COVID-19 Bulletin: October 26

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- U.S. benchmark WTI crude rose above $85/bbl Monday for the first time in seven years before steadying to close 46 cents higher on the day. Crude futures were higher in late morning trading today, with WTI up 1% at $84.58/bbl and Brent up 0.4% at $86.30/bbl. U.S. natural gas was 2.3% lower at $5.76/MMBtu.

- OPEC and its allies are due to gather next week to assess output policy amid a backdrop of tight global supplies that some analysts predict could push crude prices to $100/bbl.

- Canada’s natural gas exports to the U.S. have risen to a three-year high, prompting the nation to increase capital spending and drilling activity.

- Nine EU countries announced they will not support a reform of the bloc’s electricity market despite the continent’s recent skyrocketing gas and power prices.

- Spain’s Repsol has begun oil production at Norway’s Yme field, bringing its North Sea petroleum reservoir back online for the first time since 2001.

- Russian gas supplier Gazprom will maintain established exports to Europe and Turkey despite Russia’s struggle to secure more of the fuel ahead of winter.

- Smog in Beijing has hit its worst levels since May following the nation’s decision to allow miners to increase coal production.

- French power grid operator RTE says that new EPR nuclear reactors can help the country move away from fossil fuels on the path of becoming carbon neutral by 2050.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- A rapid drop in atmospheric pressure drenched the West Coast with historic rains Monday, causing road-closing mudslides near Los Angeles and shutting off power to more than 100,000 Californians and 50,000 Washington residents. Meteorologists are warning of heavy rains on the East Coast the next couple days, while New York City is under a flash flood watch until this afternoon.

- Persistent drought conditions in South America have halted electricity production at dozens of hydroelectric dams, driving up energy prices, while river transport of soybeans has been severely hampered.

- Up to 2,000 empty containers coming from the U.S. Gulf and Southeast are on their way to the Port of Los Angeles for shipment to Asia, threatening to further clog terminals.

- The global shipping benchmark Baltic Dry Index dropped to its lowest level in over a month Monday, falling to 4,257, a 24% decline from the 13-year peak recorded earlier this month.

- With international air cargo rates nearly double pre-pandemic levels in September, shippers are encouraged by an increase in international passenger flights, which typically haul freight in their bellyholds.

- FedEx, beset by labor shortages and delivery disruptions, is suspending its money back guarantee for air delivery services during the holiday season.

- The American Trucking Associations (ATA) is among the business groups pleading with the White House to delay its COVID-19 vaccine mandate until after the holiday season, arguing that the measure will cause workers to leave jobs and further disrupt supply chains during peak demand.

- The U.S. State Department announced plans to roll out a new cybersecurity office aimed at combating the uptick in ransomware attacks that have hit multiple industries in recent months, battering already disrupted supply chains.

- With China’s exports of magnesium sharply declining due to the nation’s energy crunch, Europe is facing a shortage that threatens to shutter industrial operations reliant on the metal within weeks, including the critical auto and packaging industries.

- Amazon has reportedly doubled its container processing capacity and secured more shipping storage from ocean freight carriers in a bid to get ahead of supply chain issues before the holiday season.

- This holiday season will likely be the second in a row that retailers hold back on normal discounts as they continue to battle supply chain disruptions, higher inflation and pandemic-suppressed sales.

- Pandemic supply chain disruptions are hitting meal programs at school districts, with cafeterias frequently forced to change menus each day to accommodate shortages.

- Malaysian production of palm oil, the most consumed edible oil and a bellwether for vegetable oil markets, has dropped to a five-year low amid record labor shortages.

- A growing number of restaurants are investing in robotic and automated technologies for kitchens and dining rooms to help improve service amid ongoing labor shortages.

- New research suggests the global shipping industry will see its greenhouse gas emissions increase 20% by 2050 absent carbon levies and other sustainability measures by industry leaders.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

- Our Logistics team reports the following:

- Bulk trucking capacity is very limited as demand is exceeding supply.

- Dry van (full, partial and less-than-truckload) capacity is very limited as demand exceeds supply.

- Port congestion continues to be very problematic, delaying deliveries of imported containers.

- Packaging and pulverizing/grinding production challenges persist as demand is exceeding supply

Domestic Markets

- Daily COVID-19 infections have dropped more than 43% in the U.S. over the past month alongside a 50% decrease in total hospitalizations since August. The nation reported 102,898 new infections and 1,401 virus fatalities Monday.

- Academic models predict that COVID-19 cases will rise across the U.S. in coming months as unvaccinated people gather indoors.

- An FDA panel will meet today to consider endorsing Pfizer/BioNTech’s COVID-19 vaccine for use with children as young as age 5.

- Moderna’s COVID-19 vaccine produced a powerful immune response in children aged 6 to 12, as the drugmaker prepares to seek clearance in the U.S. and EU.

- COVID-19 is the third-leading cause of death in Alaska this year behind cancer and heart disease.

- For the first time in state history, Ohio recorded more deaths than births last year, with deaths from COVID-19 accounting for 97% of the gap.

