COVID-19 Bulletin: December 18

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices are poised for a seventh straight week of gains on optimism about economic recovery spurred by COVID-19 vaccine rollouts.

- Crude prices were higher in mid-day trading today, with the WTI up 1.4% at $49.02/bbl and Brent 1.3% higher at $52.17/bbl. Natural gas was 1.5% higher at $2.68/MMBtu.

- U.S. shale producers have reduced their production costs by 20% this year to an average of $45/bbl.

- Canadian railway CN is partnering with firms to build a high-tech logistics center near the Port of Mobile in Alabama to export plastics resins. The facility is expected to open in late 2021 with an annual capacity of 25,000 twenty-foot equivalent units.

- U.S. renewable power capacity installations for both wind and solar projects have surged to records in 2020.

- Spanish utility Naturgy and gas system operator Enagas are partnering to build a Spanish hydrogen plant capable of making 9,000 tonnes a year of clean hydrogen.

- Berry Global Group has entered an agreement to purchase Repsol’s chemically recycled polypropylene for food and healthcare packaging at its European packaging facilities.

- Total Petrochemicals & Refining USA declared a force majeure on polypropylene products made at its LaPorte, Texas, facility, which suffered a fire on December 15.

Supply Chain

- Wednesday’s East Coast snowstorm caused record snowfall of up to 3 feet in many cities while knocking out power for about 46,000 customers between Virginia and New York. More than 600 flights were canceled yesterday due to the storm.

- Rail ramp congestion is slowing intermodal traffic in Chicago and Southern California, which are seeing greater demand attributable in part to high rates in the trucking market.

- FedEx’s peak surcharges on parcels will be extended into 2021 on continued limited carrier capacity, elevated parcel volumes and few carriers with which to partner.

- Shipping volumes at FedEx’s Ground unit surged 29% in the latest quarter on higher e-commerce shipments.

- Logistics conditions continue to deteriorate, with trucking demand exceeding availability, growing congestion at ports, and backlogs at warehousing and packaging facilities due in part to operating challenges related to the pandemic. Shipping containers are in short supply, with demurrage charges rising. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- There were 233,271 new COVID-19 infections in the U.S. yesterday and 3,270 deaths. Total infections in the country topped 17 million, 23% of the global total.

- California again smashed its record for new COVID-19 cases, reporting more than 52,000 infections on Thursday with a single-day record of 379 fatalities.

- ICU capacity at Southern California hospitals has dropped to 0% in an 11-county region, meaning hospitals will be forced to start taking “surge capacity” patients in other parts of the hospitals that already are suffering from strained resources. Greater Los Angeles is the hardest hit metro area in the U.S.

- More than half of counties in Arizona are seeing “substantial” spread of new COVID-19 cases.

- COVID-19 cases in Arkansas rose by more than 3,000 in one day, a record.

- Maine has set a new record for COVID-19 infections two days in a row.

- An FDA committee has recommended that U.S. regulators grant emergency use authorization for Moderna’s COVID-19 vaccine, which is reportedly 94.1% effective in preventing the disease and does not require the unusually cold temperatures needed to transport the Pfizer/BioNTech alternative.

- Pfizer/BioNTech is working with the U.S. Food and Drug Administration to revise fact sheets that accompany its COVID-19 vaccine after seeing side effects in inoculated patients, which include rare allergic reactions. The company is working with the federal government to double the number of doses available for the country’s vast immunization effort.

