COVID-19 Bulletin: October 28

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices declined Wednesday, with U.S. benchmark WTI pulling back from a seven-year high after government data showed a rise in domestic crude inventories along with a drop in stockpiles at a key delivery hub in Cushing, Oklahoma. Futures were lower in late morning trading, with WTI down 1.0% at $81.82/bbl and Brent down 1.3% at $83.49/bbl. U.S. natural gas was 6.2% lower at $5.81/MMBtu.

- Brazil’s president is mulling privatizing state-run oil major Petrobras, claiming the measure would quell rising fuel prices.

- China is imposing new caps on the price of domestic thermal coal, a bid to ease a power crunch that’s prompted electricity rationing and caused at least one blackout in a city last month.

- Long-awaited additional gas supplies will soon be headed to Europe after Russia’s president ordered state-owned Gazprom to start refilling European storage facilities next month. The news from the world’s largest gas producer sent the bloc’s gas prices down sharply Wednesday.

- Shell posted weaker-than-expected third-quarter earnings of $4.1 billion, down from $5.5 billion in the previous quarter but higher than the $955 million from a year earlier. The oil major is facing calls from a prominent hedge fund investor to split into multiple companies to increase its performance and market value.

- U.S. producer Hess saw better-than-expected third-quarter profit, with net income rising to $115 million compared to a loss of $243 million from the same time last year.

- BP’s trading team made at least $500 million trading LNG in the third quarter amid record-high global prices.

- Texas-based Phillips 66 announced plans to purchase the remaining stake in a pipeline affiliate for $3.4 billion as it aims to streamline its operations.

- Colombia has awarded contracts for 11 new large-scale solar projects worth $875 million that are expected to generate 796.3 megawatts of energy by early 2023.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Severe rains shut off power to 600,000 homes and businesses in the Northeast Wednesday, with storms expected to linger in the area throughout Thursday.

- Union Pacific and BNSF will start offering per-container rebates for customers that move containers out of the Ports of Los Angeles and Long Beach on Saturdays and Sundays, a bid to lessen congestion and take advantage of the ports’ recent shift to 24/7 operations.

- The 25 largest U.S. retailers acquired about 38 million rentable square feet in new industrial space last year, up from just 18.8 million the previous year as more firms calculate they will save money in the long run by owning their own warehouses.

- Luxury department store Saks opened a new e-fulfillment center in Pennsylvania that will allow the retailer to ship directly to customers nationwide.

- Lead times to get commercial desktop computers and other equipment have increased as suppliers shift focus from work-at-home setups to office and hybrid work settings.

- To quell fears from logistics industry groups over the federal COVID-19 vaccine deadline, the White House says organizations that have instituted vaccine mandates have seen overwhelming compliance.

- Some in the trucking industry are disputing statistics showing a widespread shortage of drivers, pointing instead to increased congestion at U.S. ports as the reason for downstream logjams in U.S. logistics.

- Many large U.S. manufacturers are considering imposing higher prices for the remainder of this year and next, to handle the costs of global supply bottlenecks and material shortages.

- McDonald’s is planning to raise its menu prices 6% from last year to offset rising operational costs, including a 10% increase in the average wage of its employees and a projected 4% increase in commodity supplies.

- C.H. Robinson Worldwide posted a third-quarter rise in net income and revenue of 81% and 50%, respectively, from the same time last year on higher prices and volumes across most of its operation.

- Apple said 175 of its suppliers have now committed to using clean energy in their manufacturing, which could add more than nine gigawatts of clean energy toward Apple’s goal of making its supply chain carbon-neutral by 2030.

- GE will further diversify sourcing and expand factory capacity for its healthcare unit in a bid to work around the global semiconductor shortage and get ahead of other supply chain disruptions.

- Costco raised its starting wage to $17 per hour, its second hike this year.

- Starbucks is raising its average pay to nearly $17 per hour in a bid to attract and keep workers amid the continued tight U.S. labor market.

- Demand is skyrocketing for shipping containers to be repurposed as swimming pools, with the average single-unit price hitting an all-time high of around $60,000.

- At least 59,000 workers in the U.S. meatpacking industry contracted COVID-19 last year, with 269 dying from the virus.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

Domestic Markets

- The U.S.’s seven-day average for new COVID-19 cases has dropped 58% since mid-September to roughly 69,000. The U.S. reported 99,693 new COVID-19 infections and 2,492 virus fatalities Wednesday.

