COVID-19 Bulletin: January 14

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices were down yesterday due to a stronger U.S. dollar and news of higher gasoline and distillate inventories, ending 6 straight days of increases. Prices were flat in early trading today with the WTI at $52.83/bbl and Brent at $55.94/bbl. Natural gas was higher at $2.76/MMBtu.

- One in three workers in the oil and gas industry faced pay cuts in 2020, with a majority saying they felt less secure about their jobs.

- Demand for oil tankers is expected to contract for the first time since 2015, a result of refinery closures, inventory drawdowns and pandemic-induced production cuts.

- A record five nuclear reactors are expected to close in 2021, shutting about 9.1 gigawatts of electric generating capacity.

- Wind power accounted for nearly 25% of electricity production in Texas last year, overtaking coal for the first time in history to become the number two energy source behind natural gas.

- Siemens is investing $146 million in a commercial offshore wind turbine capable of producing hydrogen energy, a potential breakthrough technology ahead of expected booms in hydrogen demand.

- Company executives see several plastic resins trends in 2021, including strong demand for PVC through the winter, higher average polyethylene prices, and polypropylene recovery with greater demand for durable goods.

- Braskem owners Petrobras, Brazil’s state-owned oil company, and construction giant Odebrecht entered arbitration over a contract dispute related to the resin producer.

- Indefinite suspension of one of Canada’s biggest PDH and PP projects, with 550,000 tonnes/year of planned capacity, is only one of the many delayed or suspended North American petrochemical projects due to the pandemic.

Supply Chain

- More than 1.9 million U.S. industrial workers called in sick in December, with some companies reporting absenteeism as high as 25% as COVID-19 infections spike, causing supply chain disruptions and threatening the recovery.

- A Maersk executive predicts sustained demand for ocean shipping services at unusually high levels into the new year. Paired with a historically low 1.5% idle capacity, congested supply chains are not expected to let up any time soon.

- Volkswagen is further cutting production at a main plant in Germany due to a global shortage of semiconductor chips used in many car parts. The move is echoed by Honda, which will shut its U.K. factory for four days next week, and Subaru, which is adjusting production in Japan and the U.S.

- Logistics conditions remain strained, with trucking demand exceeding availability, continuing congestion at ports, and backlogs at warehousing and packaging facilities due in part to operating challenges related to the pandemic. Shipping containers are in short supply, with demurrage charges rising. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- There were 238,295 new COVID-19 cases in the U.S. yesterday, the ninth straight day of more than 200,000 infections, driving total cases above 23 million. There were 3,959 fatalities.

- The number of U.S. COVID-19 hospitalizations was flat or declining this week, the first sign of flattening since September.

- The COVID-19 virus appears to be able to evolve quickly, with researchers in Columbus, Ohio, discovering two new strains likely accounting for most new infections in the city.

- Two New York City residents were found infected with a highly contagious virus strain discovered in the U.K.