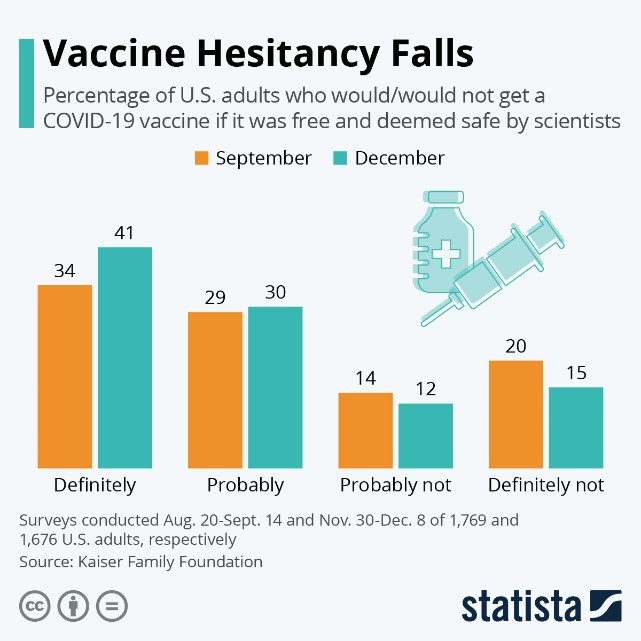

- Resistance to taking a COVID-19 vaccine is waning:

- Coronavirus precautions have blunted the impact of the flu and other seasonal viruses, with U.S. labs finding significantly fewer flu cases among tested patients this year.

- The federal government faces the possibility of a partial weekend shutdown as top leaders continue work on further pandemic aid linked to a broader spending bill for 2021.

- Every U.S. state saw personal income drop in the third quarter as federal stimulus dollars wound down, led by West Virginia with a 30% annual contraction rate.

- One third of U.S. households say they are in arrears on mortgage or rent payments and could face eviction in coming months, according to Census Bureau data.

- Foot traffic inside New York City’s financial districts has declined in some areas by nearly 80% from 2019 levels due to increasing reliance on remote work.

- Hotels in Manhattan are not expecting business volumes over the usually busy holiday season to exceed 20% of capacity due to rising COVID-19 cases and lockdowns.

- Coca-Cola will cut 2,200 jobs worldwide, including 1,200 in the U.S., amid ongoing shutdowns of soft-drink venues like theaters, bars and stadiums.

- General Mills, reporting better-than-expected third quarter sales, said it expects the pandemic-driven trend toward home cooking will continue as financially stressed consumers economize.

- According to a Consumer Reports survey, 70% of U.S. drivers are interested in getting an electric vehicle in the future, but only 4% have definitive plans to do so.

- U.S. college enrollment in the fall dropped 3.6% compared to the year-ago period, as many young students shelve plans to go into debt for school during the pandemic.

International

- The number of recorded worldwide COVID-19 cases passed 74 million Thursday.

- Italian lawmakers are pushing for harsh holiday lockdowns, including the closure of stores, restaurants and bars in the days around Christmas and New Year’s.

- Poland will enter a national quarantine from December 28 to January 17 that includes the closure of hotels, ski slopes and malls, with businesses getting extra monetary support throughout.

- Sydney, Australia reported 10 new COVID-19 cases Friday, bringing the total cluster to 28 cases in the region that previously saw nearly a month of zero transmissions.

- The European Union is eyeing December 27 as the day to start rolling out COVID-19 vaccinations, days after a planned decision on whether to authorize Pfizer/BioNTech’s shot.

- Saudi Arabia has begun inoculating citizens against COVID-19, with more than 150,000 people already registering via phone app to get the shot.

