COVID-19 Bulletin: October 20

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices fell for the fourth day in a row Monday as hopes for further U.S. economic stimulus faded and COVID-19 cases surge in the U.S. and Europe.

- In a meeting Monday, OPEC indicated it could be open to reversing course on output increases planned for early next year.

- Crude prices were flat in early trading today, with the WTI at $40.85/bbl and Brent at $42.56/bbl. Natural gas was 3.5% higher at $2.89/MMBtu.

- The largest U.S. oil deal since the start of the pandemic was announced Monday, with ConocoPhillips agreeing to buy Concho Resources for $9.7 billion. The deal will turn ConocoPhillips into the second-largest oil independent and allow the company a much larger presence in the Permian Basin of Texas and New Mexico.

- Permian Basin producers Pioneer Natural Resources and Parsley Energy are in merger talks, continuing the consolidation trend in the struggling energy industry, which has seen more than 50 bankruptcy filings this year.

- Low prices paid in recent shale deals suggest an industry reckoning with high debt and poor shareholder returns.

- Reporting positive net income in the third quarter after adjusting for severance and other non-recurring costs, oil services leader Halliburton said shale activity in the U.S. is stabilizing.

- Renewable energy comprised a record 11% of total U.S. energy consumption in 2019, with a new report showing wind energy and wood and waste energy each accounting for 24% of renewables used in the country. Hydroelectric power took third, with 22% of the renewable share.

- An idled vessel off Venezuela’s eastern coast carrying 1.3 million barrels of crude oil has raised concerns of a potential catastrophic spill, as a recent picture shows the ship tipping dangerously to one side.

- NOVA Chemicals has agreed to sell its expandable styrene business to Mexico’s Alpek.

Supply Chain

- Trucker J.B. Hunt said it is turning down thousands of freight loads a week due to shortages of drivers and unloaders and congestion at rail yards.

- Trucking giant YRC has drawn down about a third of the controversial $700 million credit line it received from the federal government and will need approval to draw more.

- UPS rates for shipments to the U.S. from China and Hong Kong will increase by 30% starting October 25, while UPS Express Freight rates from Europe to the U.S. will increase 165% starting November 1. The rising rates reflect higher volumes of shipments due to the pandemic and the holiday season.

- Two-thirds of 150 manufacturing executives interviewed in a recent survey see the pursuit of just-in-time inventory waning in favor of warehousing inventory to create greater supply chain resiliency.

- With tight freight capacity nationwide and supply constraints with many plastic resins, clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- New COVID-19 cases in the U.S. topped 58,000 yesterday.

- COVID-19 hospitalizations are growing by more than 5% in 37 states as of Sunday, with 10 states hitting record high numbers.

- Two Utah hospitals have filled their intensive care units since Friday as new COVID-19 cases reached 1,168 on Monday.

- Ohio registered 1,837 new COVID-19 cases Monday after setting a one-day record of 2,234 new cases on Saturday.

- Michigan is averaging 1,620 new COVID-19 cases per day after averaging only 1,077 new cases per day a week prior, as the state edges closer to previously set daily records.

- COVID-19 infections are rising in Florida, as the state hit a record one-day increase in new cases on Monday. The state has reported more than 20,000 new cases in the past week.

- As cases rise in the state, a Wisconsin judge has restored restrictions on public gatherings to 25% of the capacity of a room or building. The restrictions were suspended by a lower court last week.

- New York officials shut down a planned wedding after more than 10,000 people planned to attend the event in Brooklyn. In brighter news, three weeks after New York City schools reopened, only 18 people have tested positive out of 10,676 that have been randomly tested.

- The speaker of the House and the treasury secretary are continuing economic stimulus negotiations today, the deadline for reaching a deal before the November election.

- In a leading housing industry index, sentiment among homebuilders was at a record high for the second consecutive month at 84, well above 50, the threshold for positive sentiment.

- The TSA screened over 1 million air passengers on Monday, the highest daily level since mid-March, but still 60% below the same day in 2019.

- The CDC issued a “strong recommendation” for passengers on planes, trains, buses and taxis to wear masks.

- CVS is preparing for a fall and winter resurgence of COVID-19 by hiring 15,000 new employees, mostly pharmacy technicians capable of administering virus treatment and tests.

- The furniture industry is responding to changes in home design trends due to the pandemic, such as the shift toward comfort and minimalism as people are forced to spend more time indoors.

