MH Daily Bulletin: January 25

News relevant to the plastics industry:

At M. Holland

- M. Holland will be exhibiting at MD&M West in Anaheim on Feb. 7-9. Stop by Booth #4115 to meet our Healthcare team and discuss how M. Holland’s line of medical-grade resins can help you develop safe and effective medical products and packaging.

- M. Holland announced the restructuring of its leadership team to support accelerated growth and the next phase of the company’s evolution. Click here to read the full press release.

- Supply chain disruptions and balancing customer demand with available materials proved to be challenging across healthcare, packaging and sustainability in 2022. Click here to read what our market managers had to say about their predictions for the three industries in 2023.

Supply

- Oil fell 2% Tuesday on concerns about a global economic slowdown and a larger-than-expected build in U.S. crude stocks last week.

- In mid-morning trading today, WTI futures were up 1.1% at $81.00/bbl, Brent was up 0.7% at $86.74/bbl, and U.S. natural gas was down 4.6% at $3.10/MMBtu.

- U.S. crude stocks rose by 3.38 million barrels last week, according to the American Petroleum Institute. Government data is due today.

- U.S. oil and gas dealmaking declined by 13% in 2022 to its lowest level since 2005.

- Halliburton will hike its dividend by 33% after handily beating estimates for fourth-quarter earnings.

- OPEC+ is expected to keep its current levels of oil production when delegates meet next week, reports suggest.

- A wave of freezing weather in Asia is set to boost energy demand across the continent, especially for coal.

- New data show Chinese buyers account for 40% of recent long-term LNG contracts among global players.

- More news related to the war in Ukraine:

- Germany will spend more than $18 billion on its electricity price cap subsidies through May of this year, officials predict.

- Britain’s government borrowed $33.97 billion in December, the most in three decades, reflecting the huge cost of energy support and soaring interest on debt.

- India has become the largest seaborne importer of Russian crude, according to a new study.

- Angola’s 200,000-bpd Dalia offshore oilfield will shut down for a month in February as it undergoes maintenance.

- Uganda began drilling at its first commercially viable oil operation this week, officials said.

- Climate goals and the global energy crisis are pushing countries to double the lifespan of their nuclear reactors.

- Centrica, the U.K.’s biggest household energy supplier, plans to turn an idled gas-fired power station into a renewables hub in a push to move away from fossil fuels.

Supply Chain

- Tornados and severe weather hit the Gulf Coast yesterday, leaving thousands in the Houston area without power and damaging homes and businesses, including Shell Chemicals’ Deer Park site.

- French railway workers called for three more strikes through February to protest the nation’s pension reforms.

- The Baltic Exchange’s main sea freight index extended losses Tuesday to a 2.5-year low, dragged down by a dip in capesize and panamax rates.

- More smaller package-delivery companies are expanding their U.S. operations to carve away business from market heavyweights dealing with rising costs and labor uncertainty.

- Freight forwarders are increasingly hiring their own aircraft to build streamlined air cargo gateways at smaller, regional sites across the U.S.

- Global orders for new cargo ships declined 39% in 2022, according to shipping services firm Clarksons.

- Port Houston and the Port of Mobile, Alabama, saw record container volume in 2022.

- Georgia’s Port of Savannah imported 217,628 TEUs in December, down 8.7% from a year earlier.

- Container lines are shifting capacity to Vietnam as more manufacturing moves into the country.

- J.B. Hunt says it expects a rebound in its intermodal segment this year even as some shippers avoid rail over concerns about service.

- Union Pacific saw quarterly net income fall 4% on impacts from delayed shipments, labor shortages and Winter Storm Elliott.

- Uber Freight will lay off 150 employees, or 3% of its workforce, as economic uncertainty hammers demand for shipping services.

- Penske Truck Leasing says it is seeing performance gains, lower maintenance costs and reduced emissions after switching its California locations to renewable diesel.

- In the latest news from the auto industry:

- Tesla will invest $3.6 billion in two new Nevada factories to build electric-vehicle batteries and electric semitrucks.

- Ford is in talks with Chinese electric-vehicle-maker BYD over the sale of a manufacturing plant in Germany, according to reports.

- Honda plans to create a new division in April in a bid to strengthen and speed up its electrification business.

- Heavy-duty truck maker Paccar posted record annual revenue and net income in Q4 and for the full year.

- Maruti Suzuki India, the nation’s biggest automaker, doubled its profit in the latest quarter on strong demand for passenger vehicles.

- Japanese electric-motor maker Nidec slashed its full-year profit forecast by nearly half amid a slower-than-expected recovery in the global auto industry.

- Lithium prices have more than doubled in the past year and are up nearly ninefold in the past three years.