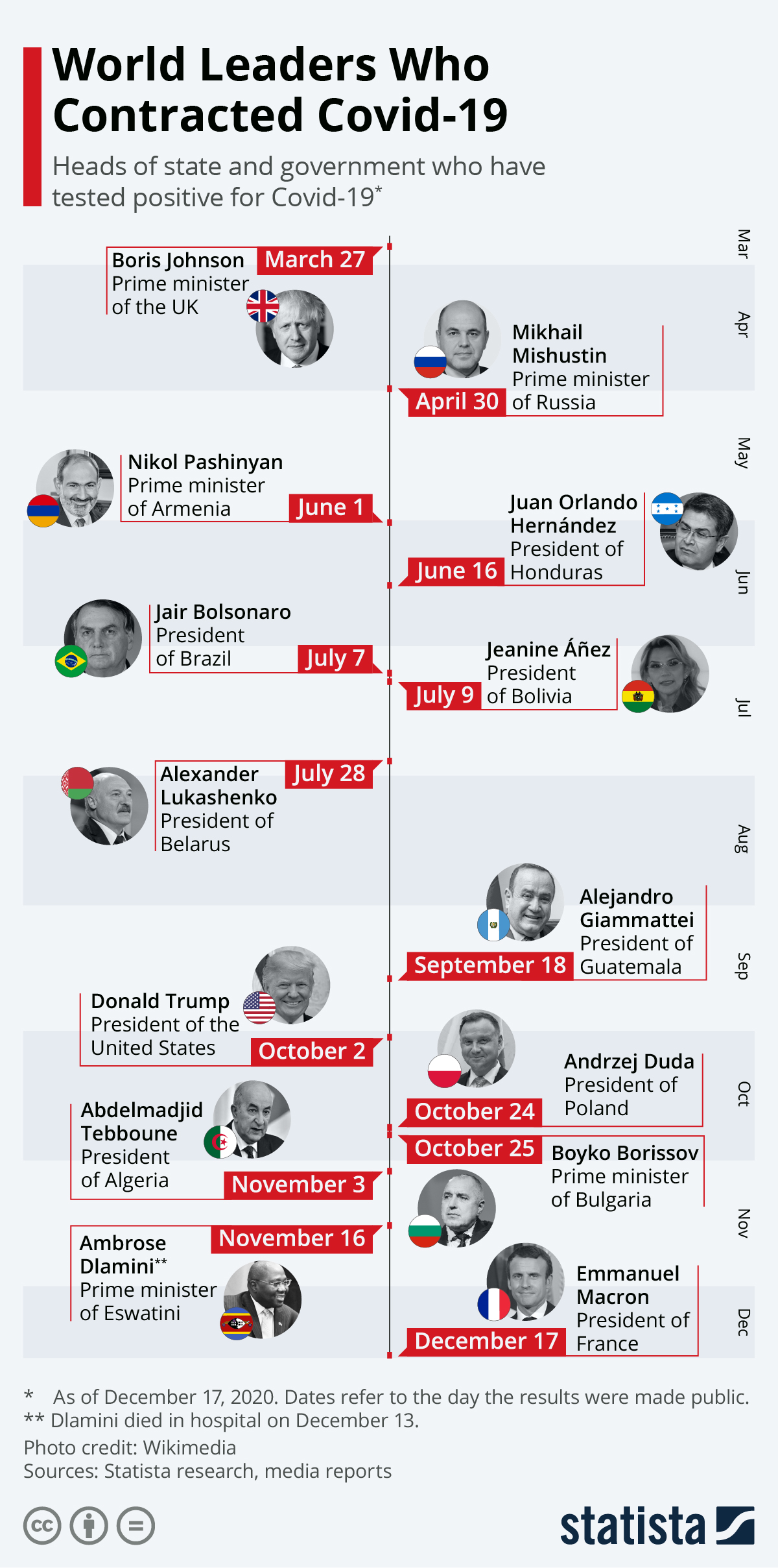

- More than a dozen heads of state have contracted COVID-19 so far:

- South Africa has missed a crucial payment deadline to secure vaccine shipments and has not arranged a guarantee to make the payment.

- Argentines are expressing concern over a Russia-created COVID-19 vaccine set to be rolled out after Russia’s president announced he would not receive the vaccine due to his age.

- Chinese electric carmakers have seen record boosts in market value in 2020, rivaling gains in U.S.-based Tesla on increased business and consumer focus on cleaner vehicles.

- Fearing a no-deal Brexit that could disrupt business operations, Nissan has chosen Japan over the U.K. as the site to produce an upcoming all-electric sport utility vehicle. Similarly, BMW is warning that a no-deal Brexit could cost the carmaker hundreds of millions of euros.

- The outgoing U.S. administration is attempting to make a “mini” trade deal with the U.K. to reduce tariffs on several goods, including Scottish whisky.

- British businesses are lobbying the European Union to delay new post-Brexit customs checks, citing inability to prepare for Brexit amid the pandemic.

- The U.K. is extending to April several economic measures to help businesses and workers through the pandemic, including support for wages and loans to firms at risk of collapse.

- BMW is employing 3D printing to make metal and plastic production parts for some luxury models.

Our Operations

- M. Holland will be closed on Thursday and Friday, December 24 and 25, for the Christmas holiday.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our online resource.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.