COVID-19 Bulletin: August 6

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Crude prices increased in mid-day trading today, with the WTI at $42.25/bbl and Brent at $45.45/bbl.

- Exxon warned that persistent low oil prices could force the write-off of 20% of the world’s proven energy reserves.

- A federal appeals court reversed a lower court ruling and will allow the 1,100-mile Dakota Access Pipeline connecting Bakken oil fields in North Dakota with refineries in Illinois to continue operating.

- Mexico’s president proposed changing the country’s constitution to strengthen state control of Pemex.

- Sabic, hurt by asset impairment charges and low oil prices, reported a loss of $592 million in the second quarter, its biggest quarterly loss in a decade.

Supply Chain

- Orders for large, Class 8 trucks in North America rose 27% in July from June.

- We’re seeing the truckload freight market continuing to tighten with some LTL shippers resorting to truckload quantities due to capacity constraints in the LTL freight market. Clients are advised to provide expanded lead times on orders to help ensure delivery dates will be met.

- We’re seeing rising spot freight pricing due to capacity constraints in the industry.

- Beyond the transportation challenges, our Gold Standard logistics partners and U.S. ports continue to operate without interruption.

Markets

- Jobless claims last week exceeded 1 million for the 20th consecutive week, with nearly 1.2 million first-time filers.

- The U.S. trade deficit shrank 7% in June, with exports up 9.5% and imports up a smaller 4.7% from May. Exports remained nearly 16% below the June 2019 level.

- Negotiators in Washington remain stalemated on a fourth aid package.

- New York City is establishing registration checkpoints today to ensure compliance with the city’s 14-day quarantine requirement for visitors from 34 high-infection states.

- Chicago, with the nation’s third largest school district, joined a growing list of major school systems to postpone an in-person return to classrooms.

- CVS Health, the largest retailer providing COVID-19 testing, has reduced the number of new tests administered and added resources to speed the weekslong turnaround times many customers experienced in July.

- Toyota reported a 40% drop in quarterly sales and a nearly 75% drop in net income while noting that production is now recovering.

- The pandemic is straining wireless bandwidth, forcing internet providers to scale back video quality and elevating demand for advances in 5G technology and the fiber optic networks it requires.

- The average cost of 5G-enabled cell phones has dropped 31% to $813 in the past year as device manufacturers fight for market share in a maturing and pandemic-impacted mobile phone market.

- The Cruise Lines International Association is again extending the suspension of cruises until November 1 after the first Alaskan cruise of the year was cut short when a passenger tested positive for COVID-19. The suspension of U.S. cruises costs an estimated $110 million in economic activity each day.