- COVID-19 deaths in Arizona have risen 138% over the past week, with experts fearing an even larger surge this winter.

- Minnesota hospitals are reporting greater strains due to rising COVID-19 patients, as the number of single-day infections in the state topped 3,000 yesterday.

- Roughly 98% of COVID-19 infections in Wyoming since May 1 have come from unvaccinated residents.

- Alabama’s governor issued a new order directing state agencies to resist the federal government’s upcoming COVID-19 vaccine mandate deadline and ordering state employees to cooperate in a lawsuit challenging the measure.

- New COVID-19 infections in Florida dropped to 15,314 last week, the lowest since June. The state’s governor plans to offer out-of-state, unvaccinated police officers $5,000 bonuses to relocate to the state.

- Missouri’s seven-day average COVID-19 positivity rate has dropped to 6.5%, a four-month low.

- The U.S.’s new travel guidelines requiring all international visitors over 18 to be vaccinated against COVID-19 will go into effect Nov. 8, along with additional testing requirements for unvaccinated U.S. citizens returning from abroad.

- The U.S. administration announced plans to invest $70 million toward boosting supply of rapid, over-the-counter COVID-19 tests.

- A new study by the National Bureau of Economic Research shows that incentives by local governments and employers failed to boost COVID-19 vaccination numbers among hesitant people.

- Coca-Cola will pay $2,000 to employees who get vaccinated against COVID-19.

- Walmart will bring back its corporate staff to in-person work beginning Nov. 8. Vaccinations are a condition of employment for headquarters campus employees and field leaders.

- United Airlines is being forced by a court temporary restraining order to pay millions in paid leave to pilots who refuse vaccinations over religious or medical objections, as vaccinated pilots refuse to fly with them.

- New CDC data shows that the highly contagious Delta COVID-19 variant does not cause more severe illness in patients stricken with the virus.

- Pfizer plans to produce 4 billion COVID-19 doses next year, up from 3 billion in 2021.

- New data shows the average bill for treatment of COVID-19 at U.S. hospitals rose above six figures.

- More than 3 million Americans have opted to retire earlier than expected during the pandemic, accounting for more than half of the 5.25 million people who have left the labor market since March 2020.

- State and local governments distributed $2.8 billion in emergency rental assistance funds last month, a record, following a recent push from the White House to quicken payments to households to prevent evictions spurred by the pandemic.

- Car rental company Hertz has ordered 100,000 Tesla vehicles, set to be delivered in the U.S. and part of Europe over the next 14 months, in a bid to begin electrifying its fleet. The move pushed Tesla’s market valuation over $1 trillion, putting it in a select group alongside Apple, Microsoft, Amazon and Google parent Alphabet.

- U.S. utility Dominion Energy is partnering with Spanish turbine maker Siemens Gamesa to build the first U.S. factory to make blades for offshore wind power, as Virginia aims to become a regional hub for the industry.

- Austin, Texas, will be the site of the nation’s largest 3D-printed home development, with more than 100 homes slated for construction using a 15.5-foot-tall printer that can build exterior and interior walls for a 2,000-square-foot house in just a week.

International Markets

- The U.K. reported 36,567 new COVID-19 infections and 38 virus deaths Monday.

- Ukraine recorded 734 COVID-19 deaths Tuesday, a record.

- Belgium is considering reimposing recently relaxed COVID-19 protocols as virus infections and hospitalizations spike.

- The Netherlands is mulling imposing new pandemic restrictions as COVID-19 cases soar in the country and start to overwhelm hospitals.

- With the highest vaccinated population in the EU, Portugal is averaging just six COVID-19 deaths per day, as the nation lifts the bulk of its virus restrictions and cautiously tries to return to pre-pandemic normality.

- China has driven COVID-19 cases back to zero three times in the past five months, a strategy requiring enormous resources for border sealing, contract tracing, lockdown enforcement and mass testing. Most recently, stay-at-home orders were issued in Inner Mongolia following an outbreak of 150 cases the past week and a separate lockdown of the 4 million residents of Lanzhou in Gansu province following 39 reported infections. Some of the nation’s provinces will begin vaccinating children as young as age 3 against the virus.

- Australia’s Victoria state recorded 1,461 new COVID-19 infections Monday, as the nation will begin administering booster shots as soon as this week.

- Singapore is seeing a record number of COVID-19 hospital patients, with more than 83% of the city-state’s 366 ICU beds in public hospitals filled.

- Indonesia is anticipating a surge in COVID-19 infections over the coming weeks as roughly 20 million people travel in Java and Bali for the holiday season.

- South Korea will further ease COVID-19 restrictions next week now that it has fully inoculated 70% of its population against COVID-19.

- Brazil’s two-dose vaccination rate has surpassed 50% of the population.

- The European Medicines Agency started reviewing a COVID-19 antiviral pill made by Merck, which, if approved, would be the first virus treatment that can be taken at home.

