COVID-19 Bulletin: August 7

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Crude prices were off in early trading today, with the WTI at $41.42/bbl and Brent at $44.60/bbl.

- New exploration is off the table for major shale producers as they brace for energy markets to remain challenging through 2021. U.S. oil production is expected to be down 20% this year with only an anemic increase next year.

- Global demand for natural gas is expected to shrink by 4% in 2020, the steepest shock in history, before resuming a long-term growth path next year.

- Despite a big drop in shale gas production during the pandemic, Pennsylvania increased permitting fees for new wells by 150% to help fund its Department of Environmental Protection.

Supply Chain

- U.S. rail traffic was down 9.3% in July from the year-ago period.

- The White House issued an executive order directing federal agencies to procure essential drugs and medical supplies made in the U.S.

- Uber lost $1.8 billion on a 75% drop in bookings for its ride-sharing services; the company’s growing Uber Eats delivery service has eclipsed the ride-sharing division in size.

- Power outages in the Northeast in the wake of Tropical Storm Isaias could last for days.

- Exhausted sea crews, stranded on vessels or away from home due to the pandemic, are over contract and refusing to work, creating disruptions in the shipping industry and at ports. Some 250,000 seafarers are stuck at sea.

- We’re seeing the truckload freight market continuing to tighten with some LTL shippers resorting to truckload quantities due to capacity constraints in the LTL freight market. Clients are advised to provide expanded lead times on orders to help ensure delivery dates will be met.

- We’re seeing rising spot freight pricing due to capacity constraints in the industry.

- Beyond the transportation challenges, our Gold Standard logistics partners and U.S. ports continue to operate without interruption.

Markets

- The unemployment rate dropped to 10.2% in July with 1.8 million new jobs, slightly better than expected but amid signs of a slowing recovery.

- There were 52,000 new COVID-19 cases yesterday, up from early in the week but down from July highs, with just seven states registering accelerating infections. However, the numbers may be understated because of declines in testing in 30 states.

- The University of Washington’s Institute for Health Metrics and Evaluation, a leading modeler of the COVID-19 virus, raised its estimate for probable deaths in the U.S. to 300,000 by December 1. It said diligent use of face masks could shave the number by 70,000.

- Mississippi, with the highest positive test rate in the country, is emblematic of the spread of COVID-19 from urban areas to the broader population, alarming health officials.

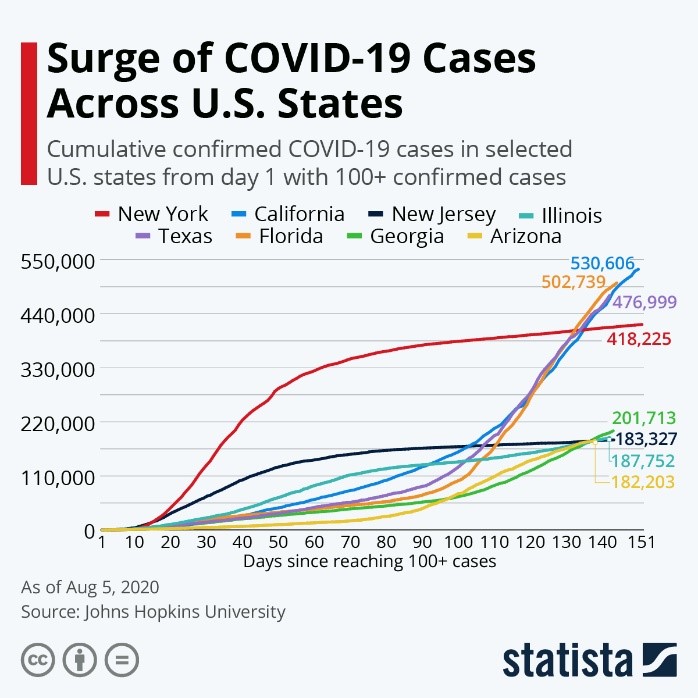

- Georgia has climbed into fifth place among states with the highest confirmed cases:

- California’s urban infection rate is flattening, but cases are soaring in rural areas of the Central Valley, which has eight of the 10 highest-infection counties in the state. Alameda County is paying infected citizens $1,250 to stay at home, while Los Angeles is threatening to shut off utilities to locations hosting large parties and gatherings.

- There will be no agreement on a fourth COVID-19 relief package this week, as congressional negotiators went home for the weekend after failing to find common ground.

