COVID-19 Bulletin: December 1

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Energy prices were lower in early trading today, with the WTI down 1.0% at $44.52/bbl, Brent down 1.2% at $47.31/bbl and natural gas off 0.1% at $2.85/MMBtu.

- OPEC member nations have delayed until Thursday a decision on whether to extend current production cuts into the new year.

- The Baker Hughes count of active oil and gas rigs climbed by 10 to 320 last week, well below the 802 active rigs a year ago.

- The energy sector was among the hardest-hit segments of the U.S. economy in 2020 demonstrated by several measures — low prices, lost jobs, low market values, a weak merger market and rising bankruptcies.

- Exxon will take a $17 billion to $20 billion asset impairment charge in the fourth quarter as it narrows its investment focus to the most promising development projects.

- An armada of 20 oil tankers is booked to deliver U.S. crude to the Far East in December amid demand fueled by the region’s strong economic recovery and a favorable arbitrage between the price of American crude and Asian crude.

- Bank of Montreal is dissolving its investment banking unit focused on the U.S. energy sector.

- Bank of America is the sixth major U.S. bank to stop providing funding for oil and gas exploration in the arctic.

- An expected boom in renewable energy capacity will require massive investment into high-voltage power line construction in the U.S., which currently falls far behind the transmission capacity of China, Europe, South America and India.

- Westlake Polymers lifted its August 31 force majeure and reported that its Lake Charles, Louisiana, facility is back in full operation.

Supply Chain

- A potential logistics disaster awaits the U.K. on January 1 when the country officially exits the European Union, bringing fears of delays, bottlenecks and shortages in essential goods as the free movement of goods across the English Channel halts.

- Container shipping rates from China to Southeast Asia as well as China to Europe are surging to new highs on limited equipment availability due to booming demand.

- Congestion at the Port of Los Angeles is delaying retailers’ holiday inventories.

- With tight freight capacity nationwide and supply constraints with many plastic resins, clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- There were 157,901 COVID-19 cases and 1,172 fatalities in the U.S. yesterday.

- Increased travel during Thanksgiving will likely lead to a surge in new COVID-19 infections in the coming weeks.

- COVID-19 hospitalizations in the U.S. reached a record 93,000 on Monday, as more than a third of the country’s total cases since spring came in November alone. In California, hospitalizations increased almost 90% over the past 14 days, leading the state’s governor to warn of new restrictions.

- New York is requiring hospitals to increase their bed counts and staff amid coronavirus infection rates not seen since May, as New York City reached a 4% positivity rate Monday.