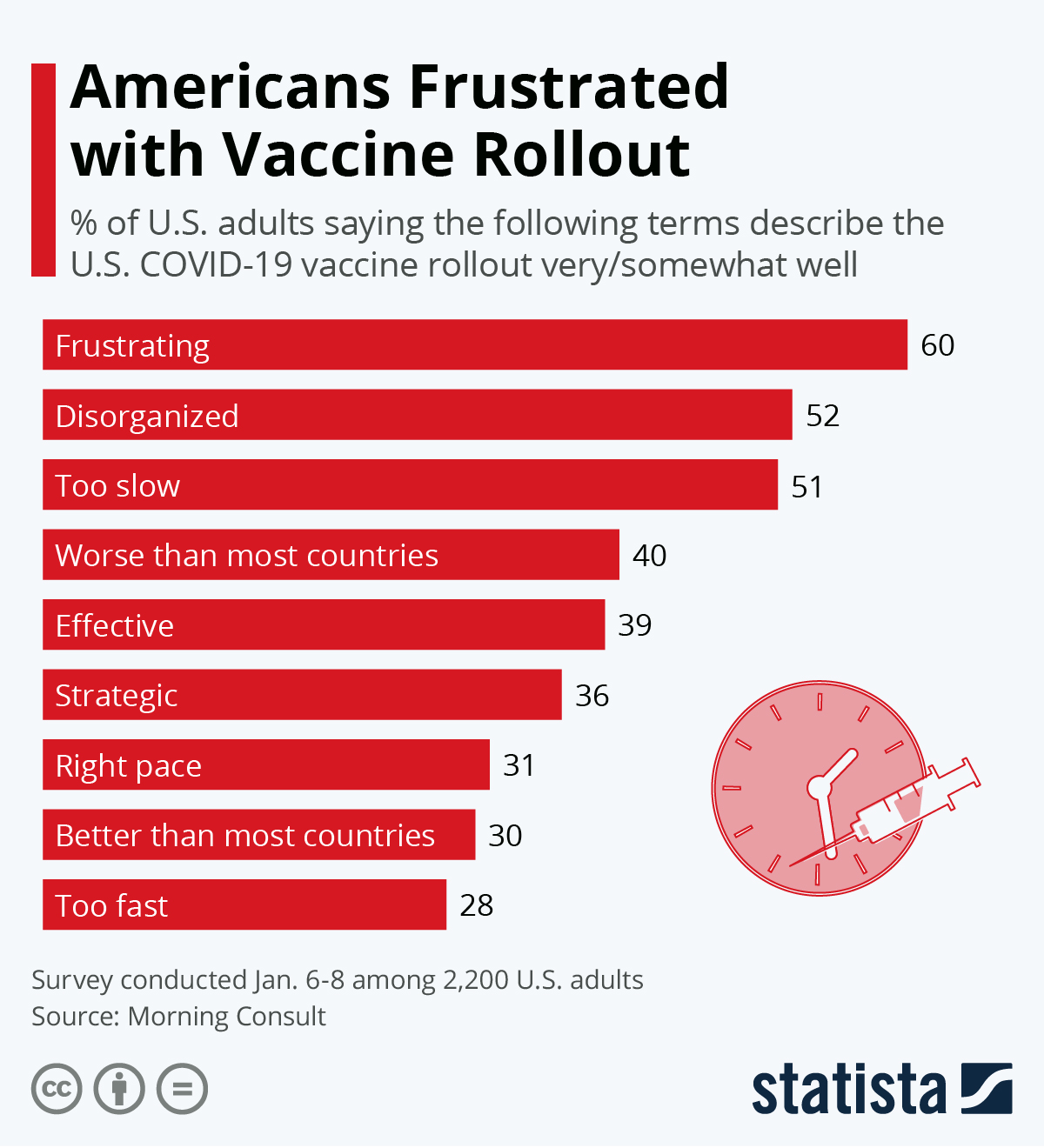

- Americans are frustrated by the vaccine rollouts:

- New Jersey is expanding COVID-19 vaccine eligibility to people 65 and older as the state continues to report weekly rises in average infections.

- Early trial data found Johnson & Johnson’s one-shot COVID-19 vaccine to be safe and to generate an immune response in patients, a promising development in the crucial addition of a third authorized vaccine behind Pfizer/BioNTech and Moderna.

- A CDC study shows no difference in COVID-19 rates between counties with in-person schools and those with remote learning, suggesting the return to in-person classes in nearly two-thirds of the U.S. is not a cause of community outbreaks.

- With 157,000 nationwide employees, Dollar General is among the first large U.S. employers to offer bonus pay to workers who get vaccinated against COVID-19.

- First-time unemployment filings last week jumped by an unexpectedly high 176,000 to 965,000, a five-month high and four times normal levels.

- The U.S. Consumer Price Index rose 0.4% in December, bumping the overall inflation rate for 2020 to 1.4% led by a spike in November. Gas prices, which rose 8.4% last month, accounted for nearly two-thirds of the overall increase in prices.

- The U.S. economic rebound slowed in the final weeks of 2020 alongside a resurgence in COVID-19 cases, the Federal Reserve’s Beige Book of business anecdotes showed.

- Government spending continued to outpace revenues in the first fiscal quarter ended December 31, with the U.S. deficit soaring 61% from the same time last year to a record $573 billion. The deficit in December hit $144 billion, compared with $13 billion in the year-ago period.

- Winter holiday sales at Target rose last year, with digital sales more than doubling in November and December and store-based sales increasing 4.2%.

- Indian automaker Mahindra is cutting more than half of its North American workforce due to pandemic pressures.

- General Motors is developing the world’s first aerial taxi, a single passenger “flying Cadillac” that could travel from rooftop to rooftop at speeds up to 55 mph.

