MH Daily Bulletin: July 26

News relevant to the plastics industry:

At M. Holland

- M. Holland has obtained Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) compliance for its Mtegrity™ line of materials. Click here to read the full press release.

- Plastics News has recognized four M. Holland Mployees as Women Breaking the Mold in the industry in 2022! Learn more about Tracy Conrady, Daisy Serdan Corona, Suky Lawlor and Lindy Holland Resnick.

Supply

- Oil prices rose 2% in volatile trading on Monday, bolstered by supply fears. Falling U.S. gasoline demand pushed the spread between Brent and WTI to $8, a three-year high.

- In mid-day trading today, WTI futures were down 1.6% at $95.18/bbl, Brent was down 0.8% at $104.40/bbl, and U.S. natural gas was up 2.5% at $8.94/MMBtu.

- OPEC+ saw an output shortfall of 2.84 million bpd in June as members fell further behind on quotas due to a lack of capacity and investment, delegates said.

- Global refiners could soon cut gasoline output following the sudden slump in prices the past two weeks, analysts say.

- The world’s four largest oil firms are poised for a record-breaking $50 billion in profits in the second quarter, higher than in 2008 when oil prices reached $147/bbl.

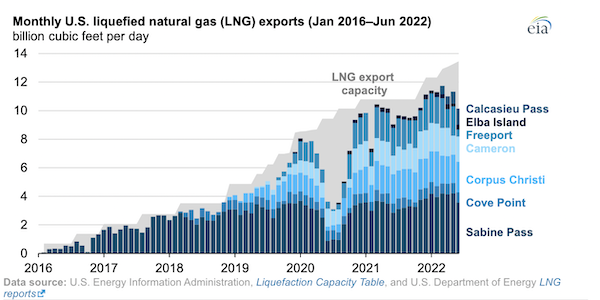

- The U.S. became the world’s largest LNG exporter in the first half of 2022 on a 12% rise in shipments from the second half of 2021, according to the EIA.

- More oil news related to the war in Europe:

- Russia will slash flows on the Nord Stream gas pipeline to Germany to just 20% of capacity starting Wednesday amid doubted claims of equipment malfunctions. The news sent European gas prices up 10% Monday and will likely propel prices even higher as countries work to hoard more supplies for winter.

- Russia’s seaborne crude exports fell 13% since mid-June on as much as a 40% decline in shipments to top buyers China and India, according to shipping data.

- Amid backlash from countries including France, EU policymakers may soften a plan to require sharp cuts in gas usage through winter, with agreement on a deal potentially coming today.

- Ukraine’s state-run oil and gas firm Naftogaz is working on a new debt-relief plan after failing to get approval from bondholders to freeze payments on $1.4 billion worth of bonds.

- Euro zone imports rose 52% in the 12 months ending in May, primarily due to rising energy costs.

- Libya’s National Oil Corporation aims to restore production to 1.2 million bpd in two weeks from the current 860,000 bpd.

- Shell is moving forward with its Jackdaw natural-gas development in the British North Sea, which could produce over 6% of the region’s gas by 2025.

- Sri Lanka will restrict fuel imports for the next 12 months due to a lack of foreign exchange dollars.

- South Africa, attempting to resolve a chronic power shortage, could soon allow private firms to build more power plants and households to profit from supplying energy to the grid.

- Guyana, the world’s fastest growing economy, plans to use its newfound oil and gas wealth to fund investments in other sectors to reduce its dependence on hydrocarbons, the government said.

Supply Chain

- Temperatures in Portland, Oregon, could top 100°F amid a scorching U.S. heatwave that is set to reach its peak in the Pacific Northwest today.

- Central California’s Oak Fire spread to 17,000 acres Monday with just 10% containment, forcing thousands of people to evacuate.

- On Monday, truckers stood down from protests that halted operations at the Port of Oakland for much of the past week, although the sudden resumption of operations created traffic jams in and around the port.

- Shenzhen officials told 100 major firms, including iPhone maker Foxconn, to set up “closed-loop” systems for workers as the south China manufacturing hub battles a COVID-19 outbreak.

- One in six German firms surveyed say high energy prices are forcing production cutbacks.

- Nearly 2,500 Boeing workers in St. Louis announced plans to strike starting Aug. 1 over a contract dispute.

