COVID-19 Bulletin: January 21

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Natural gas prices fell Wednesday on warmer weather forecasts for the next two weeks.

- Crude prices dipped on concerns about COVID-19 outbreaks in Asia and the West and a rise in stockpiles. In mid-day trading today, the WTI was down 0.3% at $53.16/bbl, and Brent was up 0.1% at $56.11/bbl. Natural gas was down 2.5% at $2.47/MMBtu.

- The pandemic claimed 107 U.S. oil and gas companies that filed for bankruptcy in 2020, fewer than the 142 bankruptcies during the industry collapse in 2016 but involving significantly higher indebtedness.

- The International Energy Agency again cut forecasts for global oil demand in 2021, predicting a 600,000 bpd decrease on the effects of lockdowns and production cuts.

- Many supertanker owners are losing money transporting oil from the Arab Gulf to China, a result of more oil tankers on the market and production cuts in Saudi Arabia, the world’s largest exporter.

- Norway announced 61 offshore exploration licenses to 30 companies in the nation’s latest licensing round.

- The White House revoked a permit needed to complete the Keystone XL oil pipeline from Alberta to Nebraska, effectively canceling the project.

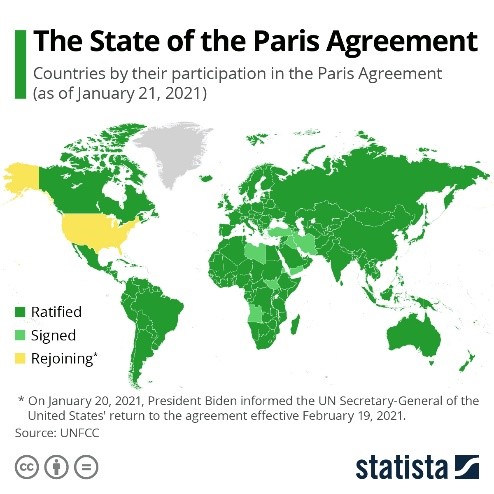

- America will rejoin the Paris climate accord within 30 days after an executive order issued by the White House on Wednesday. Another White House directive provided a temporary moratorium on oil and gas leasing in Alaska’s Arctic National Wildlife Refuge.

- Saudi Aramco may be understating its carbon emissions in official reporting by as much as 50%.

- Renew Oceans, an initiative founded in 2019 and sponsored by some of the world’s leading petrochemicals companies, has ceased operations, failing to achieve its goal of stemming the flow of plastic waste from the Ganges River into the Indian Ocean.

- INEOS Styrolution announced plans to build a demonstration polymerization plant in Belgium to convert plastic waste into ABS.

Supply Chain

- An unseasonal Santa Ana wind event stirred hurricane-strength winds and sparked numerous wildfires in Southern and Central California.

- COVID-19 outbreaks at the nation’s busiest ports are aggravating congestion, prompting officials at the national, state and local levels to urge prioritization of dock workers for vaccines.

- More than 1 in 3 worldwide containers are being “rolled over,” or not loaded onto the vessels they were meant to sail on, due to a variety of factors in congested supply chains.

- Employment in long-distance general freight transport remained relatively flat near the end of 2020, one factor of many causing elevated spot prices.

- Logistics giant Maersk announced plans to purchase its first carbon-neutral ship as soon as 2023.

- Logistics conditions remain strained, with trucking demand exceeding availability, continuing congestion at ports, and backlogs at warehousing and packaging facilities due in part to operating challenges related to the pandemic. Shipping containers are in short supply, with demurrage charges rising. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- There were 4,375 COVID-19 fatalities yesterday, the second highest daily deaths on record, and 182,695 new infections.

- The CDC expects total deaths in the U.S. to top 500,000 by mid-February, a 100,000 increase in less than a month. The death rate is expected to dip thereafter based on recent downward trends in weekly cases and hospitalizations.

- Tens of thousands of New Yorkers had their COVID-19 vaccine appointments rescheduled Wednesday due to federal procurement supply shortages.

- More than 36,000 out-of-staters got COVID-19 vaccine doses in Florida, which allows open scheduling, as supply shortages prompt Americans to travel long distances in search of shots.

- The White House issued an executive order on Wednesday requiring face masks to be worn on federal property, alongside extending the federal eviction moratorium and a pause on federal student loan payments.

- Amazon is offering the assistance of its logistics services to aid the White House in pursuit of its goal of vaccinating 100 million Americans in the next 100 days.

- Stock markets hit record highs yesterday on a flurry of quarterly earnings announcements, some of which highlighted the pandemic’s effects on the economy:

- Shares of Netflix rose nearly 17%, even as earnings fell short of analyst expectations, largely due to pandemic-driven increases in sales and passage of a landmark 200 million subscribers.

- Consumer products giant Procter & Gamble saw an 8% rise in sales fueled by demand in high-end products such as a $300 toothbrush and pricey dish soap.

- UnitedHealthcare missed earnings estimates because of rising costs tied to COVID-19 hospitalizations.

- American transportation and logistics provider J.B. Hunt reported better-than-expected results on a revenue increase of 18% from the year-ago period.

- United Airlines reported a net loss of $1.9 billion, compared to a profit of $641 million in the year-ago period, and projected that revenue in the current quarter would be 65% to 70% below the comparable period in 2019.

- First-time jobless claims last week totaled 900,000, down 25,000 from the prior week.

