MH Daily Bulletin: January 31

News relevant to the plastics industry:

At M. Holland

- M. Holland will be exhibiting at MD&M West in Anaheim on Feb. 7-9. Stop by Booth #4115 to meet our Healthcare team and discuss how M. Holland’s line of medical-grade resins can help you develop safe and effective medical products and packaging.

- Every year, M. Holland’s market managers take time to reflect on the major trends of the past 12 months. Click here to read M. Holland’s 2023 Plastics Industry Trends & Predictions, including business insight and recommendations for the 3D printing, automotive, color and compounding, electrical and electronics, healthcare, packaging, rotational molding, sustainability, and wire and cable markets.

- Automotive, Electrical & Electronics and Wire & Cable were top performers in 2022 as electrification incentives and digitalization efforts expanded market opportunity. Click here to read 2023 predictions from our market managers for these three markets.

Supply

- Oil dipped 2% Monday, extending losses as traders expect a round of interest-rate hikes by major central banks to weigh on demand.

- In mid-morning trading today, WTI futures were up 0.6% at $78.40/bbl, Brent was down 0.5% at $84.50/bbl, and U.S. natural gas was up 0.1% at $2.68/MMBtu.

- The refining maintenance season is expected to keep prices of refined products such as diesel high through the second quarter, analysts say.

- Oil and gas operators in Texas are preparing for severe winter weather this week with snow and ice expected in many parts of the state, including the Permian Basin.

- Texas produced a record 11.2 trillion cubic feet of natural gas in 2022 and is expected to further boost output this year, according to a trade group.

- Exxon Mobil earned $56 billion in 2022, shattering the previous record for annual earnings by any Western oil company.

- BP projects global oil demand to peak between the late 2020s and early 2030s due to falling use of oil in road transport and greater renewables capacity.

- Saudi Arabia may cut prices for crude grades sold to Asia for the fourth consecutive month in March, as low premiums and oversupply worries persist despite demand recovery in China.

- GAIL India, the nation’s largest gas distributor, reported a 93% drop in quarterly profit due to lower gas sales and supply disruptions, including Russia’s failure to deliver LNG cargoes after tightened Western sanctions.

- More news related to the war in Ukraine:

- Russia’s seaborne oil flows are rising as it pushes more cargoes onto the water after Germany and Poland halted piped imports.

- German industry could pay 40% more for energy in 2023 than in 2021, impacting corporate profits across Europe and suppressing investment, traders say.

- The IFA-1 interconnector, a key power cable linking Britain and France, has been used at full capacity for the first time since a fire shut it down in 2021, easing pressure on the countries’ strained power grids.

- JFK Airport’s new Terminal One will have the largest rooftop solar array on any U.S. airport, with 13,000 panels feeding into an 11.34 MW microgrid designed to help it meet 70% renewable generation by the end of the decade.

- The new government in Colombia, Latin America’s third largest oil producer, banned fracking and hopes to end exploration with the aim of transitioning the country to all renewable energy in 15 years. It has not indicated how it will replace oil revenues, which comprise a third of the nation’s export earnings.

- Venezuela’s state-owned oil firm PDVSA imposed tougher prepayment rules for its oil, requiring cargoes to be paid in cash or in goods and services before loadings can take place.

Supply Chain

- Over 40 million people from Texas to West Virginia are under winter weather alerts as a major system threatens to disrupt transport across the region.

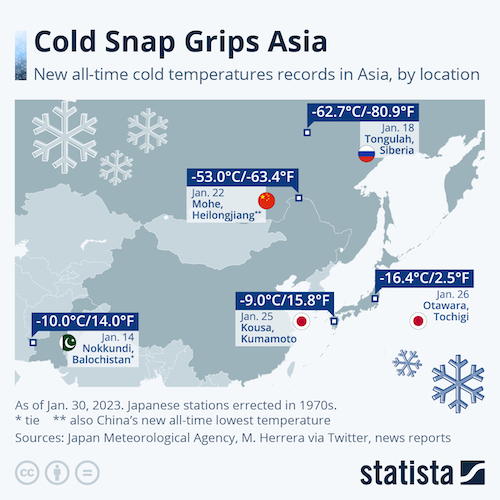

- Central and Eastern Asia saw all-time cold temperatures over the past two weeks:

- Less-than-truckload carriers are adding handling capacity ahead of an expected rebound in trucking demand after the current downturn.

- Hong Kong’s main airport moved 351,000 metric tons of cargo in December, a 26.4% decline from a year earlier.

- Cargo airline Ameriflight ordered 20 autonomous feeder aircraft from startup Natilus.

- The Las Bambas copper mine in Peru, supplier of 2% of the world’s copper, may have to halt production starting Feb. 1 due to widespread political protests, impacting the already tight global supply of copper.

- Memory chip-makers including Micron, SK Hynix, Western Digital and Kioxia Holdings are reducing investments or cutting output to address a supply glut in the semiconductor market.

- Apple supplier Jabil started making AirPods components in India, marking a step forward in Apple’s efforts to expand production in the country to reduce its reliance on China.

