MH Daily Bulletin: January 18

News relevant to the plastics industry:

At M. Holland

- M. Holland is the headline sponsor for AMI’s Thermoplastic Concentrates in Orlando on Jan. 24-26. Stop by Booth #16 to speak with our experts and attend a talk on regulatory compliance changes by Christopher Thelen, M. Holland’s Senior Regulatory Specialist, on Jan. 24 at 4:20 pm.

- M. Holland will be exhibiting at MD&M West in Anaheim on Feb. 7-9. Stop by Booth #4115 to meet our Healthcare team and discuss how M. Holland’s line of medical-grade resins can help you develop safe and effective medical products and packaging.

- Every year, M. Holland’s market managers take time to reflect on the major trends of the past 12 months. Click here to read our 2023 series, including business insight and recommendations for 3D printing, automotive, color and compounding, electrical and electronics, healthcare, packaging, rotational molding, sustainability, and wire and cable.

Supply

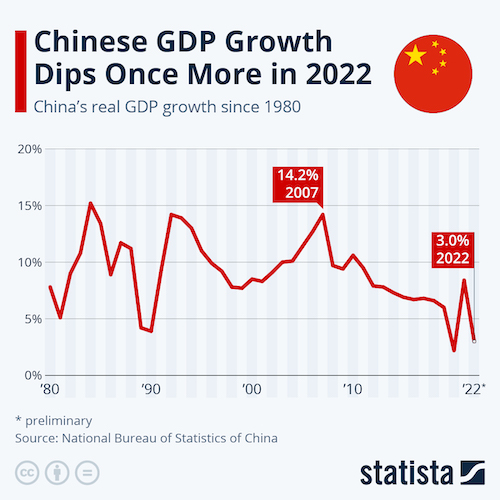

- Oil rose Tuesday after China posted weak but expectation-beating annual economic growth.

- In mid-morning trading today, WTI futures were up 2.2% at $81.90/bbl, Brent was up 1.8% at $87.43/bbl, and U.S. natural gas was down 6.2% at $3.36/MMBtu.

- U.S. gasoline prices are on the rise despite a seasonal demand slump, gaining 5.7 cents the past week to an average of $3.33 per gallon.

- Top U.S. exporter Freeport LNG says it is still targeting the second half of January for a restart of its fire-damaged export terminal in Texas.

- Top Western energy firms are expected to post a combined profit of $200 billion for 2022, a full-year record marked by extreme volatility in oil and gas prices after Russia’s invasion of Ukraine.

- The International Energy Agency raised its estimate for global oil demand this year by 200,000 bpd, now predicting demand will hit a record 101.7 million bpd driven by the reopening of China.

- OPEC maintained its forecast that global oil demand will rise by 2.22 million bpd this year, about 2.2% higher than last year, on the back of rebounding economic activity in China. Saudi Aramco’s CEO said yesterday in Davos that the firm is “very optimistic” about the market outlook in 2023.

- China’s oil refinery output fell 3.4% in 2022, marking the first annual decline in over two decades.

- New leadership at Venezuela’s state oil company PDVSA suspended most export contracts as the firm conducts a comprehensive review to avoid payment defaults.

- Japan’s biggest power generator signed initial agreements with the U.S.’s CF Industries and Norway’s Yara Clean Ammonia Norge to eventually run its coal-fired power plants on 100% ammonia by 2040.

- More oil news related to the war in Europe:

- Chemicals giant BASF said it will take a $7.9 billion impairment charge for its exit from Russia and report a net loss for 2022.

- Russian refinery runs could decline by 15% this year due to tightened Western sanctions.

- Daily pipeline gas exports by Russian energy giant Gazprom fell 22% in the first half of January amid unusually warm weather across the Northern Hemisphere.

- Russia’s deeply discounted fuel exports helped it become the third-largest oil supplier to India last year, dragging down OPEC’s share to the lowest in more than a decade.

- Bulgaria is looking to revive a trans-Balkan oil pipeline project to secure non-Russian crude supply for its only oil refinery on the Black Sea.

- Kazakhstan secured approval to use Russia’s pipeline infrastructure to transport 300,000 tons of oil to buyers in Germany in the first quarter of this year.

Supply Chain

- A string of “atmospheric rivers” that pounded California for three weeks has ended, officials say, enabling the state to begin lengthy repairs to roads and levees.

- Container terminal operators are focusing more investment on technology and efficiency measures as the expansion of ports becomes more difficult, experts say.

- MSC’s air cargo unit added South Korea and Xiamen, China, to its freighter network.

- Maersk’s venture arm Maersk Growth announced an investment in Berlin-based methanol fuel startup C1 Green Chemicals.

- Commodities trader Montfort is the top contender to acquire Uniper Energy’s oil refinery in the UAE that produces low-sulfur bunker fuel for the shipping industry.

- In the latest news from the auto industry:

- By 2030, half of all cars sold in China, Europe and the U.S. will be electric, the International Energy Agency predicts.

- Daily sales of Tesla’s China-made cars surged 76% earlier this month after it slashed prices for its top-selling models.

- Renault saw sales of its flagship brand fall 9.4% in 2022, the fourth straight yearly decline.