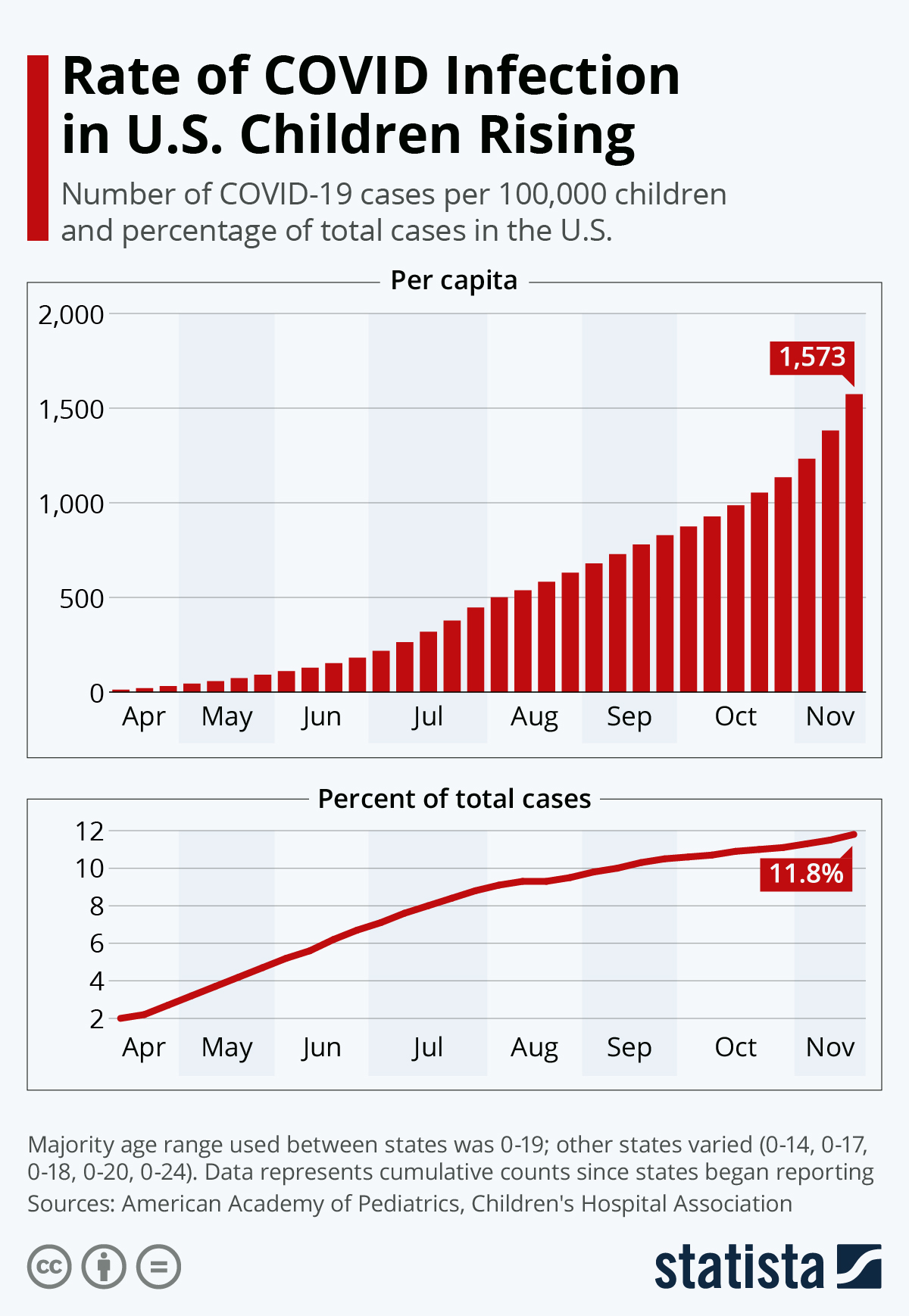

- COVID-19 cases among children are rising as a percentage of overall infections:

- Studies of American Red Cross blood samples suggest that COVID-19 was circulating in the western U.S. in mid-December 2019, weeks before the virus was identified in China.

- A little-known syndrome that causes dizziness and fatigue is helping explain the symptoms of some COVID-19 “long-haulers,” potentially opening the door to wider treatment options.

- Research shows that asymptomatic COVID-19 victims have a stronger immune response to the virus than those who develop symptoms.

- By providing a safety net for credit markets, the Federal Reserve’s pandemic-induced lending programs unlocked more than $2 trillion to support businesses, cities and states, the central bank’s top official said Monday. The programs are set to expire December 31.

- Online sales reached a record $10.8 billion yesterday, Cyber Monday, up 15.1% from last year.

- Videoconference app Zoom posted another quarter of record sales alongside higher costs associated with providing free services to some users, such as 125,000 K-12 students.

