COVID-19 Bulletin: April 17

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Second-quarter demand for OPEC oil will be down 14% from the year-ago period, a three-decade low. Oil prices closed yesterday essentially flat, with WTI crude at $19.87/bbl and Brent at $27.82/bbl.

- Brazil, which was enjoying a renewal of its energy industry, will see 62 Petrobras offshore platforms shut down to meet agreed upon production cuts as part of the OPEC+ production agreement reached last weekend.

- Russia’s export duties on oil could fall by 87% in May compared with April due to low prices and a planned 2.5 million bbl/d cut in production, a blow to the country, which derives 40% of revenues from oil.

- Nova Chemicals is resuming construction of its Sarnia, Ontario, expansion. Work at the site was suspended in late March to protect workers.

- A group of Braskem employees in Pennsylvania are voluntarily living in their plant to make PP, which is critical to the manufacture of medical gowns and protective equipment.

Supply Chain

- China, which makes an estimated 40% of the world’s medical gowns and personal protective equipment, has imposed new export restrictions on medical exports that is stranding goods needed elsewhere to fight COVID-19. The restrictions were imposed after concerns surfaced about the quality of safety supplies from the country.

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

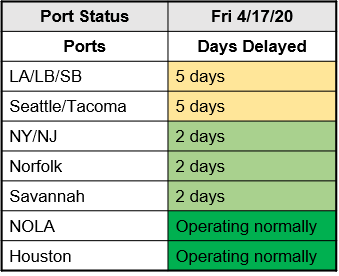

- There has been no status change with ports:

Markets

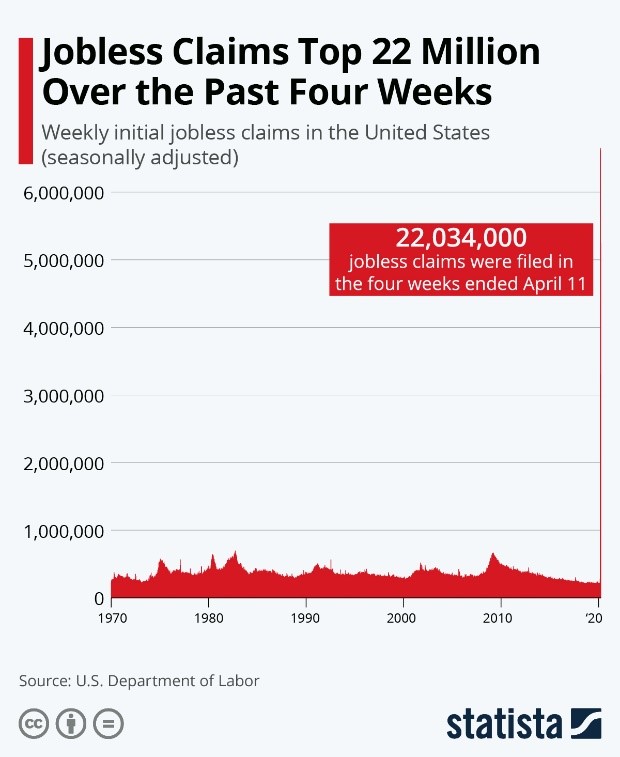

- One-in-seven workers are now unemployed after 5.2 million people filed first-time unemployment claims last week, bringing the four-week total to 22 million. The unemployment rate is expected to swell further and impact more industries beyond those most affected by mandated lockdowns.

- Unemployment could reach 20% in April; it peaked during the Great Depression above 24%.

- In guidelines announced yesterday, the White House will let the states determine the plan and pace for reopening the economy.

- Seven Midwestern states — Illinois, Indiana, Kentucky, Michigan, Minnesota, Ohio and Wisconsin — agreed to coordinate their reopening plans, joining state coalitions on the East and West coasts in taking a regional approach.

- The Paycheck Protection Program (PPP) exhausted its $350 billion in funding yesterday. Lawmakers remain divided on approving additional funding.

- Neiman Marcus failed to make a payment to bondholders, adding to the list of iconic bricks-and-mortar retailers facing potential bankruptcy.

- Fiat Chrysler Automobile plans a progressive restart, beginning with its Mexico van plant on April 20 followed by Canadian and U.S. facilities starting May 4. The company will delay product launches of the Jeep Grand Wagoneer and next-generation Grand Cherokee for three months.

- A glut of used cars in wholesale markets threatens to upend rental car companies and slow a recovery of new car sales.

- Companies shifting production to medical supplies and devices face compliance and liability risks.

International

- Great Britain extended its lockdown for three more weeks.

- China’s economy shrank 6.8% in the first quarter, its first quarterly drop on record and a foreshadowing of the economic pain ahead for other nations.

- Resin demand in China, the first country to end the COVID-19 lockdown, has been healthy for the past two weeks.

Our Operations

- This week, our 3D Printing team opened an online portal where clients can receive training, order parts and seek technical assistance for their additive manufacturing needs. The site can be accessed here.

- M. Holland is open for business, deemed essential and will continue to operate at full capacity. We have issued the following status statement:

In accordance with the guidance provided by the U.S. Department of Homeland Security Cybersecurity & Infrastructure Security Agency (CISA), M. Holland Company is considered a member of a critical infrastructure industry and will therefore remain operative. As such, with any necessary accommodations made to ensure the health and safety of our staff and business partners, we will continue to fully perform our normal business operations.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.