MH Daily Bulletin: January 20

News relevant to the plastics industry:

At M. Holland

- M. Holland is the headline sponsor for AMI’s Thermoplastic Concentrates in Orlando on Jan. 24-26. Stop by Booth #16 to speak with our experts and attend a talk on regulatory compliance changes by Christopher Thelen, M. Holland’s Senior Regulatory Specialist, on Jan. 24 at 4:20 pm.

- M. Holland will be exhibiting at MD&M West in Anaheim on Feb. 7-9. Stop by Booth #4115 to meet our Healthcare team and discuss how M. Holland’s line of medical-grade resins can help you develop safe and effective medical products and packaging.

- 2022 was a difficult year for supply chains, with 3D printing, Color & Compounding and Rotational Molding all weathering challenges to keep inventories up to date. Click here to read what M. Holland’s market managers had to say about their predictions for the three industries in 2023.

Supply

- Oil rose 1% Thursday, extending a rally fueled by rising demand from China.

- In mid-morning trading today, WTI futures were up 0.8% at $80.95/bbl, Brent was up 0.8% at $86.83/bbl, and U.S. natural gas was up 3.2% at $3.38/MMBtu.

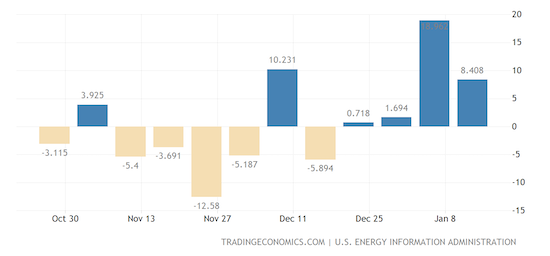

- U.S. crude stocks unexpectedly rose by 8.4 million barrels last week, according to the Energy Information Administration.

- A nationwide strike against pension reform in France Thursday led to a substantial fall in electricity output and halted deliveries from refineries operated by TotalEnergies and Esso.

- Global oil demand rose by 1.7 million bpd in November to the highest level since February, boosted by solid demand in China, India and Japan, the latest figures show.

- China’s fuel exports surged in December after authorities raised quotas for refineries to close out 2022.

- Net profit at most of China’s largest state-owned oil and gas firms jumped by at least 60% last year, according to initial data.

- Reports suggest the U.S. administration would oppose lowering the current G7 price cap of $60/bbl on the price of Russian oil, even as some countries seek to squeeze Moscow’s revenues further.

- Landlords in New York City are bracing for collective fines of up to $200 million from a new emissions law set to take effect in 2024.

Supply Chain

- U.S. intermodal volumes fell 9.2% for the first two weeks of 2023.

- The Port of Virginia handled a record 3.7 million TEUs last year, up 5.1% from 2021 as more traffic was diverted from West Coast ports due to uncertain labor conditions. The Port of Houston and ports in Georgia also saw record annual throughput.

- Canada’s eastern Port of Halifax surpassed 600,000 TEUs for the first time in 2022.

- The world’s three vessel-sharing alliances have canceled 53 Asia-to-Europe services this year, representing 27% of originally scheduled capacity.

- Falling container-shipping spot prices indicate that shippers are in a strong position heading into contract negotiations.

- Tepid demand and a strong dollar are pulling down Latin American air cargo rates during a historically strong Valentine’s Day season.

- Mexico is moving forward with a plan to move all cargo flights out of Mexico City’s major airport, the country’s largest, to a new site on the outskirts of the city.

- Business travel to Mexico more than doubled in 2022 from the prior year, boosted by companies nearshoring operations to strengthen supply chains.

- U.S. regulators are warning Class I railroads of enforcement action if the carriers fail to improve their training and certification programs.

- Walmart plans to expand its program that trains store workers as truck drivers.

- Ryder Systems will cut over 800 jobs in Texas after losing major customer Applied Materials.

- Warehouse lessor Prologis, experiencing a nearly 99% occupancy rate at its properties, expects warehouse rents to rise 10% or more in 2023.

- U.S. high schools are struggling to obtain sports equipment due to supply-chain issues.

- In the latest news from the auto industry:

- Uber is working with automakers to design lower-cost electric vehicles tailored for its ride-hailing and delivery business.

