COVID-19 Bulletin: February 26

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Winter Storm Uri

- Brent crude is up $6/bbl since the start of last week’s winter storm as overseas producers enjoy a windfall from the 18- to 40-million-barrel volume hit suffered by the Texas oil patch.

- Natural gas production in Texas fell 45% during last week’s cold front.

- Winter Storm Uri could rival hurricanes Harvey and Ike as the costliest weather events in Texas history; national cost estimates of the storm range from $195 billion to $295 billion.

- ERCOT, which manages the Texas power grid, cut electricity to many power plants during last week’s outage, exacerbating the crisis caused by unusual winter weather.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply

- Oil prices are poised to log their fourth consecutive monthly gain as crude posts its strongest start of a year on record.

- Energy prices were lower in early trading today, with the WTI down 1.7% at $62.43/bbl and Brent off 1.2% at $66.07/bbl. Natural gas was 1.4% lower at $2.74/MMBtu.

- Oil prices could rise by the fastest pace since the 1970s over the next three years, according to analyses by Bank of America.

- The chief executive of Brazilian state-owned oil major Petrobras is stepping down, a result of disputes with the nation’s administration.

- Outside Buffalo, New York, Plug Power is building a $290 million green hydrogen production facility, North America’s largest to date.

- Last year, Exxon wrote off the value of virtually all its reserves of Canadian oil sands heavy crude.

Supply Chain

- Dry van spot trucking rates jumped up to 20 cents per mile last week from the prior week in the wake of the cold snap that blanketed much of the South.

- Shipping lines are beginning to suspend cargo bookings into Myanmar after a nationwide general labor strike started yesterday to protest the country’s military coup on Feb. 1.

- Ports in the Pacific Northwest that offered a routing alternative to congested Southern California ports are now experiencing congestion themselves, including vessel delays on a surge of Asian imports and rail disruptions from the U.S. Midwest due to last week’s storms.

- DHL Freight and Volvo are teaming up to produce an electric heavy-duty truck to be used for regional transportation in Europe.

- Parts shortages unrelated to computer chips forced Tesla to temporarily suspend production in Fremont, California, and GM to suspend Corvette production the first week in March.

- We expect continuing logistics disruption in the U.S. from severe winter conditions that blanketed much of the country last week.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- The decline in U.S. COVID-19 infection rates has plateaued, with seven-day average daily infections stalling at about 72,000 for the past two weeks.

- There were 77,291 new COVID-19 cases in the U.S. yesterday and 2,417 deaths.

- California has exceeded 50,000 fatalities from COVID-19, a national record.

- Oregon extended its state of emergency after reporting hundreds of new COVID-19 cases over the past several days.