- In the latest news from the auto industry:

- General Motors beat analyst expectations for revenues and earnings in the fourth quarter and forecast robust growth in the year ahead.

- Toyota sold 10.5 million vehicles in 2022, retaining its title as the world’s top-selling automaker for a third consecutive year, despite a 9.6% dip in its home market and some chip-related supply constraints.

- Ford is lowering the prices of its electric Mustang Mach-E crossover by up to 8.8% to keep the model competitive in a rapidly changing electric-vehicle market.

- Nissan and Renault agreed to restructure their two-decade-old alliance, making them equal partners by reducing Renault’s stake in Nissan to 15% and putting 28% of the Japanese automaker in a French trust.

- Volkswagen’s Czech subsidiary Skoda Auto is cutting production due to chip shortages.

- BYD, the largest Chinese seller of electric and hybrid vehicles, expects its 2022 net profit to surge over fivefold from the previous year on strong sales growth and reduced cost pressure.

Domestic Markets

- The U.S. reported 27,077 new COVID-19 infections and 210 virus fatalities Monday.

- The U.S. administration says its COVID-19 emergency declarations will end May 11, 2023, nearly three years after they were imposed, with the costs of COVID-19 tests and medicine transferring to private and government health insurance plans.

- Inflation is taking a toll on U.S. consumer spending, evidenced by falling retail purchases, flat services spending, and unexpectedly slow sales in the housing and auto industries.

- In the latest news from quarterly earnings season:

- Whirlpool reported a 15% sales decline and a $1.6 billion net loss in the fourth quarter after divesting its European business and grappling with supply-chain issues.

- Sherwin-Williams posted disappointing earnings guidance amid macro pressures from the slowing U.S. housing market and persistent inflation.

- Pfizer reported strong fourth-quarter results, but its forecast for 2023 fell well below analyst expectations on flagging sales of its COVID-19 vaccine.

- McDonald’s posted strong fourth-quarter earnings, helped by price increases that offset rising costs.

- Amgen laid off 300 employees in the U.S., or 1.2% of its workforce, due to pressure from rising interest rates and declining demand in the post-pandemic healthcare sector.

- Philips plans to cut 6,000 jobs worldwide by 2025, equating to 13% of its workforce, as it becomes the latest tech company cutting costs due to tougher economic conditions.

- Citizens Financial Group is substantially reducing its auto lending portfolio as the bank becomes cautious on certain business amid recession risks.

- Boeing is reactivating its third 737 MAX production line and will add a fourth line in mid-2024 to meet strong demand for the aircraft.

- Analysts at Jefferies estimate that the U.S. is short 10,000 pilots, a gap that could take five years to close.

- A U.S. appeals court rejected Johnson & Johnson’s attempt to transfer thousands of talc lawsuits into bankruptcy court, the first significant rejection of the risk mitigation legal strategy and a potential disruption of U.S. corporate liability law.

International Markets

- China says its COVID-related clinic visits dropped about 40% during the Lunar New Year despite a 56% increase in domestic and international travel.

- The World Health Organization says COVID-19 continues to be a public health emergency of international concern as many countries reach a transition point that requires careful management to mitigate further impacts.

- The International Monetary Fund raised its growth outlook for 2023 to 2.9% based on “surprisingly resilient” economic activity in the U.S. and Europe.

- The European Commission’s economic sentiment index rose to a seven-month high in January amid increased optimism across all sectors except construction, while inflation expectations among consumers and companies both fell sharply.

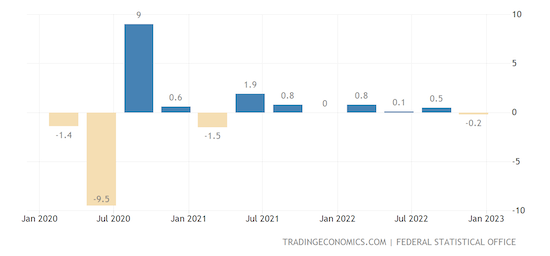

- Germany’s economy unexpectedly shrank 0.2% in the fourth quarter of 2022, signaling a potential shallow recession, with economists predicting another contraction in the first quarter of 2023.

- Spain’s consumer prices rose 5.8% year over year in January, the first increase in six months due to higher fuel prices.

- Three years after Brexit, Britain has yet to benefit from its promised dividends as it underperforms its peers in trade, investment and economic recovery from the pandemic.

- China’s fiscal revenue rose 0.6% in 2022, down sharply from 10.7% the prior year, as the government granted $843 billion in tax rebates to support its COVID-ravaged economy.

- India is considering tariffs and non-tariff measures to cut imports of non-essential goods due to trade imbalances and to reduce its massive trade deficit with China.

- Walmart plans to spend $2.5 billion to boost its presence in India’s e-commerce market.

- Hong Kong’s exports fell 28.9% in December, the steepest decline in nearly 70 years.

- Ryanair reported a record after-tax quarterly profit and has “very robust” bookings for Easter and summer flights, boosted by demand from Asian travelers and a strong U.S. dollar.

Some sources linked are subscription services.