MH Daily Bulletin: July 28

News relevant to the plastics industry:

At M. Holland

- M. Holland has obtained Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) compliance for its Mtegrity™ line of materials. Click here to read the full press release.

- Plastics News has recognized four M. Holland Mployees as Women Breaking the Mold in the industry in 2022! Learn more about Tracy Conrady, Daisy Serdan Corona, Suky Lawlor and Lindy Holland Resnick.

Supply

- Oil prices rose over 2% Wednesday on news of low U.S. crude inventories.

- In late-morning trading, WTI futures were up 0.9% at $98.12/bbl, Brent was up 0.1% at $107.20/bbl, and U.S. natural gas was down 1.5% at $8.42/MMBtu.

- U.S. crude stockpiles dropped 4.5 million barrels last week as exports surged to an all-time high, according to the EIA.

- After a sharp drop the past two weeks, U.S. gasoline demand rebounded by 8.5% week-over-week, new data shows.

- Shell reported a second straight quarter of record profit at $16.7 billion, including a $4.3 billion reversal in impairment charges it took earlier in the pandemic.

- Equinor will return an additional $3 billion to shareholders following better-than-expected Q2 profits on an 18% rise in gas output.

- More oil news related to the war in Europe:

- Russia slashed flows on the Nord Steam gas pipeline to 20% of capacity Wednesday, spelling trouble for European supplies, primarily in Germany. European gas prices have spiked 30% the past two days.

- Japan is paying record prices for coal amid a global energy crunch and shortages of alternative fuels, such as gas and crude.

- European coal terminals are rushing to stockpile Russian coal ahead of new sanctions.

- G7 nations aim to have a price-capping mechanism on Russian oil exports by Dec. 5, when EU sanctions banning seaborne imports of Russian crude take effect.

- The euro zone’s looming gas crisis will cause a mild recession by early next year, JPMorgan predicts.

- After years of wrangling, U.S. lawmakers broke an impasse on a bill providing $369 billion in new climate and energy spending, including the extension of electric vehicle tax credits.

- A large battery will replace coal- and gas-fired power plants to stabilize part of South Australia’s energy grid, a global first.

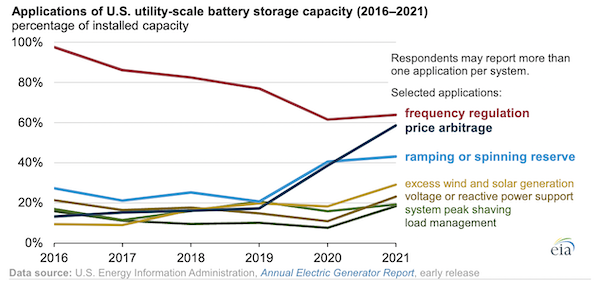

- U.S. utility-scale battery capacity more than tripled last year on greater uses for the technology in stabilizing power grids:

- TotalEnergies announced the commencement of commercial operation of a new, 1 billion pound per year ethane cracker in Port Arthur, Texas, that will provide feedstock to its Baystar joint venture with Borealis.

Supply Chain

- Britain’s rail network suffered major disruption Wednesday after tens of thousands of staff walked out in protest over wages and working conditions.

- A German court barred further strikes by the nation’s port workers until at least Aug. 26.

- U.S. ports on the East and Gulf coasts are gaining container volumes as shippers divert from West Coast ports dealing with dockworker contract negotiations. Congestion is rising at the Port of Savannah, where roughly 40 container ships were waiting for a berth on Wednesday.

- Inbound ocean containers waited an average of 13.3 days for rail transport at the ports of Los Angeles and Long Beach in June, a record-high.

- Chronic congestion led ocean carriers to skip calls at North Europe’s two largest ports in the first half of 2022, sending throughput down compared to last year.

- Union Pacific says the $1 billion deal it signed with Wabtec to modernize 600 locomotives is the largest locomotive investment in industry history.

- Boeing expects the global freighter fleet to grow 80% over the next 20 years, an average annual pace of 3%.

