COVID-19 Bulletin: October 20

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose slightly Tuesday, extending gains that have pushed WTI and Brent up a respective 21% and 19% since the start of September.

- Futures were higher in late morning trading, with WTI up 0.8% at $83.58/bbl and Brent up 0.5% at $85.51/bbl. U.S. natural gas was 1.0% higher at $5.14/MMBtu. The declines come on signs that U.S. crude stockpiles rose by a larger-than-expected 3.29 million barrels last week.

- U.S. stockpiles of propane heating fuel are expected to have peaked for the year, setting up the likelihood of shortages this winter amid the strongest price surges since 2009.

- Coal prices in China dropped 8% Tuesday night as the country’s state planner said it was studying ways to intervene to mitigate record-high prices for the fuel.

- India is encouraging joint negotiations by state-run and private refiners to make better crude import deals, the vast majority of which are made with Middle East producers.

- Japanese utility Tohuku Electric has inked a deal with BP to buy six cargoes of LNG fuel to be delivered in the first half of next year at 20% the cost of Brent crude, avoiding paying record-high prices on the spot market for short-term supplies.

- Brazil’s Petrobras is reporting that fuel demand exceeds its production capacity, with diesel and gasoline demand up a respective 20% and 10% compared to November 2019.

- Halliburton, one of the nation’s largest oilfield services companies, reported its third consecutive profitable quarter Tuesday as drilling activity rebounds alongside rising crude demand and prices. Net income rose to $236 million compared to a $17 million loss the same period last year, as the company’s CEO foresees “a multiyear upcycle unfolding.”

- An employee strike at French power firm EDF cut the nation’s nuclear production capacity by 12.2% Tuesday afternoon.

- The 650 locked-out workers at Exxon’s Beaumont, Texas, refinery voted to reject a contract offer Tuesday that could have ended a months-long standoff over job assignments at the plant.

- Spanish utility Iberdrola opted not to bid in the nation’s latest auction of renewable energy capacity due to regulatory uncertainty amid record-high power prices.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Shipping logjams are delaying deliveries to U.S. grocers, with total on-shelf product availability declining by almost one percentage point from August to September. A Manhattan grocery chain expects food prices to rise more than 10% over the next two months.

- Freight volumes at the Netherlands’ Port of Rotterdam increased 15% year over year in the third quarter.

- Container throughput at India’s largest container port in the six months ending Sept. 30 rose 40.4% from the same time last year.

- Total container traffic on Russia’s state-run railway jumped 40% in the first nine months of 2021 to 782,000 TEU and could hit a record 1 million TEU this year. The nation has seen a 47% increase in rail volumes from China year to date.

- Congestion at European ports has been growing but remains less severe than backups at U.S. counterparts.

- The post-Brexit U.K. has largely fallen behind trade upticks in the rest of the world, with export volumes 16% lower in July from 2019 levels versus a global trade increase of 4% in the same period.

- Japanese shipper Ocean Network Express will resume service at the Port of Oakland on Nov. 13, ending a two-year hiatus that U.S. exporters hope will increase volumes to Asia.

