COVID-19 Bulletin: April 23

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Natural gas prices turned higher yesterday after the Energy Information Administration reported a smaller-than-expected U.S. inventory build for last week.

- Crude futures were higher in mid-day trading today, with the WTI up 0.3% at $61.63/bbl and Brent 0.3% higher at $65.62/bbl. Natural gas was 0.1% higher at $2.75/MMBtu.

- Saudi Aramco is preparing to refinance a $10 billion debt facility raised in 2015, likely an attempt to further support state coffers amid a slide in profits.

- Utilities across the country are raising rates and imposing surcharges to recoup their costs from the collapse of the Texas grid during February’s winter storm, which sent spot natural gas costs soaring nationwide.

- Exxon Mobil expanded an agreement to buy more renewable diesel from Global Clean Energy’s biorefinery in California.

- New York City filed suit against BP, Exxon and Shell in state court, accusing the companies of misrepresenting the environmental risks of their products and seeking damages for the effects of climate change.

- A new Washington state bill would require most plastic containers to contain up to 50% post-consumer recycled content by 2031 and increase the content of recycled material used in plastic garbage bags.

- Data from the Environmental Protection Agency shows that more than 90% of plastic waste in the U.S. each year goes to landfills or incinerators, while only 9% is recycled.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Stellantis will curtail production of the Jeep Grand Cherokee and Dodge Durango at its Detroit assembly plant starting Monday due to a shortage of semiconductors.

- Mitsubishi will cut production in May by 16,000 vehicles, nearly one-fifth of its monthly production, due to the global semiconductor shortage.

- Jaguar Land Rover will temporarily cut production at two of its car factories in the U.K., citing the global chip shortage.

- Despite the global semiconductor shortage, Bosch, the world’s largest car parts supplier, expects sales to grow by 6% the rest of the year.

- Prices for used 20-foot containers in China are soaring as widespread shipping congestion tightens supply.

- The backlogging effects of the Suez Canal blockage could continue into the third quarter of 2021, according to Maersk.

- Prices for used heavy-duty freight trucks are rapidly increasing as operators rush to build their capacity.

- TravelCenters of America has formed a new business unit to roll out alternative energy options for heavy-duty trucks at its more than 270 truck stops, starting with hydrogen fueling stations in California.

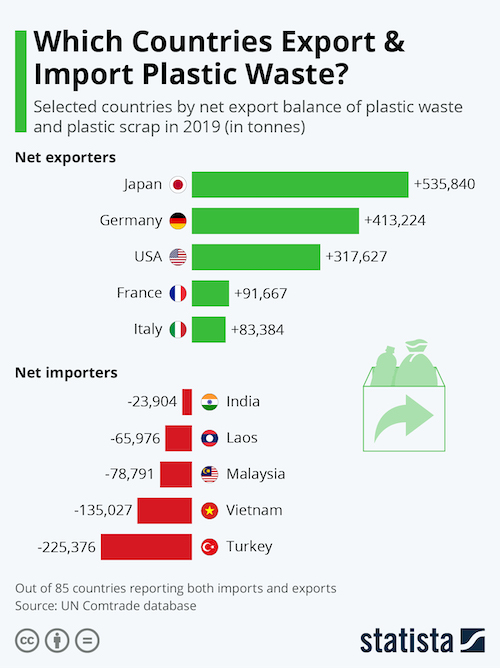

- Vietnam, Turkey and India are increasingly becoming hotspots for companies moving its sourcing away from China.

- Iron ore prices have reached their highest in a decade, led in large part by increased demand from Chinese steel mills.

- China’s corn imports have surged to record levels, driving up prices to eight-year highs.

- Colgate-Palmolive, Coca-Cola and Unilever announced they will join Anheuser-Busch InBev’s accelerator and investment program to support startups focusing on making supply chains more sustainable.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- There were 67,257 new COVID-19 cases and 943 deaths in the U.S. yesterday. Over 218 million vaccine doses have been administered, with 24.9% of the population fully vaccinated.

- Just seven states are experiencing rising COVID-19 trends this week, down from 25 last week, with only Alabama and Washington showing rising trends for both periods.

- Washington state is experiencing rising COVID-19 infections, hospitalizations and test positivity, prompting officials to warn that lockdown measures may be required if citizens ignore social distancing and mask recommendations.

- Michigan, recent epicenter for COVID-19 infections in the U.S., has seen its seven-day average infection rate decrease 12.5% in the past week.

- Virginia will begin to relax certain COVID-19-related restrictions, allowing sports and entertainment venues to operate with expanded capacity, an increase in social gathering limits, and bar seating in restaurants and saloons.

- The CDC could issue a ruling today that would allow a resumption in the use of Johnson & Johnson’s COVID-19 vaccine. The agency is examining an additional hospitalization and a death suffered by recipients of the shot.

- Long-haul COVID-19 patients not only face extended symptoms of the virus, but also an increased chance of death months after contraction, new research shows.

- BioNTech’s chief medical advisor said that it is likely that people will need a third shot of its COVID-19 vaccine for further protection from the virus, while Moderna’s CEO said it was working on a COVID-19 booster to be ready by late summer or early fall.

- A new report from the CDC suggests there is little risk for pregnant women from COVID-19 vaccines made by Moderna and Pfizer.

- A recent survey shows that more than 1 in 5 registered voters are unlikely to get a COVID-19 vaccine. Wyoming is the most vaccine-hesitant state, with a third of residents shunning shots.

- A quarter of workers who were furloughed or laid off since February think they won’t be able to retire until later than planned, a survey shows.

