COVID-19 Bulletin: December 14

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Crude prices were lower in mid-day trading today, with the WTI at $46.52/bbl and Brent at $49.92/bbl. Natural gas 34% higher at $2.65/MMBtu.

- The Baker Hughes count of active oil and gas rigs in the U.S. rose by 15 last week to 338, the biggest jump since January.

- Iran expects to sell as much as 2.3 million bpd of oil starting in March of 2021, a level not reached since May 2018 when U.S. sanctions took effect.

- Spanish utility Iberdrola and Italian power company Enel are the green energy market’s fastest growing giants, with market values rivaling oil majors Exxon and BP thanks to early bets on wind and solar farm development.

- Amazon is developing 26 wind and solar energy projects totaling 3.4 gigawatts of production capacity to power the company’s corporate offices, fulfillment centers and data centers.

- China slightly upped its climate goals by 2030, including a 5% increase in emissions reductions per unit of gross domestic product.

Supply Chain

- Heavy snows are expected in East Coast cities starting Wednesday, as a large weather system sweeps up the mid-Atlantic.

- 2020 has tied 2011 and 2017 with at least 16 different weather and climate-related disasters with a financial toll greater than $1 billion.

- Shippers exporting from China will likely face equipment shortages for another six to eight weeks as port congestion, high rates and container shortages strain the container supply chain.

- A shortage of computer chips, first felt in China, could spread to threaten the recovery of the global automotive industry.

- The value of warehouse properties, which comprise 20% of global commercial real estate investments this year, may be reaching a “bubble” stage as industrial property valuations are up 8.5% during the pandemic.

- Mercedes-Benz maker Daimler AG has reached an agreement to develop liquid-hydrogen refueling technology for fuel-cell-powered trucks, with the first refueling to take place at a German pilot station in 2023.

- Passenger-to-freighter conversion firms are capitalizing on the rush among airlines to convert old passenger jets into freighters.

- Thinning Arctic ice made the 2020 navigation season for natural gas tankers the longest on record, a result of persistently warmer-than-average temperatures throughout the year.

- Japanese transport company MOL will transport coal to a power company using a wind-powered vessel.

- Logistics conditions continue to deteriorate, with trucking demand exceeding availability, growing congestion at ports, and backlogs at warehousing and packaging facilities due in part to operating challenges related to the pandemic. Shipping containers are in short supply, with demurrage charges rising. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- The U.S. set new records for one-day COVID-19 cases (231,700), fatalities (3,300) and total hospitalizations (108,108) over the weekend.

- After adding 1 million cases in just four days, total U.S. COVID-19 cases have surpassed 16 million.

- COVID-19 case counts are rising in 63% of counties in the United States.

- California has been particularly hard hit, with record infections in Los Angeles and San Francisco counties contributing to the state’s daily new COVID-19 case counts above 30,000. The surge has completely filled hospital ICU capacities in some regions and led to record fatalities statewide.

- New York and Pennsylvania are banning indoor dining among other restrictions.

- Maryland is testing record COVID-19 case numbers posted in the spring.

- Delaware is posting record new daily COVID-19 cases.

- Texas hospital ICU capacity is the lowest since the start of the pandemic, with beds completely full in at least 28 hospitals in recent weeks.

- U.S. regulators have approved the Pfizer/BioNTech COVID-19 vaccine, said to be 95% effective in preventing the disease. FedEx and UPS picked up the first shipment of the vaccine Sunday morning, part of a rollout of 2.9 million initial doses of the drug to be distributed to states.

- The first vaccine shipments are set to arrive at hospitals and other vaccination sites today, with top U.S. lawmakers and federal officials given priority to receive the vaccine alongside essential healthcare workers and nursing home residents.

- U.S. regulators are recommending the government add the COVID-19 vaccine to the list of inoculations people 16 years and older should get.

- The U.S. has doubled its purchase of Moderna’s COVID-19 vaccine to 200 million doses by the end of 2021, contingent on the vaccine’s approval from U.S. regulators.

- Lawmakers have agreed on a bill to fund the government for one week, as details of a broader spending bill are worked out and negotiations continue on a further $908 billion in pandemic relief.

- With an expected 10% year-over-year increase in home prices from last year, the booming housing market could play a pivotal role in U.S. economic recovery from the pandemic.

- U.S. consumer sentiment increased in late November and early December on optimism about improved economic conditions as the country begins vaccine rollouts.

- The U.S. economic recovery is likely to slow further before the impact of COVID-19 vaccines are felt, most economists say.

- Costco reported a 17% increase in sales alongside an 86% jump in e-commerce sales as homebound Americans continue to spend more on food, home goods and fitness products.

- Face masks are the go-to stocking stuffer this holiday season.

- Toyota is expected to unveil an electric vehicle with a solid-state battery that can charge in 10 minutes.

- Rapid growth of electronic devices and electric vehicles is increasing demand for battery recycling and spurring a number of startup companies.

