COVID-19 Bulletin: December 11

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- The Brent crude price closed above $50/bbl yesterday for the first time since March on hopeful COVID-19 vaccine news and hopes for an economic relief bill. Crude prices were off in early trading today, with the WTI down 0.4% at $46.59/bbl and Brent down 0.6% at $49.98/bbl, while natural gas was up 2.4% at $2.61/MMBtu.

- Saudi Aramco is selling stakes in various subsidiaries in a bid to raise $10 billon in cash after suffering a 44.6% decrease in profits in the third quarter.

- Mexico’s government is mulling reducing the tax burden on Pemex, the nation’s largest company and taxpayer.

- Nova Chemicals has entered an agreement to sell recycled LLDPE made by recycler Revolution, adding to its sustainability product line.

- Amazon is banning certain toxic chemicals and restricting the use of PVC, PS and EPS in food packaging for its Amazon Kitchen brand.

Supply Chain

- Import volume at the ports of Los Angeles and Long Beach were up by a third in October from the year-ago period, as the pandemic has caused a “perfect storm” for global supply chains.

- Toyota is building 10 Class 8 semi-trucks powered by fuel cell technology for short-haul cargo testing at the Port of Los Angeles and the Port of Long Beach.

- Logistics conditions continue to deteriorate, with trucking demand exceeding availability, growing congestion at ports, and backlogs at warehousing and packaging facilities due in part to operating challenges related to the pandemic. Shipping containers are in short supply, with demurrage charges rising. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- The U.S. suffered 224,452 new COVID-19 infections yesterday and 2,768 fatalities.

- A Food and Drug Administration panel has cleared the way for final FDA approval of Pfizer’s COVID-19 vaccine, voting Thursday evening in favor of broad distribution of doses as soon as possible.

- The Midwest, recently the hardest-hit region in the U.S., is seeing flattening COVID-19 infection curves in Michigan, Illinois, Iowa, Minnesota and the Dakotas, with seven-day case averages falling week over week.

- With around 10,000 new COVID-19 cases per day, New York is verging on daily records set in the spring.

- California’s Sacramento region, home to the state capitol, is being put under the state’s harshest virus restrictions, with private gatherings banned, some businesses closed and a mask mandate. The state’s Lake Tahoe ski resorts are closing today through the holidays.

- Virginia is imposing a new nighttime curfew; Ohio is extending a nighttime curfew through New Year’s except for some high-profile sporting events; while Pennsylvania shutters indoor dining and gyms alongside business and social restrictions.

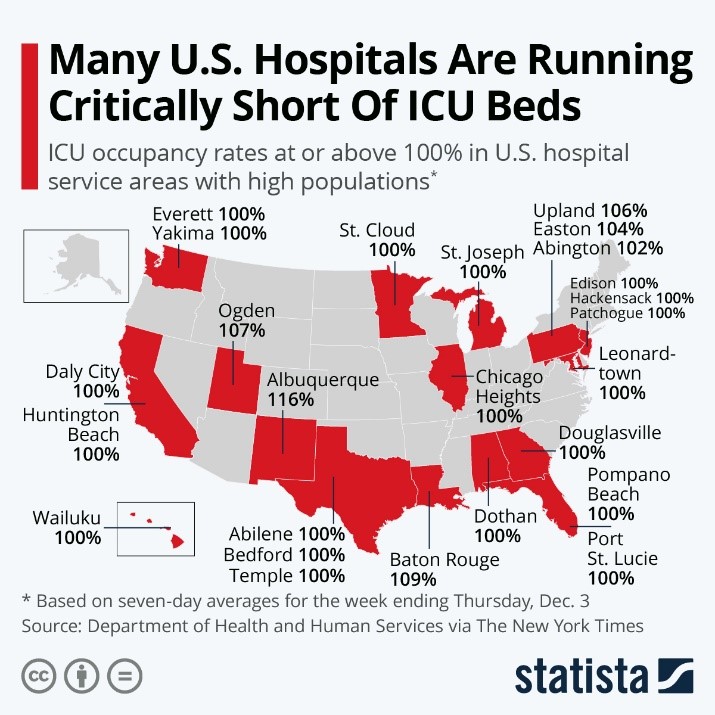

- The CDC reported that at least 200 hospitals are at capacity, and hospitals in at least 16 states are reporting ICU demand at or exceeding capacity:

- New Hampshire’s state House speaker, age 71, has died from COVID-19.

- States face daunting challenges in figuring out how to organize initial vaccine distribution to high-risk populations, as the U.S. prepares to receive its first batch of 2.9 million COVID-19 vaccine doses.

- Vaccine maker Moderna will begin testing doses on adolescents with the aim of immunizing children ahead of the next school year. Moderna’s vaccine, while likely to receive approval later than Pfizer’s, could provide a backstop to existing U.S. deals if initial dosage shipments fail to meet demand.

- Sanofi and GlaxoSmithKline delayed wide-scale testing of their experimental COVID-19 vaccines after early trials did not produce sufficient immune response.

- The leading manufacturer of AstraZeneca’s COVID-19 vaccine candidate warned that growing population density and deforestation will likely spawn more infectious pathogens jumping from wildlife to humans in the future.

- Today is the deadline for Congress to pass a short-term spending bill to avert a government shutdown.

- Lawmakers hit an impasse over limiting business liability related to COVID-19, stalling negotiations on a new relief package.