- Housing starts rose a faster-than-expected 5.8% in December, the fourth consecutive monthly increase and the fastest pace of growth since 2006.

- The Central Bank is welcoming recent signs of inflation emerging broadly across the economy.

- Restaurant chains are reporting a sales bump after the most recent federal stimulus put $600 dollars into the pockets of many Americans.

- Over three-quarters of respondents to a survey of online shoppers said they prefer paper packaging to plastic, with two-thirds indicating they would be more apt to buy products and brands with plastic-free packaging.

International

- The U.K. recorded more than 1,800 one-day COVID-19 fatalities, a record. New credit card purchases in the country are down 35% from pre-pandemic levels, underscoring the economic impact of the coronavirus.

- Sweden, experiencing the highest COVID-19 death rate in the Nordic region, extended face mask mandates and a ban on serving alcohol.

- COVID-19 deaths in Germany have doubled in the past month, surpassing 50,000. Germany’s chancellor announced that all citizens must wear medical-grade masks where masks are mandated instead of cloth coverings.

- Portugal reported 14,647 new COVID-19 cases Wednesday, a record.

- Northern Chinese provinces are ramping up efforts to contain COVID-19 outbreaks by building temporary quarantine facilities, imposing new lockdowns and rolling out citywide testing. Officials also ordered strict travel restrictions for Lunar New Year travel, along with barricades around southern Beijing after six new infections were found there.

- Pfizer/BioNTech’s COVID-19 vaccine is effective against the highly infectious U.K. strain of COVID-19, new research shows, while other research suggests vaccinated people and formerly infected patients could be susceptible to reinfection by the virulent new virus strain from South Africa.

- The benefits of AstraZeneca/Oxford’s COVID-19 vaccine — no dilution requirements or post-shot patient monitoring for severe allergic reactions — has allowed the U.K. to vaccinate more than half of its nursing home population.

- Argentina approved Russia’s Sputnik V COVID-19 vaccine, recommending its use on people over age 60.

- Investments in rubber glove production in Thailand will exceed $800 million over the next several years thanks to demand triggered by the pandemic.

- Canada’s annual inflation rate slowed in December from the previous month to 0.7%, a result of increased lockdowns and lower costs of airplane tickets, clothing and footwear. The Central Bank, expecting a robust recovery when lockdowns end, said it will maintain low rates until at least 2023.

- China, the only nation that experienced GDP growth in 2020, saw growth in domestic consumption lag increases in the industrial and export sectors, suggesting its economic recovery was highly unbalanced.

- International tennis players, some from global COVID-19 hotspots, flew in droves to Australia last week ahead of the Australian Open, a stark contrast to the thousands of Australian nationals who are stuck overseas due to the nation’s restrictive measures for inbound passengers.

Our Operations

- Our Market Managers report that tight supplies of many products continue to affect most plastics markets:

- Automotive: Automakers are being challenged to satisfy rising demand by tight resin supplies, rising materials costs and a global shortage of computer chips, which is causing spot production disruptions. Electric vehicle interest and investment is robust from both legacy automotive producers and startups.

- Color & Compounding: Activity continues to improve, but overcapacity persists depending on markets served. Consolidation trends also continue, particularly in the masterbatch industry. Demand is growing for sustainable products.

- Electrical & Electronics: Demand for home electronics and computers remains strong, with shortages of computer chips impacting value chains. We continue to see some reshoring of production from Asia as manufacturers seek greater supply chain security.

- Healthcare: The resurgence of COVID-19 infections and hospitalizations are driving a corresponding spike in demand for hospital disposables, testing supplies and personal protective equipment, with some reshoring of production from Asia for such products.

- International: Supply chains and ports are congested, with an imbalance in containers creating havoc and driving up costs, particularly from Asia to destinations in the West. China will celebrate the Lunar New Year in February, which should briefly slow manufacturing and exports.

- Packaging: Demand for packaging and single-use applications remains steady. The recent spike in COVID-19 infections has stimulated demand for staples and food products. We are seeing increasing inquiries about sustainability solutions.

- Sustainable Products: We have expanded our Sustainability team and line card in response to growing demand for sustainable products and solutions from most end markets.

- Wire & Cable: We continue to see strong demand from the telecommunications, renewable energy and home construction markets. Demand from the oil and gas and infrastructure segments remains soft.

- 3D Printing: We continue to invest in our 3D Printing business unit, adding staff, relocating to a larger facility and expanding our product line in response to growing industrial interest in the technology.

- Resource Center: M. Holland offers a host of resources to clients, prospects and suppliers. To arrange a videoconference or meeting, contact:

- Automotive: Market Manager Matt Zessin.

- Color & Compounding: Market Manager Scott Arnold.

- Electrical & Electronics: Market Manager Carlos Aponte.

- Flexible Packaging: Senior Technical Development Engineer Todd Stevens.

- Healthcare: Global Healthcare Manager Josh Blackmore.

- International: Director of Business Development Tracy Coifman.

- Rotational Molding: Product Manager Pete Nutley.

- Wire & Cable: Director Todd Waddle.

- 3D Printing: Market Manager Haleyanne Freedman.

- Sustainability: Market Manager Lindy Holland.

- For Regulatory advice, contact Regulatory Specialist Christopher Thelen.

- For Technical questions, contact Paul Lorigan, Manager of the M. Holland Technical Innovation Center.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.