COVID-19 Bulletin: February 22

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Winter Storm Uri

- The battered Texas electricity grid was back up and running on Friday, as the White House made a Major Disaster declaration that will provide federal funds for temporary housing, home repairs, low-cost loans and other aid.

- Hundreds of thousands of people, however, still faced the challenges of reconnecting to electricity supplies and navigating ice-blanketed roads.

- Many people who kept even small amounts of power on over the several-day storm are reporting energy bills in the thousands of dollars, even tens of thousands of dollars.

- The monetary toll of the storm could exceed that of even major hurricanes, with some estimates expecting an $18 billion hit.

- Water problems in Texas have not abated, as residents deal with burst pipes and bacteria-infected water. People also struggled to find necessities as many restaurants and grocery stores were forced to throw out food or close entirely.

- Winter Storm Uri delayed the shipments of about 6 million doses of COVID-19 vaccines in the U.S., causing UPS, FedEx and Moderna to work through Sunday to package and transport backlogged orders. Many people are now behind on their second scheduled doses of the shots.

- Texas will likely report a surge of new COVID-19 infections over the next week as testing sites closed by the storm catch up on a backlog of new cases. The state also administered hundreds of thousands of fewer vaccines during the cold snap.

- Texas power plants were unprepared for Winter Storm Uri. They are designed to shed heat instead of keeping it in, a useful tool during hot summer months that can falter in an instant during unusually cold weather. Texas’s power grid operator is being hit with multiple lawsuits over weatherization failures.

- Mexico’s president urged citizens to reduce their power consumption amid shortages of imports from Texas. More than 20 fatalities in Mexico were blamed on the storm.

- Several refineries in the state could take weeks to renew full production as they repair damages from the “big Texas freeze.”

- The storm has caused unprecedented disruption to North American petrochemicals production:

- BASF declared force majeure on nylon products and intermediates made at its Freeport, Texas, plant and on Ultraform® POM Q600 grades.

- Braskem declared force majeure on polypropylene products.

- Celanese declared force majeure on a broad list of products.

- Chevron Phillips declared force majeure on polyethylene products.

- Covestro announced a new force majeure effective Feb. 14 on all polycarbonate products, superseding a prior force majeure that was in place.

- DuPont declared a global force majeure for Zytel® (including Zytel® HTN and Zytel® Specialty Nylons), Crastin®, Rynite®, Selar®, Minlon® and Pipelon®.

- Flint Hills declared force majeure on polypropylene products due to the storm.

- ExxonMobil said it is allocating polypropylene products.

- Formosa expanded and extended its force majeure declaration to all Formolene® polyolefin products.

- Ineos declared force majeure on polypropylene products due to the storm.

- Ineos Styrolution declared force majeure on Luran® S ASA, Terluran® ABS and Novodur® high heat ABS.

- Invista declared force majeure on U.S. supply of PA66 intermediate chemicals.

- LyondellBasell declared force majeure on polyethylene and polypropylene products due to the storm.

- LyondellBasell announced a partial lifting of force majeure, affecting Line 5 at its Morris, Illinois, facility and LD1, LD2 and PF4 at its Clinton, Iowa, facility.

- Occidental, the second largest producer in the Permian Basin, declared force majeure on oil deliveries.

- OxyChem declared force majeure on U.S.-based PVC products.

- Sabic declared force majeure on LEXAN™ resins, CYCOLOY™ resins, XENOY™ resins, GELOY™ XP series resins, VALOX™ FR resins and XYLEX™ resins, as well as ABS product from its Tampico, Mexico, plant.

- Total declared force majeure on polypropylene products made at its La Porte, Texas, facility.

- Vestolit declared force majeure on suspension, copolymer and emulsion PVC resins produced in Colombia and Mexico due to feedstock disruptions from the Gulf Coast.

Supply

- Oil prices fell slightly below $60 per barrel at the end of last week, a dip from mid-week highs but still at a level not seen since January of last year.

- Crude prices were higher in early trading today, with the WTI up 0.8% at $59.69/bbl and Brent up 0.9% at $63.46/bbl. Natural gas was down 3.8% at $2.95/MMBtu.

- The U.S. oil rig count ended its 12-week streak of gains, slipping by 1 last week to a total of 397 — still nearly 400 fewer than pre-pandemic levels.

- Brazil’s president ousted the head of state-run oil company Petrobras after weeks of clashes over fuel price hikes.

- Italian energy company Eni became the latest energy group to pledge carbon neutrality by 2050.

Supply Chain

- Freight operators and transportation groups are lobbying for faster driver access to COVID-19 vaccinations, as the logistics industry has been one of the most critical operations in keeping the economy moving during soaring e-commerce activity.

- We expect continuing logistics disruption in the U.S. from severe winter conditions that blanketed much of the country last week.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- The U.S. surpassed 500,000 COVID-19 fatalities, despite all virus statistics posting a month-long decline, including a halving of virus hospitalizations.

- There were 56,495 new COVID-19 cases in the U.S. yesterday and 1,249 deaths.

- Daily virus fatalities dropped below 100 in New York for the first time since mid-December.

- A handful of U.S. governors have dropped statewide mask mandates in recent days, raising conflicts with local city leaders who want to keep restrictions in place to combat localized hot spots.

- The White House is pushing for a reopening of all schools in the U.S. by April.

- New research from Pfizer shows the company’s vaccine provides robust immunity after only one dose and can be stored in ordinary freezers instead of at ultracold temperatures, simplifying the logistics of distributing the shots. Further, those previously infected with COVID-19 likely need only one shot.

- The U.S. is extending non-essential border travel restrictions with Canada and Mexico until at least March 21.

