COVID-19 Bulletin: April 15

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- The International Energy Agency (IEA) projects that global oil demand will fall by 29 million bbl/day in April, equating to 29% of last year’s annual demand of about 100 million bbl/day. The projection sent the WTI price below $20/bbl and Brent below $29 in early trading today. Prices were already falling yesterday, with WTI down 10% and Brent down 6.7%.

- The Railroad Commission of Texas, which regulates the state’s oil industry, is considering output cuts, while the state’s oil producers are divided about government intervention. Antitrust laws prohibit the federal government or individual companies from coordinating production levels.

- China, India, South Korea and the U.S. are offering storage capacity in their strategic oil reserves, but the measures may fall short of alleviating the industry’s storage capacity challenge, according to the IEA.

Supply Chain

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

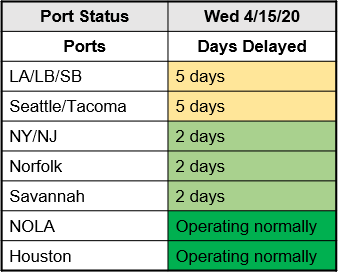

- There’s been no status change with ports:

Markets

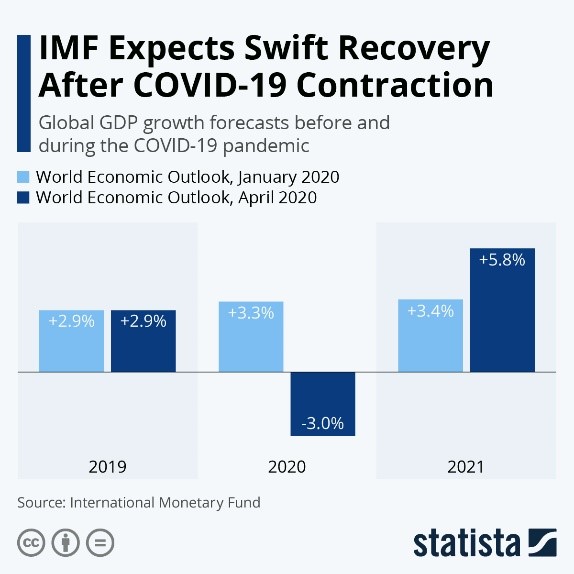

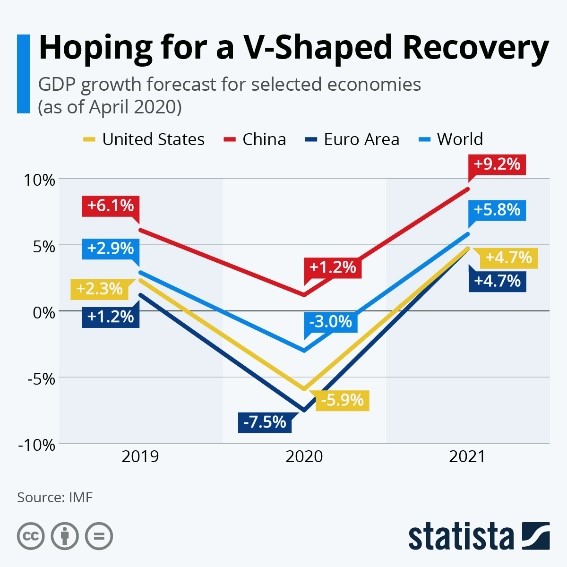

- The International Monetary Fund currently expects a deep recession followed by a fast recovery:

- Governors across the country are planning a slow rollback of lockdowns as progress continues in mitigating the medical emergency.

- Retail sales fell nearly 9% in March.

- Walmart reports a shift in consumer buying from essentials and staples to grooming and baking products.

- After COVID-19 hit service worker jobs hard, a second wave of layoffs among salaried workers is underway; a survey of economists sees unemployment peaking in June at 15%.

- In March, Boeing suffered the largest monthly order cancellations in its history.

- The Association of General Contractors, in its weekly survey, reports that construction job cancellations are accelerating and nearly half of firms lack adequate personal protective equipment.

- JP Morgan and Wells Fargo set aside big reserves for expected loan losses in announcing their first-quarter results, anticipating the economic damage of the COVID-19 recession will be severe.

- GM is preparing to ship its first delivery of ventilators just a month after announcing it would shift production to make them.

- The Ocean Plastics Leadership Network, a coalition of environmentalists, corporations and non-governmental organization, remains committed to solving ocean-waste issues, despite the current respite in activity due to COVID-19.

International

- China’s March exports fell 6.6%, less than expected by economists, buoyed by delayed shipments from January and February. Exports are expected to fall 20% in the second quarter due to weak international demand.

- China is responding to a renewed COVID-19 outbreak along its border with Russia.

- PE prices and demand in China are continuing their upward trend this week after rebounding from 10-year lows last week. China’s Purchasing Managers Index jumped more than 50% in March as the country reopened its economy.

Our Operations

- M. Holland is open for business, deemed essential and will continue to operate at full capacity. We have issued the following status statement:

In accordance with the guidance provided by the U.S. Department of Homeland Security Cybersecurity & Infrastructure Security Agency (CISA), M. Holland Company is considered a member of a critical infrastructure industry and will therefore remain operative. As such, with any necessary accommodations made to ensure the health and safety of our staff and business partners, we will continue to fully perform our normal business operations.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.