Domestic Markets

- The U.S. reported 28,949 new COVID-19 infections and 272 virus fatalities Tuesday.

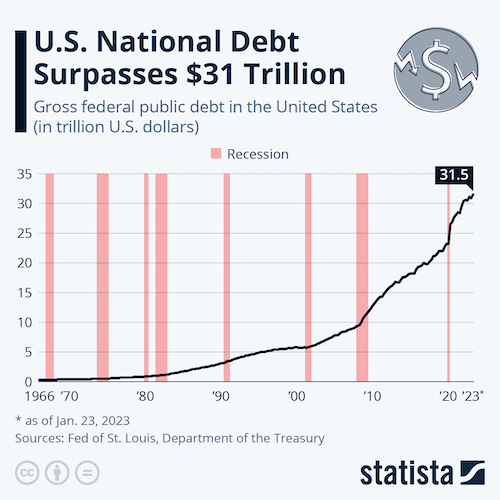

- The U.S. administration suspended daily reinvestments in a large government retirement fund Tuesday, another extraordinary cash management measure aimed at avoiding breaching the federal debt limit.

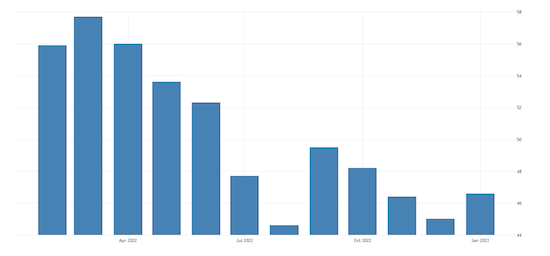

- S&P Global’s composite index of U.S. business activity hit 46.6 in January, a slightly slower pace of contraction from December’s reading of 45.

- A gauge of business activity in the Philadelphia region was negative for the fifth straight month in January.

- In the latest news from quarterly earnings season:

- Microsoft topped estimates on a 38% sales boost in its cloud-services business even as demand slumped for its personal-computer and corporate software. Overall sales growth was the slowest in six years, the company said.

- Logitech’s sales fell 22% on a downturn in spending by business customers.

- Chipmaker Texas Instruments saw revenue fall 3% on weak performance in most segments except for auto.

- U.S. credit card companies are forecast to post their slowest growth in seven quarters amid slowing consumer demand.

- General Electric exceeded earnings forecasts on robust demand for jet engines and power equipment but gave a disappointing full-year outlook as problems persist at its renewables business.

- Lockheed Martin forecast annual profit below Wall Street expectations on impacts from lingering supply-chain bottlenecks and higher costs.

- Defense contractor Raytheon Technologies saw boosted demand for its jet engines, parts and services, which led to a 60.7% jump in operating profit.

- U.S. homebuilder D.R. Horton beat estimates as demand outpaced supply due to raw material and labor shortages.

- Verizon forecast lower annual profit as the pandemic-led boom in wireless customer growth fizzles out and the company makes heavy investments in 5G technology.

- Property and casualty insurer Travelers Companies reported a 37% profit decline, hurt by losses from Winter Storm Elliott.

- The share of remote jobs on digital job sites is shrinking fast as more companies step up their return-to-office policies.

- Eli Lilly plans to invest an additional $450 million to expand capacity of a plant in North Carolina.

- Amazon is offering a $5 monthly subscription plan for U.S. Prime members that will cover a range of generic drugs and their doorstep delivery, furthering the e-commerce giant’s push into healthcare.

- Serta Simmons Bedding, which accounts for nearly 20% of U.S. bedding sales, has filed for bankruptcy protection amid slowing consumer demand.

International Markets

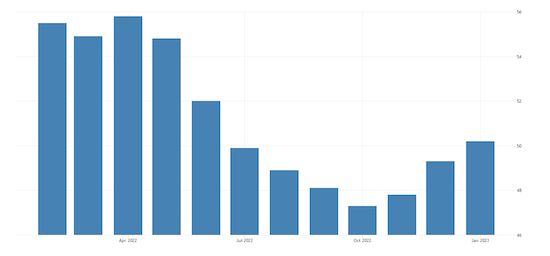

- S&P Global’s composite index of European business activity rose to 50.2 in January, signaling expansion and raising hopes that the region might escape recession.

- British private-sector activity fell at its fastest rate in two years in January, according to S&P Global.

- Mexico’s headline inflation hit 7.94% in the first half of January, rising slightly from the previous month for the first monthly pickup since September.

- Economies in the six-member Gulf Cooperation Council will grow this year at half the rate of 2022 as oil revenues take a hit from a global slowdown, economists say.

Some sources linked are subscription services.