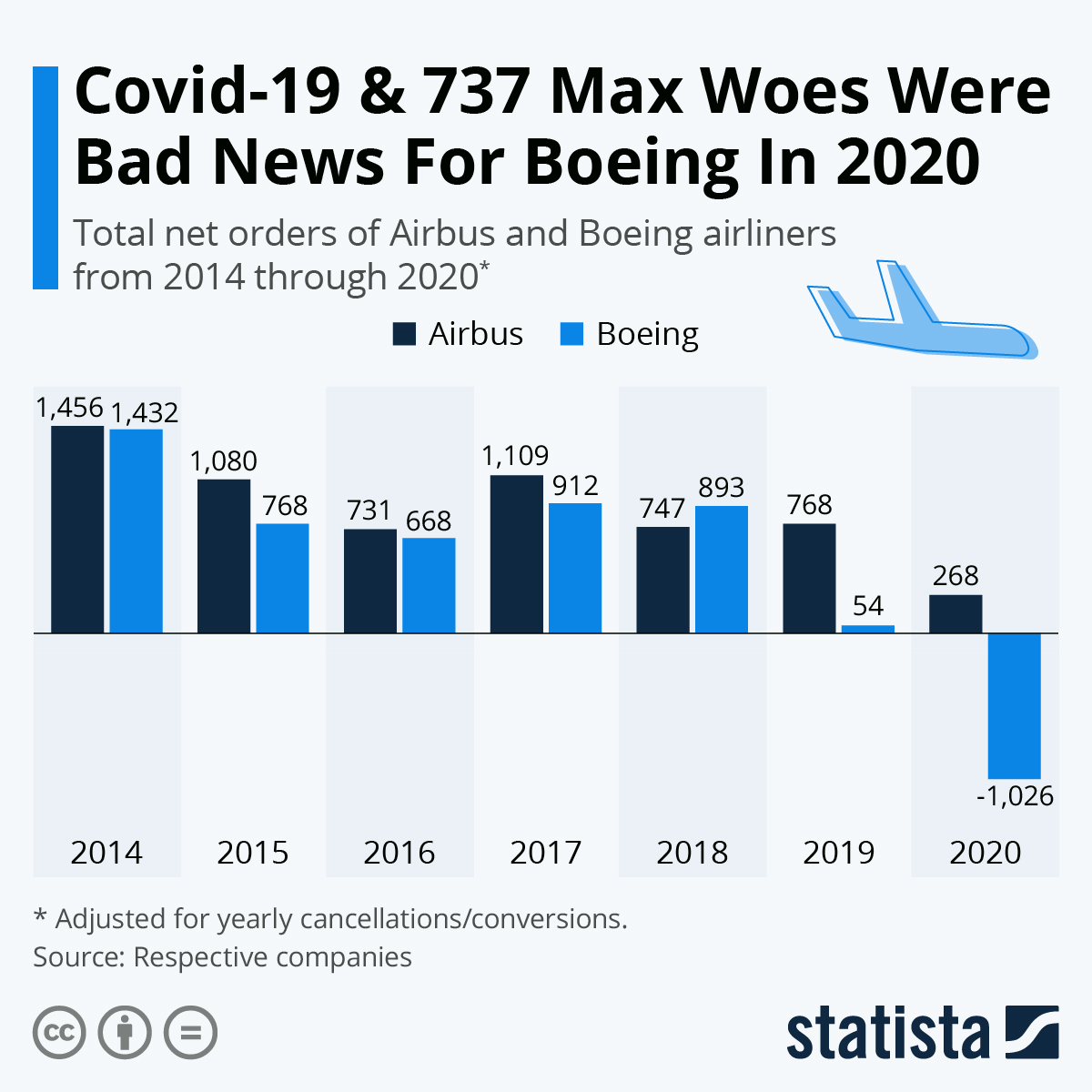

- An airline executive expects development of Boeing’s latest, and largest, twin-engine jet to be delayed further into 2023, a result of increased regulatory scrutiny after the company’s 737 MAX crisis.