- Struggling used-car seller Carvana adopted a “poison pill” this week to limit shareholders from raising their stakes and reached agreement to sell up to $4 billion of auto loans.

- Chinese auto giant BYD plans to start selling vehicles in Britain this quarter.

- Indonesia is finalizing agreements with Tesla and Chinese auto giant BYD for new investment for electric-vehicle production facilities in the nation.

- Renault, China’s Geely Automobile Holdings and oil giant Saudi Aramco are in talks to form a company to develop and supply low-emission power trains for conventional and hybrid vehicles as the growth of e-vehicles threatens fossil-fuel models.

- India’s Maharashtra state entered a $2.5 billion partnership with Taiwan’s Gogoro to build a regional network of electric-vehicle battery-swapping and charging stations.

- Hertz plans to make up to 25,000 electric vehicles available to rent for Uber drivers in European cities by 2025.

- GM plans to introduce an electric Corvette later this year with a starting cost of roughly $104,000.

- Global semiconductor sales fell 9.2% year over year in November to a total of $45.5 billion, including a sharp 13.9% decline in Asia-Pacific sales.

- Glencore’s massive Antapaccay copper mine in Peru is operating at limited capacity due to disruption from widespread political protests in the country.

- Saudi Arabia is courting top mining companies to help capitalize on untapped mineral deposits that could be worth hundreds of billions of dollars.

- Malaysia will consider halting palm oil exports to the EU in retaliation for the bloc’s new deforestation regulations.

- Danone, one of the world’s biggest dairy companies, plans to cut methane emissions from its milk supply chain by 30% by 2030.

Domestic Markets

- The U.S. reported 67,635 new COVID-19 infections and 695 virus fatalities Tuesday.

- Clinical trials show Moderna’s vaccine against RSV was highly effective in preventing the lung disease in older people, paving the way for the company to seek its first approval outside COVID-19.

- Retail sales fell 1.1% in December, the biggest monthly decline of the year.

- The Richmond Fed says U.S. inflation, although declining, is still too high to justify easing the Federal Reserve’s pace of monetary restraint.

- Citigroup expects the U.S. Federal Reserve to slow its pace of interest-rate hikes in late spring or early summer.

- Growth in American household spending rose by 7.7% in December, down from a record-high 9% over the summer but still well above the 5.1% recorded in December 2021.

- New York state manufacturing activity contracted to the lowest level in 2.5 years this month as orders collapsed and employment growth stalled, according to the New York Fed’s latest index reading.

- Over 5 million businesses were created in the U.S. last year, a sign that the entrepreneurship boom spawned by the pandemic may be long-lasting.

- In the latest news from quarterly earnings season:

- Profit plunged 66% from a year ago at Goldman Sachs and 40% at Morgan Stanley, reflecting a continued slowdown in the corporate deal-making that had fueled record earnings a year earlier.

- United Airlines saw a stronger-than-expected 30% rise in profit as consumers continued to shell out for airline tickets despite broader economic worries.

- Appliance-maker Whirlpool posted a record $1.5 billion loss as it works to turn over much of its struggling European business to a Turkish company.

- Microsoft is laying off 10,000 employees, the latest big tech firm to reduce staff in response to slowing demand and a worsening global economic outlook.

- Apple rolled out its first new products of the year Tuesday, offering faster versions of its high-end MacBook Pro laptops and the Mac mini desktop.

- Starbucks expanded its U.S. partnership with DoorDash this week, a bet that its customers will remain willing to pay more for deliveries even as the pandemic fades.

International Markets

- In the latest China news:

- New data shows China’s economy grew just 3% in 2022, one of its slowest rates in decades as repeated lockdowns hammered households and businesses.

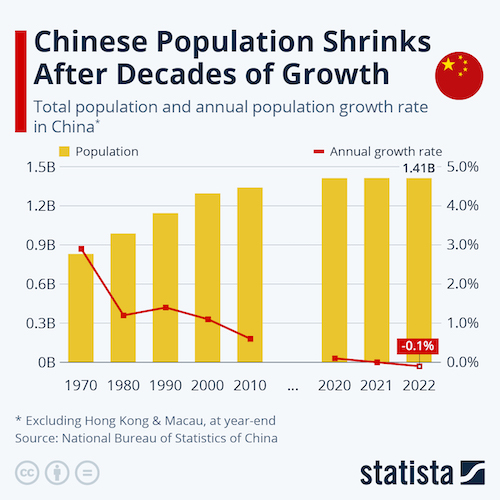

- China’s population shrank last year for the first time since the early 1960s, the latest evidence of a worsening demographic crisis for the world’s second-largest economy.

- China’s industrial production expanded 1.3% year over year in December, the weakest growth since May.

- Two-thirds of private and public sector economists polled at this week’s World Economic Forum in Switzerland expect a global recession this year.

- The International Monetary Fund is warning that fragmented international cooperation could significantly lower economic output over the long term.

- Unemployment should stabilize around the world this year and next despite a sharp economic slowdown, experts say.

- The EU is advancing plans to push back against U.S. clean-tech tax breaks with its own new funding and subsidy rules.

- Ryanair says strong demand across Europe and the U.K. drove its best-ever sales last weekend, exceeding the pre-pandemic record by 25%.

Some sources linked are subscription services.