- Hertz launched a new program that works with municipalities to introduce more rental electric-vehicles and build out local charging infrastructure.

- Toyota is limiting orders for its Lexus luxury cars in Japan due to semiconductor shortages.

- Electric-vehicle battery startup Britishvolt filed for the British equivalent of bankruptcy protection.

- A deal to overhaul the alliance between Renault and Japanese partner Nissan could be announced as soon as February, according to reports.

- Electric-bus-maker Proterra plans to cut hundreds of jobs and combine bus and battery production in South Carolina as it looks to trim costs.

- Volvo took an undisclosed stake in Canadian self-driving technology-maker Waabi Innovation.

Domestic Markets

- The U.S. reported 88,981 new COVID-19 infections and 1,285 virus fatalities Thursday.

- The Treasury Department began taking special measures to keep paying the government’s bills Thursday as the U.S. bumped up against its $31.4 trillion borrowing limit, kicking off a potentially lengthy debate in Congress over raising the debt ceiling.

- A “soft landing” for the U.S. economy is becoming more likely, according to top Federal Reserve officials

- JPMorgan Chase expects the U.S. Federal Reserve to hike interest rates beyond 5% this year due to strong underlying inflation.

- The share of unionized U.S. workers fell to a record low 10.1% in 2022 even as unions added more members than in any year since 2008.

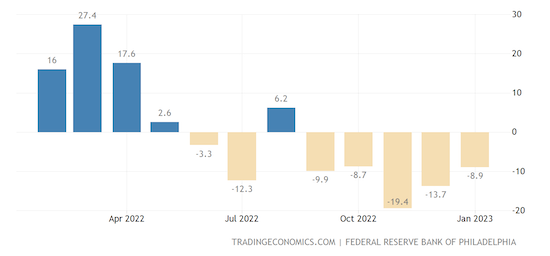

- U.S. manufacturers probably entered a recession in the fourth quarter, analysts say. The Philadelphia Fed’s gauge of East Coast manufacturing activity remained negative for the fifth straight month in December, signaling contraction:

- Google became the latest tech behemoth to cut jobs, announcing this morning that it will lay off 12,000 employees, or 6% of its workforce.

- Capital One cut 1,100 positions in its technology segment this week, while reports suggest Bank of America froze most hiring.

- Wayfair plans to lay off over 1,000 workers as the online furniture seller confronts shrinking sales after a pandemic-driven boom.

- WeWork plans to eliminate 300 job roles across countries as part of efforts to cut back on underperforming locations.

- Nordstrom slashed its annual profit forecast after heavy discounting failed to spur demand at its off-price Rack stores, leading to weak holiday sales.

- Proctor & Gamble saw sales fall 6% in the latest quarter but said that it plans to continue raising prices due to pressure from high commodity costs.

- T-Mobile says it expects to incur significant costs related to a January cyberattack involving data from 37 million accounts.

- U.S. building permits fell 1.6% in December to an annual rate of 1.33 million units, the lowest level since May 2020:

- On a bright note, single-family homebuilding rebounded for the month.

International Markets

- In the latest China news:

- China said its COVID-19 hospitalizations jumped by 70% last week to a total of 63,307, what would be the highest weekly tally of the pandemic.

- China this week kept benchmark lending rates unchanged at 3.65% for a fifth consecutive month, meeting market expectations.

- More than 1 million people, many of them workers, took to the streets of France Thursday to protest pension reform. Key services such as transport, utilities and education were severely disrupted.

- Core inflation in Japan reached a fresh 41-year high of 4% in December, adding pressure on the Bank of Japan to unwind its decade-long monetary easing.

- South Korea’s export-dependent economy likely shrank in the fourth quarter on weak foreign demand and rising interest rates. On a positive note, the nation’s producer inflation dropped to the lowest level in almost two years in December.

- LATAM Airlines, South America’s largest carrier, expects revenue to grow up to 21% this year as pent-up demand is unleashed.

- German carrier Lufthansa is bidding for a stake in ITA Airways, the successor carrier to Alitalia. The move is likely the beginning of what could be significant consolidation in the European aviation industry this year.

- Airbus will carry out design changes to its A350 passenger jets in response to a $2 billion dispute with Qatar Airways over surface damage.

Some sources linked are subscription services.