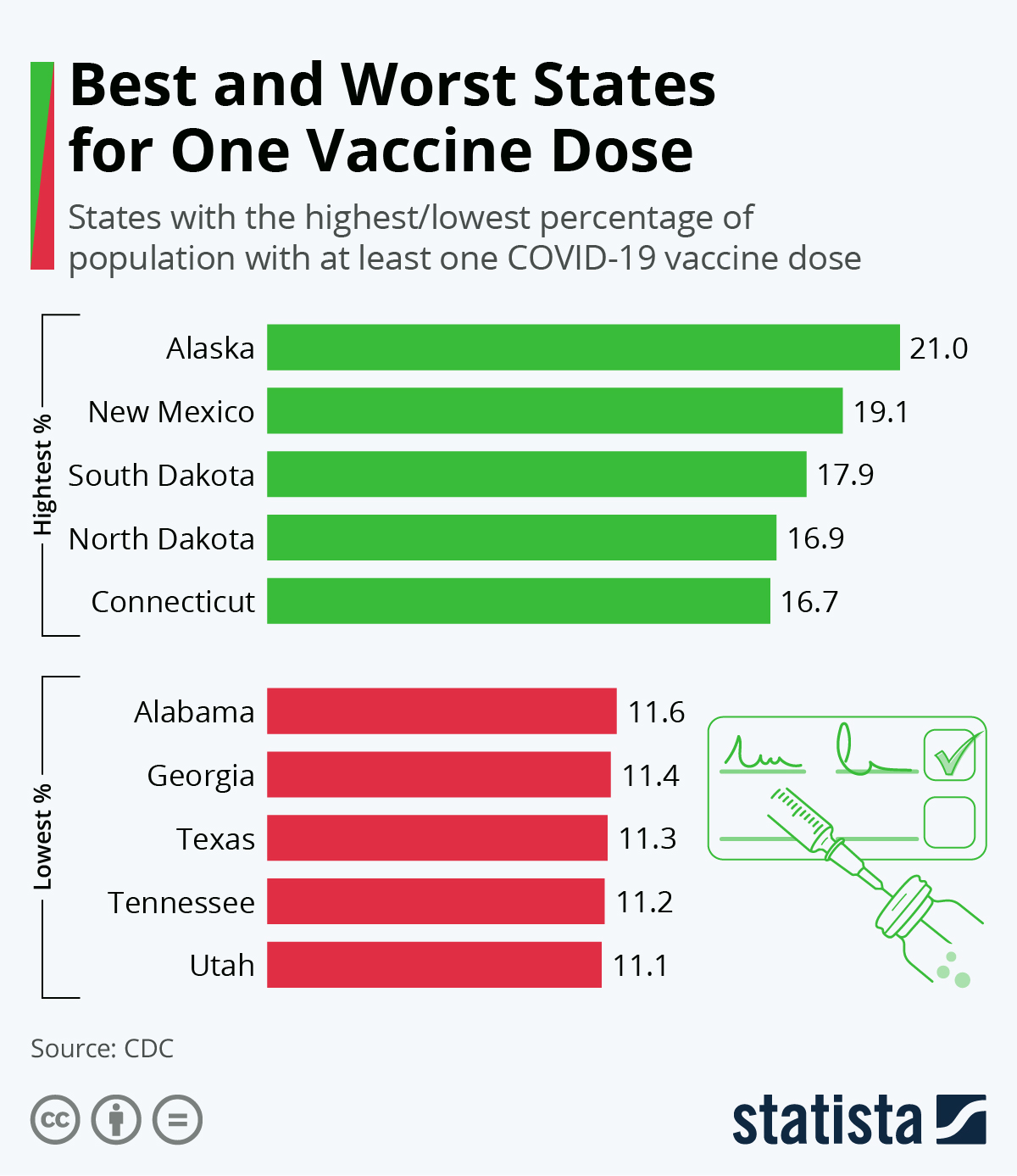

- The White House commemorated the 50 millionth COVID-19 vaccine dose administered in the U.S., a milestone, with nearly 60% of people over the age of 75 receiving shots. As of this morning, total doses administered exceeded 68 million, with more than 21 million people, 6.6% of the population, fully vaccinated.

- In the past month, COVID-19 hospital admissions dropped more than 70%, with the largest drop coming from those 85 years and older.