- High inventory levels combined with sluggish order growth will take a hit to U.S. manufacturers’ second-half revenue, analysts say.

- Over 20% of supply-chain executives surveyed expect disruptions to continue until the second half of 2023, according to Carl Marks Advisors.

- The average age of cargo vessels across the globe has increased by two years since 2017.

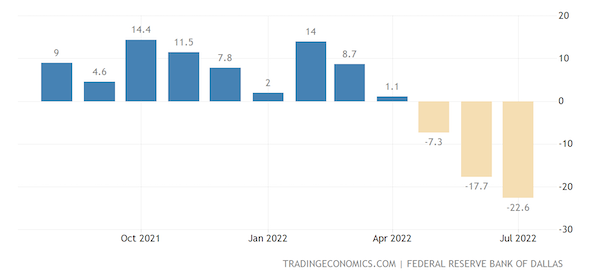

- The Dallas Fed’s gauge of manufacturing activity in Texas fell to -22.6 in July from -17.7 in June, the lowest since the start of the pandemic:

- In the latest news from the auto industry:

- GM reported a 40% drop in its second quarter earnings due to losses in China and supply chain challenges.

- Toyota has stopped taking orders for its Harrier SUV due to lingering fallout from this year’s lockdowns in Shanghai. Separately, the automaker is considering a plan to support the energy bills of its cash-strapped suppliers in a bid to keep production steady.

- The U.S. Energy Department will loan $2.5 billion to GM to help build three battery-cell factories in Ohio, Tennessee and Michigan, part of the administration’s plan to jump-start the electric vehicle market.

- Buick and Cadillac are aiming for fully electric vehicle lineups by 2030.

- Redwood Materials’ $3.5 billion factory under construction in Northwest Nevada will be one of the first U.S. facilities to produce key ingredients for electric vehicle batteries.

- Dutch semiconductor maker NXP, the world’s second-largest chip supplier for the auto industry, raised its current-quarter revenue guidance on signs of strong demand for vehicle components.

- Harley Davidson says supplier issues that caused a two-week production shutdown in May raised its order backlog and could spur revision of the firm’s 2022 earnings guidance.

- After weeks of uncertainty, the U.S. Senate is set to vote this week on a massive bill to support advanced technology, including $52 billion for domestic semiconductor production.

- Intel’s year-old chip foundry unit, which supplies computer chips to other firms that design them, signed one of its largest deals with Taiwan-based MediaTek Monday.

- Appliance maker Whirlpool cut its 2022 profit outlook as higher costs and reduced sales volumes weigh on its North America business. The firm also suffered a $371 million loss tied to its exit from Russia in the latest quarter.

- Higher prices boosted Unilever’s second-quarter sales even as volumes slipped by 2.1%, as the consumer-goods maker lost ground to less expensive generic store brands.

- Target is expanding its sortation network by 50% with three new hubs in Chicago and Denver, part of the retailer’s plan to boost its same-day shipping service.

- Brazilian plane-maker Embraer delivered just 32 jets in the second quarter as its order backlog rose to $17.8 billion, a four-year high.

- California startup Zipline will soon launch Washington state’s first drone delivery service providing time-sensitive medical products to hospitals, labs and doctors’ offices.

- Bulk and cargo sailings from Russia are approaching pre-invasion levels, although container ship activity is failing to recover, new data show.

- Ukraine still hopes to export grain from Black Sea ports despite Russia’s bombing attack just a day after the two nations signed a deal for port protection.

Domestic Markets

- The U.S. reported 120,032 new COVID-19 infections and 365 virus fatalities Monday.

- More U.S. cities are considering mask mandates amid a broad rise in COVID-19 cases and hospitalizations. Los Angeles County, the nation’s most populous, could impose the measure as soon as Thursday.

- COVID-19 cases fell by 1.5% in New York state last week, signaling a potential plateau.

- All but two Florida counties are ranked “high” for risk of COVID-19 infection as cases remain elevated for the eighth straight week.

- An inflammatory complication found in children infected with COVID-19 has almost disappeared as the predominant U.S. virus strain transitions to BA.5.

- New research suggests taking COVID-19 antiviral pills, even when symptoms aren’t severe, significantly reduces the chance of hospitalization or death.

- A Monday ruling in federal court will allow Texas to keep its ban on school mask mandates.

