COVID-19 Bulletin: September 27

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil futures climbed for a fourth straight session Friday, with Brent crude closing at its highest price since October 2018.

- Energy futures were higher in morning trading today with the WTI up 2.0% to $75.45/bbl and Brent up 1.9% to $79.56/bbl. Natural gas was up 8.3% to $5.57/MMBtu.

- Roughly 16% of U.S. Gulf Coast production remained offline over the weekend, more than a month after Hurricane Ida made landfall.

- The Baker Hughes count of active drilling rigs rose by nine to 521 last week, as September marks the 14th consecutive month of increase and a 100% rise from a year ago.

- European coal prices are at a 13-year high as more of the fuel is added to the bloc’s electricity generation amid record-high gas prices. A 50-fold increase in power rates will have a lasting impact on the bottom lines of eurozone mining and metals companies, industry officials warn.

- Nearly half of China’s 23 provinces are under regulatory pressure to curb their power use as demand for electricity surges alongside coal and gas prices.

- Plastic shortages and rising prices are being cited by more companies as a cause of supply chain disruption and inflation.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Currently in the mid-Atlantic, Category 4 Hurricane Sam is expected to weaken as it tracks north-northwest over the next five days, bringing large surf and rip currents from Florida to Maine as early as Wednesday.

- Roughly 90% of the U.S. West has been in drought since June, with conditions expected to intensify as La Niña climate shifts develop over the winter season.

- Disruptions in manufacturing, shipping, port operations and labor markets are combining to once again empty supermarket and retail shelves, a reminder of the panic-buying phase of the early pandemic.

- The surge in online retail is causing a global shortage of paper products, from toilet paper to cardboard to school and office supplies.

- Logistics providers are raising pay, adding flexibility, boosting recruitment tactics and using more robots in a hyperactive effort to prepare for surging e-commerce volumes this holiday season.

- More than 60 ships are waiting to dock outside the Ports of Los Angeles and Long Beach, with queue times stretching to as many as three weeks. The congestion is exacerbated by the ports’ limited operating hours, a contrast to many Asian and European gateways that stay open 24/7.

- Export container volume from major Chinese ports rose 5.7% in September from the same time last year.

- Roughly 5.5% of dry bulk vessels worldwide are locked in congestion off China ports, adding inflationary pressures to commodities shipping.

- U.S. cropland values hit a record this year alongside soaring prices for new and used farm equipment, as rising agricultural commodity prices prompt a revival in the U.S. Farm Belt.

- Lawmakers in the U.S. House are set to vote on a groundbreaking $550 billion infrastructure bill Thursday.

- New data suggests FedEx is lagging significantly behind rival parcel carriers in on-time delivery.

- Trailer availability is set to be the transport industry’s primary issue over the next several quarters, surpassing even the disruption caused by production losses in the Class 8 heavy truck market, chief executives from Yellow and Werner Enterprises say.

- Air cargo handlers in the U.S. and Europe are beginning to see critical staffing shortages as demand picks up significantly — in some cases up to 20% — from the same time last year.

- A construction backlog in the U.S. warehouse building industry could take up to two years to clear even as demand surges for industrial space.

- Iron ore prices have fallen more than 50% since mid-July to their lowest levels in more than a year amid worries that a crisis in Chinese housing market debt will cause lower demand for steel.

- Prices for palladium and platinum, two key ingredients for gas engine components, are slipping toward their worst month in a decade as the global chip shortage constrains auto production with ripple effects into other markets.

- Thai officials announced plans to launch a national shipping company next year, an effort to step into a larger global logistics role in response to shortfalls revealed by the pandemic.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

- Here are updates from our logistics team:

- Port congestion continues to be very problematic, delaying the delivery of imported containers.

- Dry van (full, partial and less than truck load) capacity is very limited as demand is greatly exceeding supply.

- Bulk trucking capacity is very tight as demand is greatly exceeding supply.

- Packaging and pulverizing/grinding production challenges persist as demand is exceeding supply.

Domestic Markets

- There were 30,952 new COVID-19 infections and 286 deaths reported in the U.S. yesterday.

- The seven-day average of U.S. COVID-19 hospital fatalities is down 8.9% from a peak on Sept. 16.