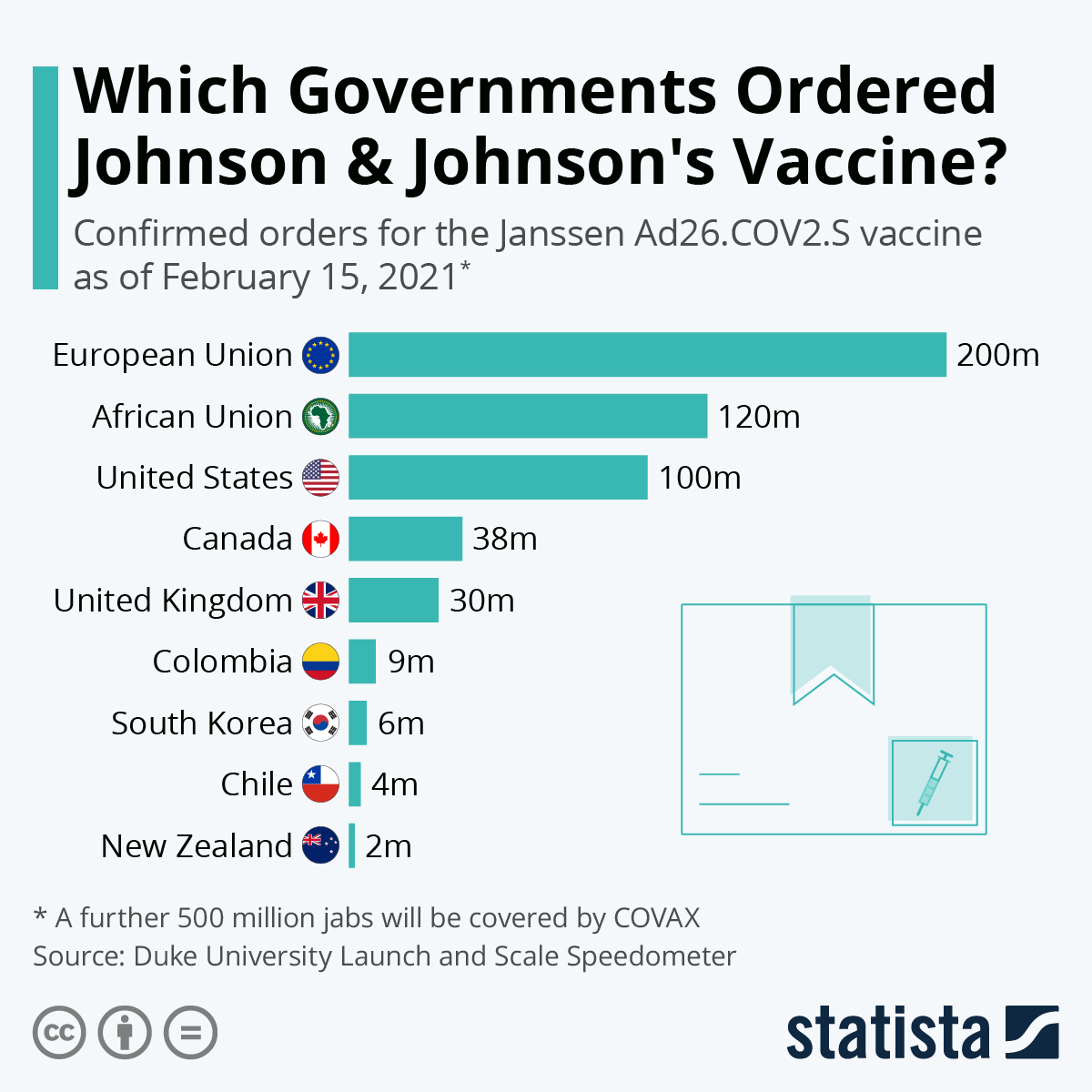

- J&J’s one-shot COVID-19 vaccine takes the next step on the path to emergency use authorization today with a review by a panel of outside advisors to the FDA.

- Pfizer/BioNTech is beginning a study to see whether a third dose of its COVID-19 shot will protect against emerging strains of the virus, a differing approach than Moderna, which recently reconfigured its vaccine to specifically respond to the South African variant.

- Pfizer/BioNTech’s COVID-19 vaccine can be stored at standard freezing temperatures for up to two weeks, expanding access to the shot among rural and low-income regions that lack specialized shipping equipment.

- The FDA requested more data on an experimental COVID-19 treatment from Merck & Co., delaying the company’s plans to ship supplies before July.

- Durable goods orders rose 3.4% in January, the ninth consecutive monthly gain.

- The U.S. is extending eligibility for jobless benefits to people who have declined offers of employment due to risks of exposure to COVID-19 on the job.

- Regulators have flagged 29.2% of higher-risk corporate debt as “troubled” in 2020, up from 13.5% in 2019, amounting to a trillion dollars of debt at risk.

