COVID-19 Bulletin: April 16

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- U.S. oil inventories surged, prompting hopes among traders that domestic producers will be forced to close wells due to a lack of storage capacity. Prices in early Thursday trading were stable after the WTI closed Wednesday at $19.94/bbl and Brent closed at $27.50/bbl.

Supply Chain

- The shipping industry has canceled 384 sailings and is bracing for a 10% drop in business in 2020.

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

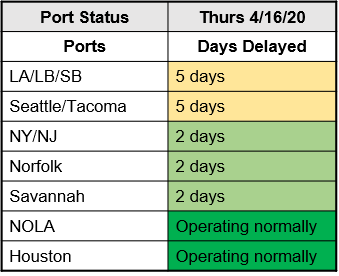

- There has been no status change with ports:

Markets

- U.S. industrial activity fell more than 5% in March, worse than expected and the biggest drop since 1946.

- Consumer sales are slowing after the initial surge in panic buying when stay-at-home restrictions were announced:

- Foot traffic was down 30% at Target and 20% at Walmart over the past two weeks.

- After an initial surge in sales early in the pandemic, Best Buy will furlough 40% of its workforce after sales plunged 30% in the past month.

- J.C. Penney skipped an interest payment to bondholders, foreshadowing a possible bankruptcy.

- Offices will likely reopen ahead of retail stores, potentially with temperature scanning as part of the new normal.

- The Paycheck Protection Program (PPP) is nearly exhausted after issuing 1.5 million SBA-guaranteed loan approvals worth more than $320 billion. Congress and the White House are negotiating over additional funding.

- There is a growing consensus among businesses that broad-based testing will be needed to facilitate an economic recovery.

- In a Gallup poll, 71% of respondents expressed concern about resuming normal activities if restrictions are lifted without wide-scale testing.

- With new effective procedures in place to respond to the COVID-19 crisis, our Rapid Response Team has moved from meeting daily to three times a week. Here’s what we’re seeing in markets:

- Automotive — With most of the North American industry shut down, volume currently is meager. We anticipate a restart of plants at the end of April into early May and a slow and uneven ramp-up of production. We are expecting May output to be 40% of normal rates due to weak consumer demand. Given the complexity of the supply chain, we are carefully planning our stocking strategy to facilitate a smooth resumption of production.

- Color & Compounding — Conditions are mixed, with demand for healthcare, consumer-goods and safety supplies steady, and compounders serving automotive, construction and harder-hit markets slowing. We expect a general slowing trend through at least June.

- Electrical & Electronics — Demand for electronic and computer devices, much of which is imported, has outstripped supply due to supply chain disruptions in Asia. The power and industrial sectors have slowed. We expect this demand dichotomy to continue for the foreseeable future due to the growing importance of digital technology contrasted with economic stresses in both the public and private sectors relative to construction and infrastructure investment.

- Flexible Packaging — Demand has eased to more normal levels for packaging applications as store shelves are restocked and consumers remain sequestered. Demand for agricultural and industrial applications is slowing. We expect consumer packaging demand to steady and demand for other sectors to trough in the second quarter before a slow rebound.

- Healthcare — Demand remains strong for non-woven gowns, testing devices, safety supplies, ventilators and other products critical to the COVID-19 fight. We expect strong demand for these applications for the foreseeable future, with a longer-term expansion and upgrading of healthcare facilities generally.

- Rotational Molding — With many rotational molding applications directed to construction, industrial, and sports and leisure applications, overall demand is down. We expect conditions to remain challenging for the remainder of 2020.

- Wire & Cable — Demand is strong for electronic, computer and telecommunications applications and weakest in the automotive and oil and gas markets. We see a slowing trend in construction markets as work is postponed on non-essential projects.

- 3D Printing — Demand is strong as this nascent manufacturing technology is gaining much attention for its design flexibility, speed and proximity advantage. We expect the COVID-19 crisis to broaden industrial interest and acceptance of 3D printing.

International

- In international markets, we see moderating demand in LATAM and accelerating quoting to Asia and Europe as they reopen their economies ahead of North America.

- Mexico expects the growth in COVID-19 infections to peak between May 8-10; the federal government is extending sequestration recommendations until May 30.

- Germany will begin reopening its economy next week.

- Japan will extend its state of emergency from a few urban centers to the entire country as COVID-19 infections climb.

Our Operations

- Today, our 3D Printing team opened an online portal where clients can receive training, order parts and seek technical assistance for their additive manufacturing needs. The site can be accessed here.

- M. Holland is open for business, deemed essential and will continue to operate at full capacity. We have issued the following status statement:

In accordance with the guidance provided by the U.S. Department of Homeland Security Cybersecurity & Infrastructure Security Agency (CISA), M. Holland Company is considered a member of a critical infrastructure industry and will therefore remain operative. As such, with any necessary accommodations made to ensure the health and safety of our staff and business partners, we will continue to fully perform our normal business operations.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.