COVID-19 Bulletin: August 21

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Crude prices were down in mid-day trading today, with the WTI down 2.7% at $41.68/bbl and Brent down 2.4% at $43.78/bbl.

- Offshore drilling giant Valaris, based in London, filed to reorganize in U.S. bankruptcy court.

- Caution prevails among U.S. natural gas producers, despite a 60% increase in prices since late June.

- Europe’s “Green Recovery” initiative is sparking growing interest in hydrogen, which contains three times the energy of gasoline with zero harmful emissions.

- Improving demand and supply disruptions at several production facilities have made polypropylene especially tight in North America with producers requesting accurate forecasts and extended lead times.

Supply Chain

- Two separate tropical depressions, one in the Atlantic and one in the Caribbean Sea, threaten to grow into hurricanes and strike the Gulf Coast next week.

- Four-hundred-million square feet of new warehouse space may be needed to accommodate rising e-commerce sales and increases in inventories by companies adjusting their supply chains due to the pandemic.

- Uber and Lyft will continue operating in California for at least a few more months after an appeals court issued a stay of an injunction that would have forced them to end ride-sharing services unless they convert drivers from contractors to employees. The companies are backing a ballot measure in the upcoming election that would provide contract drivers with additional protections but not deem them employees.

- Pilotless cargo aircraft could be in commercial operation as early as 2022, enabled by technology from startup Xwing that retrofits existing aircraft for autonomous flight.

- While dry van capacity is improving, the bulk trucking sector has worsened, with rising manufacturing activity and low inventories expanding regional tightness into a national capacity shortfall. Clients are advised to provide expanded lead times on orders to help ensure delivery dates will be met.

- Freight pricing continues to rise due to capacity constraints and the higher cost of operations due to the pandemic.

- Beyond the transportation challenges, our Gold Standard logistics partners and U.S. ports continue to operate without interruption.

Markets

- New COVID-19 infections in the U.S. decreased yesterday to 44,023. Deaths remained above 1,000.

- Wildfires in California, fed by record heat and a rash of lightning strikes, have forced tens of thousands to evacuate to shelters, creating COVID-19 infection concerns.

- The federal deficit has risen a historic 25 percentage points this year to 106% of GDP, but inflation remains in check, defying traditional economic theory.

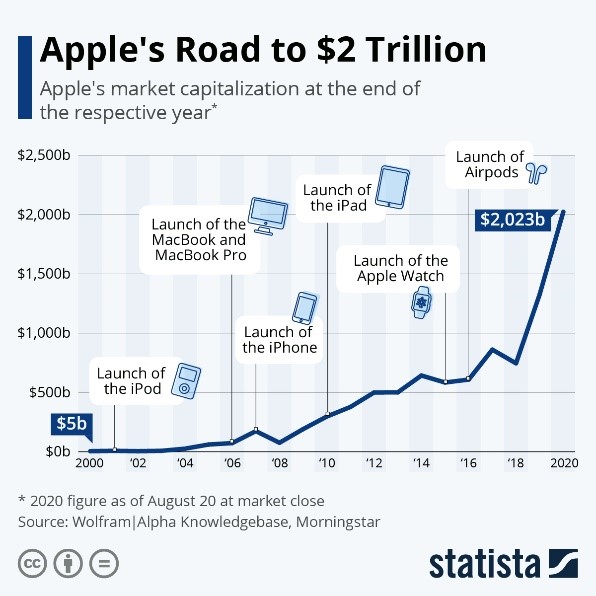

- Apple became the first U.S. corporation to pass $2 trillion in market capitalization as the pandemic accelerates growth of the gig economy:

- U.S. businesses have added $1.6 trillion in new debt to their balance sheets during the pandemic, raising corporate debt to record levels that could impair the economic recovery.

- Nearly $10 billion worth of infrastructure projects has been canceled or postponed during the pandemic, with government fiscal woes likely to constrain future infrastructure spending.

- While new mortgage delinquencies declined in July, delinquencies over 90 days jumped 20%.

- Johnson & Johnson is recruiting 60,000 volunteers for the largest Phase 3 test of a vaccine yet, with testing set to begin in September.

- While national airline traffic is still two-thirds below normal and improving only modestly this month, Southwest Airlines said it will continue curtailing flights and expects traffic in October to remain down by up to 50%, worse than its earlier estimates of a 30% decline.