- Alaska’s COVID-19 case rate remains the highest in the country and nearly five times the national average.

- Florida reported just 1,887 new COVID-19 cases and zero virus fatalities Tuesday, as hospitalizations continue to edge downwards.

- North Carolina’s COVID-19 hospitalizations have dropped 38% over the last two weeks.

- A federal judge upheld the White House’s COVID-19 vaccine mandate for large companies by Dec. 8, rejecting a legal challenge by employees of Southwest Airlines.

- A number of states have begun ordering hundreds of thousands of COVID-19 vaccines doses for children ahead of expected approval by the CDC that could come as early as tomorrow.

- Following Pfizer, Moderna says its COVID-19 vaccine could be approved for children as young as five within the next several weeks.

- Americans with compromised immune systems will be eligible to receive a fourth dose of Pfizer or Moderna COVID-19 vaccines six months after their third shot, the CDC ruled.

- Breakthrough COVID-19 infections in fully vaccinated people pose a higher risk of causing “long COVID,” new research shows, while a separate study shows that virus victims suffering from extended symptoms could see alleviation with a single vaccine dose.

- First-time jobless claims reached a pandemic low of 281,000.

- iPhone owners will soon be able to add a verifiable COVID-19 vaccination certificate as well as test results to their Wallet app.

- One benefit of the pandemic has been a 40% increase in internet speeds nationally, as many states invested in wireless infrastructure to support remote work and schooling.

- The number of people seeking liver transplants in the U.S. rose 50% more than predicted during the pandemic, highlighting a link between new liver disease cases and higher retail alcohol sales.

- Strong demand and tight capacity helped U.S. capital goods orders rise 0.8% in September, the seventh consecutive month of increases. Orders for durable goods such as appliances, computers and cars decreased 0.4%, the first decline since spring as manufacturers faced higher materials costs along with parts and labor shortages.

- Despite supply chain disruptions, the National Retail Federation expects holiday sales to rise as much as 8.5% to 10.5%, a record increase.

- Ford stock soared 11% Wednesday after the carmaker announced it would raise full-year profit forecasts and restore its dividend after shattering earnings expectations in the third quarter.

- GM saw third-quarter profits drop 40% compared to a year earlier, largely a result of the ongoing global chip shortage hampering output. The company is restoring overtime at six North American plants in November as computer chip supplies improve.

- Volkswagen’s operating profit fell 12% in the recent quarter as the computer chip shortage cost it 600,000 vehicle sales.

- Kraft Heinz saw sales rise 1.3% in the third quarter from last year, as the company announced plans to maintain higher prices on products through at least the first half of 2022.

- U.S. air carriers are bracing for a surge in travel with the nation set to reopen its borders to fully vaccinated international travelers on Nov. 8.