- Retailers including Abercrombie & Fitch, Dillard’s and American Eagle Outfitters are joining the push to charge customers for e-commerce returns.

- All eyes are on the U.S. House of Representatives after the Senate approved a multi-billion-dollar package aimed at boosting domestic semiconductor manufacturing Wednesday.

- Alphabet’s Wing subsidiary has developed new drones designed to deliver packages weighing up to seven pounds.

- The U.K. is setting up a 164-mile airspace corridor for what it calls a drone superhighway.

- A seafarer shortage threatens the Ukrainian grain corridor designed to ease an international food shortage.

- In the latest supply chain news from second-quarter earnings season:

- Prologis’ earnings rose 1.8% to $610 million as warehouse rental income ticked up by $1.1 billion.

- Surging transport and raw material costs weighed on profit margins at Kraft Heinz, despite several recent price hikes.

- Higher costs for commodities, freight and energy ate into profit at Nestle despite modest rises in sales volumes and selling prices.

- Profit (+15.3%) and revenue (+21.6%) rose at Samsung Electronics, though it warned that mobile and PC chip demand will start to weaken.

- Qualcomm saw 59% growth in its handset chip business but lowered current-quarter forecasts on slowing smartphone demand.

- Losses at Boeing were better than feared, although the plane maker cut estimates for 737 MAX deliveries this year and said two years of production issues for 787 Dreamliners has left it with over $25 billion of the aircraft in inventory.

- Airbus’ operating profit fell 31%, and it cut forecasts for deliveries and output due to parts shortages.

- U.S. aerospace firm General Dynamics saw profit rise 3.9% on strong demand for business jets.

- In the latest news from the auto industry:

- Ford posted a 50% gain in second-quarter revenue as inventories finally began catching up with demand. The automaker warned rising costs will prompt curbs on spending and hiring.

- Mercedes-Benz posted better-than-expected Q2 earnings despite a fall in unit sales. The automaker plans to bolster supply chains by dealing directly with chipmakers and will reduce German gas use by 50%.

- Rivian is cutting 6% of its 14,000-member workforce to reduce costs and avoid another round of fundraising.

- U.S. auto sales could fall 5.7% this month due to continued low inventories, J.D. Power said.

- The average price of used trucks sold through Ritchie Bros. auctions rose 31% in the second quarter.

- Toyota will cut 4,000 vehicles from production this month due to supply disruption from heavy rains and a COVID-19 outbreak in central Japan.

- Toyota plans to invest $1.8 billion to start building electric vehicles in mineral-rich Indonesia over the next five years.

- Battery makers are raising prices as Russia’s invasion of Ukraine triggers shortages of key raw materials.

- Tesla supplier LG Energy Solution is looking to scale up battery production in Asia outside China and with a new factory in Europe.

Domestic Markets

- The U.S. reported 127,786 new COVID-19 infections and 366 virus fatalities Wednesday.

- COVID-19 hospitalizations rose 70% in New York City the past month, while statewide hospitalizations are at their highest since February.

- Some major public school systems have reinstated mask mandates or are considering doing so as new Omicron variants of COVID-19 spread.

- Los Angeles County could avoid a new mask mandate this week as COVID-19 infections and hospitalizations stabilize.

- U.S. GDP unexpectedly shrank 0.9% in the most recent quarter, the second consecutive quarterly contraction, which typically defines a recession.

- First-time jobless claims eased by 5,000 last week to 256,000.

- International bookings to the U.S. surged 93% after the White House lifted a pre-arrival COVID-19 testing requirement six weeks ago.

- The House of Representatives voted overwhelmingly to extend pandemic-era expansions of telehealth services.

- As expected, the Federal Reserve raised its benchmark interest rate by another 75 basis points Wednesday to between 2.25% and 2.5%. Stocks rose on the announcement, which came alongside assurances that the U.S. is not in a recession.

- The U.S. trade deficit in goods shrank 5.6% to a seven-month low in June on a surge of food and industrial exports.