- Expiring eviction moratoriums could reveal up to $70 billion owed by U.S. renters, with the average lease about three months behind payment.

- The U.S. budget deficit rose 25% in October and November from the year-ago period, a result of higher spending on virus relief and shrinking tax revenues from the economic downturn.

- The net worth of U.S. households hit a record $123.52 trillion in the third quarter driven by surging values in the stock market and real estate. Household debt, on the other hand, rose 5.6% from the second to third quarter, the fastest pace in two years.

- Cadillac’s latest CT4-V and CT5-V Blackwing models contain a number of functional and aesthetic parts that are 3D printed.

- Hyundai acquired Boston Dynamics, a maker of humanoid and animal-like robots, as it pushes to develop robotic and autonomous vehicles. The company also has plans to introduce autonomous Urban Air Mobility (UAM) vehicles, essentially flying taxis, by the end of the decade to shuttle cargo and passengers in congested urban areas.

- The U.S. Air Force gave a safety endorsement for flying taxis for military use, paving the way for eventual commercial approvals and the growth of a new transport industry.

- The golf industry is enjoying a COVID-19 revival, with rounds played in September up 26% from the year-ago period as duffers seek recreation in a sport considered safe.

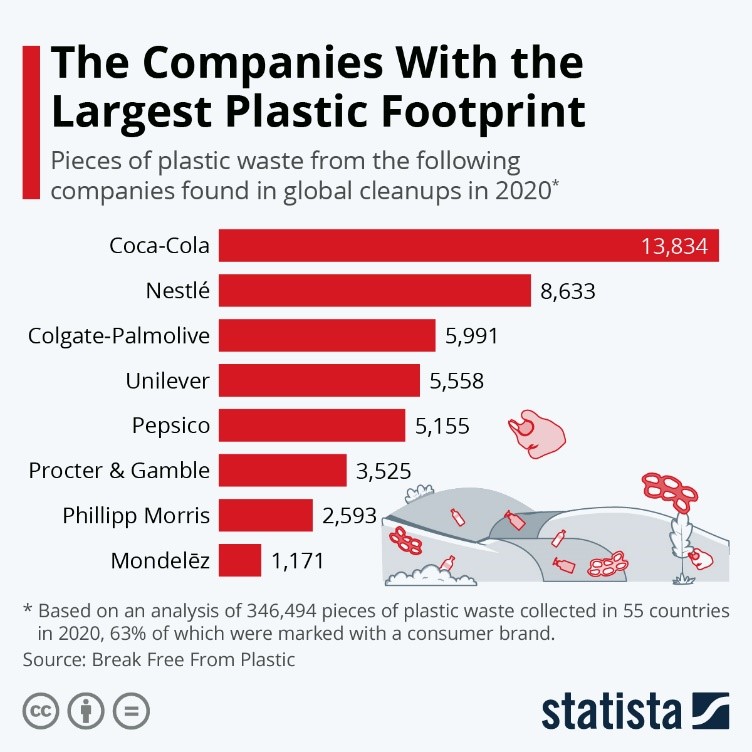

- Consumer goods companies top the list of plastic waste polluters, with Coca-Cola in the lead:

International

- France is imposing a new curfew starting December 15, with officials asking the population to stay home for New Year’s Eve as circulation of the virus remains high.

- Inconsistent upticks of the virus in other European countries, including Germany and Belgium, are prompting governments to extend restrictions.

- Russia is falling far short of its promised 30 million doses of a state-produced COVID-19 vaccine by year’s end, on track to produce just 2 million.

- Mexico’s median age for COVID-19 fatalities is 55, significantly below Europe’s median age of 75, due to higher rates of obesity, diabetes and other risk conditions in the country.

- Governments around the globe are gearing up to track those who have been vaccinated for COVID-19, as rapid development of the drug leaves lingering questions about vaccine effects and efficacy.

- The European Bank unveiled a new stimulus package that scales up its emergency bond-buying program by a third alongside new batches of ultracheap loans for banks. The move pushes the ECB’s monetary stimulus this year above 3 trillion euros.

- Britain’s prime minister is cautioning that a “no-deal” Brexit could likely occur by year’s end, prompting significant border disruption on January 1 for about $900 billion worth in trade.

- While the current global wave of COVID-19 is worse than in the spring, markets have been less affected as governments seek to apply shorter, less stringent and more targeted restrictions in response.

- Technological change combined with the effects of the pandemic could be exacerbating economic inequality in Asia, which threatens to deepen once more economies start rebounding.

- Saudi Arabia has authorized use of the Pfizer/BioNTech COVID-19 vaccine, becoming the fourth country to do so after neighboring Bahrain, the U.K. and Canada.

- A man who caused a Singapore “cruise to nowhere” ship to be evacuated and its guests put in quarantine falsely tested positive for COVID-19 on board and does not have the virus.

- Australia is canceling an order for 51 million doses of an experimental COVID-19 vaccine developed by CSL Ltd., as the doses caused some trial participants to falsely test positive for HIV.

- Car sales in China, the world’s largest automobile market, rose 11.6% in November over the prior-year period.

- One in four homes in Australia now has rooftop solar panels, a boon for the environment that also makes it increasingly difficult for networks to maintain a stable grid and power market.

- Japan’s ruling coalition is mulling tax breaks on low-emission cars and green investments in excess of $612 million.

Our Operations

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our online resource.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.