MH Daily Bulletin: January 16

News relevant to the plastics industry:

At M. Holland

- M. Holland is the headline sponsor for AMI’s Thermoplastic Concentrates in Orlando on Jan. 24-26. Stop by Booth #16 to speak with our experts and attend a talk on regulatory compliance changes by Christopher Thelen, M. Holland’s Senior Regulatory Specialist, on Jan. 24 at 4:20 pm.

- M. Holland will be exhibiting at MD&M West in Anaheim on Feb. 7-9. Stop by Booth #4115 to meet our Healthcare team and discuss how M. Holland’s line of medical-grade resins can help you develop safe and effective medical products and packaging.

- Every year, M. Holland’s market managers take time to reflect on the major trends of the past 12 months. Click here to read our 2023 series, including business insight and recommendations for 3D printing, automotive, color and compounding, electrical and electronics, healthcare, packaging, rotational molding, sustainability, and wire and cable.

Supply

- Oil prices rose 1.5% Friday, ending the week 8% higher for their biggest weekly gain since October.

- In mid-morning trading today, WTI futures were down 0.9% at $79.11/bbl, Brent was down 0.9% at $84.51/bbl, and U.S. natural gas was up 5.7% at $3.62/MMBtu.

- Oil demand in China is forecast to rise 800,000 bpd this year to a record 16 million bpd.

- U.S. gasoline prices declined 9.4% from November to December and were down 1.5% from a year earlier.

- Active U.S. drilling rigs rose by three last week to a total of 775, about 300 lower than the same time in 2019, according to Baker Hughes.

- The U.S. East Coast will likely dodge a winter fuel crisis as unusually warm weather has reduced heating costs by 23% from November highs, according to the government.

- Freeport LNG canceled some upcoming cargo orders, adding to uncertainty over when the top U.S. exporter will resume shipments following a facility explosion last summer.

- Exxon Mobil will sharply boost gasoline and diesel production at its Beaumont, Texas, refinery this week, completing a $2 billion expansion the company first considered nine years ago.

- Analysts say OPEC+ could cut output again in February in a bid to lift prices after recent declines.

- Qatari officials expect natural gas markets to whipsaw for the next several years due to persistent supply shortages.

- Exxon, Chevron and TotalEnergies are considering boosting investments in India’s oil and gas exploration and production sector, Indian officials say.

- Chevron sold a cargo of Venezuelan crude to another U.S. refinery, Phillips 66, marking the first such sale since the U.S. sanctioned Venezuelan crude years ago.

- The suspected cause of Friday’s explosion of a gas pipeline connecting Lithuania and Latvia was an unexpected rupture.

- Nigeria LNG canceled several shipments due to vandalism on gas pipelines that disrupted operations.

- More oil news related to the war in Europe:

- Prices for Russia’s flagship Urals crude has dropped to its lowest level since November 2020, trading around a third lower than Moscow predicted.

- Russia is using more of its own oil tankers to deliver crude after Western sanctions led to a decline in European tanker cargoes from key oil ports in the country.

- Questions are rising over how Europe will replace the roughly 220 million barrels of diesel-type products imported annually from Russia when a complete ban is imposed on Feb. 5. The ban will coincide with a separate European ban on almost all imports of Russian oil products.

- Prospects for a European recession this year are declining amid unexpectedly low energy prices during winter.

- TotalEnergies is now one of Germany’s main LNG suppliers after the producer began supplying a new floating storage unit on the country’s Baltic Sea coast Saturday.

- Britain’s latest forecasts show gas prices declining sharply in the second half of 2023, potentially saving the government billions of pounds in household support.

- Poland and Lithuania are pushing Europe to lower its price cap on Russian oil while also targeting Russia’s nuclear sector.

- Top U.S. officials outlined plans last week for a carbon-offset program meant to help developing nations speed their energy transition.

- Agriculture companies are investing millions of dollars to develop farming programs designed to capture more CO2 in fields, a possible solution to bring down emissions in one of the top-polluting industries.

Supply Chain

- Steady rain across much of California brought more flooded roads and rockslides over the weekend, continuing a streak of severe weather that has left 19 people dead since Dec. 26. The state could start to dry out amid milder weather this week, forecasters say.

- Spot prices for jet fuel in the U.S. rose to $2.89 per gallon in December, up 38% from a year earlier.

- The Cass Freight Index of U.S. shipping demand fell 3.9% to a reading of 1.161 in December, the steepest annual rate of decline since August 2021.