- U.S. durable goods orders rose 1.9% in June, with the increase spread across most categories, including cars and military aircraft.

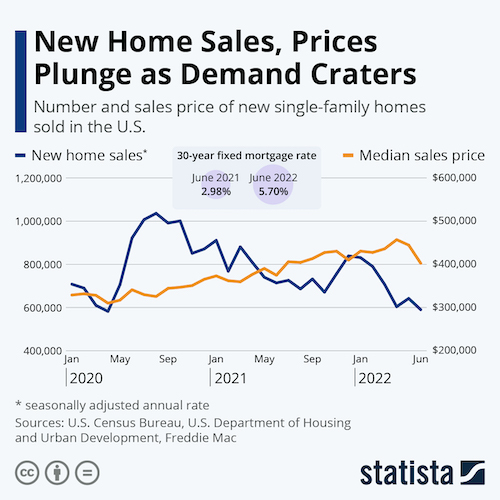

- U.S. pending home sales dropped 20% in June from a year ago, prompting the National Association of Realtors to lower its 2022 sales forecast by 13%.

- Twitter is closing or downsizing offices in major hubs including San Francisco and New York as it pivots harder toward remote work.

- Spirit Airlines canceled its planned merger with Frontier Airlines after a months-long bidding war, and could announce a deal with rival carrier JetBlue as soon as today.

- In the latest news from second-quarter earnings season:

- Facebook parent Meta posted its first-ever quarterly revenue decline amid a challenging market for digital ads and losses in its metaverse unit.

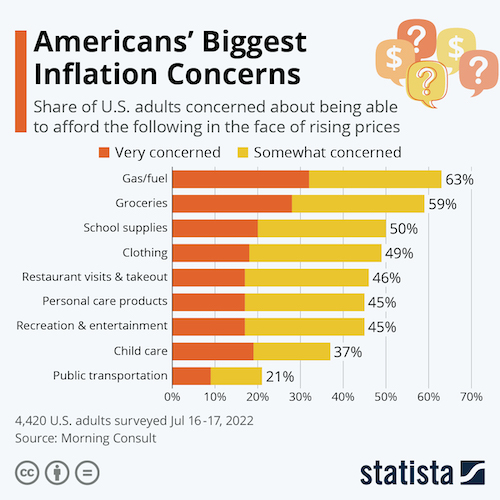

- Best Buy joined the growing list of retailers forecasting lower sales and profits as consumers get pinched by high inflation.

- T-Mobile blew past rivals Verizon and AT&T with the addition of 1.7 million monthly customers.

- Hilton beat forecasts with $367 million in net income on rising occupancy levels.

- Danone beat forecasts on strong demand for baby food and bottled water. The French firm is shipping millions of cans of its baby formula from Europe to the U.S., where a nationwide shortage persists.

- Bristol Myers Squibb posted better-than-expected profit but cut its annual sales forecast. The firm also reported a $39 million loss from pulling its business in Russia.

International Markets

- On Wednesday, Beijing reopened for international flights for the first time in nearly two years, although the city remains severely isolated. The International Monetary Fund says China must rethink its COVID-zero strategy if it wants to limit economic harm.

- New COVID-19 cases in Russia rose yesterday to their highest level since mid-April just weeks after the country lifted all virus restrictions.

- Multiple central banks, including in Hong Kong and Gulf states, followed the U.S. Federal Reserve in lifting interest rates Wednesday.

- London-based Barclays’ profit nearly halved in the second quarter on fresh hits from a debt-sale blunder and souring loans.

- Amazon Web Services expects sustained growth in Chile and the rest of Latin America in coming years despite expansive political turmoil.

- McDonald’s raised the price of a cheeseburger in Britain for the first time in 14 years Wednesday, a well-founded bet that demand will remain strong despite soaring living costs.

- Ryanair’s Spanish cabin crew plans to strike on four days of every week until January to press for higher pay, union officials said.

Some sources linked are subscription services.