- The CDC is warning of “dire straits” for healthcare systems in some under-vaccinated regions of the U.S., as overwhelming numbers of COVID-19 patients force hospitals to ration care.

- Some U.S. primary care doctors are refusing to see patients who are not vaccinated against COVID-19.

- New York is prepping to deploy National Guard members to fill expected hospital staffing shortfalls after the state’s COVID-19 vaccination mandate for healthcare workers takes effect today. The state will not extend unemployment benefits to those fired for failing to get a vaccine.

- Alaska currently has the highest COVID-19 transmission rate of any state in the nation.

- West Virginia, where COVID-19 is raging, has fallen from the fourth most vaccinated state for adults in March to last, and is now the only state with fewer than 50% of adults fully vaccinated.

- Funeral homes in Idaho, where only 40.3% of residents are fully vaccinated, ranking it ahead only of West Virginia (40.3%) and Wyoming (41%), are running out of storage capacity for bodies due to surging COVID-19 fatalities.

- As vaccinations rise in Florida, hospitalizations are falling, with COVID-19 patients occupying 11.8% of inpatient beds yesterday, down from 12.3% Saturday.

- COVID-19 cases among children rose faster in Arizona counties that did not mandate face masks in schools, the CDC says.

- Pfizer’s chief executive suggested annual coronavirus shots could be a requirement for post-pandemic “normal” life.

- Life expectancy for U.S. men fell by 2.2 years in 2020 due to the pandemic, the biggest drop among 29 countries studied. Among the countries studied, 27 experienced a drop in life expectancy, and 22 saw drops of more than six months, the biggest setback since WWII.

- Another mysterious “long haul” symptom: Men who have been infected with COVID-19 appear to be six times more vulnerable than normal to sexual dysfunction.