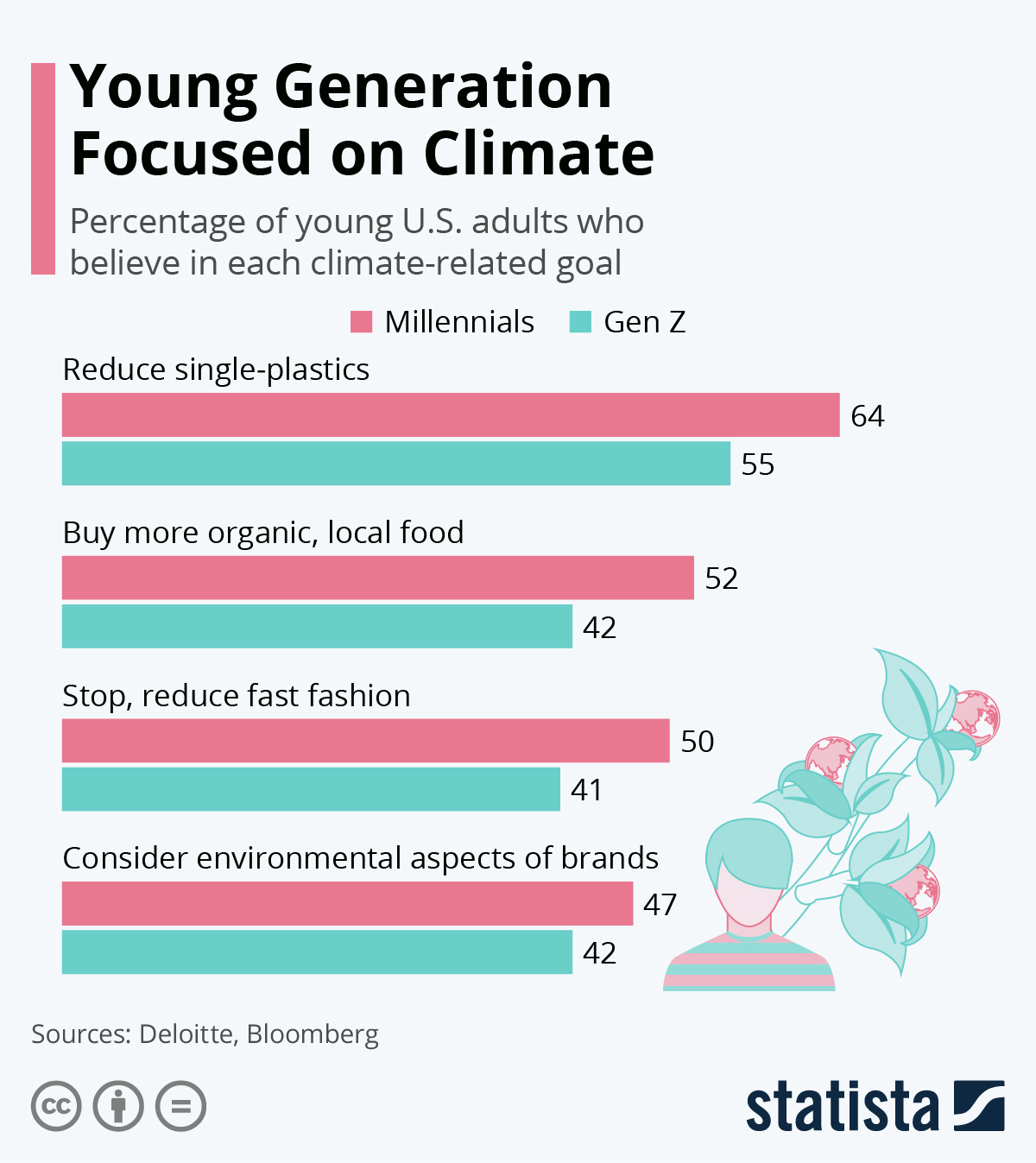

- More than half of young adults believe in reducing single-use plastics:

International

- Hong Kong is implementing work and social restrictions after 76 people tested positive for COVID-19.

- Social restrictions will remain in place until the end of the year in the Philippines.

- Croatia’s prime minister became the latest world leader to test positive for COVID-19.

- Pfizer/BioNTech applied for formal approval of their COVID-19 vaccine today in Europe, opening the possibility for dissemination yet this year.

- China is emerging as the top foreign market for companies that do business across Asia-Pacific, a result of a years-long trade war that has decoupled the U.S. and Chinese markets.

- Japanese capital expenditures fell 10.6% in the third quarter from the year-ago period, the country’s second straight quarter of double-digit declines in spending on plants and equipment in the wake of weak private sector demand.

- Mexico announced its second stimulus package in less than two months of more than $10 billion in infrastructure funding as the country seeks to accelerate an economic rebound.

- Canada has been the most aggressive among its G-20 peers in applying fiscal stimulus to counter the economic impact of the pandemic, raising concerns about a longer-term fiscal crisis.

- Canada plans to impose a new tax on digital services companies beginning in 2022 to help stem a budget shortfall, prompting threats of trade retaliation from the White House.

- The Organization for Economic Cooperation and Development raised its outlook for the global economy in 2020 to a 4.2% contraction, versus its earlier estimate of a 4.5% decline, but lowered its projections for growth over the next two years and urged governments to continue stimulus efforts.

- In a divergence with its struggling European neighbors, Germany experienced an unexpected drop in unemployment in November and a continued growth in industrial output on strong export demand.

- Boosted by pre-Brexit orders from abroad, the U.K.’s industrial sector grew in November with the industrial purchasing managers index rising to 55.6 from 53.7 in October.

- The U.K. auto industry, down 34% this year due to the pandemic, faces up to $74 billion in tariff costs over the next five years in the event of a no-deal Brexit.

- The French car market is expected to close the year down 26%, the lowest level since 1975.

- With a third of the world’s passenger jets in storage, concerns are being raised about the proficiency of pilots who are taking their first trips after months without regular flying.

Our Operations

- We are pleased to introduce M. Holland’s new Application Development Engineer for Sustainability, Debbie Prenatt. With 20+ years in the plastics industry, Debbie will focus on developing our portfolio and expanding our expertise in the Sustainability segment to better serve our clients.

- Our latest Founders Series video is a tribute to Joan Holland, co-founder and matriarch of M. Holland, who recently passed away.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our online resource.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.