- Slow patient uptake could result in a surplus of 70 million courses of Pfizer’s COVID-19 antiviral pill by year’s end, weighing on sales estimates.

- Almost 4 million Americans called in sick due to COVID-19 in the first work week of July, more than double the 1.8 million who called in sick in July 2021.

- Rising interest rates are upending the junk bond market, with junk-rated companies raising just $74 billion so far this year compared with $300 billion in 2021.

- A stronger U.S. dollar and varying central bank moves are making it harder for U.S. firms to hedge against currency risks, executives say.

- In June, U.S. companies borrowed 1% less for investments in equipment compared with the prior-year period, reflecting the recent rise in borrowing costs.

- About half of Americans over age 65 say they are unable to cover essential expenses due to surging inflation.

- The monthly mortgage payment on the average U.S. home was $1,613 in June, up 4.5% from a month ago and 62.2% from a year ago, according to Zillow.

- San Francisco home foreclosures rose 90% during the first half of 2022 compared with a year ago but remained below pre-pandemic levels.

- Walmart shares plummeted Monday evening after the retailer said full-year profit would decline up to 13% compared to the 1% fall it previously forecast. Surging prices for food and fuel prompted consumer cutbacks on discretionary purchases, while the firm expects to cut prices to reduce merchandise levels, further denting profit.

- Poor forecasts from top U.S. retailer Walmart ignited a sell-off in shares of major U.S. retailers late Monday, quickly evaporating over $100 billion in stock market value.

- Tesla recorded a $170 million impairment charge against the carrying value of its cryptocurrency and sold 75% of its Bitcoin holdings.

- Twitter reported a data breach impacting millions of subscribers, while T-Mobile agreed to a $350 million settlement for a massive data breach in 2021.

- MIT researchers say they developed a biodegradable form of silk that could be an alternative to microplastics in agriculture products, paints and cosmetics.

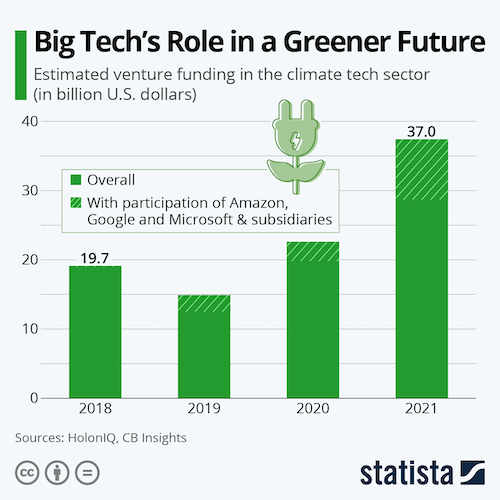

- Big tech companies are investing big dollars in startups focused on carbon reduction.

International Markets

- A “worrying increase” of COVID-19 outbreaks in Europe should spur countries to start preparing for rising infections in the fall and winter, officials said Monday. Virus hospitalizations in Europe doubled over the past six weeks.

- Australia’s COVID-19 cases and fatality rates were the third highest in the world per capita last week, when the nation saw record hospitalizations.

- China’s sluggish pace of vaccinating vulnerable populations will impede any departure from the cycles of mass testing and lockdowns that are hobbling the world’s second-largest economy, experts say.

- A gauge of German business confidence fell from 85.8 to 80.3 in July, marking the worst level since the early months of the pandemic. Industry groups warn the country is on the cusp of recession.

- British industrial output grew at the slowest pace in over a year in the three months to July, according to new data.

- Mexico’s economy likely expanded 0.8% from the first to the second quarter, marking the third straight quarter of growth despite impacts from the war in Ukraine and Chinese lockdowns.

- Unemployment among Chinese youth between ages 16 and 24 has surged to a record 19.3%, spelling trouble for the nation’s growth ambitions.

- Chinese imports of high-tech products and mechanical and electrical goods fell 8% in June and are poised to drop further this month, as the nation’s economic slowdown spills over into major exporters in Europe and East Asia.

- Ryanair posted a better-than-expected $174 million profit for the three months through June but said inflation and geopolitics could hurt its chances of returning to profitability for the full year.

- Ground staff at Lufthansa announced a one-day strike on Wednesday over wages, prompting the carrier to cut almost all mid-week flights in Frankfurt and Munich.

Some sources linked are subscription services.