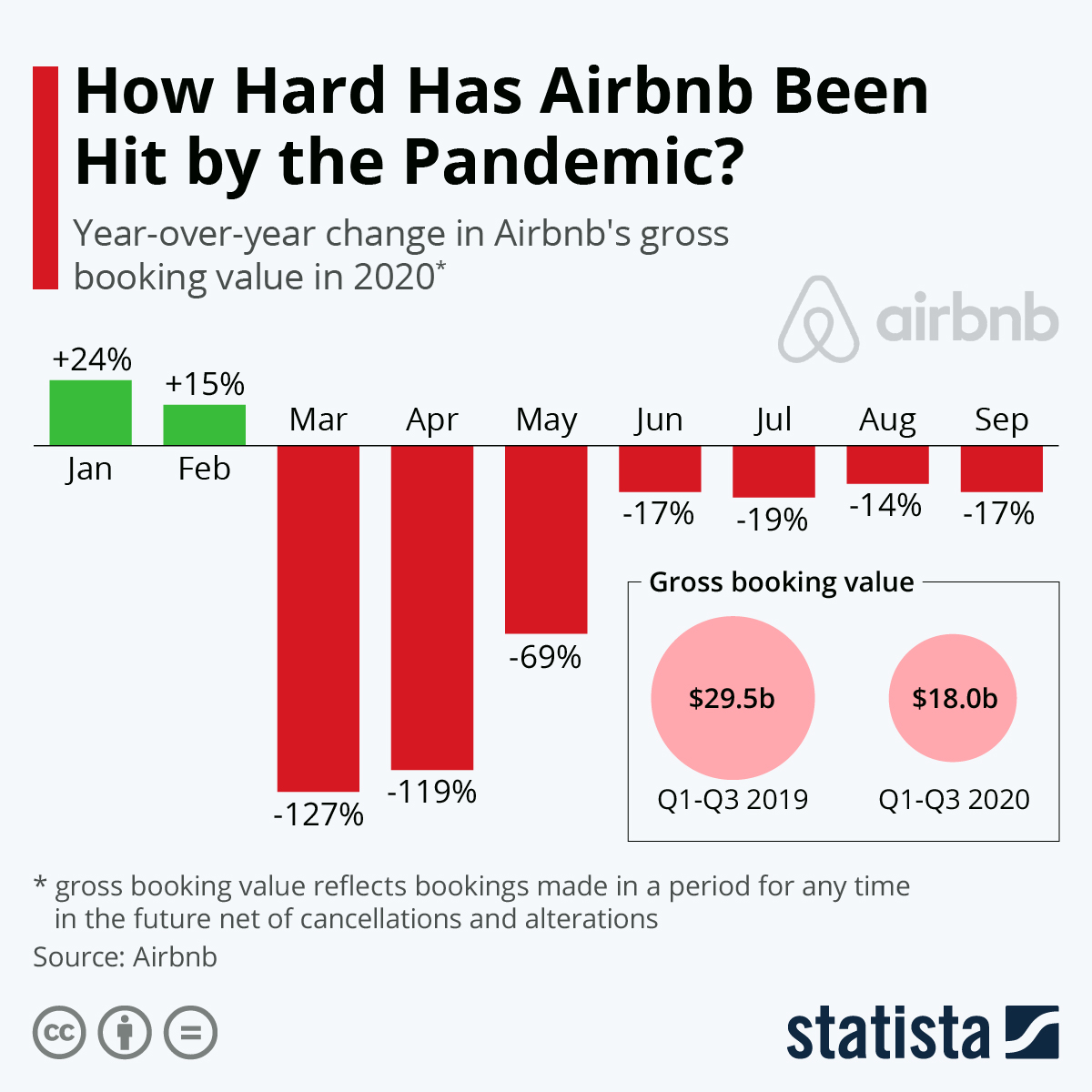

- While Airbnb and the lodging industry have made a slow recovery from the pandemic…

