COVID-19 Bulletin: March 23

Good Afternoon,

The COVID-19 crisis continues to impact the plastics industry:

Supply

- The oil price (WTI) closed last week at $22.53, down 11% on Friday and 29% for the week, the biggest weekly drop in as many years.

- Texas regulators began talks with OPEC to seek a truce in the ongoing oil price war, which has driven prices down more than 60% this year. U.S. antitrust laws present a barrier to a formal agreement regarding production levels or pricing.

- Current oil prices are well below Russia’s approximately $40/bbl. average fiscal breakeven point and the roughly $80/bbl. Saudi Arabia needs to maintain its economy.

- Oil producers are challenged by the industry downturn:

- Occidental Petroleum, which made a big bet on the Permian Basin with its recent acquisition of Anadarko, slashed its dividend and is expected to announce board room changes.

- Total S.A. announced an austerity program involving expense and capital spending cuts and suspension of stock buybacks.

- Many debt-laden shale producers face potential bankruptcy.

- Domestic resin suppliers report no production issues; resin production is deemed “essential business” in states with work-at-home restrictions.

- Suppliers are beginning to announce that order changes will not be accepted.

- Some resin producers are delaying previously announced PE price increases for March.

- PP pricing is facing a push-pull dynamic between falling monomer prices and spiking demand for non-wovens, packaging and other markets bolstered by the COVID-19 crisis.

Supply Chain

- Our domestic Gold Standard Distribution Centers and trucking partners are operating without interruption and are deemed “essential” in stay-at-home states. We will update clients of any closures daily.

- U.S. Customs and Border Protection advised importers that payment of duties, taxes and fees may be deferred under certain circumstances due to the COVID-19 outbreak. Requests will be decided on a case-by-case basis.

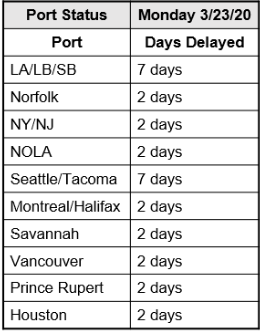

- U.S. Ports are experiencing modest delays:

Markets

- More than a third of the U.S. population is now under state-mandated stay-at-home restrictions.

- As more states impose formal social-distancing restrictions, many plastics manufacturers are unsure of their status as “essential” or “non-essential” businesses. Some clients have declared force majeure as a result of mandated shutdowns.

- All U.S. automakers have announced production pauses. BMW was the last automaker to make an announcement.

- Toy manufacturers such as Hasbro are reporting a surge in sales as more families are locked down in their homes.

- There is a growing consensus among economists that a recession is underway; Goldman Sachs projects U.S. output will decline by 3.1% for the year and unemployment will approach 10%, the high from October 2009, the peak in the Great Recession.

- St. Louis Federal Reserve President James Bullard warns that GDP could fall 50% and unemployment could reach 30% in the coming months, followed by a rebound once the healthcare crisis is tamed.

- In a Willis Towers Watson survey of more than 800 large employers, more than half intend to continue paying hourly workers whose workplaces are closed due to the virus.

- Hospitals are enlisting crowdsourcing and 3D Printing to produce parts for medical safety gear; Smile Direct, HP and others with 3D Printing capacity are diverting production to make ventilator valves, breathing filters and face mask clasps.

- Supply chain disruptions have been reported for importing 3D filament from Asia and Europe. Amazon is “prioritizing” restocking in its warehouses to medical supplies and essential products, creating tight supply for discretionary goods, including 3D filament.

International

- The U.S. and Mexico agreed to close their border to non-essential travel.

- The U.S. dollar continued to strengthen, sending values of other assets lower and weakening some foreign currencies to record lows. The Mexican peso fell below 25:1.

- Europe is encountering growing logistics challenges due to longer border crossings, labor constraints, container shortages and route reductions due to falling freight demand.

- Retailers and factories in China are reopening, two months after COVID-19 shut down the country.

Our Operations

- Our entire team is mobilized and operational remotely.

- Today we launched an internal database to monitor the production status of clients in order to manage inventories in real time while ensuring we have the right materials in the right places at the right time to meet market needs.

- We are requiring firm ship dates on all new orders.

- After Illinois announced stay-at-home restrictions, our 3D Printing distribution business and laboratory initiated contingency plans and remain operational.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.