- American Airlines is suspending service to 15 cities and six additional airports.

- With business air travel still moribund, United Airlines is straying outside its hub system and starting 17 point-to-point flights to Florida to serve winter tourists, borrowing a page from discount airlines.

- Delta Airlines said it will continue blocking middle seats through January 6.

- Hawaii, among states hardest hit by the pandemic and desperate to restore its tourism industry, will experiment with “resort bubbles,” where visitors can enjoy a luxury resort experience without enduring the state’s mandated 14-day quarantine.

- Despite the pandemic, the fragmented moving industry is booming, with urban dwellers relocating to suburbs and colleges reopening.

- To ease the burden of working parents, some major companies are offering educational benefits, such as tutoring services, virtual field trips and search services for nannies and learning facilitators, as a new form of perk.

International

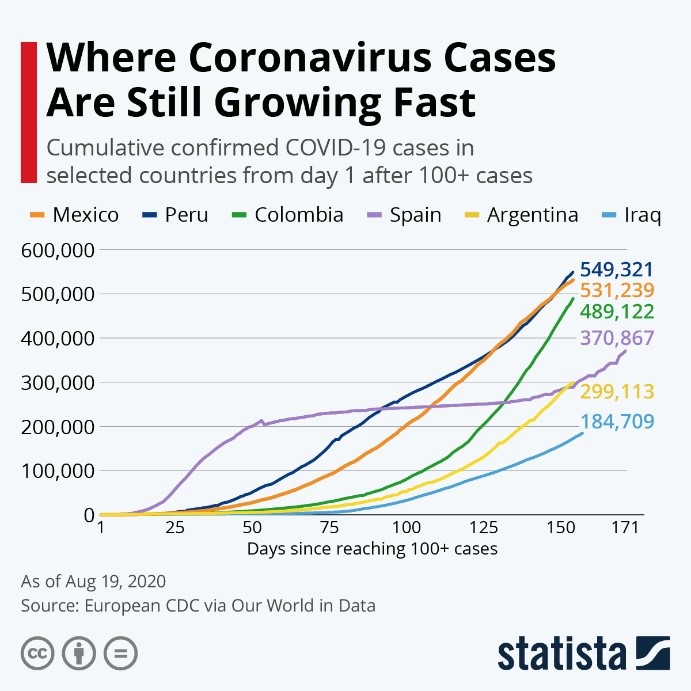

- Latin America, suffering more than 3,000 COVID-19 deaths a day for the past week, saw total deaths top 250,000 yesterday.

- Latin American countries make up four of the five countries with the fastest growing infection rates globally:

- Europe’s economic recovery slowed in August, with the Purchasing Managers’ Index slipping to 51.6 from 54.9 in July.

- The European Central Bank is concerned that a surge in unemployment will follow the expiration of stimulus programs and derail Europe’s fragile economic recovery.

- The U.K.’s public debt exceeds 2 trillion pounds ($2.6 trillion) for the first time in history.

- The European Union’s lead negotiator expressed pessimism that a Brexit deal can be negotiated before the U.K. leaves the Union at the end of the year.

- Europe’s vacation season is being abruptly shut down as countries restore border restrictions in the face of a wave of new COVID-19 infections.

Our Operations

- As a follow-up to this week’s Fireside Chat on the new North American trade agreement, our regulatory team shared key considerations on reporting requirements related to USMCA.

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Resource Center: M. Holland offers a host of resources to clients, prospects and suppliers. To arrange a videoconference or meeting, contact:

- Automotive: Market Manager Matt Zessin.

- Color & Compounding: Market Manager Scott Arnold.

- Electrical & Electronics: Market Manager Carlos Aponte.

- Flexible Packaging: Senior Technical Development Engineer Todd Stevens.

- Healthcare: Global Healthcare Manager Josh Blackmore.

- Rotational Molding: Product Manager Pete Nutley.

- Wire & Cable: Director Todd Waddle.

- 3D Printing: Market Manager Haleyanne Freedman.

- Sustainability: Market Manager Lindy Holland.

- For Regulatory advice, contact Regulatory Specialist Christopher Thelen.

- For Technical questions, contact Paul Lorigan, Manager of the M. Holland Technical Innovation Center.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.