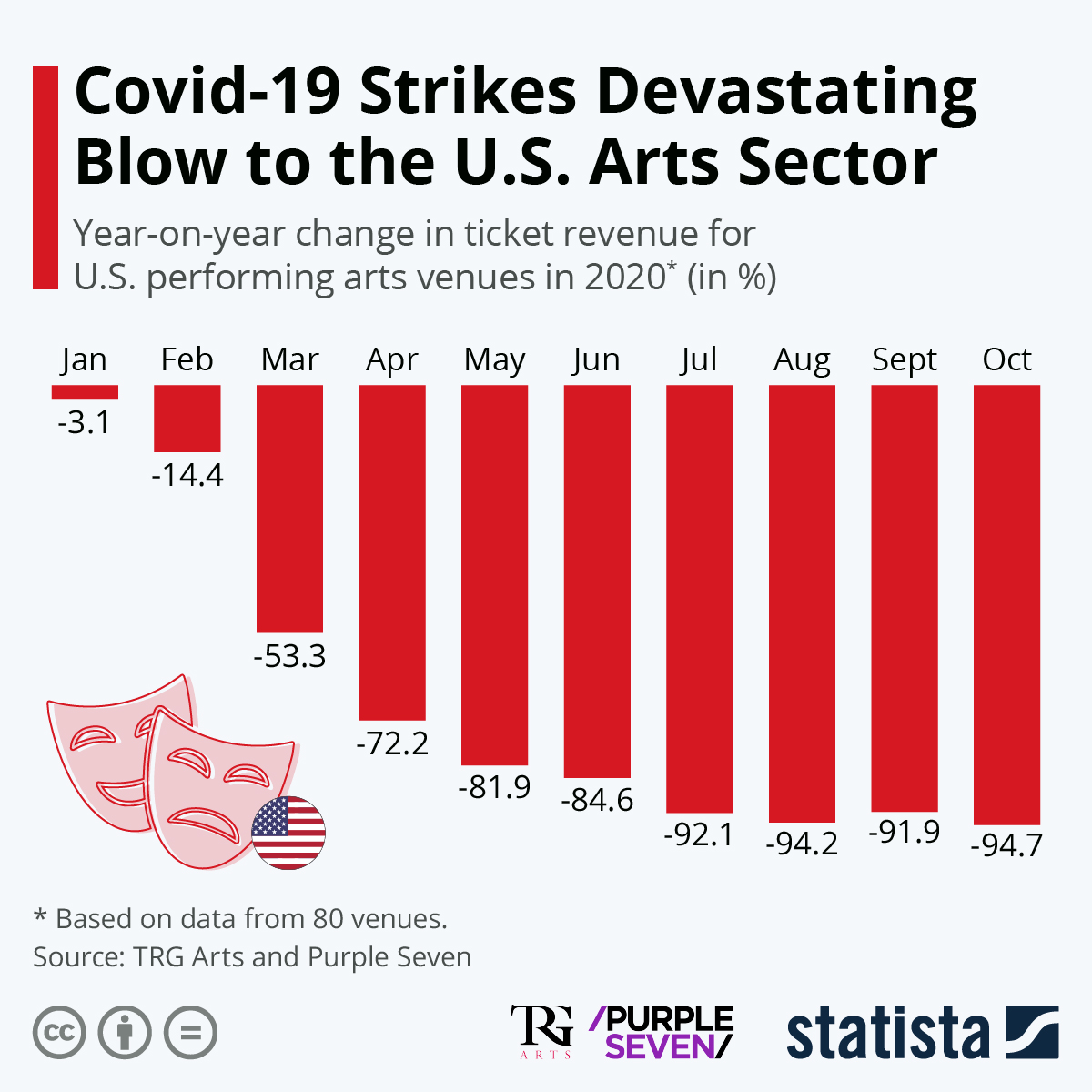

…the performing arts sector has failed to recover at all:

- Deutsche Bank AG is considering moving some of its nearly 5,000 Manhattan staff to other hub cities across the U.S. due to the possibilities of remote work, while Oracle is moving its headquarters from Silicon Valley to Texas.

International

- Sweden is facing a shortage of healthcare workers due to mounting resignations and increasing COVID-19 hospitalizations.

- Italy has overtaken the U.K. for the highest number of COVID-19 fatalities in Europe at 64,026.

- German lawmakers are mulling adding restrictions to current lockdown measures that began November 2 after the country reported its highest death toll from the disease last week.

- Rising COVID-19 cases in Portugal have led to a record number of single-day fatalities.

- New COVID-19 cases in Japan are topping 3,000 per day for the first time, as government officials consider tighter restrictions.

- South Korea recorded nearly 1,000 new COVID-19 cases in one day, leading the nation’s president to declare an emergency.

- The prime minister of Swaziland became the first head of state to die after contracting COVID-19.

- New Zealand and Australia have agreed to allow quarantine-free travel in the first quarter of 2021.

- Peru is halting trials of a Chinese COVID-19 vaccine after a patient suffered unidentified health problems, while Bahrain has approved the same vaccine.

- Officials in the Philippines say inoculating a planned 60 to 70 million people will take from two to five years.

- After meeting Sunday to discuss whether it was worth keeping negotiations going, U.K. and European Union trade officials will continue talks on a Brexit deal until December 31, one day before deadline.

- Japanese manufacturing sentiment improved for the second straight quarter due to a recovery in exports and production, a central bank survey shows.

- Australia’s central bank will extend its quantitative easing program by purchasing a further $75.4 billion of government securities over the next six months.

- Global CO2 emissions are expected to drop an unprecedented 7% from 2019 to 2020.

- Swedish lawmakers have agreed to start exploring the transition to a digital currency.

- South Korea-based Hyundai Motor announced a 40% increase in spending on developing electric and fuel cell vehicles over the next five years.

Our Operations

- M. Holland will be closed on Thursday and Friday, December 24 and 25, for the Christmas holiday.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our online resource.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.