- The CDC and the White House estimated that only 10 to 20 million initial doses will be available of any successful vaccine, prompting questions about how they will be allocated to more than 100 million high-priority people, such as healthcare and front-line workers.

- Demonstrating the fickleness of COVID-19 testing, Ohio’s governor tested positive for the virus using a rapid test, then tested negative later in the day in a standard test.

- Major corporations, flush with cash and hungry for growth in the challenged economy, could prompt an increase in merger and acquisition activity.

- Sweden’s Nolato Group has acquired GW Plastics, a leading Vermont-based medical device maker.

- Honda and Toyota are among car companies paring low-margin subcompacts from their lineups, forcing entry-level buyers into the used vehicle market.

- After a four-month delay due to the pandemic, General Motors unveiled its Cadillac Lyriq crossover, an all-electric vehicle that won’t be available to buyers for two years.

- Polyester fiber spunlace, used in sanitary wipes and protective equipment, is in short supply, which could impact production of sought-after health and safety products until 2021.

- Many returning office workers face an apocalyptic experience, finding time capsules of the life they suddenly left six months ago.

- A coalition of major companies is launching the Plastic Waste Reduction Program in 2021, a market-based crediting system, similar to the carbon credits system, intended to drive plastics recovery investments.

- The COVID-19 death count in the U.S. topped 160,000.

International

- Just weeks after finalizing the USMCA trade agreement with Canada and Mexico, the White House is re-imposing 10% tariffs on Canadian aluminum starting August 16, prompting a promise of retaliation from Canada.

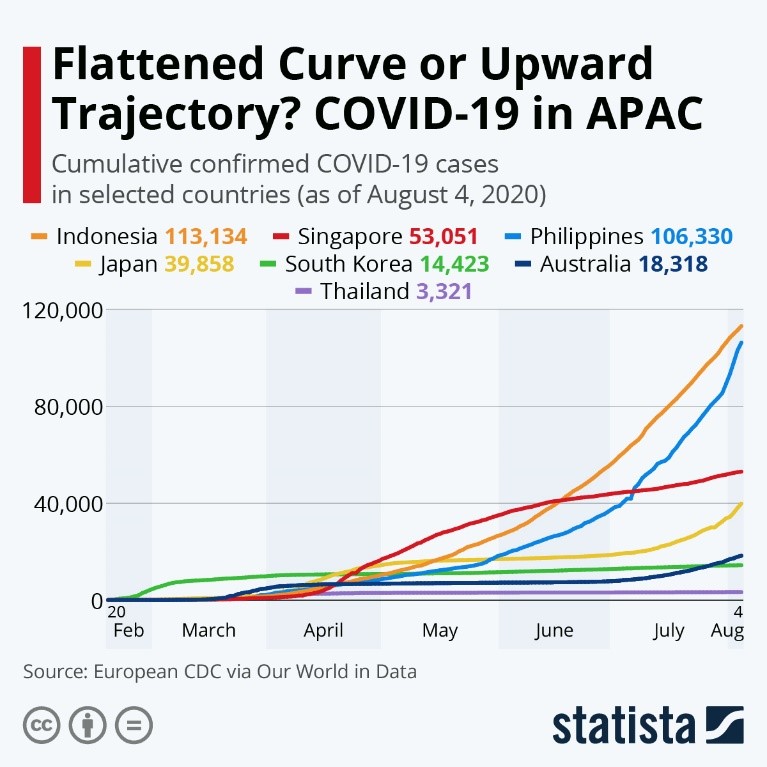

- Indonesia and the Philippines are experiencing runaway infection rates among Asia-Pacific countries:

- China’s exports rose 7.2% in July compared with the prior-year period, higher than expected and a sign of an accelerating economic recovery.

- The United Nations projects that the regional economy of Latin America and the Caribbean will contract by 9.1% this year, with 45 million people joining the poverty ranks.

- The U.S. State Department lifted its blanket advisory against all international travel, replacing it with specific country advisories. Most countries are ranked at Level 3, the highest risk category.

Our Operations

- Our M. Holland Technical Innovation Center, which closed due to Tropical Storm Isaias, will remain closed until next week. Our team is working remotely and available to assist clients and suppliers.

- We congratulate our own Monica Christler and Lisa Kaplan, along with all the talented women featured by Plastics News as “Women Breaking the Mold 2020.”

- Join us for our next Fireside Chat on August 19. Panelists from M. Holland and Plante Moran will discuss the new USMCA and how it will impact businesses, the economy and the plastics industry. For more information and to register, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.