- Major U.S. airlines joined an international contact tracing program that will relay passenger information to the CDC.

- The TSA will hire 6,000 new airport security screeners by the summer as progress in vaccinations is expected to boost travel.

- Home sales in the U.S. rose 0.6% in January as the market stayed hot even during the usually slower winter period, pushing prices up further.

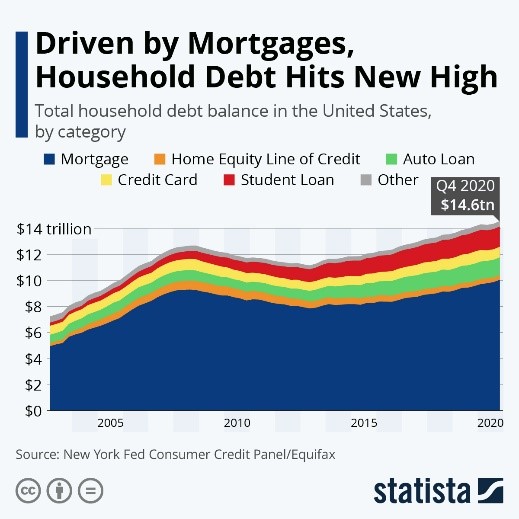

- U.S. household debt hit a record high in the fourth quarter:

- U.S. business debt is nearing historical highs, with bankruptcy risks at small- and medium-sized firms remaining “considerable,” the Federal Reserve says, while commercial real estate is likely to take even more hits once the pandemic subsides.

- A U.S. House committee unveiled a $1.9 trillion COVID-19 aid bill that is expected to pass by late next week.

- JPMorgan expects the U.S. economic recovery to outpace that of China.

- U.S. services companies reported increased activity during February on higher consumer demand, while service-sector firms in Europe and Japan saw declines.

- U.S. factory activity slowed in early February, an effect of the global semiconductor chip shortage and higher input prices.

- The Midwest saw the country’s best economic recovery in 2020, with cities such as Columbus, Indianapolis, Minneapolis and Cincinnati notching the lowest unemployment rates of 51 major metro areas. Meanwhile, blue-collar jobs in construction, package delivery and warehousing are some of the only jobs to exceed pre-pandemic levels.

- The FAA is using satellites to track all Boeing 737 MAX jet flights around the world, a precaution as the plane resumes flight after a 20-month grounding.

- A Pratt & Whitney engine on a Boeing 777 wide-body jet failed shortly after taking off from Denver, dropping large chunks of debris on local parks and neighborhoods. Boeing recommended that airlines ground 777 aircraft with Pratt & Whitney engines, while airlines in Korea, Japan and the U.S. grounded dozens of 777 jets.

- In the Netherlands, officials are investigating a Boeing 747 cargo plane with Pratt & Whitney engines that dropped engine parts after takeoff from Maastricht airport on Saturday.

- MGM will resume 24/7 operations at three of its Las Vegas resorts on March 3.

- The U.S. officially rejoined the Paris climate accord last week as the White House pursues a major policy shift toward cleaner energy.

- Winter Storm Uri is expected to boost sales of rooftop solar systems.

International

- The seven-day average COVID-19 case count in France rose for the past four days, with the more than 22,000 new infections on Sunday nearly a third higher than a week ago.

- Mexico on Friday registered 857 COVID-19 fatalities, bringing the country’s total to 178,965, the world’s third highest.

- Mexico’s healthcare workers are beginning to experience high levels of fatigue, stress and frustration as case counts build, especially due to the nation’s prioritization of teachers ahead of medical professionals for first vaccines in some areas.

- While Mexico’s official coronavirus case tally stands around 2 million, researchers predict the number is closer to 18 million.

- Foreign investment in Mexico slumped 11.7% last year compared to 2019.

- Ireland is keeping its hospitality sector closed through mid-summer.

- Poland restricted travel from the Czech Republic and Slovakia due to their rising COVID-19 cases.

- The U.K. is easing some restrictions, including opening all schools on March 8 and allowing people to meet one-on-one to sit down for a coffee or picnic outdoors.

- Israel lifted restrictions on most commerce and public activity, otherwise requiring “green passports” for proof of vaccination in remaining activities that are restricted.

- Russia gave emergency approval to a third COVID-19 vaccine, CoviVac, despite a lack of long-term testing. The country expects to produce 88 million vaccine doses in the first half of this year.

- With more than 75% of existing COVID-19 vaccine shipments going to the world’s 10 richest nations, a group of world leaders has offered $7.5 billion to distribute shots to low- and middle-income countries.

- AstraZeneca will soon start producing more of its COVID-19 vaccines in Japan and begin local distributions shortly after.

- Australia and New Zealand began rolling out initial doses of COVID-19 vaccines.

- Spain is edging closer to vaccinating all its nursing home residents against COVID-19 after a rocky start to rollouts.

- Taiwan’s 2021 GDP is expected to rise nearly 5%, the fastest growth in seven years, on surging exports from global semiconductor chip demand.

- Canadian retail sales declined by 3.4% in December, the biggest monthly drop since April amid continued coronavirus restrictions on businesses.

- Moscow will quadruple the number of electric buses it operates in coming years amid a fleet-wide shift toward electric vehicles, expected to be completed by 2030.

- Thailand’s recent ban on plastic bags threatens the existence of nearly 1,000 of the nation’s factories, with many expected to close in coming months. The nation is the sixth leading contributor to ocean waste.

Our Operations

- Last week’s Plastics Reflections webinar on 2021 Drivers and Trends for the North American Plastics Market can be viewed here.

- Our 3D Printing business unit has launched a new e-commerce site. Access the new site here.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.