will need to invest up to $200 billion per year in low-carbon programs over the next nine years to have a chance at reaching net-zero emissions by 2060, a new study shows.

- Inadequate supplies of lithium, nickel, manganese and cobalt are expected to slow European production of electric vehicles from Volkswagen, Daimler and Stellantis.

- Volkswagen warns it could lose 30,000 jobs if it transitions too slowly to electric vehicles.

- Honda is preparing to launch a new electric vehicle brand in China next year, with plans to sell only battery-electric, hydrogen fuel-cell or hybrid vehicles in the nation by 2030.

- Volvo manufactured a new prototype vehicle it claims to be made from steel produced without using fossil fuels.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.