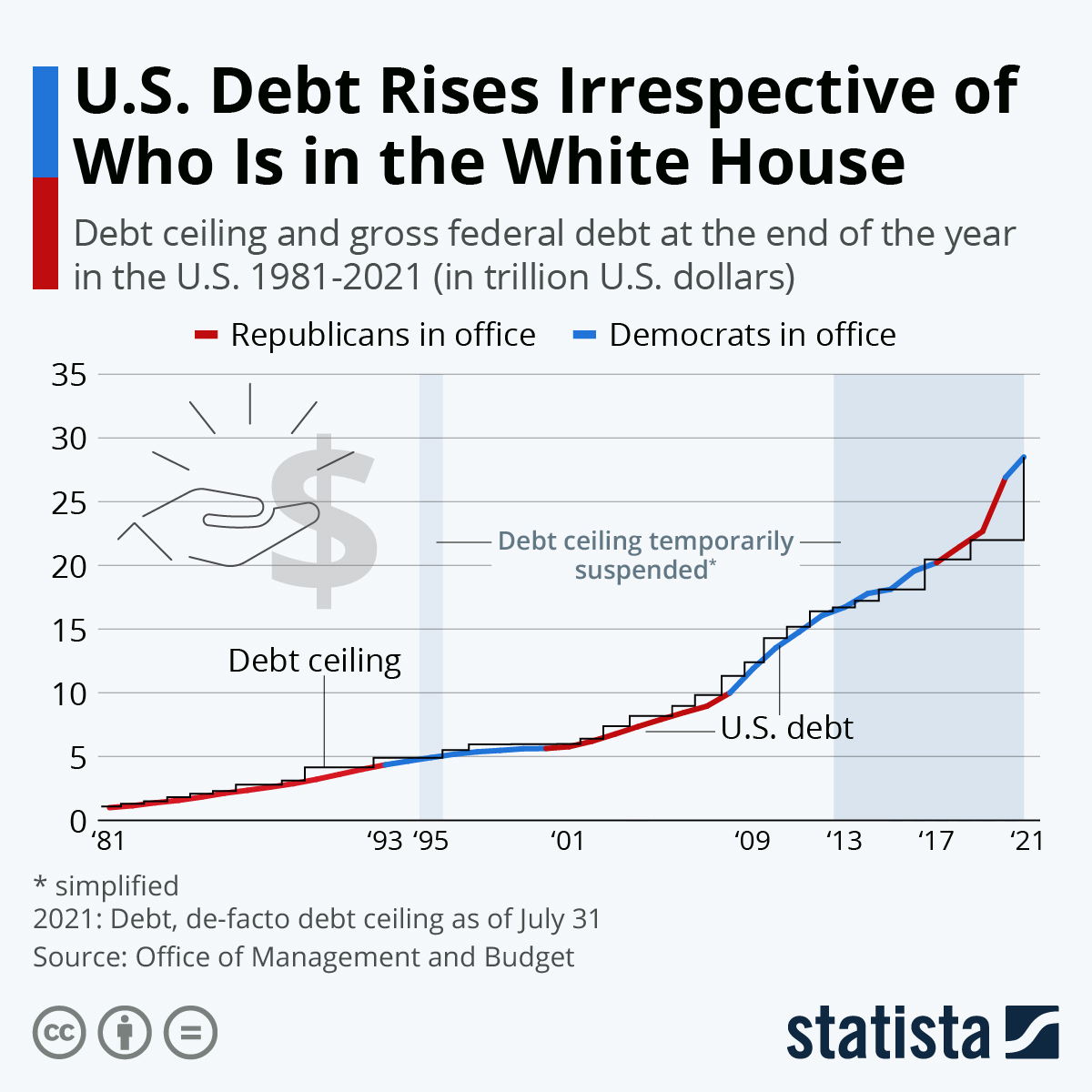

- The U.S. Senate is set to vote this evening on a measure extending the government’s funding through Dec. 3 and suspending the debt limit into December 2022 to avoid a partial shutdown looming this Friday.

- Facing a national labor shortage, many companies are dropping drug screenings and drug testing for employees.

- U.S. employers are resorting to new and unconventional tactics to recruit workers amid a severe labor shortage, including attaching job applications to products sold to consumers.

- The Federal Reserve is maintaining its stance that pandemic-induced price rises in durable products such as cars and electronics are temporary and do not provide an accurate portrait of U.S. inflation, which is more modest than it appears.

- Pandemic uncertainties have made Gen Z, aged 9 to 24, among the more conservative generations, more inclined to invest and less apt to spend on discretionary goods such as makeup, where sales are at an all-time low.

- Dell is opening its computer recycling initiative to devices made by other manufacturers.

- Corporate buyouts by private-equity firms have surged to levels not seen since just before the 2008 financial crisis, as the Federal Reserve’s continued easy-money policies push Wall Street deal making to new highs.

- A new California law will require all light-duty self-driving vehicles to emit zero emissions by 2030, a bid to prevent autonomous vehicles from becoming major polluters in the future.

International Markets

- Global COVID-19 deaths were down 10% and cases were down 12% last week.

- Just 2.2% of people have received a single shot of COVID-19 vaccines in low-income nations across the globe, particularly in Africa, setting the stage for an irreversible vaccination gap between rich and poor nations.

- Official COVID-19 fatalities in Mexico City topped 50,000, a tally thought to be grossly understated. Nationwide, official counts of infections and deaths are 3,632,800 and 275,446, respectively.

- Four members of Brazil’s delegation to a recent U.N. conference have now tested positive for COVID-19, while the president remains in isolation.

- The economy of western Australia, the nation’s most remote state, has grown nearly twice as fast as other states after completely shutting its borders to travel, including from inside Australia.

- In a recent survey, roughly 45% of American multinational companies operating in China said the nation’s travel restrictions and new policies favoring domestic businesses had a negative impact on their operations, with just a quarter reporting profit from their China operations.

- Overall business activity in India expanded for the first time in four months in August, with economists pointing to a ramp-up in the nation’s COVID-19 vaccine distribution to now more than 826 million shots.

- Twenty scientists have been assembled to reopen a stalled World Health Organization inquiry into the origins of COVID-19 in China.

- Norway’s $1.4 trillion sovereign wealth fund, the largest stock owner in the world, will soon insist that all companies it owns have clear targets for cutting carbon emissions.

- CFOs from 60 large international firms last week committed to linking roughly half of their corporate financing to environmental, social or governance targets by 2025.

At M. Holland

- Plastics Reflections Web Series: Supply Chain Constraints & Forecast — Experts from BPI, LyondellBasell and MTS Logistics joined M. Holland to discuss current supply chain challenges impacting the global plastics industry. Click here to read key insights shared during the broadcast and access the recording.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.