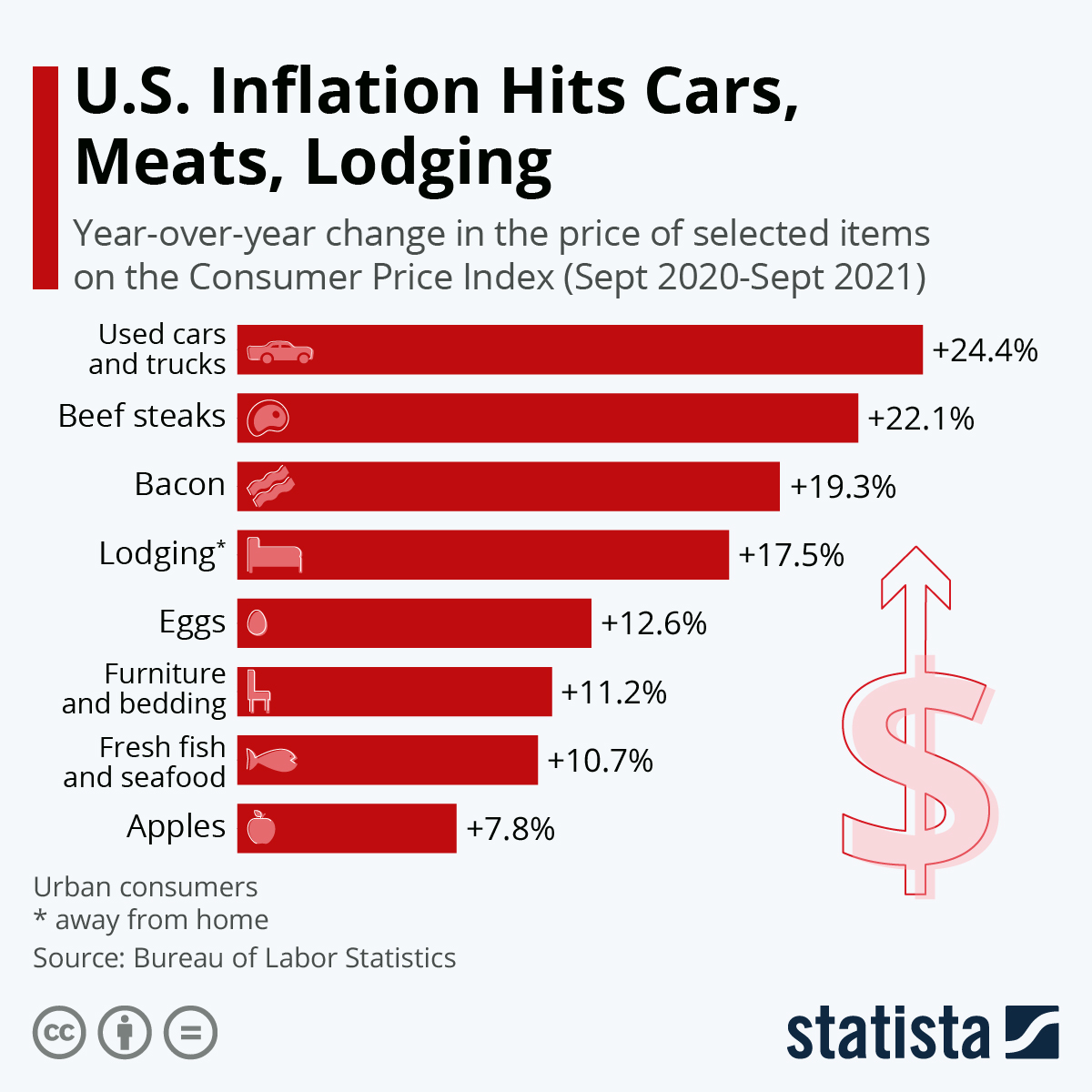

- High levels of inflation hit a broad section of U.S. industries in September, the most recent data shows:

- Procter & Gamble, maker of Tide detergent and Crest toothpaste, will start charging more for razors and certain beauty and oral care products, the second round of price increases since July due to rising freight and raw material costs.

- Ship insurers are indicating significant rate increases heading into next year, potentially by as much as 25% or more.

- Oat futures have climbed to all-time highs and are more than twice the level of 2019 and 2020 because of severe dry weather parching big North American growing regions.

- Italian-American CNH Industrial — maker of farm machinery, Iveco commercial vehicles and construction equipment — will shut several of its European plants for eight days this month due to the global computer chip shortage.

- Europe is short roughly 400,000 truckers, while a similar shortage in the U.S. pushed spot rates for dry trucks up 13% year over year in the third quarter.

- The wine market is one of the latest to be hit by logistics disruptions, with packaging materials such as bottles, adhesives and paper getting held up at congested ports.

- Union Pacific and its labor unions have sued one another over how to implement the federal vaccine mandate.

- Canada’s Purolator parcel delivery service projects a 10% gain in volume this holiday season.

- Amazon has begun shipping its own containers on a chartered open-hatch bulk ship, while it also is in the market to buy long-range jet freighters to fly from China.

- Software firm SPS Commerce is partnering with C.H. Robinson in a bid to boost the latter company’s less-than-truckload capacity and provide better rate visibility.

- Amazon, Ikea and Unilever have all recently pledged to using only zero-carbon marine fuels by 2040.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, clickhere.

- Our Logistics team reports the following:Bulk trucking capacity is very limited as demand is exceeding supply.

- Dry van (full, partial and less-than-truckload) capacity is very limited as demand exceeds supply.

- Port congestion continues to be very problematic, delaying deliveries of imported containers.

- Packaging and pulverizing/grinding production challenges persist as demand is exceeding supply

Domestic Markets

- The U.S. reported 81,238 new COVID-19 cases and 2,357 virus fatalities Tuesday.

- New York City will require its more than 160,000 municipal employees to be vaccinated against COVID-19 or potentially lose their jobs.

- The U.S. Supreme Court declined to hear an emergency appeal of Maine’s COVID-19 vaccine requirement for healthcare workers, the first time the nation’s highest court weighed in on a statewide vaccine mandate.

- COVID-19 vaccination rates in Puerto Rico are the highest in the U.S. by a wide measure, with the U.S. territory of Guam and the state of Vermont following.

- Florida’s seven-day moving average of new COVID-19 cases is down 48% from two weeks ago.

- Texas reported 4,950 patients hospitalized with COVID-19 Monday, its lowest total in nearly three months.

