COVID-19 Bulletin: August 19

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Optimism about a higher-than-expected draw on U.S. oil inventories last week was offset by a surprisingly high increase in gasoline inventories, sending oil prices lower late yesterday.

- Crude prices were down in early trading today, with the WTI at $42.42/bbl and Brent at $44.89/bbl.

- After slashing employment this year, the oil industry faces a generation gap in its workforce and concerns about recruiting the right talent for an emerging renewable energy future.

- Under pressure from investors, Australia’s BHP Group, the world’s largest mining company, plans to sell its thermal coal businesses over the next two years as it prepares for a low-carbon future.

- Polyethylene demand and prices continue to strengthen in the Americas.

- Braskem entered talks with the Mexican government regarding ethane contracts for Braskem Idesa.

Supply Chain

- FedEx will add surcharges for parcel deliveries between November 2 and January 17, joining UPS and the U.S. Postal Service in adding fees during the holiday season.

- FedEx has introduced a Pay Premium Program for hourly workers at its Express World Hub in Memphis, Tennessee, temporarily raising the minimum hourly wage to $15/hour beginning September 6.

- Freight markets remain challenged. Clients are advised to provide expanded lead times on orders to help ensure delivery dates will be met.

- We’re seeing rising spot freight pricing due to capacity constraints in the industry.

- Beyond the transportation challenges, our Gold Standard logistics partners and U.S. ports continue to operate without interruption.

Markets

- COVID-19 infections in the U.S. are trending downward, with 44,091 recorded yesterday, well below the peak of more than 77,000 registered on July 16. It’s the fourth straight day with infections below 50,000.

- The S&P stock index hit a record high yesterday, erasing all its losses during the pandemic.

- Improvements in treatment for COVID-19 patients has reduced the number of those hospitalized requiring ventilation from a third to a quarter, causing a glut of ventilators in federal stockpiles.

- As U.S. colleges reopen, the World Health Organization warned yesterday that young people have become the leading spreaders of COVID-19 with people under 40 comprising a majority of recent spikes in several countries.

- California’s governor declared a state of emergency in response to spreading wildfires amidst a historic heat wave in the state.

- The tsunami of evictions expected after federal and state moratoriums expired has not occurred yet, with eviction rates down this year in major cities.

- Evidence remains elusive about whether the COVID-19 pathogen, which thrives in cold and dry conditions such as cold storage, can spread on food packaging.

- Soaring home improvement spending propelled Lowe’s to a 35% increase in U.S. same-store revenues in its latest fiscal quarter, while Home Depot’s revenues jumped 25%.

- Boeing plans a second voluntary layoff offer and will reduce headcount beyond the 10% reduction announced early in the pandemic. The cuts will affect its commercial aircraft and services businesses.

- The defense industry, largely insulated from the recession so far, has still been impacted by the pandemic, with Lockheed Martin reporting that simulator testing for its new F-35 fighter jet will be delayed five months due to the virus.

- ByFusion has introduced ByBlock, a construction-grade brick comprised entirely of recycled plastic.

- Younger generations care about recycling, with nearly half of millennials and Gen Zers surveyed saying they won’t date someone who does not recycle.

- Major retailers are offering incentives to customers to bring in spare change as they wrestle with a persistent coin shortage caused by the pandemic.

International

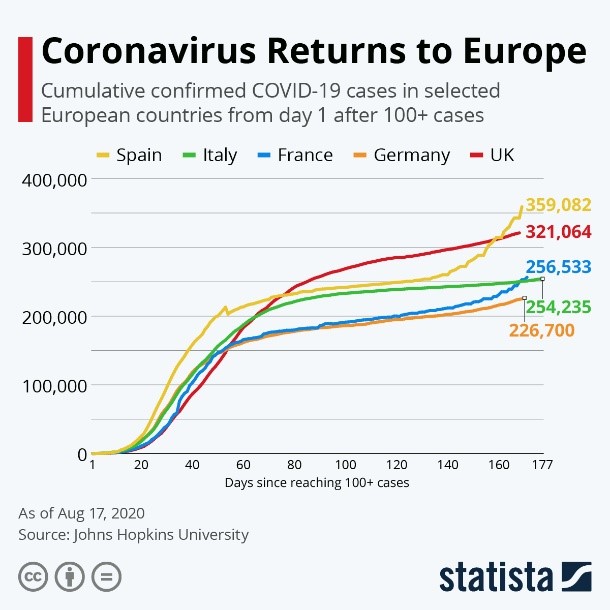

- Major countries in Europe are experiencing an uptick in COVID-19 infections:

- The World Trade Organization tempered its expectations for a sharp global economic rebound in 2021 as its Goods Trade Barometer slipped to 84.5 in June from 87.6 in May. Readings below 100 indicate a negative outlook.

- Bloomberg indicates that Asia, led by Taiwan, South Korea and Thailand, is the global region closest to returning to pre-pandemic economic activity, while Latin America is the weakest region, with Bolivia, Argentina and El Salvador suffering the worst.

- The White House canceled scheduled trade talks with China over the weekend concerning the Phase 1 trade deal and signaled it may withdraw from the agreement.

- China plans to stockpile cobalt, a strategic material critical to batteries in electric vehicles, due to potential pandemic-related supply disruptions in Africa.

- Ten states in Mexico, where over 70% of citizens are considered overweight, are looking to ban junk food for minors to help control their weight, a risk factor for COVID-19.

- Canada, Mexico and the U.S. have extended the closure of non-essential border crossings for another month.

- Venezuela is denouncing those infected with COVID-19 as “bioterrorists” and detaining citizens returning from abroad after losing their jobs.

Our Operations

- We announced on Friday that our Northbrook and Chicago, Illinois, offices will remain closed at least through the end of the year.

- We are moving and expanding our 3D Printing business unit to the mHUB manufacturing innovation complex in Chicago.

- We are proud that Crain’s Chicago Business has ranked M. Holland as one of its Top 100 Best Places to Work.

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.