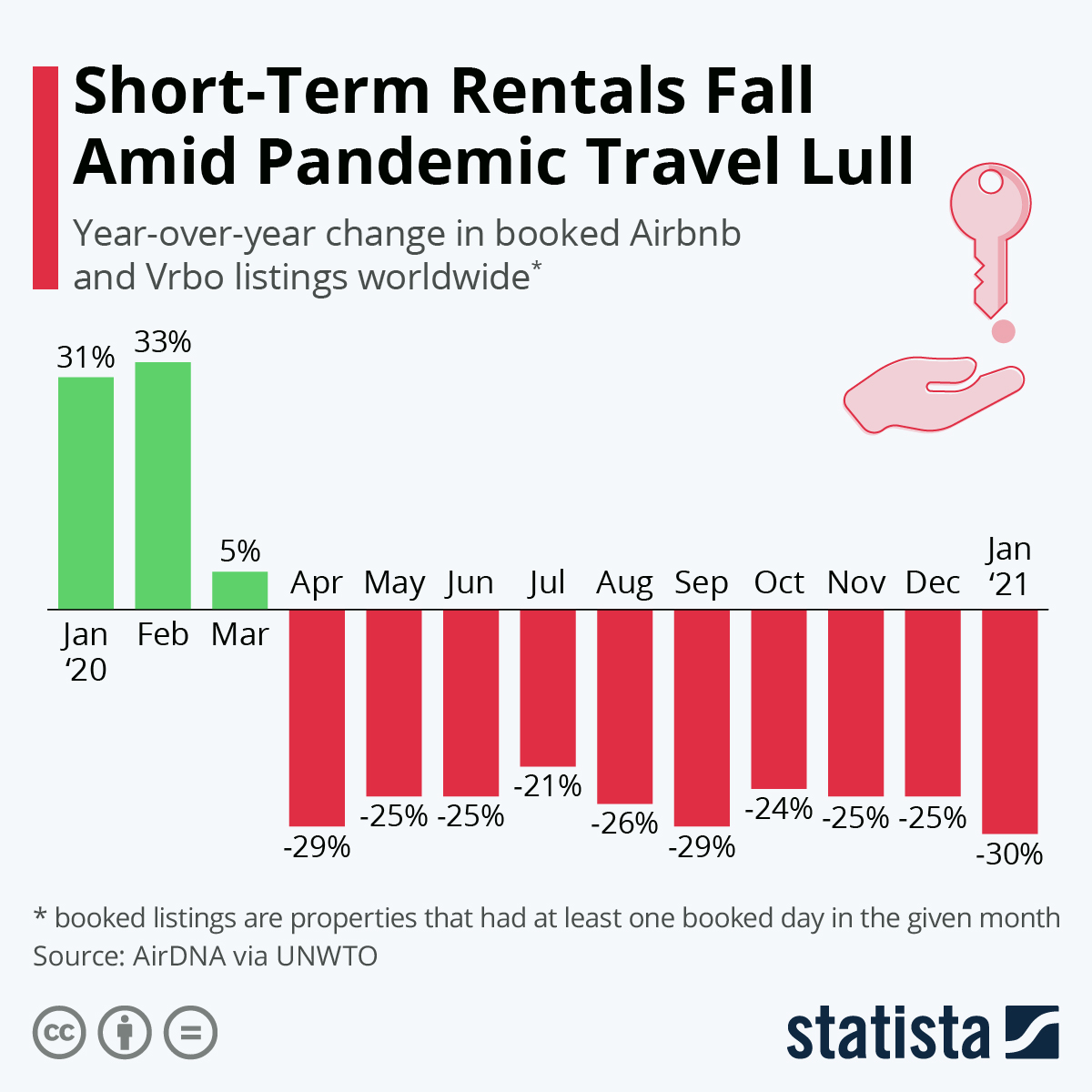

- Airbnb posted lower-than-expected losses in 2020, a result of increased local travel that offset the effect of harsh lockdowns on worldwide travel.

- Best Buy is mulling reducing its retail floor space by half to make more room for e-commerce delivery fulfillment.

- Ford’s CEO called for investment in domestic battery production to avoid the kind of supply chain challenges currently affecting computer chips.

- Batteries from retired electric vehicles are finding continued life in second-life battery systems providing power to businesses and farms.

- Hasbro, following in the steps of Mattel’s rebranded Barbie doll, is upgrading its 70-year-old Mister Potato Head brand, dropping “Mister” and adding parts to allow kids to create more diverse and inclusive characters.

International

- Global COVID-19 fatalities have topped 2.5 million.

- Brazil’s COVID-19 fatality toll topped 250,000, the second highest in the world behind the U.S.

- Japan is set to lift states of emergency in its western regions.

- South Africa has recorded nearly 4,000 cases of re-infection with COVID-19, an outcome more likely when a person is infected with that nation’s variant of the virus.

- The U.K., with among the most ambitious vaccination efforts in the world, lowered the eligibility age to 40 and older.