- Container lines are seeing resilient demand in Asia-Mediterranean trade lanes, a contrast to the North European market.

- Several big ship insurers are seeking double-digit rate increases this year, what would mark the fourth consecutive year of higher premiums.

- Commodities giant Cargill and trading house Mitsui & Co. ordered two methanol-fueled bulk carriers from Japan’s Tsuneishi Shipbuilding.

- Greek ship owner Tsakos is switching orders for two new container ships to mid-sized tankers.

- Hapag-Lloyd is building a transshipment terminal in Egypt with annual handling capacity of 3.3 million containers.

- Canada will soon require freight railroads to provide more detailed performance data as part of an effort to strengthen the nation’s supply chains.

- Spot warehouse pricing was flat in the fourth quarter, though stored inventories remained elevated.

- In the latest news from the auto industry:

- Electric vehicles comprised about 10% of global car sales last year, up about 68% from the year before.

- BMW is planning a major new investment in the central Mexican state of San Luis Potosi, where the company already has a plant, according to Mexican officials.

- Carvana is terminating more workers and taking other measures such as reduced work hours as the used-car retailer contends with weak sales.

- U.S. prices for used cars and trucks fell 2.5% in December and 8.8% for the year, the latest inflation data shows.

- The U.S. Energy Department will lend Australian lithium producer ioneer Ltd. up to $700 million to build a new mining project in Nevada.

- Chinese automakers are ordering car carriers due to frustration with shipping capacity.

- Global automakers lost an estimated $210 billion in sales last year due to missing computer chips, according to consulting firm AlixPartners.

- China’s imports of integrated circuits fell 15% last year to 538.4 billion units, the first decline in almost two decades.

- Apple partners Foxconn and Pegatron plan to invest more in Southeast Asia this year, showcasing a drive to add production capacity outside China to mitigate geopolitical and economic risks.

- Goldman Sachs raised its price forecasts for aluminum this year, saying higher demand in Europe and China could lead to supply shortages.

- Only about one-third of grocers say their e-commerce operations can adequately handle online fulfillment during peak demand periods, according to a new survey.

- A move by top palm oil exporter Indonesia to restrict shipments is set to squeeze global vegetable oil supplies already dampened by lower output in Southeast Asia and Latin America.

Domestic Markets

- The daily average for new COVID-19 cases declined to 59,246 last week from 67,243 the week before, while average fatalities rose to 558 from 390.

- Johnson & Johnson is vastly scaling back efforts to produce its COVID-19 vaccine amid slumping demand.

- COVID-19 exacerbated the nation’s labor shortage last year, reducing the available workforce by as much as 2.6%.

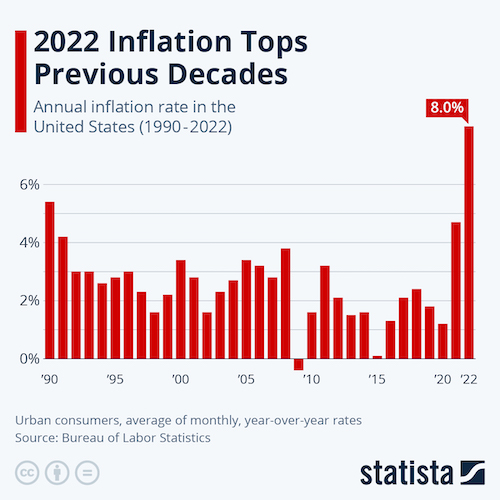

- Average annual inflation in the U.S. hit 8% last year, the highest in at least three decades:

- The U.S. administration plans to take special cash management measures to avoid breaching a $31.4 trillion debt limit this month, but warned that Congress needs to raise the nation’s debt ceiling by early June to avoid default.

- Economists still expect higher interest rates to push the U.S. economy into a recession this year despite recent data showing inflation starting to recede.

- U.S. consumers believe price pressures will ease considerably over the next 12 months, with a survey on Friday showing one-year inflation expectations falling to 4%, the lowest level in almost a year.

- A widely tracked gauge of U.S. consumer sentiment rose to 64.6 in January from 59.7 in December, the highest reading since April, according to the University of Michigan:

- Worker pay increases fell behind inflation in 2022 for the second year in a row, leaving households worse off despite historically strong pay gains.

