COVID-19 Bulletin: August 5

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Crude prices were sharply higher in early trading today, with the WTI up 4.0% at $43.35/bbl and Brent 3.7% higher at $46.09/bbl.

- The crude inventory draw was higher than expected for the second week in a row, with 8.6 million barrels drawn last week, more than twice what analysts predicted.

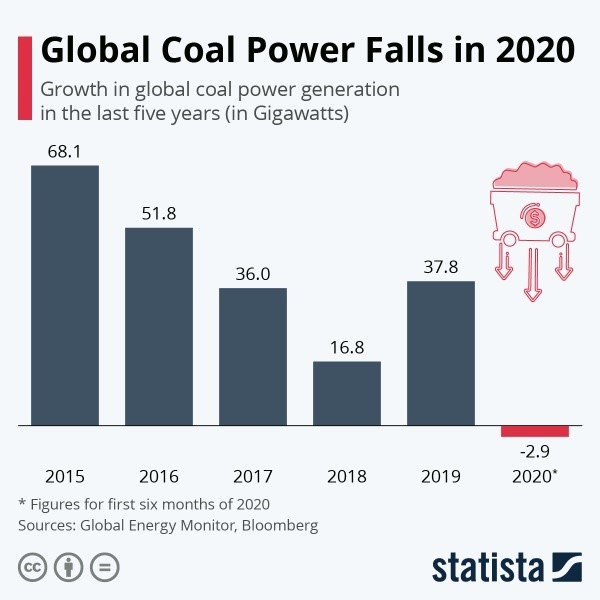

- The pandemic is having a dramatic impact on the global coal industry:

- Louisiana’s governor predicts that Formosa’s planned $9.4 billion St. James Parish petrochemicals complex, among his signature development projects, will survive court challenges over environmental permitting.

- BASF committed to providing carbon emissions data on all its 45,000 products to help customers calculate their own carbon footprint.

Supply Chain

- Ports are scaling back projects to expand container capacity, with capacity expected to grow by 25 million containers a year over the next five years, down from previous plans that would have grown capacity by 40 million containers per year.

- The sudden need for warehousing space during the pandemic is changing site selection criteria, including port centricity, internet accessibility, climate seasonality and local real estate costs.

- Strained supply chains are driving food prices higher, adding to pressures facing 30 million unemployed Americans, with beef and veal prices up 25.1%, eggs up 12.1%, and pork up 11.8% from a year earlier.

- We’re seeing the truckload freight market continuing to tighten with some LTL shippers resorting to truckload quantities due to LTL delivery challenges caused by labor shortages and operational delays from COVID-19 protocols. Clients are advised to provide expanded lead times on orders to help assure delivery dates will be met.

- Beyond the transportation challenges, our Gold Standard logistics partners and U.S. ports continue to operate without interruption.

Markets

- New COVID-19 cases in the U.S. climbed above 57,000 yesterday after two straight days below 50,000. Eighteen states have rising seven-day average case counts.

- The White House and leaders of the House of Representatives continued negotiations on the next relief deal, as the Senate leadership said it will support whatever emerges from the talks. Negotiators hope to cement a deal by the end of the week.

- In the absence of a national COVID-19 testing strategy, six states — Louisiana, Maryland, Massachusetts, Michigan, Ohio and Virginia — are banding together to procure 3 million “rapid point-of-care” testing kits.

- Two recent studies suggest that young children are major spreaders of COVID-19 and may be more infectious than adults.

- A just-published study of 402 recovered patients of COVID-19 links the disease to ongoing psychological disorders, with over half the study group experiencing higher than normal incidents of post-traumatic stress, anxiety, insomnia and depression.

- Twenty percent of small businesses are planning layoffs now that prior relief funds are spent; the number of employed people fell during July, the first such drop since March, according to employee scheduling service Homebase.