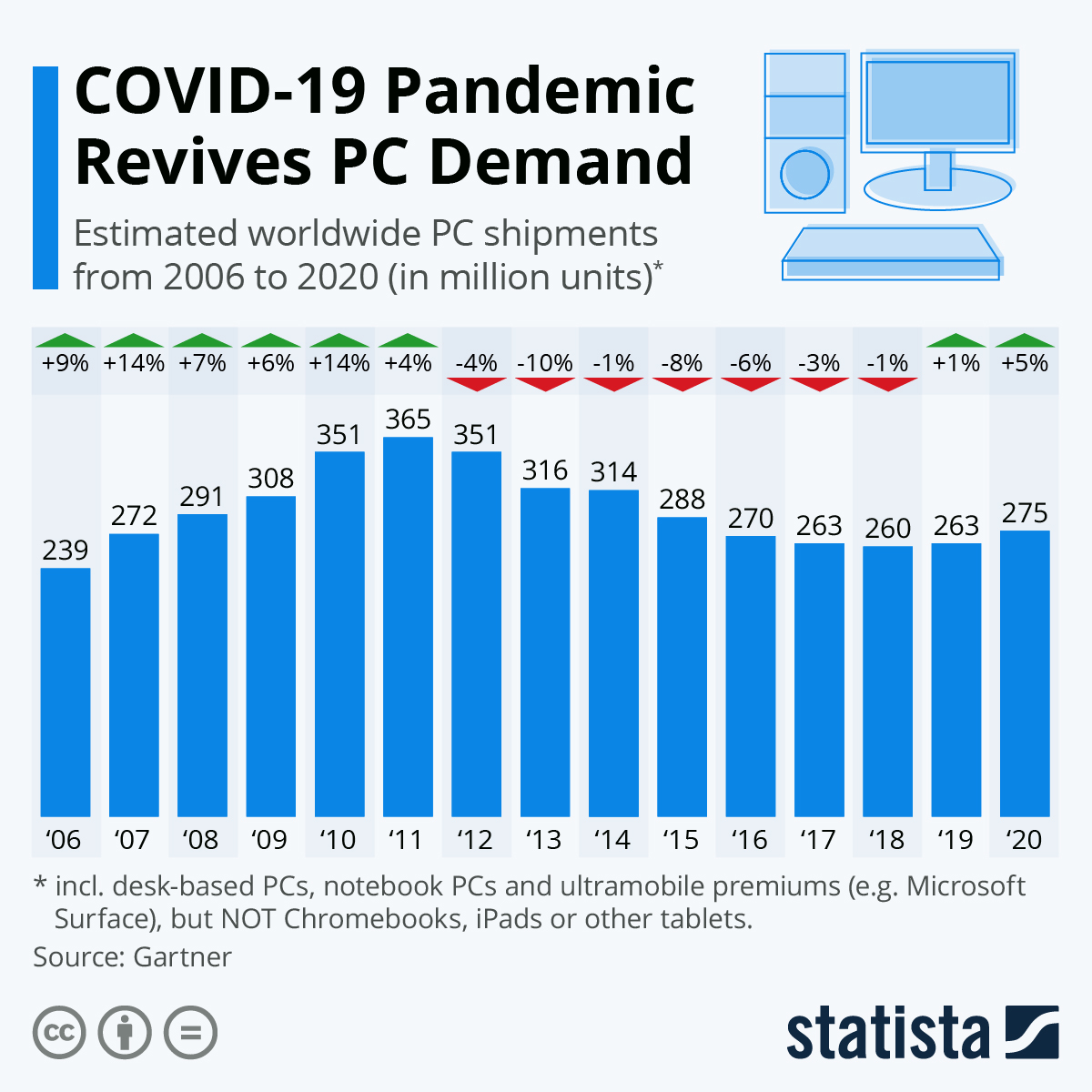

- The pandemic has helped reverse a multi-year slide in demand for personal computers as remote work and virtual learning drive sales:

- File hosting service Dropbox is cutting 11% of its global workforce, citing remote work trends forcing the company to cut resources dedicated to in-office environments.

- McDonald’s said it will phase out the use of PFAS, known as “forever chemicals,” in food packaging by 2025.

- Kraft is introducing a new, recyclable food cup container that is fiber based.

- Los Angeles permit applications for new films fell 25% in December from the previous month.

- The NBA postponed its seventh game of the new season as COVID-19 contact tracing forces more players to the sidelines.

International

- Japan’s state of emergency was extended to seven more metro regions encompassing more than half the nation’s population, with the feasibility of this year’s delayed Tokyo Olympics once again being called into question.

- U.K. law enforcement is forcing tighter compliance with COVID-19 restrictions after government leaders urged increased police patrols and quicker fine issuances. Britain’s prime minister cautiously said the country is seeing the first positive signs that recent lockdowns are working.

- Several Spanish regions increased COVID-19 restrictions yesterday, with officials blaming rising infections on lax adherence of rules over the holidays.

- France banned the use of police drones to enforce lockdowns as a privacy violation.

- China reported 115 new COVID-19 cases Wednesday, the largest daily increase in five months with most infections occurring near the capital city, Beijing.

- Two members of the World Health Organization delegation investigating the origins of COVID-19 in China were denied entry into the country after testing positive for virus antibodies.

- AstraZeneca will send 2 million COVID-19 vaccine doses to the U.K. per week by mid-February.

- Turkey approved China-developed Sinovac’s COVID-19 vaccine for emergency use.

- Russia, with the world’s fourth-highest number of COVID-19 infections, will expand its vaccination program to the entire population next week.

- China is the only major economy expected to report growth in 2020, a result of quicker-than-expected COVID-19 recovery that refreshed the nation’s prominent manufacturing role in global trade.

- Japanese currency in circulation and bank deposits rose at a record pace in December, suggesting firms and households are emulating cash stockpiling trends prevalent in many other nations.

- The U.K. will host a round of United Nations climate change talks in November focused on the goal of helping countries draft plans for net-zero carbon emissions by 2050.

- Fully electric vehicle sales in Germany tripled last year as EV and hybrid cars captured 22% of the nation’s auto market in the fourth quarter.

Our Operations

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our online resource.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.