- GM is expected to announce a $1 billion+ investment to convert a plant in Spring Hill, Tennessee, to manufacture its first all-electric Cadillac. It will be the company’s third electric vehicle production facility.

- Universal is releasing double the number of movies to theaters in the last months of 2020 than it did in 2019, a lifeline thrown to the struggling theater industry.

- For the first time in history, movie ticket sales in China have surpassed those of the U.S.

- The U.S. Federal Reserve suggested its hesitation on issuing a digital currency any time soon, citing unresolved problems with fraud and theft.

- We are seeing continuously improving demand for plastic resins since early summer lows with varying conditions in key markets:

Automotive- Pent-up demand from industry shutdowns continue to drive a sales recovery.

- The supply chain remains delicate.

- Low fuel prices are driving consumers to light trucks and SUVs.

- OEMs have retired some models from their line-ups, and many new introductions are delayed.

- Electric vehicle interest and demand is accelerating.

- Capacity utilization remains below pre-pandemic levels.

- Demand varies by ultimate end application, with improving conditions in the hard-hit automotive and construction industries and continuing robust conditions in sporting goods, consumer packaging and other markets.

- Resin constraints are frustrating the recovery, particularly PP shortages impacting the automotive, appliance and other sectors.

- Continuing uncertainty prevails in commercial construction and infrastructure markets.

- Demand is robust in computer and consumer electronics markets.

- Demand remains strong for safety equipment, hospital disposables, testing pipettes, etc.

- Demand is recovering for surgical equipment and medical devices.

- The early pandemic surge in demand for consumer goods packaging has eased, but conditions remain healthy.

- Single-use plastics remain central to pandemic defenses.

- Demand for sustainability solutions is rising across resin families.

- Demand in the oil and gas sector remains anemic.

- Demand is improving in the construction and infrastructure sectors but remains below pre-pandemic levels.

- Demand is strong in electronics and telecommunications sectors, particularly related to 5G investments.

- The pandemic is driving growing interest in 3D printing for both product development and industrial production.

- We’re seeing rising interest and activity for our online training resources.

- We’re seeing rising demand for customized equipment and materials.

International

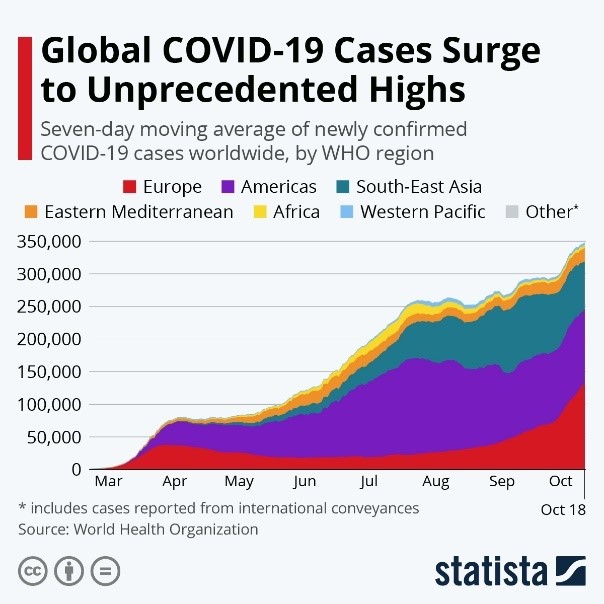

- COVID-19 infection rates are soaring globally:

- To stem a tide of rising infections, Ireland will impose Europe’s toughest restrictions Wednesday, including closing all but essential stores and asking people to stay home except to exercise.

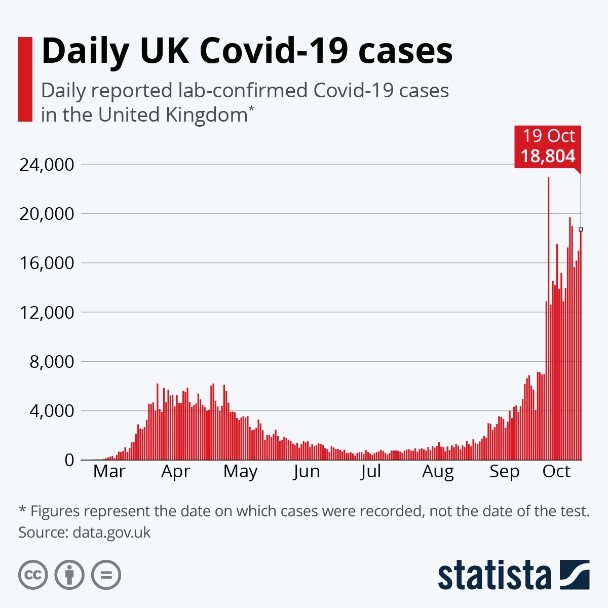

- Daily COVID-19 cases in the U.K. continue a rising trend:

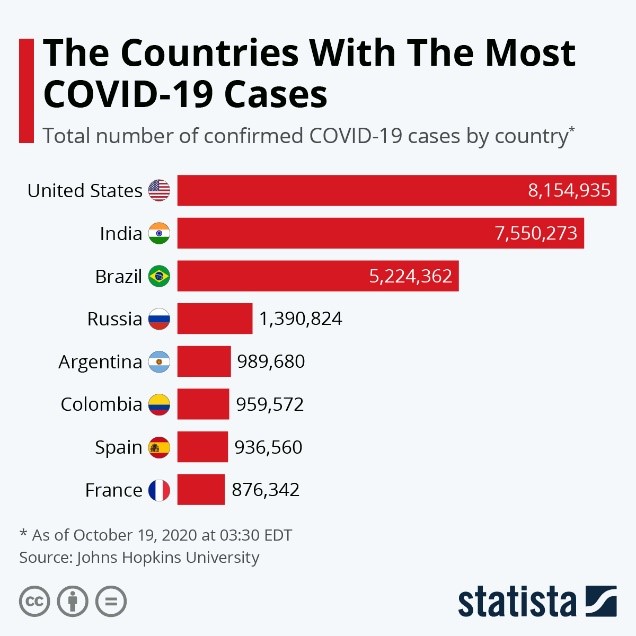

- New COVID-19 cases in India have dropped from 100,000 per day to around 55,000 per day in a month, a result of strict lockdowns that, if continued, officials believe will contain the virus by February. India has the second highest overall infections in the world:

- Average daily COVID-19 cases in Canada rose 29% in the last seven days compared to the previous seven-day period, leading to more lockdowns and social restrictions.

- The spike in COVID-19 cases in Canada is taking a toll on consumer confidence, with last week’s consumer confidence index falling for the third straight week.

- The European Union plans to add Canada, Tunisia and Georgia to its list of blacklisted nations whose citizens are restricted from entering Europe due to high infection rates in their home countries.

- Mexican officials are closing cemeteries for the country’s Day of the Dead celebration on November 2 in order to curb the spread of COVID-19.

- A new Chinese law allows the country to ban exports to the U.S. that have dual use in civilian and military applications. It remains unclear how the law will affect exports generally.

- More than half of people polled in a 27-country survey said they fear losing their jobs within the next year.

- Hong Kong’s Cathay Pacific Airways is cutting 6,000 jobs as passenger numbers for the international airline fell 98% from the year-ago period.

- China, the world’s largest fashion market, is grappling with how to recycle more than 26 million tons of used or discarded clothes, a national issue with giant environmental costs.

Our Operations

- The MAPP 2020 Benchmarking and Best Practices Conference started yesterday. Stop by M. Holland’s virtual booth, and mark your calendars for our breakout session on Thursday, October 22. Click here for more details.

- Global Healthcare Manager Josh Blackmore will be a featured speaker at the Plastics in Healthcare Virtual Edition, sponsored by Plastics News, October 26-30. The title of his talk: Applying the Lessons from the First Wave of COVID-19 to Successfully Navigate the Second.

- Resource Center: M. Holland offers a host of resources to clients, prospects and suppliers. To arrange a videoconference or meeting, contact:

- Automotive: Market Manager Matt Zessin.

- Color & Compounding: Market Manager Scott Arnold.

- Electrical & Electronics: Market Manager Carlos Aponte.

- Flexible Packaging: Senior Technical Development Engineer Todd Stevens.

- Healthcare: Global Healthcare Manager Josh Blackmore.

- Rotational Molding: Product Manager Pete Nutley.

- Wire & Cable: Director Todd Waddle.

- 3D Printing: Market Manager Haleyanne Freedman.

- Sustainability: Market Manager Lindy Holland.

- For Regulatory advice, contact Regulatory Specialist Christopher Thelen.

- For Technical questions, contact Paul Lorigan, Manager of the M. Holland Technical Innovation Center.

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.