COVID-19 Bulletin: April 9

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Initial unofficial reports indicated that today’s Russia/Saudi Arabia meeting could result in agreement to reduce oil production by up to 20 million bbl/d, but oil prices plunged when the parties failed to make an announcement.

- Oil prices rose in early trading today on hopes that Russia, Saudi Arabia and their respective oil-producing coalitions will agree to reduce output. Brent crude rose above $34/bbl and WTI approached $27/bbl. Goldman Sachs says a production cut of more than 10 million bbl/d will be necessary to stabilize markets.

- As the White House threatens to use tariffs to counter the Russia/Saudi Arabia price war, U.S. producers are split in their support of governmental intervention to protect the domestic industry.

- A wide $10 divergence between oil prices and oil futures suggests that investors are betting the global industry will reach agreement to reduce production.

- BP’s pending sale of its Alaska business, part of a broader divestiture and deleveraging plan, is in jeopardy as banks balk at financing the deal in the face of low oil prices.

Supply Chain

- The Port of New Orleans (NOLA) and the Port of Houston have instituted temperature checks on all visitors to their facilities.

- Carriers have also instituted temperature checks on employees reporting to work, in addition to social distancing restrictions and no-touch transactions.

- Despite a surge in demand for digital devices, global supply-chain constraints are creating delivery delays and shortages.

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

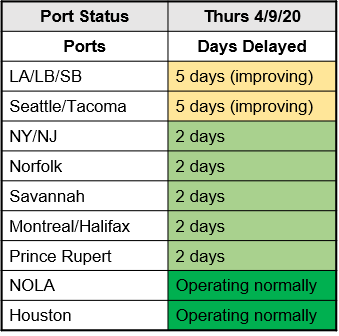

- There’s been no status change with ports:

Markets

- Another 6.6 million Americans filed for unemployment last week bringing the six-week total to more than 16 million.

- The Federal Reserve will pump another $2.3 trillion into the economy, buying local government debt and higher-risk company debt outside of the recent SBA programs. Stock markets initially rose on the news.

- Political rancor is delaying further funding for the SBA’s Paycheck Protection Program (PPP), with Democrats seeking relief for hospitals and state and local governments in addition to small businesses.

- Economists surveyed by the Wall Street Journal expect the economy to bottom this quarter, with unemployment peaking at 13% and a year-over-year GDP contraction of 25%; they expect a recovery beginning in the third quarter.

- Daimler AG said sales for Mercedes Benz fell 15% in the first quarter, with drops of 20% in China, 16% in Europe and 5% in the U.S.

- McDonald’s announced a 22% drop in global same-store sales in March, impacting a swath of the restaurant supply chain.

- With two-thirds of the global airline fleet grounded, Boeing and Airbus are slashing production as they face a surge in cancelled and deferred orders.

- 3D printing businesses are encountering shortages of filaments due to supply disruptions from China.

- Microsoft, which has seen usage of its Teams collaboration platform surge, sees a “new normal” emerging in how people work in the future.

- Johns Hopkins tracks the global spread of COVID-19.

International

- The IMF anticipates that more than 170 nations will experience declines in per capita income in 2020. More than 90 countries have inquired about IMF aid.

- Equador has been hardest hit among LATAM nations, both by COVID-19 and the combined economic impact of the disease and low oil prices.

Our Operations

- NOTICE TO CLIENTS: M. Holland Company will be closed on Good Friday, April 10. Our Mexico operations will be closed today and Friday.

- M. Holland is open for business, deemed essential and will continue to operate at full capacity. We have issued the following status statement:

In accordance with the guidance provided by the U.S. Department of Homeland Security Cybersecurity & Infrastructure Security Agency (CISA), M. Holland Company is considered a member of a critical infrastructure industry and will therefore remain operative. As such, with any necessary accommodations made to ensure the health and safety of our staff and business partners, we will continue to fully perform our normal business operations.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.