- The U.S. is mulling a plan to ease intellectual property rights for COVID-19 vaccines in an effort to increase access to the shots across the world.

- A key measure of risk in low-rated corporate bonds fell to its lowest level in 10 years, a sign of investors’ mounting confidence in the economic outlook.

- Southwest and American Airlines are reporting that more people are beginning to travel for leisure, a trend that could build into a summer surge.

- More than 100 Boeing 737 MAX airplanes remain grounded by an electrical issue. Expected deliveries of eight jets to Irish airliner Ryanair remain weeks away, a month after the airline announced the new purchases.

- Capital investment borrowing among U.S. companies rose 4% in March from a year earlier as the labor market improves and interest rates remain low.

- While still early in the earnings reporting season, U.S. companies are posting records amid a broad economic rebound from the pandemic downturn:

- Nestle posted its best quarterly sales growth in nearly a decade, the result of more people buying coffee and coffee supplies for the home.

- Trucker Knight-Swift Transportation raised its earnings outlook after a near doubling of quarterly net profit to $129.8 million.

- Dow’s first quarter results handily beat analyst estimates, with revenues $1 billion higher than expected, boosted by robust global demand for plastics, supply constraints after the February winter storm in Texas and a 14% increase in prices over the fourth quarter.

- Intel’s profit fell short of expectations as the company spends heavily to get its manufacturing operations back on track with chip-making competitors. However, the company raised its annual sales outlook for personal computers.

- A climate summit at the White House yesterday led to a flurry of news:

- The White House officially unveiled its goal of reducing the nation’s emissions by up to 52% from 2005 levels by 2030.

- The U.S. will invest $174 billion to boost electric vehicle and charging stations, while the administration declined to set a timeline for phasing out gas-powered vehicles.

- The U.S. will double climate financing to poor countries by 2024.

- The U.S., Norway and Britain joined with companies including Amazon and Nestle in a plan to raise $1 billion in financing to preserve the world’s tropical forests.

International

- For the second day in a row, India set a global record for most daily infections with 332,730 new cases. Vaccinations in India won’t be open for all adults until next month, as its inoculation program struggles with delayed shipments and plateauing manufacturing capacity. The nation’s death toll, fourth-highest globally, is believed to be significantly above official numbers.

- Indonesia will ban entry to people traveling through India to prevent the spread of COVID-19 variants.

- The U.K. is imposing a 10-day quarantine for travelers from India, requiring testing on the second and eighth days and forcing those who test positive to remain quarantined for an additional 10 days.

- Pakistan is instating new measures to help curb a surge of COVID-19, banning outdoor dining, forcing offices to close at 2 p.m. and ordering markets to shut down at 6 p.m.

- Canada will ban passenger flights originating in India and Pakistan for the next 30 days, citing many COVID-19 cases in travelers from those countries. The head of the nation’s largest province is facing calls to resign over his handling of the pandemic amid a third wave of the virus.

- Romania and Iraq became the 24th and 25th countries to log more than 1 million COVID-19 cases.

- Germany’s first national lockdown will take effect Saturday, bringing nightly curfews and school and store shutdowns for areas that go above certain levels of COVID-19 infection rates.

- Hungary is set to relax certain COVID-19-related restrictions by the middle of next week when the country reaches a 40% inoculation rate.

- Countries in Southeast Asia are implementing early restrictions on movement to contain an expected surge of COVID-19 cases during the Ramadan holidays.

- Starting today, Ecuador is imposing a four-week curfew and restrictions to counter a wave of COVID-19 infections that is straining hospitals.

- Brazil’s latest virus wave saw deaths in those aged 30-39 nearly quadruple from the beginning of the year, suggesting virus mutations have a greater impact on previously resilient populations.

- Japan will declare a third state of emergency for Tokyo and three other prefectures later today.

- Thailand is facing a shortage of ICU beds as the country struggles to contain a surge of COVID-19 infections. The country said it will continue to use China’s Sinovac vaccine despite six reports of recipients having “stroke-like” side effects.

- Singapore is quarantining 1,200 migrant workers after finding COVID-19 cases in their dorm building, including men who had already recovered from the virus.

- The European Commission is declining an option to purchase 100 million additional AstraZeneca COVID-19 vaccine doses, planning instead for the purchase of up to 1.8 billion doses of Pfizer/BioNTech’s vaccine.

- COVID-19 infections in adults of all ages fell by 65% after a first dose of AstraZeneca’s or Pfizer’s COVID-19 vaccine, a British study shows.

- Surveys of purchasing managers point to a global economic recovery as vaccination programs around the world allow more parts of the services economy to reopen.

- A purchasing managers index in the U.K. hit its highest level in seven years this month, while retail sales in March grew at the fastest pace in nine months. British manufacturers are expecting their strongest rebound in nearly a half-century this month as the economy reopens.

- Industrial confidence in Brazil started off at an eight-month low in the second quarter of this year, a disappointing sign amid high levels of COVID-19 infections in the country.

- Manufacturing activity in Japan expanded for the third month in a row in April, with the purchasing managers index rising 0.6 points to 53.3.

- Electric and hybrid vehicles accounted for 15% of European car sales in the first quarter.

Our Operations

- This week’s recent Plastics Reflections webinar on Driving Sustainability Action in the Plastics Industry can be viewed here.

- M. Holland is the headline sponsor for AMI’s Thermoplastic Concentrates & Masterbatch Virtual Summit on April 26-29. Christopher Thelen, Regulatory Specialist for M. Holland, will be speaking on Monday, April 26 at 8:00 am CT.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.