COVID-19 Bulletin: April 3

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- After jumping more than 20% yesterday, a single-day record, oil prices rose further this morning on news that Russia, Saudi Arabia and other oil-producing nations will meet Monday. Brent crude closed at $29.94 Thursday and WTI closed at $25.32.

- There could be hurdles to a quick deal to resolve the Russia/Saudi price war.

- While our supply chains remain steady, some suppliers are informally cautioning that disruptions could occur if the spreading COVID-19 directly affects their operations. We are examining our supply by geography to develop contingency plans.

- PE and PP continue to show strong demand in “essential” market segments.

- PE is seeing some tightness in certain grades as the supply community is rationalizing assets to support “essential” segments.

- Despite strong demand, we are seeing downward pricing pressure based on global dynamics.

Supply Chain

- Stalling global trade has created turmoil for ocean shipping companies, putting some in jeopardy:

- The average shipping rate for bulk carriers is below the breakeven level.

- Vehicle carriers are idling vessels and furloughing workers.

- Container shippers are struggling to adapt to reduced trade and disruption of traditional routes.

- Only oil tankers are experiencing stable demand.

- We are in touch with our Gold Standard logistics and transportation partners daily. They report no service disruptions.

- Experts predict that the upcoming hurricane season, which begins June 1, will be abnormally active with above-average probability that at least one major storm will hit the U.S. mainland.

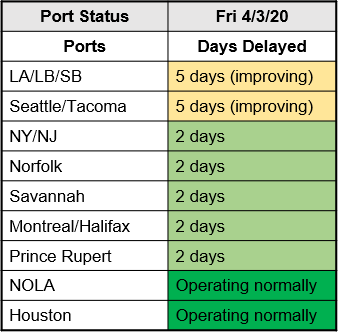

- Ports continue to operate steadily:

Markets

- GE, Medtronic and other companies enlisted to make scarce ventilators welcomed the White Houses’ invocation of the Defense Production Act to open supply channels.

- GE’s Aviation Division furloughed half of its U.S. manufacturing workforce, 10 days after implementing a 10% force reduction.

- Tesla reported that deliveries in the first quarter rose 4%, beating estimates and defying the broader market, where auto sales declined. Tesla’s California production facility remains idle.

- GM and Honda will team up to develop two new electric vehicle models to be manufactured in North America.

- John Hopkins tracks the global spread of COVID-19.

International

- Some clients in Mexico and LATAM are extending normal Easter holiday shutdowns.

- The strong U.S. dollar is causing working capital strains for companies in many international markets.

- Credit Fitch is warning about rising refinancing risk among LATAM corporations.

- The global economic response to COVID-19 may make it difficult for LATAM countries to leverage weak currencies to export their way out of recession, the pattern of past downturns.

- German factories continue to operate at 80% of capacity, providing a blueprint of how to maintain production while fighting the spreading virus.

Our Operations

- NOTICE TO CLIENTS: M. Holland Company will be closed on Good Friday, April 10.

- M. Holland is open for business, deemed essential and will continue to operate at full capacity. We have issued the following status statement:

In accordance with the guidance provided by the U.S. Department of Homeland Security Cybersecurity & Infrastructure Security Agency (CISA), M. Holland Company is considered a member of a critical infrastructure industry and will therefore remain operative. As such, with any necessary accommodations made to ensure the health and safety of our staff and business partners, we will continue to fully perform our normal business operations.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.