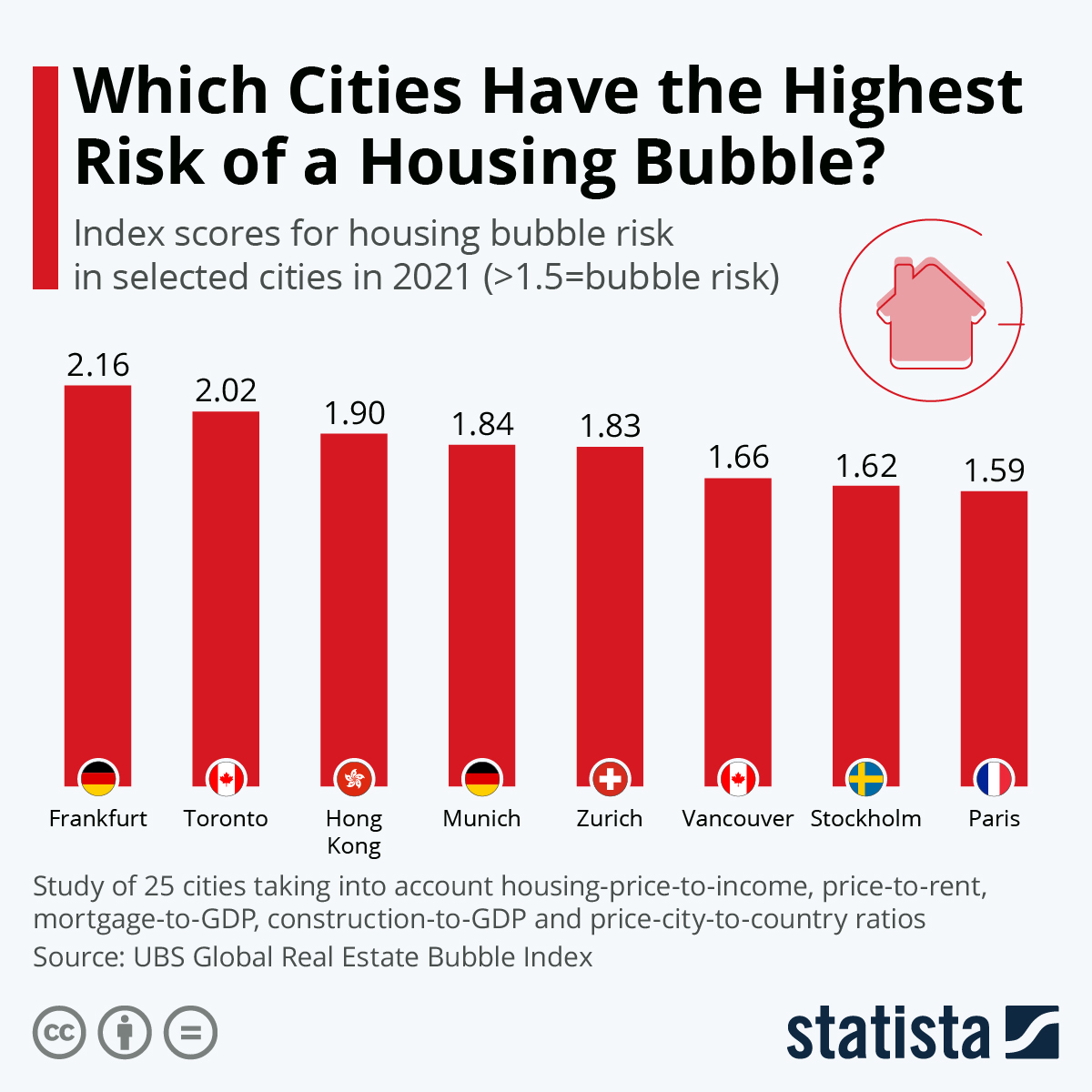

- Frankfurt, Germany, was found to have the highest risk of a housing bubble in a recent survey from investment bank UBS.

- Beijing-based Modern Land China, a so-called “green” real estate developer, has become the latest of the nation’s builders to miss debt payments amid a growing crisis over widespread property debt.

- German air carrier Lufthansa expects business travel bookings to remain strong at more than 90% of pre-pandemic levels through the winter.

- Airbus rejected calls by aircraft leasing companies to lower production of its A320 aircraft over concerns it could upset the market and lower plane values, with the jet maker saying its plans are justified by record demand.

- Germany’s BASF has inked a deal with Chinese battery maker SVolt to begin developing battery materials.

- Tesla registered 24,591 new Model 3 cars in Europe in September, 58% higher than the previous year and the first time an electric vehicle topped monthly sales charts in the bloc. Meanwhile, Japan’s Panasonic unveiled a new large prototype battery aimed at helping the carmaker lower production costs.

- Global CO2 levels surged to 413.2 parts per million in 2020, rising by more than the average rate over the last decade, as world leaders prepare to meet in Glasgow Sunday for a new agreement on curbing emissions. The EU’s top climate official will meet with China’s climate envoy in London this week in a bid to build momentum ahead of the summit.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.