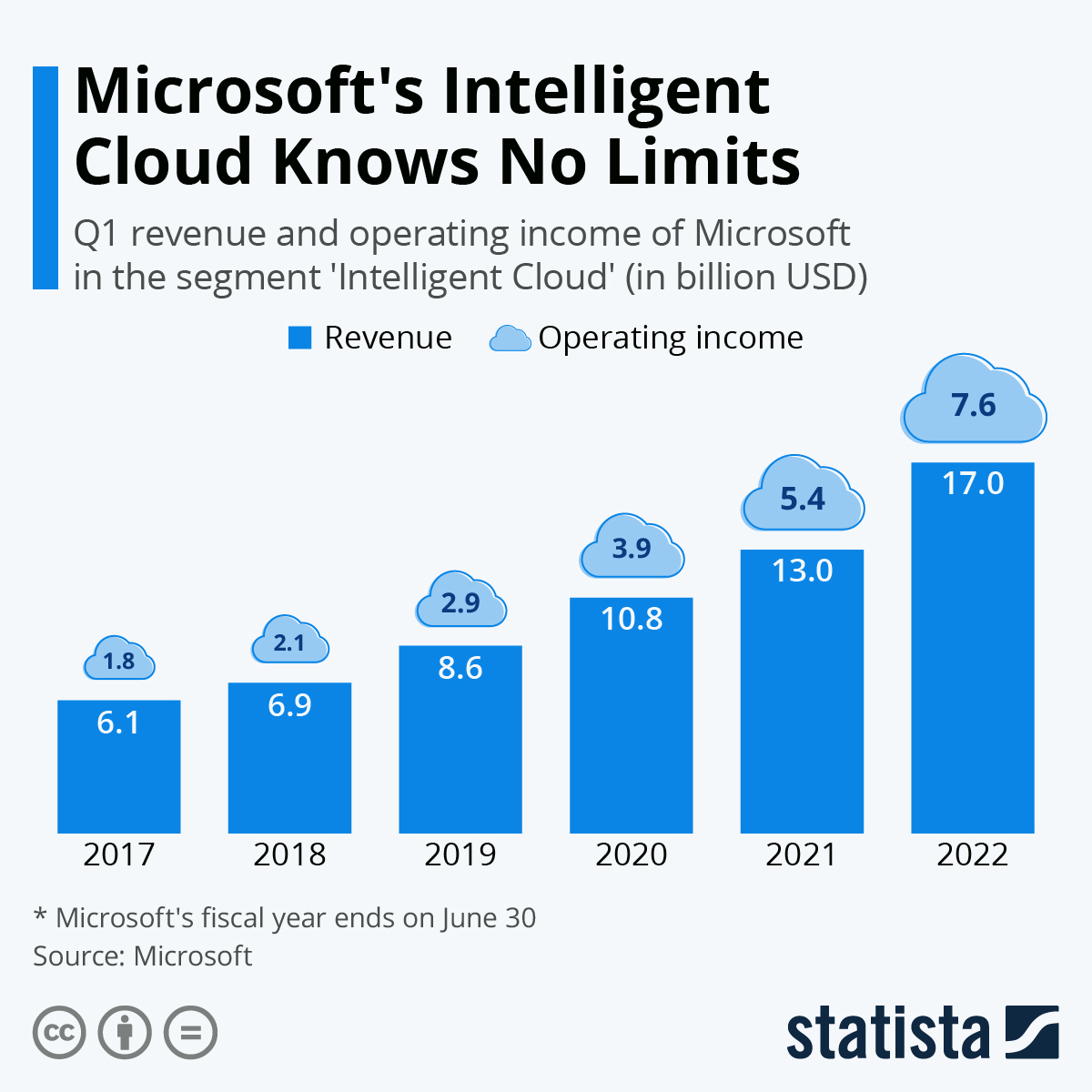

- Microsoft’s cloud computing unit brought in $16.96 billion in third-quarter revenue, up 31% year over year.

- Prime New York City neighborhood real estate is shooting up in value, with resale prices in Greenwich Village and Chelsea rising 40% and 24%, respectively, year over year in the third quarter.

- U.S. battery recycler Redwood Materials is partnering with Korean battery maker L&F to supply for up to 1 million electric vehicles per year by 2025 and more than 5 million by 2030.

International Markets

- Europe is the globe’s only region seeing a surge in COVID-19 infections and deaths, with total cases on the continent rising 18% week over week. New cases are rising sharply in Bulgaria, Poland and the Czech Republic.

- The U.K. recorded 43,941 new COVID-19 infections and 207 virus deaths Wednesday.

- Germany’s new government plans to let federal pandemic restrictions expire on schedule in late November.

- Sweden and Switzerland became the latest nations to approve COVID-19 booster shots for their populations.

- Singapore reported 5,324 new COVID-19 infections Wednesday, a record, as officials warn the city-state’s hospitals could soon run out of capacity.

- South Korea is warning its residents that it will strictly enforce pandemic restrictions during Halloween amid fears that gatherings could lead to new outbreaks threatening the nation’s plans to reopen next month.

- Eighteen months after the nation first closed its borders, Australia will finally begin allowing fully vaccinated citizens to board outgoing flights on Nov. 1.

- A Brazilian senate panel formally voted to recommend criminal charges against the nation’s president for mishandling the pandemic.

- U.S. drugmaker Novavax has filed for authorization of its COVID-19 vaccine in the U.K.

- Canada’s British Columbia province will begin offering booster doses of Pfizer and Moderna COVID-19 vaccines to the broad public starting in January, the first North American jurisdiction to make the third doses widely available.

