2023 Market Insights: 3D Printing, Color & Compounding and Rotational Molding

Every year, M. Holland’s market managers take time to reflect on the major trends of the past 12 months and share predictions and advice for the coming year. In the first installment of our 2023 Market Insights series, we spoke with Carlos Aponte, Scott Arnold and Bill Christian — M. Holland’s market managers for the 3D Printing, Color & Compounding and Rotational Molding markets, respectively — about their expectations for the industry in 2023.

Though all three markets weathered recent supply chain disruptions, inventories are finding balance as we enter 2023. Now, 3D printers, compounders and molders are focusing on expansion.

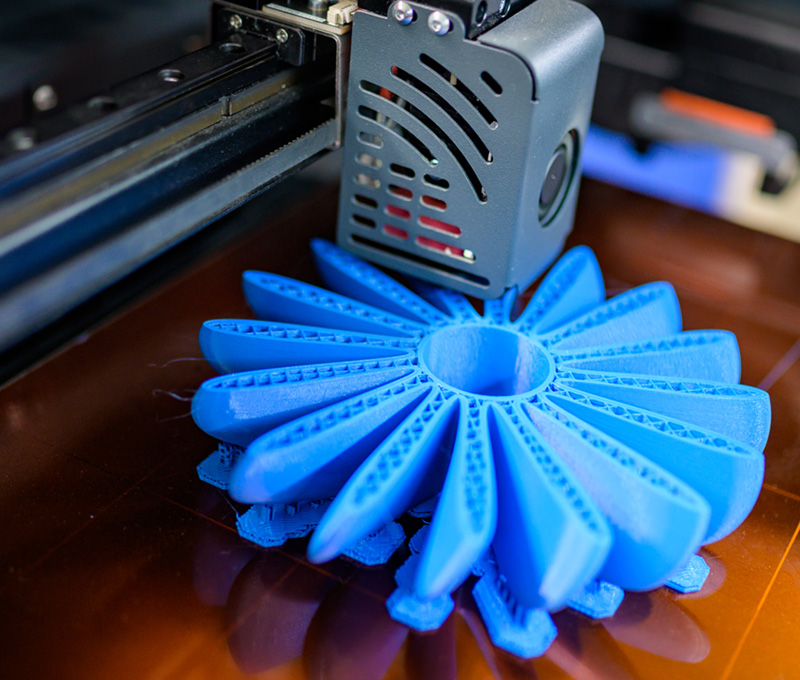

3D Printing: Full Production Applications Increase Industry Adoption

As 3D printing technology evolves and becomes more cost-competitive, manufacturers are more broadly incorporating additive manufacturing into their operations. Process and material innovation has advanced 3D printing beyond prototyping, allowing for full production applications. This is driving greater adoption and integration into manufacturing facilities, research and development centers, quality laboratories, engineering centers, and design houses.

Carlos Aponte, M. Holland’s 3D Printing Market Manager, expects the accelerated adoption of new additive manufacturing applications to benefit the plastics market in multiple ways. As processes and materials continue improving throughout 2023, he expects fast prototyping to extend beyond just form and fit evaluations. Going forward, applications will take into consideration form, fit and function.

As original equipment manufacturers (OEMs) take advantage of 3D printing’s expanding functionality, Carlos predicts the industry will see new additive manufacturing facilities opening this year. But small run sizes, minimum purchase requirements and tool, mold and fixture retention all pose barriers to efficiency and profitability.

To overcome these barriers, 3D printers opening new facilities should evaluate equipment and materials for individual applications. “3D printers are often pressured by equipment manufacturers to use their materials and ancillary products, which may not be ideally suited to the need,” Carlos explained. “There are a lot of equipment and materials options today, so employing an agnostic approach and evaluating each application individually will help determine the most effective solution.”

A solid partnership is key to successfully adopting new technology. To explore M. Holland’s additive manufacturing capabilities and offerings, visit the 3D Printing market page.

Color & Compounding: Consolidation Creates Sourcing Challenges

The Color & Compounding market has dealt with supply shortages for months, but that has not deterred private equity interest in the space. When consolidation takes place, the surviving entities are often cutting back on sales and support functions to reduce cost and reduce redundancy. And according to Scott Arnold, M. Holland’s Color & Compounding Market Manager, many compounders are prioritizing higher valued customers.

“Low-margin molders are struggling to find new compounding sources as compounders make a long-term play for bigger business opportunities,” Scott explained. “While it’s great that private equity sees value in the color and compounding space, the consolidation is making sourcing difficult for smaller converters.”

Sourcing had already been a persistent problem for many as resin, additive and pigment shortages frustrated compounders through the COVID-19 pandemic. Demand continued to outpace supply for much of 2022 as geopolitical tension in Europe and Asia disrupted already fractured supply chains. Fears of a looming recession and rising interest rates are beginning to slow demand. Scott predicts recessionary planning will limit longer-term orders for resin and help to balance the market in 2023.

“Inventory has largely caught up to demand as warehouses have filled,” Scott said. “In 2023, I expect customers to tighten their belts further to conserve cash due to recessionary fears and work to unload excess inventory.”

Moving forward, Scott recommends customers continue to dual-source resins despite the recent reprieve. Learn how M. Holland can help on the Color & Compounding market page.

Rotational Molding: Automation Powers High Market Growth

In the rotational molding space, increased labor costs and supply chain issues stressed molder margins in 2022. Economic conditions have caused rotational molders to eliminate lower-margin product lines, reevaluate short run rates and decrease the production of complex parts. This effect has led impacted OEMs to open new manufacturing facilities, which has caused increased pressure on machine and equipment suppliers.

Bill Christian, M. Holland’s Product Manager for Rotational Molding, predicts that worker scarcity will significantly impact business. “Due to labor shortages, processors are beginning to embrace automation with primary machinery and secondary operational equipment to fill the gaps,” Bill said. “Automation efforts will likely grow in 2023 as new molders develop manufacturing processes without access to the volume of labor that supports more traditional methods.”

Although many costs were passed through, increased labor costs and supply chain issues continue to stress operations. But relief is coming to the market. “The first three quarters showed constrained material supply and high demand,” Bill said. “However, we project an ebb in demand, back to a pre-pandemic level, coupled with additional PE capacity looming, which most molders hope will provide price relief.”

M. Holland’s focus on developing sales and technical expertise continue to drive our strategy to offer consultative support within the rotational molding community. Visit the Rotational Molding market page for more information.

New Year, New Opportunity

Despite labor and material shortages, a potential recession and changing manufacturing processes, the 3D Printing, Color & Compounding and Rotational Molding markets continue to grow. Stay tuned for upcoming installments of the 2023 Market Insights Series featuring commentary from M. Holland’s other market groups to see how the Automotive, Electrical & Electronics, Healthcare, Packaging, Sustainability and Wire & Cable markets are likely to perform in the year to come.

If you enjoyed this post, please check out some additional posts:

- M. Holland’s 2023 Plastics Industry Trends & Predictions

- 2023 Market Insights: Healthcare, Packaging and Sustainability

- 2023 Market Insights: Automotive, Electrical & Electronics and Wire & Cable

- Inflation Reduction Act Will Spark North American Manufacturing Renaissance

- Plastics Reflections Webinar: Macroeconomics, The Plastics Industry and Riding Out a Possible Recession

- Integrating Masterbatch PCR Carrier Resins to Support Sustainability Goals

- M. Holland Company Collaborates with LyondellBasell to Distribute Purell Medical-Grade Resins

- M. Holland Company Offers Post-Consumer Recycled Resins to Help Brands Meet Sustainability Goals