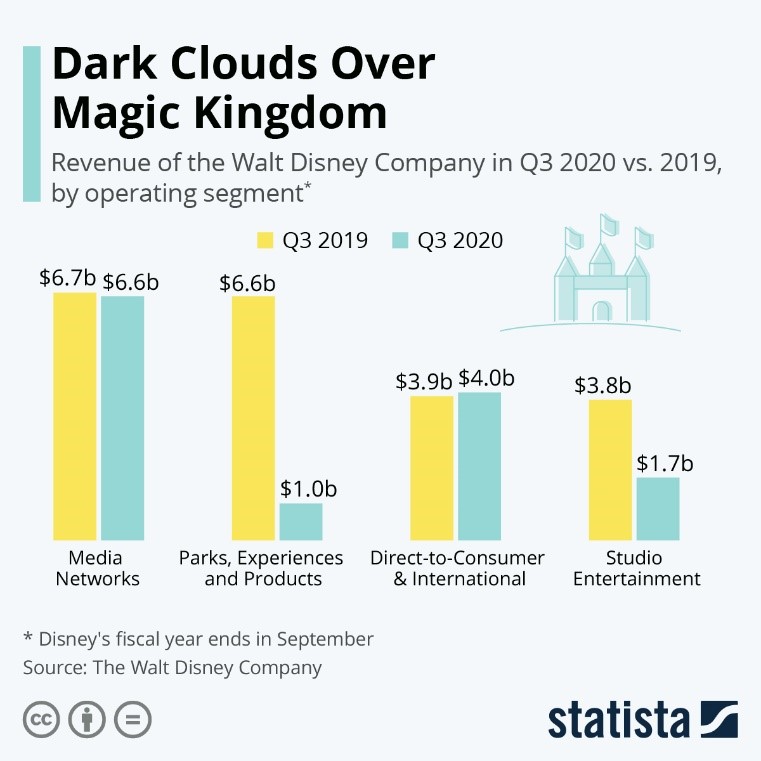

- Disney lost nearly $5 billion in its most recent quarter with revenue down in most of its businesses:

- Bankruptcies among farmers squeezed by the COVID-19 crisis are up 8% this year, despite $33 billion in federal farm support. Government aid now comprises 36% of farm income, the highest level in nearly two decades.

- Congress and the Securities and Exchange Commission are investigating the circumstances of the federal government’s $765 million Defense Production Act loan to Kodak to make chemicals for COVID-19 drugs after the company’s stock price rose from $2.62 to $60 a share following the announcement last week.

- As an added incentive to buy its private label, Kroger is offering free recycling of plastics packaging of its Simple Truth branded products.

- The Harvard Global Health Institute launched a Pandemics Explained website with an interactive map assessing county-by-county risk in the United States.

- Global COVID-19 cases are approaching 19 million.

International

- The Bank of England upped its outlook for the U.K. economy from a 14% drop in economic activity to an expected 9.5% contraction in 2020 but warned that the recovery will be slower than previously thought.

- France recorded its highest daily COVID-19 infections since May yesterday.

- Germany reported that new COVID-19 infections topped 1,000 yesterday for the first time since May. Meanwhile, factory orders in the country rebounded 27.9% in June.

- Facing record COVID-19 infection rates in recent weeks, Poland is imposing strict restrictions in 19 of its 380 counties beginning Saturday.

- The lockdown in Victoria, Australia’s second largest city that has experienced a COVID-19 outbreak, is expected to cut the nation’s third-quarter GDP by 2.5%.

- Defying economist predictions, remittances to Mexico have risen during the pandemic, with year-over-year remittances up 11% through June.

- Growing protectionism, regionalization of supply chains and weak commodity prices caused by the pandemic may stall progress for developing nations and interrupt traditional “convergence,” where developing nations grow faster and close the gap with developed economies.

Our Operations

- Our M. Holland Technical Innovation Center, which closed yesterday due to Tropical Storm Isaias, remains closed for a second day. Our team is working remotely and available to assist clients and suppliers.

- We congratulate our own Monica Christler and Lisa Kaplan, along with all the talented women featured by Plastics News as “Women Breaking the Mold 2020.”

- Join us for our next Fireside Chat on August 19. Panelists from M. Holland and Plante Moran will discuss the new USMCA and how it will impact businesses, the economy and the plastics industry. For more information and to register, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Resource Center: M. Holland offers a host of resources to clients, prospects and suppliers. To arrange a videoconference or meeting, contact:

- Automotive: Market Manager Matt Zessin.

- Color & Compounding: Market Manager Scott Arnold.

- Electrical & Electronics: Market Manager Carlos Aponte.

- Flexible Packaging: Senior Technical Development Engineer Todd Stevens.

- Healthcare: Global Healthcare Manager Josh Blackmore.

- Rotational Molding: Product Manager Pete Nutley.

- Wire & Cable: Director Todd Waddle.

- 3D Printing: Market Manager Haleyanne Freedman.

- Sustainability: Market Manager Lindy Holland.

- For Regulatory advice, contact Regulatory Specialist Christopher Thelen.

- For Technical questions, contact Paul Lorigan, Manager of the M. Holland Technical Innovation Center.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.