- Unvaccinated public employees in both Washington state and Massachusetts now face termination after failing to meet vaccine mandate deadlines this week. The policy has led to the firing of Washington State University’s head football coach, the highest paid public employee in the state.

- California continues to have the lowest rate of COVID-19 transmission in the nation, becoming the only state to reach the CDC’s “moderate” virus risk category.

- COVID-19 cases and hospitalizations in Hawaii have declined significantly, with officials prepared to welcome vacationers and business travelers starting Nov. 1.

- The U.S. Labor Department is working to revoke state-level oversight of workforce safety programs in Utah, Arizona and South Carolina, citing a failure by the states to adopt more rigorous COVID-19 safety standards.

- General Electric and Union Pacific are the latest major U.S. companies to impose COVID-19 vaccine mandates to comply with the federal government’s Dec. 8 deadline for federal contractors.

- In a policy reversal, Southwest Airlines is temporarily delaying the firing of unvaccinated employees whose religious or medical exemption status for vaccines is pending.

- New York City expects an annual loss of $111 million in tax revenue due to employees shifting to remote work.

- The U.S. administration clarified that recently eased international travel restrictions apply to fully vaccinated visitors only, and that those with just one dose of a two-dose COVID-19 vaccine regimen will continue to be denied entry to the country.

- New CDC data shows that Pfizer’s COVID-19 vaccine was 93% effective in preventing virus hospitalization among teens aged 12-18.

- Americans have lost a combined $585 million since March 2020 due to scams involving stimulus packages and the pandemic, according to new data from the Federal Trade Commission.

- Elkhart, Indiana, rose to the top of the Wall Street Journal/Realtor.com Emerging Housing Markets Index, as high housing costs and remote-work opportunities boost migration into smaller U.S. cities. The trend has caused salaries for tech workers in San Francisco and New York to drop for the first time in roughly five years.

- Single-family house rental prices rose 9.3% year over year in August, as abnormally high home prices push more would-be buyers into the rental market.

- U.S. housing starts fell 1.6% in September while permits for future homebuilding fell 7.7% to a one-year low, as labor and raw material shortages hamper the construction sector.

- Survey results show 11.5% of U.S. holiday shoppers do not plan to spend anything on gifts and services this season, the highest percentage of people in at least a decade.

- American telecom giant Sinclair suffered a ransomware attack over the weekend, impeding local newscasts in a variety of regions and rendering the company’s computer systems unusable.

- Johnson & Johnson’s revenue rose 11% year over year in the third quarter to $234 billion, led by an increase in sales in medical devices and pharmaceuticals.

- Google says its new Bay View campus in Mountainview, California, will run entirely on carbon-free energy.

- Researchers at Concordia University claim to have developed self-healing polymers that can be used to repair cracked cellphone screens and potentially increase the lifespan of cellphone batteries.

International Markets

- The U.K. reported 233 COVID-19 fatalities Tuesday, the highest single-day toll since March, as infection rates in the nation return to among the highest in the world. One in 10 of the nation’s high school students tested positive for the virus in the week ending Oct. 9, prompting officials to let children as young as 12 make vaccine appointments.

- Nearly 6,500 people are currently hospitalized with COVID-19 in France, the most in two months, sparking fears of a fifth virus wave.

- Ireland walked back plans to fully reopen its economy this Friday amid rising COVID-19 hospitalizations.

- New Zealand reported 94 COVID-19 infections Tuesday, a record, with 87 reported in Auckland, the nation’s largest city.

- Nearly 4,000 COVID-19 cases were reported in Singapore Tuesday, a record, as the city-state’s hospitals are stretched thin with patients.

- Russia posted 1,015 COVID-19 deaths Tuesday, the second record in as many days, as Moscow began ordering strict lockdowns for seniors and many workers.

- Romania reported 561 COVID-19 deaths Tuesday, a record.

- Belarus halted routine medical care at state clinics to devote resources to a surging wave of COVID-19 hospitalizations.

- New international research suggests repeat infection with COVID-19 could occur every 16 months.

- Roughly 72% of Australians have received at least one dose of a COVID-19 vaccine, compared to just 66% in the U.S.

- The International Monetary Fund cut its economic growth forecast for Asia this year from 7.6% to 6.5% as regional surges of COVID-19 hamper consumption and factory output.

- Home prices in China have begun falling for the first time in six years, a potentially big blow for the nation which relies on property industries for roughly 25% of its output. Meanwhile, the string of Chinese real estate firms defaulting on their debt is growing.

- The U.K. unveiled its net-zero strategy ahead of the COP26 United Nations climate talks later this month, containing detailed plans on creating 440,000 green jobs by 2030. Officials indicated new taxes may be needed to offset revenue losses caused by a shift away from fossil fuels.

- German power company RWE plans to invest $21 billion in green technologies and infrastructure in the U.K. by 2030.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.