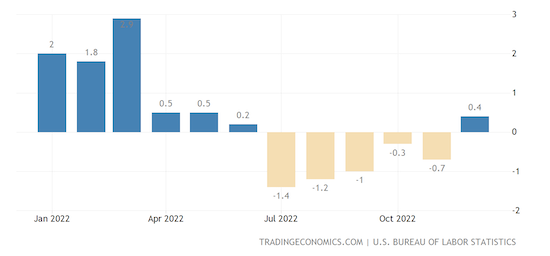

- U.S. import prices rose 0.4% last month, the first monthly increase since June:

- In the latest news from quarterly earnings season:

- The U.S.’s four largest commercial banks reported mixed profits, including JPMorgan Chase (+6%), Bank of America (+2%), Citigroup (-21%) and Wells Fargo (-50%).

- BlackRock saw profit decline 18%, hit by a global market rout that squeezed fee income.

- Wendy’s is shaking up leadership amid a broader organizational overhaul that could include staff cuts and new investments. The fast-food chain’s sales grew 6% in the latest quarter.

- UnitedHealth Group says the “tripledemic” of respiratory diseases this winter did not substantially drive up medical costs, with demand for healthcare services staying in the range of a typical fourth quarter.

- Bank of New York Mellon plans to cut around 3% of its workforce this year, joining a number of Wall Street firms in trimming headcount to cope with turbulent markets.

- JPMorgan Chase and Bank of America are continuing to add staff even as the economy softens, breaking with the downsizing trend of other major Wall Street and tech firms.

- Delta Air Lines expects to see lower-than-expected first-quarter profit due to higher non-fuel operating costs, especially labor.

- December airfares were up 28.5% from a year earlier, according to the latest inflation data.

- The price of eggs rose 11.1% in December as the deadliest bird flu outbreak on record continues to devastate poultry flocks across the country.

- Bed Bath & Beyond is reportedly in talks with private equity firm Sycamore Partners for the sale of its assets.

International Markets

- Excluding China, COVID-19 infections globally fell 23% week over week, while virus fatalities declined 13%.

- In the latest China news:

- China raised the reported COVID-19 death toll since it scrapped its zero-COVID policy last month to 59,938 amid global criticism of the country’s data reporting.

- The peak of China’s COVID-19 wave is expected to last up to three months and will soon swell over into the nation’s vast countryside where medical resources are scarce, a top Chinese medical expert said.

- A new study estimates that roughly 900 million people in China have contracted COVID-19 since the start of the pandemic and around 64% of its population currently has the virus.

- Some researchers predict China’s population may have seen its first decline since 1961 last year, a historic shift with far-reaching implications for the global economy.

- China’s exports declined further in December, falling 9.9% from a year earlier for the biggest dip since the first month of the pandemic:

- Top officials say the government will avoid unleashing massive monetary stimulus this year in a bid to balance growth with price stability.

- A Boeing 737 MAX made its first passenger flight in China in nearly four years last week, a milestone in the plane-maker’s attempt to rebuild its business there.

- Two of China’s largest state-owned airlines plan to delist from the New York Stock Exchange, joining a raft of government-controlled firms departing.

- Germany will end its mask mandate for long-distance trains and buses starting Feb. 2.

- Major central banks delivered a record 2,700 basis points of rate hikes in 2022, which could land global borrowers with $8.6 trillion in extra debt servicing costs in coming years, according to S&P Global.

- Global banks are in the process of cutting over 6,000 jobs as investment-banking profits come under pressure, a Reuters analysis shows.

- Global personal computer shipments dropped nearly 29% in the fourth quarter, the largest quarterly decline since the mid-1990s.

- The EU is asking member states for proposals on countering the U.S.’s clean-energy incentives with the bloc’s own subsidies.

- Germany’s economic output was flat in the fourth quarter and grew 1.9% for the full year, slightly above forecasts.

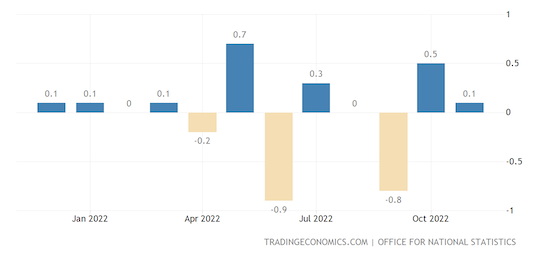

- Britain’s GDP rose a better-than-expected 0.1% in November, new data shows:

- A wave of industrial action across Britain will intensify in coming weeks with new or expanded strikes by teachers and nurses, according to labor leaders.

Some sources linked are subscription services.