COVID-19 Bulletin: August 31

Good Afternoon,

More news relevant to the plastics industry:

Supply

- Crude prices were higher in early trading today, with the WTI at $43.32/bbl and Brent at $45.17/bbl.

- Some refineries along the Gulf Coast, spared significant damage from Hurricane Laura, began to restart operations.

- Power outages will delay the restart of some Louisiana facilities in areas most impacted by the storm.

- Baker Hughes’ count of active oil rigs in the U.S. fell by three last week to 180.

- Dozens of dead dolphins prompted protests in Mauritius about the government’s response to a large oil spill after a ship ran aground and broke up offshore.

- Several companies are working on new methods for cleaning up ocean oil spills, including robots, absorbent wood chips and super sponges.

- Capital spending by Canada’s oil and gas industry fell by 54% in the second quarter.

- The American Chemistry Council is lobbying U.S. trade representatives to press Kenya to loosen its restrictions on plastics in ongoing trade negotiations as the petrochemicals industry focuses more on plastics with fossil fuel demand maturing.

Supply Chain

- A non-profit truckers coalition is assisting with disaster relief in the wake of Hurricane Laura.

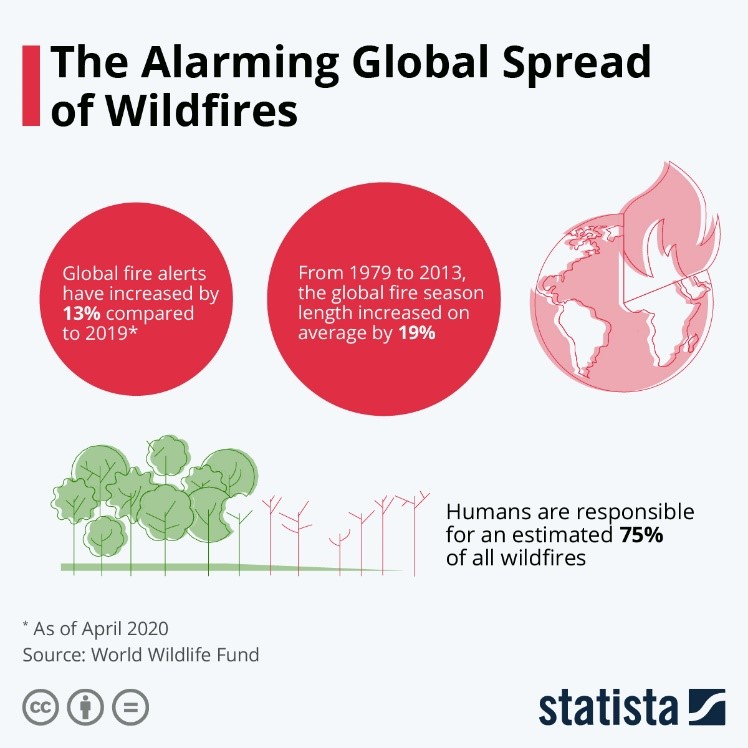

- Nearly 16,000 firefighters continued making progress in their two-week battle to contain historic wildfires in Northern California.

- California imposed new regulations on heavy-duty diesel trucks that will eliminate emissions equivalent to 16 million automobiles.

- The Mayflower Autonomous Ship will trace the route of the original Mayflower next month in a fully autonomous trans-Atlantic voyage, demonstrating the potential of robotic shipping.

- We anticipate the Labor Day holiday will cause roadway congestion this weekend and early next week, impacting trucking capacity, pricing and performance. Clients are urged to schedule shipments early this week.

- The Commercial Vehicle Safety Alliance has scheduled its (USA/CAN/MEX) Roadcheck for September 9 to 11 — we expect this to reduce capacity and service levels for the week.

- Clients are advised to provide expanded lead times on orders to help ensure delivery dates will be met.

Markets

- COVID-19 infections in the U.S. surpassed 6 million today, while deaths passed 183,000 over the weekend.

- Twenty-two states have experienced rising COVID-19 infection moving averages over the past three days, up from 10 early last week.

- Children and teenagers are experiencing faster growth rates in COVID-19 infections, hospitalizations and deaths than the general population, according to the American Academy of Pediatrics.

- Universities experiencing major COVID-19 spikes are wrestling with whether to close campuses and put the families of students at risk or sequester students on campus to contain the spread.

- Consumer spending between June and July rose a better-than-expected 1.9% but remained 4.6% below spending in February, with expenditures on goods above pre-pandemic levels while the services sector remains down.

- The Treasury Department issued a notice implementing the recent executive order deferring payroll tax withholding for those earning less than $104,000, putting the administrative burden on employers.

- Recent workforce reductions announced by some major employers, including Salesforce, Coca-Cola, GM Resorts International and Stanley Black & Decker suggest a potentially long economic recovery absent more stimulus from the government.

- Used car pricing is softening with pent-up demand from shutdowns beginning to dissipate.

- Chinese electric-car maker NIO’s initial stock offering in the U.S. was oversubscribed, allowing the company to raise 20% more than originally anticipated. It’s the third Chinese electric vehicle company to raise money in U.S. markets since July.

- American Airlines is cutting more flights for October, reducing capacity to 45% of the prior-year period.

- Effective immediately, United Airlines is scrapping change fees on U.S. flights to revive ridership.

- The motel industry, in decline in recent years, is making a comeback as COVID-19-wary travelers gravitate to their open corridors, lack of elevators and modest cost.

- In a sign of the ascendance of e-commerce, redemptions of digital coupons exceeded those of paper coupons for the first time in the second quarter.

- A sharp increase in residential garbage coupled with COVID-19 infections among sanitation workers is causing trash to pile up in cities across the country.

International

- India recorded 78,761 new cases Sunday, the highest single-day COVID-19 infection rate ever. The country, which is easing restrictions to bolster the economy, now has the fastest growing infection rate in the world.

- The lockdown was lifted in Auckland, New Zealand’s largest city, scene of a recent COVID-19 spike that broke the country’s 102-day streak without a new infection.

- Italy’s second-quarter GDP contracted a bigger-than-expected 17.7% compared with the second quarter of 2019 and 12.8% versus the prior quarter, as consumer spending, exports and investments all fell.

- France is tightening face mask mandates starting tomorrow to stem its highest rate of new COVID-19 infections since March.

- Electricity consumption in China hit a record high in August, signaling a robust recovery of both manufacturing and consumer activity.

- In a pattern common at airports through much of the world, retail activity at London’s Heathrow Airport remains largely shut down after years of rapid growth.

- Global COVID-19 cases topped 25 million.

Our Operations

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Resource Center: M. Holland offers a host of resources to clients, prospects and suppliers. To arrange a videoconference or meeting, contact:

- Automotive: Market Manager Matt Zessin.

- Color & Compounding: Market Manager Scott Arnold.

- Electrical & Electronics: Market Manager Carlos Aponte.

- Flexible Packaging: Senior Technical Development Engineer Todd Stevens.

- Healthcare: Global Healthcare Manager Josh Blackmore.

- Rotational Molding: Product Manager Pete Nutley.

- Wire & Cable: Director Todd Waddle.

- 3D Printing: Market Manager Haleyanne Freedman.

- Sustainability: Market Manager Lindy Holland.

- For Regulatory advice, contact Regulatory Specialist Christopher Thelen.

- For Technical questions, contact Paul Lorigan, Manager of the M. Holland Technical Innovation Center.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.