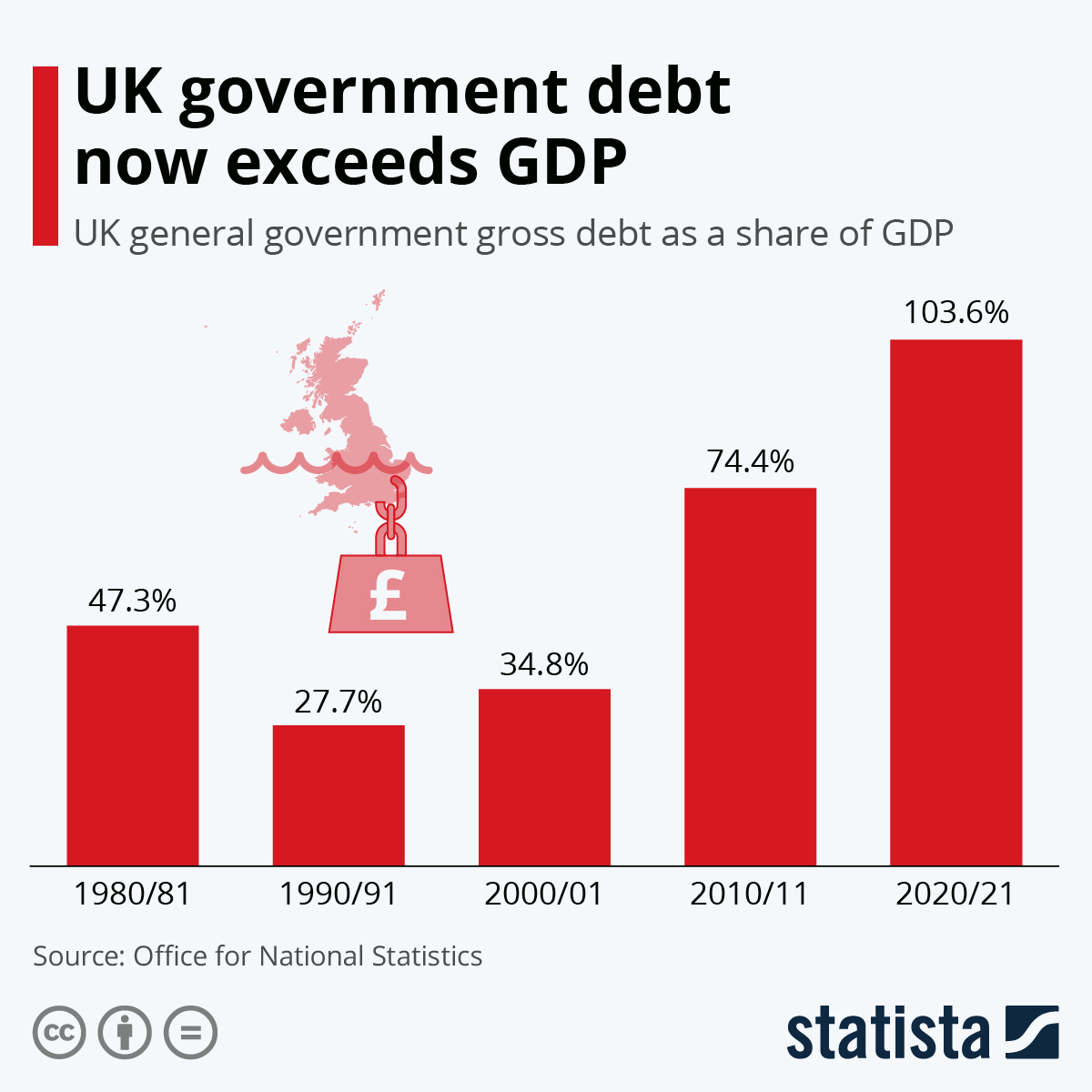

- The U.K. has dialed back emergency pandemic spending faster than any other Western economy, while the size of that spending has caused the British government’s debt to exceed national GDP for the first time since World War II.

- The International Labor Organization estimates the number of global hours worked in 2021 will be 4.3% lower than pre-pandemic levels, the rough equivalent of 125 million full-time jobs.

- French lender BNP Paribas has set up a team of bankers and industrial experts to help clients transition to sustainable and low-carbon investments, a move expected to trend amid increased investor focus on the environment.

- Turkey will receive a combined $3.2 billion in loans from the World Bank, France and Germany to help the nation meet clean energy goals outlined in the Paris climate accord.

- International climate groups are calling for massive scale-ups in clean energy measures ahead of the COP26 summit starting Sunday, with experts warning the meeting could be the last chance to develop joint efforts to combat climate change. Ahead of the meeting, China announced it does not expect peak carbon emissions to arrive before 2030.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.