COVID-19 Bulletin: April 13

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- The U.S. intervened on Sunday in negotiations among oil-producing nations, which led to an agreement to reduce production by nearly 10 million bbl/d, after meetings last Thursday and Friday of the Russia/Saudi oil-producing coalitions and the G20 nations failed to deliver results.

- The reaction on oil prices was positive but muted because of concerns about the size of the cuts and the outlook for demand. Brent traded below $32/bbl and WTI was at $23/bbl this morning.

- Shale producers are shutting wells in the face of a 20% drop in global oil demand and the saturation of storage capacity.

- Domestic PE supply is running strong; however, there is concern for weak May demand.

- Certain market segments continue to see a decline in PE demand and orders being pushed or canceled.

- Spot offerings are increasing from the North American supply community.

Supply Chain

- Export controls and labor shortages are disrupting global supply chains, increasing prices for medical supplies and food.

- Companies can better prepare for COVID-19-like disruptions through greater digitization, formal risk management procedures and better visibility of their supply chains.

- U.S. regulators are preparing to allow airlines to haul cargo in the passenger cabins of aircraft to give them more flexibility in adapting to the decline in passenger traffic.

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

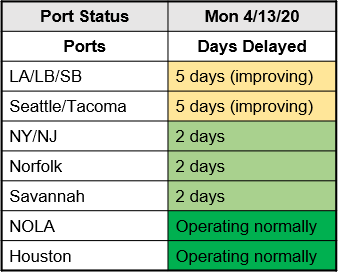

- There’s been no status change with ports:

Markets

- Confusion and administrative stumbles have stalled funding for small businesses approved for loans under the SBA-run Paycheck Protection Program (PPP); 725,000 loans worth $182 billion were approved through Friday with only 2% of the approved loans funded.

- Consumer prices fell 0.4% in March, the biggest drop in five years, led by big declines in energy and transportation/travel costs.

- Home sales fell 27% last week as inventories rose in what is normally the start of the busiest selling season of the year.

- First-quarter automotive sales in China fell 42%, the industry’s seventh consecutive quarterly sales decline, as dealership traffic sputtered following the relaxation of COVID-19 restrictions.

- Automakers are delaying new product launches as they confront plant shutdowns and capital constraints.

- Concerns are growing that a collapse in used-car markets and prices could further disrupt new car markets.

- Medical supply shortages are prompting efforts to sanitize and reuse, furthering progress toward sustainability and a circular economy.

- Public companies are drawing down credit lines to preserve cash, while many face downgrades of their credit ratings, making it harder to raise cash in public credit and equity markets.

- Johns Hopkins tracks the global spread of COVID-19.

International

- Mexico’s President is resisting calls for a relief package for businesses; the head of Mexico’s stock exchange died on Sunday, a month after it was announced he tested positive for COVID-19.

- Puerto Rico extended its lockdown until May 3. Our M. Holland Export Services team, well-practiced in remote work after Hurricane Maria, has functioned through the shutdown without interruption.

Our Operations

- Our 3D Printing team and Mployee volunteers are manufacturing face masks in a temporary sanitized room in our Northbrook, Illinois, headquarters, which has been mostly empty for the past four weeks. The face masks are being donated to local medical facilities.

- Our Automotive team is strategizing on how to ensure supply to a changed automotive landscape when the industry emerges from its shutdown, which is expected to begin in May.

- M. Holland is open for business, deemed essential and will continue to operate at full capacity. We have issued the following status statement:

In accordance with the guidance provided by the U.S. Department of Homeland Security Cybersecurity & Infrastructure Security Agency (CISA), M. Holland Company is considered a member of a critical infrastructure industry and will therefore remain operative. As such, with any necessary accommodations made to ensure the health and safety of our staff and business partners, we will continue to fully perform our normal business operations.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.