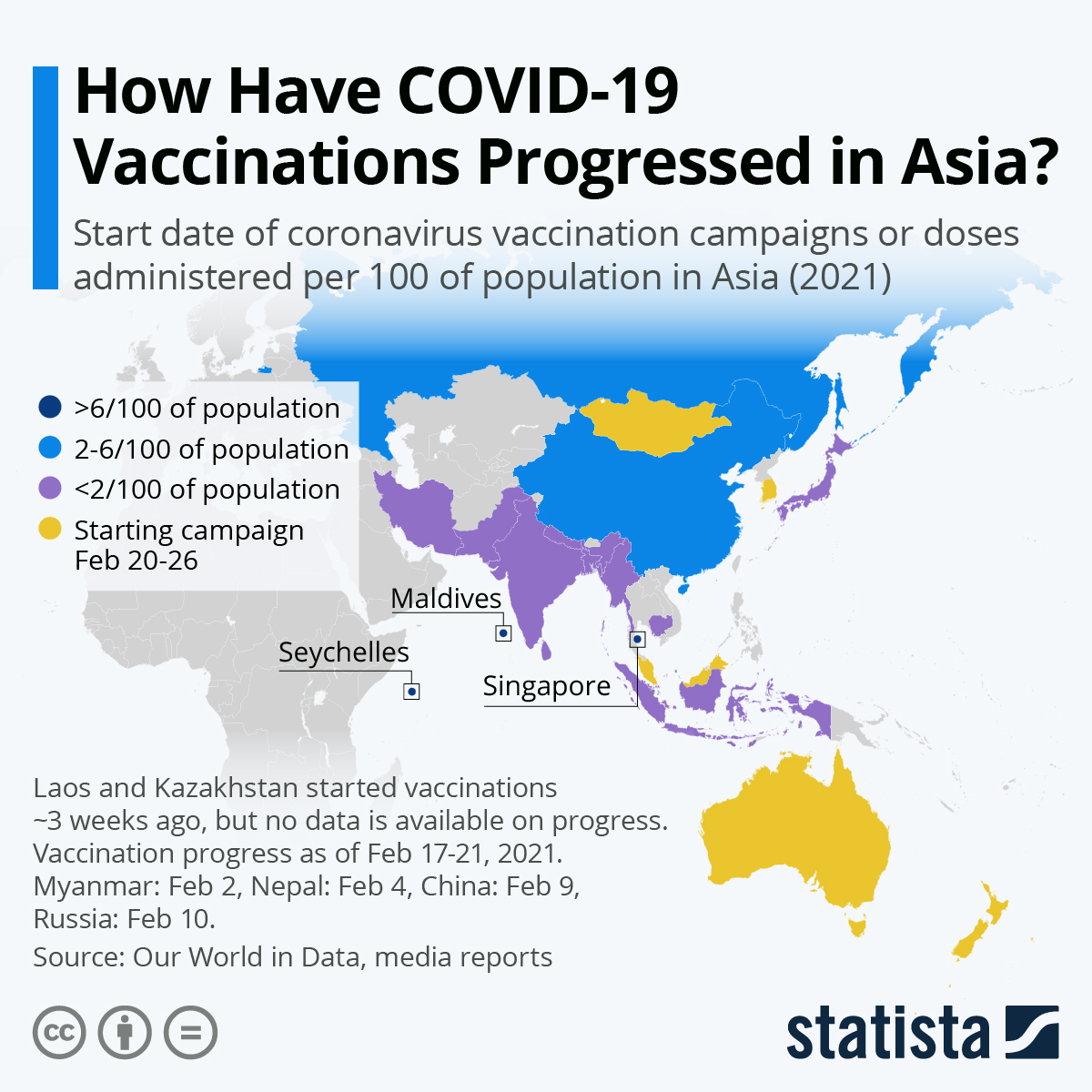

- South Korea began its COVID-19 vaccine campaign yesterday with the first shots distributed to people at long-term care facilities.

- Hong Kong also began its COVID-19 vaccine rollout yesterday, administering the first shots of a vaccine made by China’s Sinovac.

- Medical oxygen is a scarce commodity in Africa and Latin America among low-income countries that do not have enough medical resources to deal with the surge of COVID-19 patients.

- The European Union is planning to set up a vaccine-certificate system in less than three months that would provide vaccinated people with increased access to travel and other activities.

- China, the only major economy that grew last year, could experience growth of 8%-9% this year.

- Industrial output in Japan rose a higher-than-expected 4.2% in January, the first increase in three months.

- Mexico posted an annual current account surplus for the first time in 15 years last year as imports declined more sharply than exports during the pandemic.

- A mass exodus of immigrants during the pandemic is posing an added obstacle to the U.K.’s economic recovery, suppressing economic output and crimping tax receipts.

- Australian international airline Qantas pushed back its plan to resume most international flights by four months to late October.

- Airlines could burn through as much as $95 billion this year in the wake of extended travel restrictions caused by highly contagious variants of COVID-19, a higher loss than initially predicted by the International Air Transport Association.

Our Operations

- Last week’s Plastics Reflections webinar on 2021 Drivers and Trends for the North American Plastics Market can be viewed here.

- Our 3D Printing business unit has launched a new e-commerce site. Access the new site here.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.