- Urban office markets have been upended by the pandemic, with property values expected to fall by 17.2% this year, nearly as much as the 19.2% expected drop for retail real estate and the 20.5% drop for lodging properties.

- Long-haul airline Virgin Atlantic filed for bankruptcy in the U.S. as part of a court restructuring plan in the U.K.

- Daimler lost $2.2 billion in the second quarter on a 34% drop in vehicle sales but sees the automobile industry recovering.

- Honda reported a $1.1 billion operating loss in the second quarter but predicted it will be profitable for the year.

- The motor coach industry is a less visible victim of the pandemic, with revenue this year on pace to drop from $15 billion to $4 billion and 40% of private bus companies in danger of extinction. The industry is lobbying for help in the next relief package.

- The chaotic effects of the pandemic were on display yesterday as insurance giants Allstate and Prudential reported second-quarter results, with Allstate reporting better-than-expected earnings on fewer claims by homebound customers, while Prudential swung to a loss on charges related to interest-rate hedges and the loss of future investment income.

- A lack of access to and competence with digital technology may deny telemedicine to one of the groups with the highest need: the elderly.

- Global demand for post-consumer plastic is expected to grow by over 6% a year through 2016 to more than $10 billion.

- The Association for Packaging and Processing Technologies will hold its PACK EXPO virtually this year, the first time in more than 60 years that the show will not be in person.

- Spirits maker Diageo said it will launch its all-paper bottle for Johnnie Walker scotch early next year at retail outlets in Spain and Scotland, noting that plastic comprises now less than 5% of its packaging materials.

- With business leaders now raising workplace hygiene to the strategic level, robots are in high demand for janitorial and other mundane tasks.

- Confirming the view of stay-at-home workers, the average workday lengthened by 48.5 minutes and the number of meetings increased by 13% in the weeks following lockdown orders.

- The Harvard Global Health Institute launched a Pandemics Explained website with an interactive map assessing county-by-county risk in the United States.

- Global COVID-19 deaths topped 700,000.

International

- Europe’s composite Purchasing Managers’ Index rose to 54.9, better than expected and the highest reading in two years, but companies continued to shed workers, and international trade remained weak, casting concerns about the strength of the recovery.

- Amid deteriorating relations between China and the U.S, the two nations will meet on August 15 to discuss compliance with their phase-one trade agreement.

- The head of France’s scientific council urged the country to prepare for a COVID-19 surge in autumn when cold weather will force people indoors.

- Cities around the world are reshaping their road grids to encourage more bicycling both to fight the pandemic and reduce carbon emissions.

Our Operations

- Flooding and downed trees in eastern Pennsylvania from Tropical Storm Isaias forced us to temporarily close our M. Holland Technical Innovation Center. Our team is working remotely and available until we can reopen the laboratory in the next day or two.

- We congratulate our own Monica Christler and Lisa Kaplan, along with all the talented women featured by Plastics News as “Women Breaking the Mold 2020.”

- Join us for our next Fireside Chat on August 19. Panelists from M. Holland and Plante Moran will discuss the new USMCA and how it will impact businesses, the economy and the plastics industry. For more information and to register, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Resource Center: M. Holland offers a host of resources to clients, prospects and suppliers. To arrange a videoconference or meeting, contact:

- Automotive: Market Manager Matt Zessin.

- Color & Compounding: Market Manager Scott Arnold.

- Electrical & Electronics: Market Manager Carlos Aponte.

- Flexible Packaging: Senior Technical Development Engineer Todd Stevens.

- Healthcare: Global Healthcare Manager Josh Blackmore.

- Rotational Molding: Product Manager Pete Nutley.

- Wire & Cable: Director Todd Waddle.

- 3D Printing: Market Manager Haleyanne Freedman.

- Sustainability: Market Manager Lindy Holland.

- For Regulatory advice, contact Regulatory Specialist Christopher Thelen.

- For Technical questions, contact Paul Lorigan, Manager of the M. Holland Technical Innovation Center.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.